Gold has traded between $1,268 and $1,283 so far today…as of 9:30 am Pacific, bullion is up $5 an ounce at $1,279…Silver is 14 cents higher at $17.26…Copper is flat at $2.12…Crude Oil, hitting a 6-month high today, is up 57 cents at $48.29 while the U.S. Dollar Index has retreated one-fifth of a point to 94.37…

U.S. regulatory filings yesterday showed that some influential investors bought into Gold through ETFs in the 1st quarter…billionaire financier George Soros, who once called Gold “the ultimate bubble”, returned to the metal after 3 years with 1.05 million shares in SPDR Gold Trust valued at about $123.5 million…Soros also bought shares in Barrick Gold (ABX, TSX)…

U.S. regulatory filings yesterday showed that some influential investors bought into Gold through ETFs in the 1st quarter…billionaire financier George Soros, who once called Gold “the ultimate bubble”, returned to the metal after 3 years with 1.05 million shares in SPDR Gold Trust valued at about $123.5 million…Soros also bought shares in Barrick Gold (ABX, TSX)…

Meanwhile, well-known hedge fund manager John Paulson actually trimmed his Gold holdings…

Hedge funds took a bigger interest in Silver as they increased their bullish bets while increasing their short bets in Gold, according to the latest data from the Commodity Futures Trading Commission through trading last Tuesday (May 10)…Silver’s long bet increased almost 6.7% to a new record high from the previous week’s level…the Gold-Silver ratio ended the survey period near 74 which is still well above what analysts say is the historical average at 60…Gold’s net positioning decreased for the 1st time in 8 weeks but remained near its historic highs…commercial traders still hold extreme net short positions in both Gold and Silver…

“We’re in a secular bull market in Gold and most people don’t believe it,” stated Frank Holmes, U.S. Global Investors’ CEO and chief investment officer, in an interview with Kitco’s Daniela Cambone…

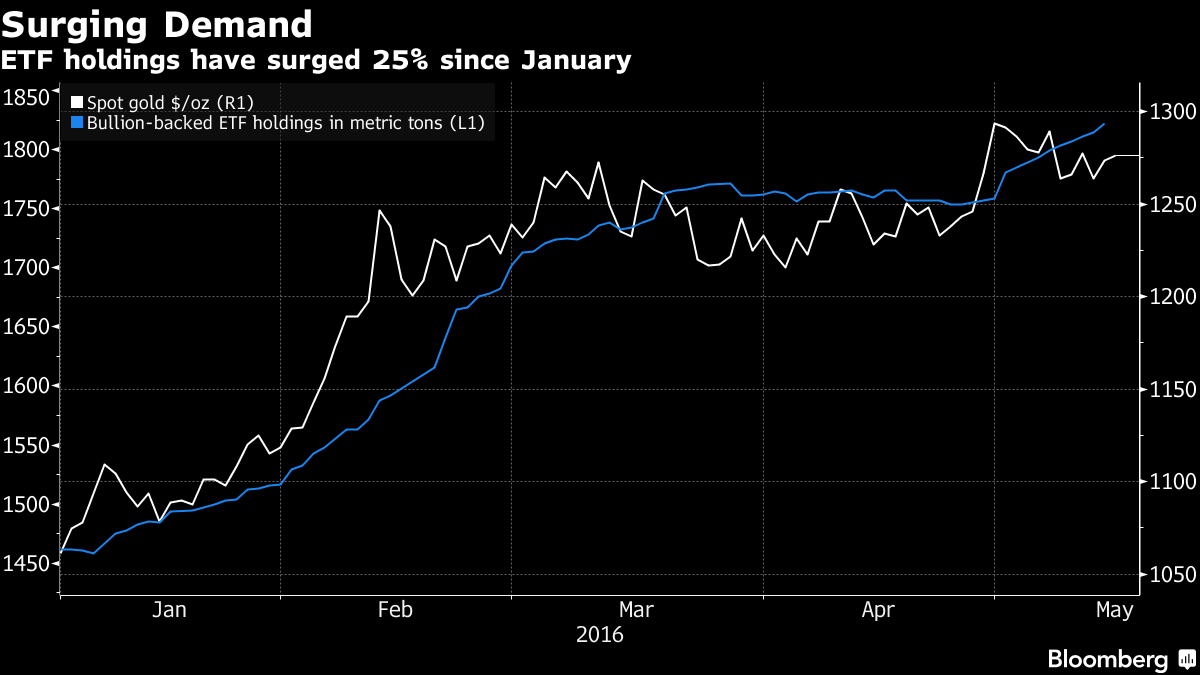

Below is a Bloomberg chart that shows how Gold ETF buying picked up again recently after bullion touched the $1,300 level…

In today’s Morning Musings…

1. GoldQuest Mining (GQC, TSX-V) delivers highest-grade surface sample ever recovered from the company’s Tireo belt concessions (what’s also important is where this was adjacent to)…

2. The huge upside potential in Kootenay Silver (KTN, TSX-V) in a new Silver bull market…

3. Skeena Resources (SKE, TSX-V) announces 3,000 m summer drill program to target high-grade extensions of past producing Snip mine in the “Heart of Gold” Camp…

4. Updates on GGI and BTR…

5. Pure Gold Mining (PGM, TSX-V) hits more high-grade Gold at Madsen Project…

6. New addition to the BMR Top Opportunities List…

Plus more…click here to take advantage of our Spring Sizzler Subscription Special in effect for a limited time only, or login with your username and password to view the rest of today’s Morning Musings…

SAVE 25% with a risk-free subscription (as little as $1 per day) as you gain full access to this and other exclusive BMR content and features including our upcoming new Top Opportunities List…

28 Comments

URGENT.

Stockcharts.com does not have MTS.V in its database so we cannot include a chart. It will only enter it if enough investors request it.

As Jon has pointed out MTS.V could be a very important stock for all of us this Summer, so I am asking everyone to go to the Stockcharts website and request it.

stockcharts.com

In the “ENTER SYMBOL: box enter MTS.V, then “enter”.

On the new page click on “REQUEST NEW SYMBOL”, then “enter”.

Then fill in the form….the symbol to enter is MTS.V

Thank you

Yes, the more readers/subscribers who email Stockcharts today – the sooner they will add MTS to their database so John can start to produce some charts on this one…appreciate everyone’s help on this…MTS will be a critical play in the Heart of Gold Camp…

Jon

just sent my request

thanks

I also….

done.

Just sent in my request also Jon.

I am a bit surprised CXO traded below the proposed PP today. Is it an indication that the funds are more difficult to obtain, insiders selling to participate, or MM’s playing games?

Some games going on there for sure, Dan, and perhaps some loose apples being knocked off the tree….grab, grab, grab…

I picked up more GGI at .075 today, hopefully the selling is almost done. It’s getting to be a better deal all the time.

Jon

can Travis at CXO share with you how the PP is going or is that insider info?

thanks

Greg, this is my intuition only, knowing the demand in the district for land and the money flow we’re seeing in these stocks and the dollars that are being raised…CXO will have no problem closing the full $4 million…don’t be thrown off by the games in CXO stock today…

The 2016 Tahltan industry Newsletter (see link), may be of interest to some. Certainly a few of the same companies mentioned here. Talks about responsible companies and some having “work to do” Re: GGI…seems to fit their definition, certainly confirms the positive relationship the company has with the Tahltan.

http://tahltan.org/wp-content/uploads/2016/04/Exploration-NL-Final-Published-lower.pdf

CXO…here is your chance to load up at 31c……looks to be a MUST Seller….140k on the ASK at 31c

GGI just got drill permits and alot more land in the BC triangle

GGI: this is going to be an exciting summer. Soooo many properties with potential. Their head must be spinning…

Astute move by GGI to beef up its land package and move deeper into the Camp…maps look fantastic…King drill permits are also key, giving GGI the opportunity to pull the trigger hot on the heels of CXO drilling and in advance of drilling at the Snip mine just to the south of the newly expanded King…huge opportunity around the Eskay Creek mine…Tudor is positioned there now (for a reason) and ESK could ink a deal with a major on a JV shortly for SIB…exciting geology around Eskay Creek, suggesting there are more deposits to be found…immediately to the southeast, Tudor will also be drilling Treaty Creek…everywhere around the Heart of Gold Camp there will be drilling and exploration activity…crazy summer coming up…all it will take is just 1 company that hits big (CXO has first shot) and absolutely everything will go nuts…it’ll be like Voisey’s Bay or 1989 Eskay Creek all over again…

Many companies MUST be looking at taking out MTS with its huge land package right in the middle of the Heart. Very tight share structure and ridiculous market cap.

Why not have a merge, CXO-MTS-ESK or some combo and open things right up!!!!

Excellent point, diesel…I can’t help but think MTS is being approached by a number of companies…potential merger/takeover situation as well…targets throughout the Kirkham Property with 3 different potential deposit types…$3.5 million market cap…it’ll fly.

MTS – in discussion with potential partners, which would explain why they may not need cash to work their properties.

Great news for GGI, bought some at .075 but it looks like my bid at .07 won’t get filled which is OK. Time for GGI to get moving.

No mention of DBV in the Tahltan Industry Newsletter! Haha…

I guess we’ll find out DBV’s fate next week…in the court’s hands now.

Awesome new GGI Maps!

marketsmartnewsletter.com/Garibaldi/GGIAreaPlayMapMay18.pdf

marketsmartnewsletter.com/Garibaldi/GGIPSPMapGoogleEarthMay18.pdf

Thanks for the maps Maxwell, looking very good!

John

did we get enough people requesting the MTS chart yet?

thanks

John’s traveling today, Greg, but I believe we did…should hear from Stockcharts on that in the next few days…

Wow, what a great move by GGI! Talk about increasing your land position. Should be a awesome summer. Can hardly wait.

GGI – more great properties , pregnant with possibility. Lets hope Steve starts getting behind it with regular news again, and rewards everyone involved, (including the new Geo, John Buckle who has skin it it) so the SP gets some wheels. Work at 2 if not 3 sites this summer is not a pipe dream. TUD has 40MM shrs, a $1MM work commit on its less than 60%+ owned property close to GGI, giving it a mkt cap of $40MM+. A similar mkt cap for GGI would be a 0.35 cent shr at least and TIMELY news from 3 projects could certainly make that a possibility!

David

very good post re: GGI above and I agree, lets start with some news on Rambo and really get this summer off to a great start, time for Steve to really build the shareholder value that he has always talked about and this is the perfect opportunity, glad to see them being aggressive and taking advantage of what is about to unfold in the Golden Triangle, maybe I wont have to be playing Neil Young Old Man after all, lol…