Gold has traded between $1,335 and $1,355 an ounce so far today…as of 9:45 am Pacific, bullion is up $10 an ounce at $1,343 after profit-taking sent the metal down $20 yesterday…Silver has jumped 21 cents to $20.33…Copper has climbed another 3 pennies to $2.24…Crude Oil has plunged $2 a barrel to $44.81 while the U.S. Dollar Index is off one-third of a point to 96.18…

Holdings of SPDR Gold Trust, the world’s largest Gold-backed exchange-traded fund, fell 1.63% yesterday to 965.22 tonnes, its biggest single day decline since December 2, 2015…

Holdings of SPDR Gold Trust, the world’s largest Gold-backed exchange-traded fund, fell 1.63% yesterday to 965.22 tonnes, its biggest single day decline since December 2, 2015…

Gold has strong technical support in the $1,320’s and $1,330’s, so it wasn’t surprising to see bargain hunters step up to the plate this morning after yesterday’s minor sell-off took bullion to a 2-week low…

Malaysia’s central bank unexpectedly lowered its interest rates today for the first time in 7 years in an effort to boost the country’s economy, but Canada’s central bank has stayed the course…

China’s dollar denominated exports fell more than expected in June, according to figures released today…imports also shrank more than forecast as waning global demand and Brexit concerns put some grey clouds over the world’s 2nd-largest economy…

CNBC’s just-released 2016 ranking of top states for business has Utah at the top, followed by Texas, Colorado, Minnesota, North Carolina, Washington State, Michigan, Georegia, Iowa and Florida…the 5 worst states are Maine (#46), Mississippi, West Virginia, Hawaii and Rhode Island (#50)…

Crude Oil Update

The International Energy Agency (IEA) warned that today that a global supply glut threatened a price recovery in Oil, while data showed an unexpected weekly gain in U.S. Crude stocks…the IEA, which advises industrialized nations on energy policies, said Crude inventories kept rising last month and pushed floating storage to the highest level in 7 years. “(Stocks) are at such elevated levels, especially for products for which demand growth is slackening, that they remain a major dampener on Oil prices,” the Paris-based IEA said in its latest report…

Rising Metal Prices

Metals are on the move, prompting Goldman Sachs to hike its various price forecasts through 2017 as stimulus in China and elsewhere supports demand through the 2nd half of 2016…Nickel has hit an 8-month high amid expectations of supply cuts in the Philippines, the world’s top producer of the metal, while Zinc is at its best levels in more than a year…Copper has picked up steam this week while Palladium has touched an 8-month high…

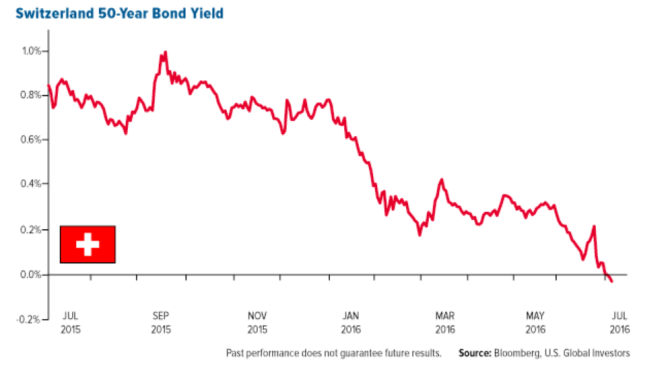

Plummeting Global Bond Yields

This month, for the first time ever, Switzerland’s entire stock of bond yields has fallen below zero, with the 50-year yield plunging to negative 0.03%….

The Canadian 10-year yield closed just below 1% yesterday (has recovered slightly today) while inflation in May came in at 1.5%…when you subtract the latter from the former, you get a real rate of negative 0.5% – meaning inflation is eating your lunch…like negative bond yields, negative real rates have in the past accelerated momentum in Gold’s Fear Trade…

Bank Of Canada Keeps Rates Steady

The Bank of Canada kept interest rates at 0.5% today but slightly cut its economic outlook for the year, saying the extensive damage from the Alberta wildfires will result in an economic contraction in the 2nd quarter…among the projections, the bank for the first time released numbers on the potential impact of the UK’s vote to leave the EU…it said the fallout from the vote will lower global GDP by 0.2% by the end of 2018, with most of that expected to be tied to an extended period of uncertainty around investment. “The impact on the level of Canadian GDP over the projection period is likewise anticipated to be modest, about –0.1%, reflecting, among other factors, Canada’s small direct trade exposure to the UK,” the bank said in its latest monetary policy report…

In today’s Morning Musings…

1. Fresh Gold chart – sell me some more!…

2. The breakout in Nickel…

3. IDM Mining (IDM, TSX-V) “revs up” at Red Mountain…

4. Daniel’s Den – a Copper junior on the rebound…

Plus more…click here if you’re a non-subscriber to receive 3 Top Picks for the rest of July, or login with your username and password to view the rest of today’s Morning Musings…

SAVE 25% with a risk-free subscription as part of our July special to gain full access to this and other exclusive BMR content…

11 Comments

What’s your opinion about CopperBank Resources?

AHR – interested to see what the 2016 drill program pulls up at IKE

COR – Camino picked up a copper property in Peru.

CUM – has to be cheap at its current level.

I took a position n CBG today.

CXO…looking stronger.

well what are we up to now,5,6 projects on the go for ggi,thats all great but this should be moving up,time for regoci to come out of hoarding, oops mean hideing ….did I see results for cxo mid july sometime, almost there.

Yep stronger close for CXO but on fairly low volume. Took 10% off the table today. The rest will hopefully ride a lot higher!

CXO – nice close.

Serengeti – potential for first nations issues on that drill program.

Deveron – the news we’ve been waiting for, just came out…

“Effective at the close of business on July 13, 2016, the common shares were delisted from the TSX Venture Exchange at the request of the company.”

Deveron had to get approval from the Venture to de-list from the Venture, prior to commencement of trading on the CSE (seems the Venture dragged its feet, but they’re growing irritated at losing customers to the CSE).

I suspect DVR will be trading on the CSE imminently (likely by Monday)…

Jon – DVR – great news:) thx matey!!!

This will be more exciting than any of your teenage years, Jeremy.

Larry

5-6 projects for GGI and results from one over the last year, maybe we will see results on the king next year if we are lucky?

Teenage years lol.. looking back.. Grade 11-12.. probably the best 4 years of my life!!