Gold has traded between $1,210 and $1,224 so far today in a quieter than usual session…markets in parts of the world remain closed for Easter…as of 9:00 am Pacific, bullion is up $3 an ounce at $1,219…Silver has added 4 cents to $15.24…Copper is flat at $2.26…Crude Oil is 27 cents lower at $39.19 while the U.S. Dollar Index has fallen half a point to 95.89…last week’s jump in the Dollar Index should be viewed as a “relief” rally given the bearish overall trend in the greenback…the Dollar Index will run into a wall just above 97, according to John’s latest charts…

Gold tumbled 3% last week, its biggest weekly loss since November on speculation that the next U.S. rate increase could come as soon as next month after hawkish rhetoric from regional Fed presidents James Bullard, Charles Evans, Patrick Harker and Dennis Lockhart…what was that all about, just days after a dovish statement from a Fed policy meeting?…all eyes tomorrow will be on Fed Chair Janet Yellen who speaks on the U.S. economy and monetary policy, with investors looking for further clues on the number and timing of rate hikes this year…

Gold tumbled 3% last week, its biggest weekly loss since November on speculation that the next U.S. rate increase could come as soon as next month after hawkish rhetoric from regional Fed presidents James Bullard, Charles Evans, Patrick Harker and Dennis Lockhart…what was that all about, just days after a dovish statement from a Fed policy meeting?…all eyes tomorrow will be on Fed Chair Janet Yellen who speaks on the U.S. economy and monetary policy, with investors looking for further clues on the number and timing of rate hikes this year…

Inflows into Gold exchange-traded funds (ETF) continue, suggesting there’s strong confidence that bullion will hold support around $1,200…holdings in the SPDR Gold Trust rose to the highest levels since December 2013 at 26.48 million ounces on Thursday, according to the latest available data…

U.S. economic growth in the 4th quarter of 2015 was slightly stronger than expected, according to the latest data from the Commerce Department released Friday morning…the final reading of Q4 GDP came in at 1.4%, up slightly from the second estimate of 1.0%…the report noted that economic activity was still weaker in the last 3 months of the year, down from the 2.0% 3rd quarter GDP…annually, the U.S. economy expanded by 2.4% in 2015, the same increase seen in 2014…

The proper way to kick-start the U.S. economy is not through useless Trudeau-style government “stimulus” spending but by implementing serious tax and regulatory reforms that would create a healthier climate to empower entrepreneurs, the real job creators, to grow the private sector which has not been running on all cylinders under the Obama administration…there needs to be more focus on wealth creation, not wealth re-distribution…the fact that a 74 year-old socialist from Vermont could have such strong appeal to young Democratic voters in America is an excellent example of how the U.S. has lost its way in recent years, and that line of thinking has unfortunately crossed the U.S.-Canada border…

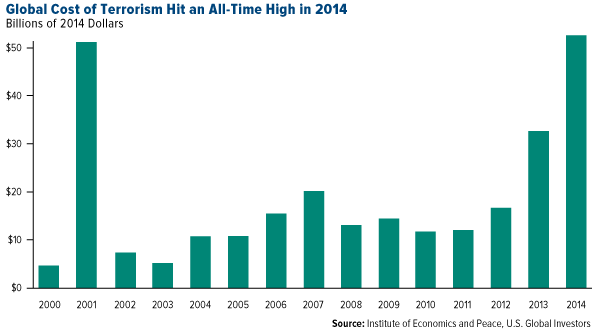

The Cost Of Terrorism Dwarfs “Climate Change”

Last week’s terrorist attacks in Brussels have revealed how much of a “failed” state Belgium really is, and that in turn may fuel more anti-EU sentiment among Britons ahead of that country’s critical June 23 referendum on whether or not to remain in the EU…the latest polls continue to give the Brexit side a slight edge…political and economic uncertainty created by Britain’s possible exit from the EU could help fuel the next leg up in Gold prices…

Yet another Islamist terrorist attack over the weekend as an explosion ripped through a crowded Pakistan park where Christians were celebrating Easter yesterday, killing at least 70 people (many of them women and children) and injuring hundreds of others…the breakaway Taliban faction Jamaat-ul-Ahrar, which has sworn allegiance to ISIS, took responsibility for the bombing…

Frank Holmes, the Canadian-born CEO and chief investment officer of U.S. Global Investors, noted in his weekly Investor Alert (www.usfunds.com) that “few things are as disruptive to our lives and the economy as terrorist activity. A recent Gallup poll found that 79% of respondents believe global terrorism to be a ‘critical threat’ to the U.S., the highest of any other potential threat.”

The global cost of terrorism has been surging the last few years as you can see in this chart from usfunds.com which tracks the period from 2000 through 2014…the figures take into account only direct, short-term costs…the 9/11 attacks were initially estimated to have cost $27.2 billion, but when indirect and long-term expenditures were factored in – the economic impact, war funding, future veterans’ care and more – it came closer to $3.3 trillion, according to the New York Times…

In today’s Morning Musings…

1. A spectacular 2nd half of 2016 coming up for the TSX Gold Index?…

2. Fresh charts for Crude Oil and Silver…

3. Updates on Scandium International (SCY, TSX-V) and Gold Bullion Development (GBB, TSX-V)…

Plus more…to view the rest of today’s Morning Musings, login with your username and password, or click here to gain full access to this and other exclusive BMR content and features…

3 Comments

Sure wish somebody or some company would announce something good, sure is dead around here, who knows maybe Regoci will throw his shareholders a bone and let us know that they started doing something?? Feb 11th Regoci stated “We eagerly anticipate updating shareholders in the very near future with regard to the Ultra 1 Zone discovery as soon as important metallurgical information is received and reviewed,” … approaching 2 months very soon since the so called Ultra 1 zone discovery… those labs must be really backed up… sheesh..

BLO news out … they are building the beta!!!!!

Looks good, Jeremy. There are obviously making a lot of headway with the University of Florida chemists.