Gold has traded between $1,335 and $1,345 so far today…as of 9:30 am Pacific, bullion is unchanged at $1,339…Silver is also flat at $18.89…Copper has slid another 2 pennies to $2.13…Crude Oil has reversed higher, up 51 cents to $47.92, while the U.S. Dollar Index is off its lows of the day, unchanged at 94.55…

Holdings of SPDR Gold Trust, the world’s largest Gold-backed ETF, rose 0.25% to 958.37 tonnes yesterday…

Holdings of SPDR Gold Trust, the world’s largest Gold-backed ETF, rose 0.25% to 958.37 tonnes yesterday…

TD Securities doubts Gold prices would fall much below $1,300 an ounce even if Federal Reserve Chair Janet Yellen were to suggest a coming rate hike when she addresses a Jackson Hole Fed symposium on Friday…

TD: “While we do think that Janet Yellen may point the Fed in a more hawkish direction on Friday, there is likely to be continued ambiguity surrounding future U.S. monetary policy. This, in combination with the fact that some $13 trillion worth of fixed-income assets are yielding negative rates, should impact interest rates only modestly and neither the opportunity cost to hold the yellow metal or the carry costs should rise too much. Add to this risk of an equity correction and other systemic risks forming from the current experimental monetary policy practiced by the ECB and the BOJ, the demand for Gold should remain firm.

“As such, Gold is unlikely to drop much below $1,300 an ounce, even if we hear a more hawkish monetary policy tone emanating from the annual Jackson Hole, Wyoming gathering.”

China’s Deliberate Move Away From The Dollar

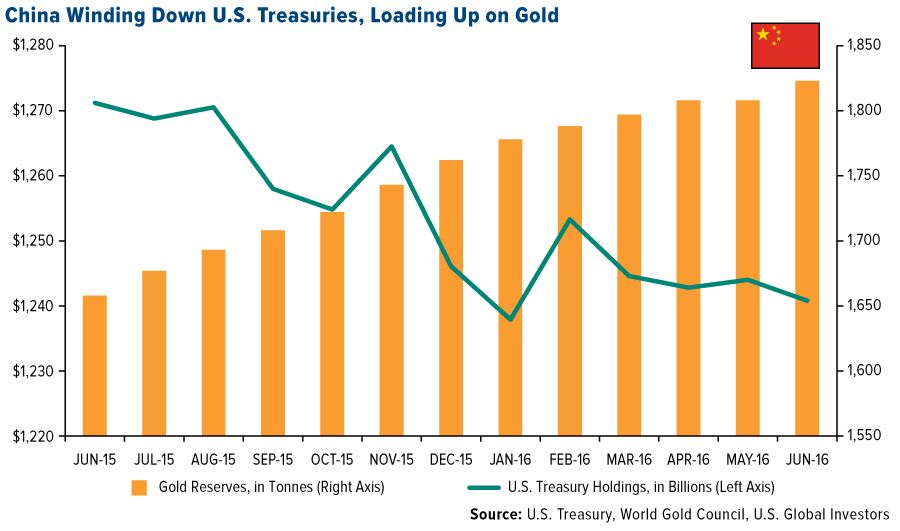

China continues to gradually wind down its holdings of U.S. government debt while increasing its Gold reserves, and it’ll be interesting to see if this pattern accelerates over the next year…

Frank Holmes, CEO & Chief Investment Officer for U.S. Global Investors, had this to say in his weekly Investor Alert…

“Confidence in monetary policy and appetite for government debt continues to erode. According to Zero Hedge, foreign central banks dumped a record $335 billion in U.S. Treasuries during the last year. The top seller in June was China, which cleared $28 billion in Treasuries off its balance sheet. Over the same period, the world’s second-largest economy added to its official Gold reserves – 500,000 ounces in June alone – in an effort to diversify its holdings.”

In Today’s Morning Musings…

1. U.S. Dollar outlook – we’ll show you what’s happening, and what this means for the Venture…

2. More evidence of an explosive near-term move in Silver (a head fake lower, first?)…

3. Venture stock jumps 80% today after company wins large judgement, but can they collect?…

4. Probe Metals (PRB, TSX-V) on the fly…

Plus more…click here to read the rest of today’s Morning Musings and all BMR exclusive content, through a risk-free Pro, Gold or Basic package, or login with your username and password…

20 Comments

can someone explain to me why VGN has been a bust? while their valuation has been cut in half there is obviously no demand for their stock due to DVR.

Just because the company has or may have more money in October, what does this do for the valuation?? something doesnt make sense!

I would say it just temporarily ran out of gas and had a simple correction, Jeremy, right down toward its longer term moving averages and on relatively low volume which is a good sign (500,000 shares or so this month)…approaching strong support…fundamentally, it holds lots of cash plus the Nevada Gold properties which haven’t been put into play yet by the company (that will happen I suspect on Gold’s next move above $1,400), and when DVR kicks into gear it will also advance accordingly…so great value where it’s at now…looks like it will settle between the 100 and 200-day SMA’s (9-11 cents) and then prepare for another wave higher IMHO…

Jon, any plans to visit one of GBB’s presentations and comment on it?!

Sure, if I have the chance…

David – A re=post from yesterday. I believe SOI has a lot of free trading shares coming up, it could hinder its movement.

Jon – I would say that most were looking for a pop with sustainability on VGN which just didnt happen.. the play was DVR.. Nevada is discounted or not even considered…

I also wonder about DVR and that gear that it may kick into… Me thinks that the ‘market’ sees thru the DVR veil and sees something they dont like..

I really have serious doubts Jon.. and I am being serious.. and I did participate in the DVR PP. cash in VGN means bonuses for those who are there.. not sure that it would ever translate into a valuation story for VGN… all just concerning mate

You’re assuming the market is efficient, Jeremy, and it clearly isn’t…if you haven’t spoken recently with Dave MacMillan, I suggest you give him a call at (416) 367-4571, ext. 226…

Leading into Yellen’s speech Friday…RSI(2) on the TSX Gold Index daily chart is now more oversold than at any point since late 2015…what a great opportunity we’re being handed…the wise contrarian approach is to be taking advantage of this dip, unless of course you have enormous faith in the Fed…

I havent recently.. but will.. and Jon… there is a whole whack of assumptions here.. with one being that we are dealing with manipulators (Cannacord) and retail nervousness..

Jon, when will you be updating subscribers on KSK? Interested in what their plans are to garner interest in the market.

We have an article in draft at the moment that we’ll be posting very soon, Dan1….the 8 to 10-cent range is the support band on the stock…

Jon, thanks for that info on TSX Gold index being oversold. Can you recommend a few major gold producers you feel are in the same oversold position right now?

Hi Vepper, we expect to be outlining some later today, perhaps in a separate post…one example of the opportunities being created is Richmont (RIC, TSX) in the vicinity of its 100-day moving average ($11.25)…if you go back in history, that’s a remarkable supporting moving average for RIC…25% off its high at the moment…the 100-day on the Gold Index (240) could be the magic mark…

Also what are your thoughts on when drilling will begin at Huckleberry? Anyone with a helicopter, can you swing by the Labrador trough and tak a peek? Must be getting close to turning now.

good one, faith in the fed? wouldn’t that be the same as asking Clinton about her emails?

It’s remarkable how so many traders/investors are continuing to make the same mistake over and over again with regard to the Fed…it’s unbelievable…

Jon – any excuse to drive stuff into the woodshed and pick this up cheap – they all know how this is going to end..

the CDNX is in correction mode… at what point does it breakdown thru the up trend line John?? TIA

The Venture won’t be in “correction” mode, Jeremy, until its SMA-20 begins to decline which we’re not seeing yet…so far, the drop is entirely within the context of the upsloping channel the Index has traded in since February, and there is also Fib. support at 784…it would be without precedent during a bull market to have the Index go into a “correction” in September…the Venture’s RSI(2) on the daily is also at levels we haven’t seen since the January all-time low in the Index…healthy pullback, shaking up the nervous nellies – that’s all this has been so far…and it’s good to have now in the sense that it clears the track for the next move higher…tomorrow/Friday am is an ideal time for a bottom/reversal, also coincides with month-end settlement and (ironically) Jackson Hole…watch Silver for a turnaround at $18 or a little higher…Friday will be an important trading day, as often can be the case…

Someone’s taking down NRN this morning.

Dan1 – A lot of retail in NRN from the .01 to .03, profit taking at its best. Could see .18 to .20, maybe