Gold has traded between $1,208 and $1,236 so far today with some knee-jerk sell pressure setting in immediately following the release of the March jobs report…as of 9:00 am Pacific, bullion is down $19 an ounce at $1,213…Silver is off 56 cents at $14.89…Copper is flat at $2.22…Crude Oil has softened by $1.37 a barrel to $36.97 after Saudi Arabia’s deputy crown prince made comments in an interview that threw more cold water over hopes for an agreement on a production freeze…the U.S. Dollar Index, coming off its worst month in 5 years and clearly in the midst of a downtrend, is rallying off its morning lows around 94.30…it’s is up one-tenth of a point at 94.72…

Thomson Reuters GFMS released its Gold Survey 2016 report yesterday…the research firm’s manager of precious metals demand, Ross Strachansaid, told Kitco News that the metal has already seen its low for the year. “We believe that the lows of this price cycle have already been seen at $1,050…in fact, our low is expected to be $1,150 and we would expect that probably to occur somewhere around the 3rd quarter of this year.” After that, Strachan said he expects Gold prices to recover into “a long-term cyclical uptrend”…

Thomson Reuters GFMS released its Gold Survey 2016 report yesterday…the research firm’s manager of precious metals demand, Ross Strachansaid, told Kitco News that the metal has already seen its low for the year. “We believe that the lows of this price cycle have already been seen at $1,050…in fact, our low is expected to be $1,150 and we would expect that probably to occur somewhere around the 3rd quarter of this year.” After that, Strachan said he expects Gold prices to recover into “a long-term cyclical uptrend”…

Gold prices rose 16.5% in the first 3 three months of the year, the biggest quarterly leap in more than 25 years…holdings at SPDR Gold Shares, the world’s largest Gold exchange-traded fund, are approaching their highest level since December 2013, while traders are placing more bets on rising prices…hedge fund manager John Paulson made a bad call when he pared his long-held bet on Gold by $400 million in the final quarter of 2015, according to a 13F filing…

Among many factors involved in Gold’s revival is U.S. political uncertainty which may also be influencing the Fed…markets are also concerned about what a potential U.K. exit from the EU (late June referendum) would mean for European trade…

Today’s U.S. Economic Data Deluge Won’t Change Dovish Fed Posture

U.S. non-farm payrolls increased by 215,000 for March, modestly above expectations for a gain of 200,000 but certainly not strong enough to change Janet Yellen’s dovish views and the interest rate trajectory…retail, construction, health care and food services were the top sectors…the jobs growth came as the headline employment rate rose to 5.0%, the first month-over-month increase since May of last year…average hourly earnings rose 7 cents or 0.2% (slightly less than expected) to $25.43 from February…they are up 2.3% from a year ago…

The share of Americans participating in the labor force rose to 63.0% in March…the measure may have bottomed out at 62.4% in September – the lowest level since 1977…it has been rising gradually over the last 6 months with more people joining the workforce or starting to search for work…

This morning’s jobs report bucked an interesting trend in recent years…in 7 out of 8 reports from 2008 through 2015, the government’s first print of March payroll data significantly missed the mark, falling below the consensus of Wall Street economists by a wide margin…

In other economic news this morning, U.S. manufacturers expanded in March to snap a 5-month streak of declining factory activity…the Institute for Supply Management says reported that its manufacturing index rose to 51.8 last month (above expectations) from 49.5 in February…new orders and production shot up but employment at manufacturers declined…the U.S. Markit manufacturing PMI came in at 51.5…

Meanwhile, U.S. construction spending fell in February by the largest amount in 3 months…weakness in non-residential construction and government offset the strongest month for home construction in more than 8 years…the final University of Michigan consumer sentiment read for March was 91.0, slightly below February’s level and down 2.2% year-over-year…

Big Q1 Comeback For Dow

The Dow enjoyed its biggest quarterly comeback since 1933…in January, the major indices plunged more than 10% and the Dow touched critical long-term support going back to 2009…however, equity markets rebounded as the Fed backed off from its hawkish monetary tone from December…the Dow climbed 7.1% in March to finish the quarter at 17685, more than 2200 points or 14.5% above the January 20 intra-day low…

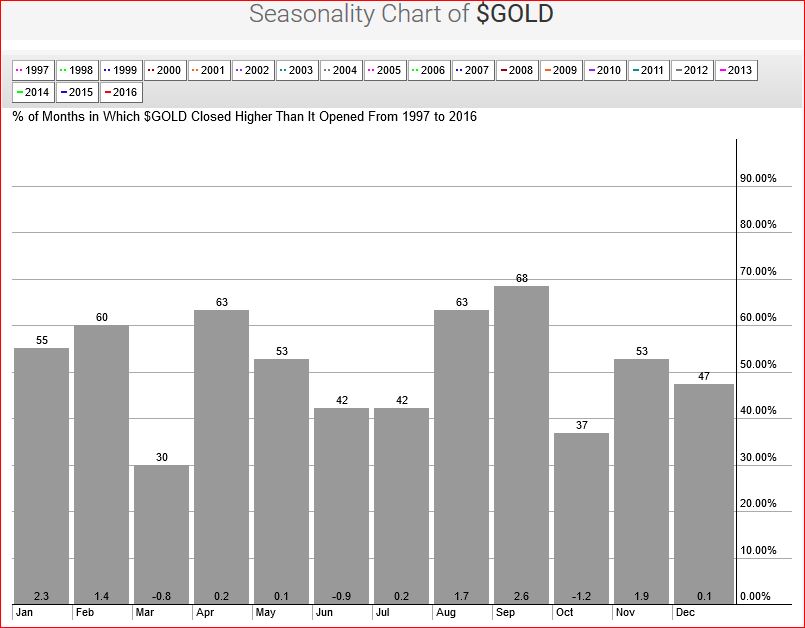

Gold Seasonality Chart: March Showers, April Flowers

Historically, going back to 1997, March is one of Gold’s worst months of the year with an average decline of 0.8%…in addition, Gold has closed higher in March over February only 30% of the time since 1997…

Gold fell slightly this March, just under one-half of 1%, essentially in line with the 20-year average…

April, however, tends to be the best month of Q2 with the price increasing 63% of the time in the 19 Aprils since 1997 as you can see in the chart below…

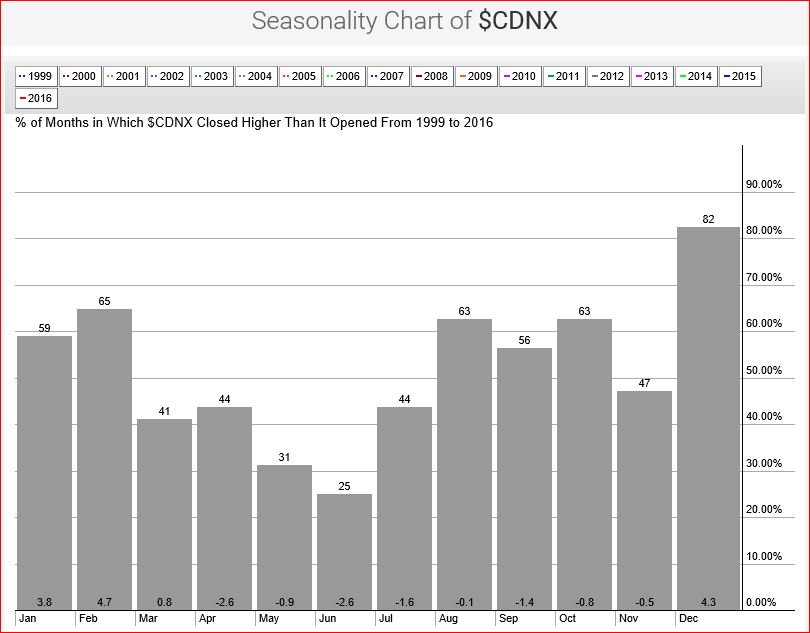

Venture Seasonality Chart

The Venture posted its strongest March since 2009 with a gain of 7.2%…a positive March such as that has always led to a strong year for the Venture, and we believe that trend will continue in 2016…

Historically, the Venture typically stumbles/corrects at some point during Q2 with April and June being the worst months on the calendar as you can see below…any pullback this quarter – perhaps we won’t see it until May – should be viewed as a buying opportunity leading into what could be a very powerful final half of the year…a strong band of support exists between the 550’s and 520…nearest Fib. resistance is 591…an April breakout above 600 is certainly possible, though such an event would likely be followed by a healthy retrace of 5% to 10% with support in the 550’s holding…

In today’s Morning Musings…

1. Gold and the U.S. Dollar – what the Big Picture trend is telling us about that critical relationship…

2. GoldQuest Mining (GQC, TSX-V) strengthens the case for multiple deposits along the Tireo Gold-Copper trend in the DR…

3. A prolific area of northwest B.C. with major recent infrastructure improvements that will quickly lead to much increased exploration activity and investor attention…

Plus more… to view the rest of today’s Morning Musings, login with your username and password, or click here to register and gain full access to this and other exclusive BMR content and features…

14 Comments

Maybe just maybe we will hear something from GGI next week. The bid is a little stronger at. 085 today.

Dan, as the GGI drill turns, for a little encouragement from a piece in the Mexico Mines Handbook, “numerous well-mineralized veins cut the rock in the Rambo-Progreso area” (quartz diorite at Progreso, porphyritic andesite at Rambo which is 1 km to the north) and “carry shoots of rich silver-gold ore.” The family that controls Progreso and the mining operation there are not explorers – they have simply been content to mine the 2 main known high-grade gold and silver veins, ship the ore off to a nearby smelter, and count their U.S. dollars. Progreso remains hugely underexplored, and the vein system likely extends well beyond what’s currently known. These are the first holes ever drilled into Rambo, directed by the same geo who pulled off the discovery on the Temoris option that’s now in the hands of Coeur Mining. Given the drill success ratio elsewhere at Rodadero, Rambo odds are more than good.

jon, your thoughts on add.v ,nar.v has an interest.thx.

Yes, Laddy, Arctic Star has been doing some nice volume on an interesting breakout. We’ll be looking at the chart over the weekend. I wouldn’t be chasing it today. Let’s see how it closes and we’ll be looking at the chart over the weekend.

EGX just did a 10-1 reverse split, now only 25M shares outstanding majority of which are owned by insiders.If you look at the level II, , there is barely anything for sale. This thing could soar quickly.

rite on jon,thanks. nope not chaseing,but one to keep on the radar anyway folks.

ADD – Powers is still working hard here. His addition of Buddy Doyle years ago helped his profile, but they have come up empty for a long time. ADD kinda like EQT, stock play vs long term. NAR is a safer hold IMO over time if you like NAR’s chances.

EQT – Dundee just bought a million at .06, and anon bought 500k, wow

Jon,I know you have spoken about Rambo over the last couple of days, but do you think the silence so far from GGI has more to do with it trying to reacquire Progreso or other claims in the area, or the reassaying results from Grizzly?

Lithium – Watch this TESLA Model 3 unveiling video and ask yourself about what the future of lithium will be? The introduction starts at the 2 minute mark. youtube.com/watch?v=wqMJeR1Yvm4

Vepper – graphite.. does it match the lithium chemistry?? havent researched.. but.. just asking:)

Jeremy – With regard to your question… I’m not sure, I’m not a chemist. But from what I have read, graphite is a smaller component required in an electric vehicle (EV) battery, the two would work hand in hand together I imagine. One thing is certain, TESLA alone will require a constant supply of lithium and the closer to the Gigafactory the cheaper the transportation cost will be for them to reach their goal of a 30% cheaper lithium battery. If you look at the entire EV market(including cars, trucks, bus’s, forklifts, bicycles, just to mention a few), it is mind boggling what an impact it would make on the environment by 2030-2040 to have millions fewer emission producing vehicles out in the world. The statistics mentioned in the video are eye opening. The increase in charging superstations & destination stations projected calls for incredible growth. For now, lithium is the future in transportation.

what will power the EV stuff? hydro infrastructure is challenged today, how does it double capacity to charge everything? good time to invest in Copper?

I also worry about the environmental impact all these used batteries will have unless they can be recycled.