Gold is under pressure today due in part to a firmer U.S. dollar and hawkish comments from another Fed member, but keep in mind the Dollar Index has suffered some major technical damage recently and any rallies are likely to be sold into…Gold, which has traded between $1,243 and $1,215 so far today, is down $25 an ounce at $1,223 as of 10:00 am Pacific…selling, which has now stabilized, started in Asia overnight…Silver is off 62 cents at $15.25 after failing to push above $16 yesterday, but the metal has very strong support around $15 and could rebound powerfully at any time given a bullish overall chart pattern…Copper is 3 cents lower at $2.27…Crude Oil is down $1.28 a barrel to $40.17 while the U.S. Dollar Index has rallied half a point to 96.16…

This is Gold’s worst day in more than a month as it trades near levels not seen since February 29…however, support is rock-solid between $1,200 and $1,220 an ounce…overnight, Philadelphia Fed President Patrick Harker (FOMC voting member) said in a Reuters report the central bank should consider another interest rate hike as early as next month if the U.S. economy continues to improve as it has of late…while he supported last week’s decision by his colleagues to leave policy unchanged, “there is a strong case that we need to continue to raise rates,” he said in the article…

This is Gold’s worst day in more than a month as it trades near levels not seen since February 29…however, support is rock-solid between $1,200 and $1,220 an ounce…overnight, Philadelphia Fed President Patrick Harker (FOMC voting member) said in a Reuters report the central bank should consider another interest rate hike as early as next month if the U.S. economy continues to improve as it has of late…while he supported last week’s decision by his colleagues to leave policy unchanged, “there is a strong case that we need to continue to raise rates,” he said in the article…

According to data released by the Swiss customs department yesterday, Venezuela exported 11 tonnes of Gold to Switzerland last month which equates to about 443 million Swiss francs ($456 million U.S.) worth of the metal…it’s believed that the financially strapped Venezuelan government has sold at least that same amount of bullion thus far in March…

Oil Update

John’s most recent Crude Oil chart continues to show a bullish trend, so today’s weakness should be viewed as just another healthy pullback in a rising market…

The Energy Information Administration (EIA) reported this morning that U.S. Crude stocks rose more than expected last week, up 9.4 million barrels to a record total of 532.5 million barrels…offsetting the build was a 4.6 million barrel decline in gasoline inventories…weekly production ticked down by about 30,000 barrels per day, the EIA said…

Oil prices have been rebounding on supply disruptions from Nigeria and Iraq and on discussions over a proposed output freeze by members and non-members of the OPEC…the possible deal to stabilize production was snubbed as “meaningless” by the head of the International Energy Agency’s Oil industry and markets division, Neil Atkinson, yesterday. “Amongst the group of countries (potentially participating) that we’re aware of, only Saudi Arabia has any ability to increase its production,” Atkinson said. “So a freeze on production is perhaps rather meaningless. It’s more some kind of gesture which perhaps is aimed…to build confidence that there will be stability in Oil prices.”

Oil and gas exploration company Emerald Oil filed for bankruptcy protection last night, the latest victim of stubbornly low Oil prices…more than 50 Oil and gas companies have sought bankruptcy protection since the beginning of 2015, according to law firm Haynes & Boone…that number is expected to rise this year…

The New Canada – Welcome Back To The 1970’s

Yesterday’s federal budget was an absolute disaster…coming into the budget, of course, the Liberals had already chopped 45% off Canadians’ annual TFSA contributions, and more importantly they also introduced a sequel to Pierre Trudeau’s horrendous National Energy Program with a “climate-change” driven energy strategy that will do nothing but hinder the ability of Western Canada to get its Oil and natural gas to market…

It is a national disgrace that Canada is content to import tens of billions of dollars in Crude Oil from Saudi Arabia while at the same time pursuing policies at home aimed at eliminating Canadian Oil from the market…how have we lost our way as a nation?…

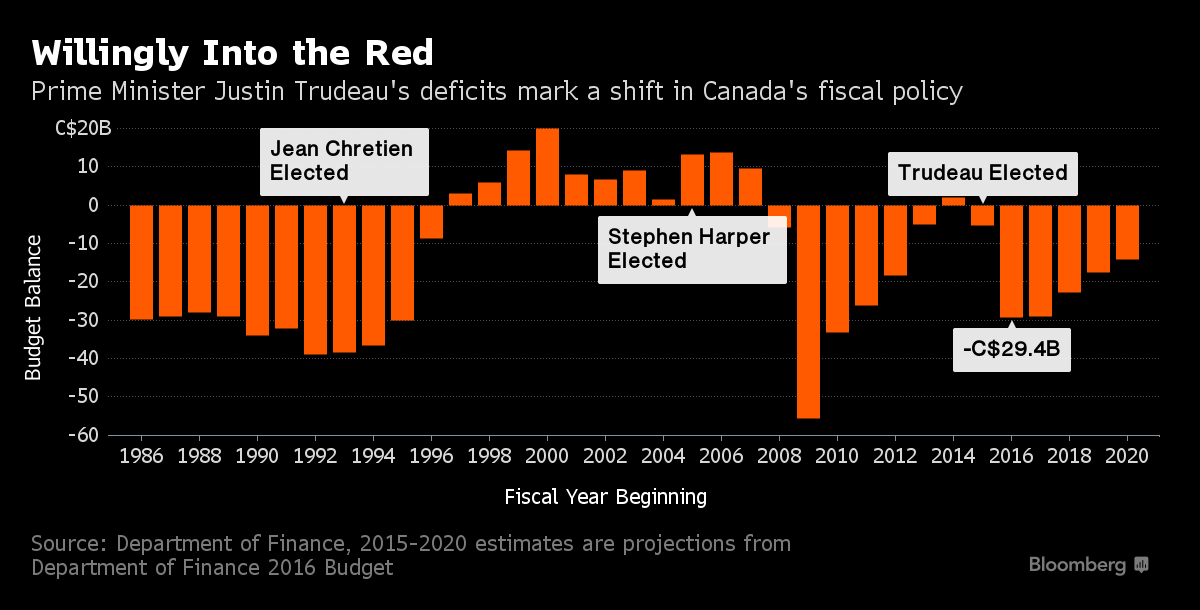

But getting back to yesterday’s budget, how can Canadians have any trust in the political system when the Liberals have committed what amounts to election fraud?…the party ran on a platform to incur only “modest deficits” of no more than $10 billion a year before bringing the national budget back into balance by the end of its mandate (keep in mind, the Liberals inherited a budget surplus)…now after getting elected, the Liberals have gone on a wild social program spending spree with a forecast deficit of $30 billion in their first fiscal year, part of a cumulative $118.6 billion that will be added to the national debt over the next 6 fiscal years…that’s simply not what Canadians voted for, especially when 2 out of the 3 main parties promised balanced budgets…what’s worse, the Liberals are creating chronic, structural deficits, very different from what was introduced in 2009 by the Conservatives (after 11 straight surplus national budgets) during the global financial crisis…

In addition, the Liberals courted Conservative voters in the election campaign when they proposed lowering the small business tax rate to 9.5% by the end of 2019, from 11% at the end of last year, but that was a promise broken yesterday as well…the rate, now at 10.5% after a small cut in January, will remain unchanged in the foreseeable future….

It gets even worse…at a time when anti-terrorism measures and national defense should be key priorities, the Liberals are actually starving those areas in their budget plans at the same time as they are pumping hundreds of millions of more dollars into their favorite media outlet – the CBC…

Justin Trudeau is taking Canada back to the 1970’s, and we all know what that led to…the Liberals aren’t “investing in Canadians”, as they claim…they are investing in the ideology of Big Government, something that even the Chretien-Martin Liberals tried to resist as they kept the books balanced and actually ran surpluses to pay off debt…in his budget speech yesterday, Finance Minister Bill Morneau waxed poetic about how this government will be a direct job creator (infrastructure programs, and the like)…not once – yes, not once in his 40-minute speech did he mention the private sector, or the need to create the environment necessary to unleash the power and productivity of the private sector and Canadian entrepreneurs…

The only hope for Canada is if some of the provinces rebel, starting with Ontario, and if a Republican wins the White House in November and is able to implement game-changing tax and regulatory reform, spurring job creation while slowing down the growth of government in the process…

In today’s Morning Musings…

1. CRB Index update…

2. Newly discovered deposit widens on fresh drill results from Cansasil Resources’ (CLZ, TSX-V) Sandra Escobar Property…

3. New addition to BMR Top 50 Opportunities List…

Plus more…to view the rest of today’s Morning Musings, login with your username and password, or click here to gain full access to this and other exclusive BMR content and features…

19 Comments

well I said it befour, people wanted change and that’s excactly what we are going to get..adding charging systems at your local gas pumps for your electric car is all fine and dandy on paper,but wont you need a job to buy one and drive to? ok everyone together now, BOONDOGLE !!!!

Jon,

Orex – They hit a fault on holes 7 and 8. Is it quite plausible that the fault may have caused a drop in the deposit. By that I mean the other part of the deposit sits higher in the hillside rather than dipping into it? The current deposit has much further room to grow to the west yet along strike up to 750 meters but maybe the deposit is separated by a fault and the other section higher into the hillside. If you look at their presentation it sure appears that it may be possible from looking at the photo and cross section of the area. Thoughts?

That’s certainly quite possible, Dan1. The fault obviously caused some displacement. I’ll be checking more into it the next couple of days when I review the material further. The deposit is coming together very nicely based on all the results to date.

KGI short looking well. I should have shorted FM or TCK. Looking at buying HOD and HVU now also.

Hey Jon, take a look at where the second round hole # 18 (pending assays) is located and the future drill collar proposal – phase 2 drilling. It appears they like what they saw in hole # 15 and drilled even further into the hillside. I said key an eye on hole # 15 a while ago. My bet is this thing not only extends further along strike but into the hillside as well which makes this a game changer. Who knows, this thing could wrap right around the hillside. The buying opportunity today was a good one. If we get any further weakness, I will grab some more. Top institutional fund managers bought at 22 cents.

orexminerals.com/s/Drilling-SandraEscobar.asp

Hi Jon, I think in the fall you posted a couple great charts showing how the Venture has done historically in each month. Could you post that again or direct me to where I can find those charts. Thanks!

REX & CLZ – The deposit is a minimum 100 meters wide as proven by hole # 9, but according to the diagram and cross section view from hole # 1, 2, 15, and 18, it has the potential to widen to a minimum 200 meters. The only unknown at the moment is the grade from hole 15 and 18.

Jon,does it seem strange to you that WRR was done drilling 760 metres in December,yet has only released 53.4 metres of total core length results since then?Is this the actual total,or parts of longer lengths?David’s PRs are vague at best.

Any idea why it would take 6 more weeks after Holes 1-2 were released to get Hole #3?

Think we should expect another set of results immediately for effect?I have a hard time believing we’ll have to wait another few weeks for 20 metres worth of results.

Very strange,overall,in my view.

David has results he should be able to use to drive the stock,but a lack of information,in the PRs and so long between such short lengths of results has to be leaving investors with questions about WRR’s credibility.

I’d like your opinion on this one,if you can.

robinandthe7hoods, these were shallow holes. Also, my understanding is that all the holes were not submitted at the same time for assaying. Michel indicated he wanted to make sure they had the right assaying method, so that would explain the delay. So when the first 2 holes were reported in early February, the remaining core had not been sent in yet for assaying.

Bottom line is that the first 3 holes are showing impressive high-grade numbers very close to surface. Holes 1 and 2 were drilled 150 m apart. Hole 3 was drilled 30 m below hole #2 and also hit high-grade.

Robin – GEM.V is showing some strong volume. its looking good. Jon would you be able to provide a chart on GEM.V? Im being told China is here and they are negotiating. South Korea was also here recently looking at gem and elliot lake for another project. Lots of interest here.

REX Website – See new map with drilled and new proposed drill collar locations. It certainly looks like they believe the mineralization continues into the hillside.

orexminerals.com/s/Drilling-SandraEscobar.asp

Deveron News out… doing an 800K PP at 20 with a half warrant .. have the drone space license.. they are getting ready … too bad about the PP pricing tho… I dont think it will open above 20ish Jon when it does start trading.

The 20-cent PP is just fine, Jeremy…they couldn’t discount more than 20% from the last closing price…I’m sure Masotti is taking down a good chunk of that PP…that certainly doesn’t mean the stock won’t open significantly higher than .20 when it starts trading…I’ve seen that happen a lot in change of business situations…remember BLO?….they did a 5-cent PP and opened around .20 on the CSE…Deveron’s PP will be kept tight, won’t be spread around much with mostly insiders taking it down…DVR is going to be a huge play with immediate cash flow and that’s why VGN is such a steal at 8 cents…

Jon, how hard would it be to get involved in the PP for Deveron? Have never participated in a PP before.

I’ll look into it, pole.

Thanks Jon.

Pole, I have participated in private placements numerous times. First you have to qualify and be willing to sign off that you are an Accredited Investor on the subscription agreement. Assuming you meet this criteria, then I would contact the company, let them know that you are an accredited investor and that you would like to participate if there is room. If they don’t know you it may be tough. Easier if you have built up a relationship with IR and they know your history. They may not allow you in due to it already being fully subscribed or if they don’t know you and suspect that you may just sell them out when the stock comes free trading after 4 months from closing.

I don’t want to write a book so I will stop there.

Thanks for that Jamie.I think I will wait for DVR to start trading again and try and grab some shares then.Sounds easier to do it that way. Thanks again for the info.

pole – go thru the motions.. a learning experience.. What Jamie says is true… I have been in many… but it is a risky biz depending on who you are dealing with but the DEV thing… minimal risk as such… make the call… regardless of the outcome you will be better prepared for the next one!:)