Gold has traded between $1,281 and $1,302 so far today as it once again backs off from just above $1,300…as of 10:15 am Pacific, bullion is down $4 an ounce at $1,287…Silver is off a dime at $17.41…Copper has slid a nickel to $2.24…Crude Oil has shed $1.32 a barrel to $43.48 while the U.S. Dollar Index tumbled to a low of 92 before a sharp rebound out of temporarily oversold conditions…it’s now up one-tenth of a point at 92.72, trying to snap a 6-session losing skid…

Recent dollar weakness helped trigger a sharp increase in money flowing into the SPDR Gold Trust, the world’s top Gold-backed exchange-traded fund (ETF)…assets of the fund rose 20.8 tonnes to 824.94 tonnes yesterday in the biggest jump since February 22…holdings are at their highest since December 2013…

Recent dollar weakness helped trigger a sharp increase in money flowing into the SPDR Gold Trust, the world’s top Gold-backed exchange-traded fund (ETF)…assets of the fund rose 20.8 tonnes to 824.94 tonnes yesterday in the biggest jump since February 22…holdings are at their highest since December 2013…

“The trend on Gold is in a strong short-term uptrend that now has the potential to reach the $1,400 level over the next few months,” according to Bob Dickey, technical analyst for RBC Capital Markets, in a research report released yesterday…our charts agree with that, despite Gold’s jitters at the moment around $1,300…

U.S. Gold bullion coins “are proving very popular at present”, says Commerzbank…analysts cite data showing that April sales of American Eagle Gold coins were 105,500 ounces, more than triple the 29,500 ounces sold in the same month a year ago. “Four months into the year, U.S. coin sales have already totaled 351,000 ounces, twice as much as in the same period last year,” Commerzbank adds…

Gold is enjoying a great year, surging more than 20% as the S&P 500 is barely positive…what’s unusual is for bullion to outperform equities so dramatically in a year when stocks are up…going back to 1980, there has been only 1 year in which Gold has outperformed the S&P by 20% or more while the S&P was positive on the year: 2007…

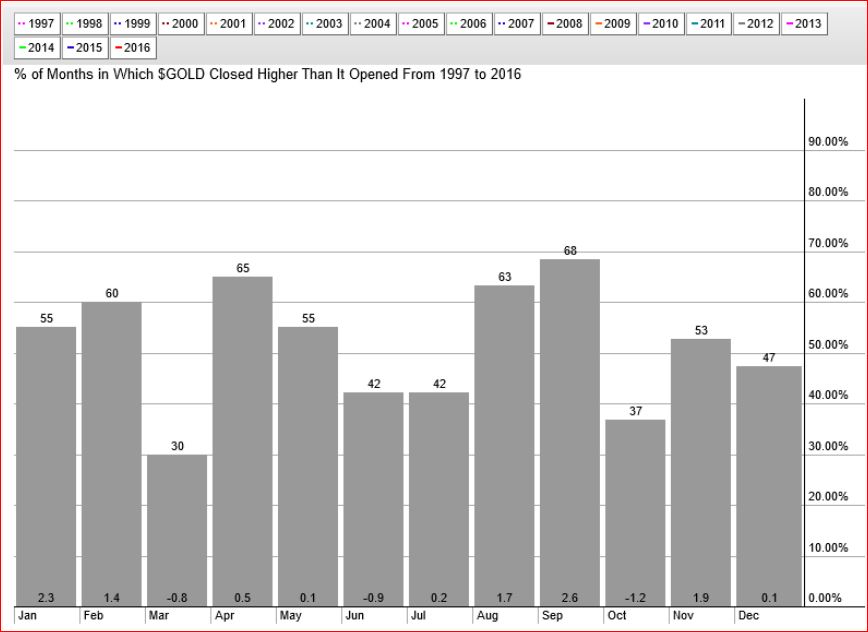

Gold Seasonality Chart

Historically, May has tended to be an average month for Gold, not quite as strong as April but better than June…Gold has closed higher this month slightly more than half the time since 1997 as you can see in John’s seasonality chart…bullion’s best quarter of the year (July-August-September) is rapidly approaching, and no doubt that has to be weighing on the minds of the bears right now…

In today’s Morning Musings…

1. What the seasonality chart for the Venture is saying…

2. Equitas Resources (EQT, TSX-V) targets higher grade Gold in near-surface oxides at its Cajueiro Project in Brazil…

3. New addition (under 10 cents) to the BMR Top 50 Opportunities List and a short video that explains why…

Plus more…click here to take advantage of our Spring Sizzler Subscription Special in effect for a limited time only, or login with your username and password to view the rest of today’s Morning Musings…

SAVE 25% with a risk-free subscription (as little as $1 per day) as you gain full access to this and other exclusive BMR content and features including our upcoming new Top Opportunities List…

3 Comments

Eric Coffin update On Lion One Metals

Lion One Metals (LIO-V; 0.72) came to life in the past couple of weeks. In part, the move stemmed from a release detailing historic results at Lion One’s Tuvatu project in Fiji. The release outlined some of the high grades from past drilling and from sampling in the exploration drifts. I think the point LIO was trying to make was that this is a project that went all the way to feasibility in the not too distant past. Lion One issued a PEA on the project last year but Emperor Mines subjected the project to much more detailed and advanced work 15 years ago and not that much has changed. We’ve been expecting LIO to pull a financing package together for Tuvatu ever since the PEA was released. I know management has been in discussions with numerous groups ever since and, frankly, I know management was frustrated by the lack of progress. The move in the gold price in the past couple of months has to be shifting the balance of power at the negotiating table. High grade is hot and LIO has it. While we’re all still in the dark about the form and specifics of a funding deal to move Tuvatu to production I think the odds of one showing up soon have increased dramatically in recent weeks. I expect management to get this across the fin-ish line if this strong resource market persists for much longer. Buy on weakness in anticipation of a deal to finance and construct the Tuvatu gold mine.

bit.ly/1SGPoT4

Coffin makes a good point, in that, Emperor vetted the project 16 years ago for an estimated annual production of 80,000 ounces and its only gotten better since. They spent a lot of money on exploration and then on their extensive underground workings, all to the benefit of present day shareholders of Lion One.

I think Eric is right that a good financing is drawing near that will bring upward momentum to the SP. There’s not a lot of willing sellers, and those that are will miss the boat, imo, and it may well be a big boat.

NRN – was 3cents , 2 wks ago. millions of shrs later, now at 11/12 ! hmm talk of Norilsik#2

Colorado arranges $4.03-million private placement

2016-05-04 09:54 ET – News Release

Mr. Adam Travis reports

COLORADO ANNOUNCES NON-BROKERED FINANCING FOR UP TO $4M

Colorado Resources Ltd. is undertaking a non-brokered private placement for a total of $4,032,000 of securities of Colorado, comprising of 7.2 million units of the company at an issue price of 35 cents per unit and 3.6 million flow-through units for common shares of the company that qualify as flow-through shares for purposes of the Income Tax Act (Canada) at an issue price of 42 cents per flow-through unit.

Each unit will consist of one common share in the capital of the company and one common share purchase warrant, with each warrant entitling the holder thereof to acquire an additional common share at an exercise price of 50 cents for 24 months after the date of issuance. The warrant terms will contain an acceleration provision such that if, commencing on the date that is four months after the closing date, the closing price of the common shares on the exchange is higher than 75 cents for 20 consecutive trading days, then, on the 20th consecutive trading day, the expiry date of the warrants may be accelerated to the date that is 20 trading days after the acceleration trigger date by the issuance of a news release announcing such acceleration within two trading days of the acceleration trigger date.

Each flow-through unit will consist of one flow-through common share in the capital of the company and one-half of one non-transferable non-flow-through common share purchase warrant. Each non-flow-through warrant will entitle the holder thereof to purchase one additional common share of the company at an exercise price of 60 cents per non-flow-through warrant share for a period of 24 months from the closing date. The non-flow-through warrant terms will contain an acceleration provision as described hereinabove.

The offering is being offered on a non-brokered private-placement basis in the provinces of Alberta, British Columbia and Ontario, as well as such other jurisdictions as the company may determine in its sole discretion, and will be subject to a statutory hold period of four months and a day from the closing date of the offering. The company may pay finders’ fees in accordance with the rules and policies of the exchange. The offering remains subject to the approval of the exchange. The proceeds will be used by the company for exploration activities on its Canadian properties.

We seek Safe Harbor.