Gold has traded between $1,325 and $1,339 so far today following last night’s first Presidential debate…as of 10:00 am Pacific, bullion is down $11 an ounce at $1,327…Silver is off 38 cents at $19.04…Copper has slipped 2 pennies to $2.16…Crude Oil is down $1.59 a barrel to $44.34 while the U.S. Dollar Index has added one-tenth of a point to 95.45…

Markets are saying today that the edge went to Hillary Clinton in last night’s first Clinton-Trump showdown, though it was clear that neither candidate delivered a knockout punch…how much those somewhat disappointing 90 minutes may have “moved the needle” with the electorate remains to be seen…next debate is Sunday, October 9…

Markets are saying today that the edge went to Hillary Clinton in last night’s first Clinton-Trump showdown, though it was clear that neither candidate delivered a knockout punch…how much those somewhat disappointing 90 minutes may have “moved the needle” with the electorate remains to be seen…next debate is Sunday, October 9…

CMC Markets’ chief market strategist, Michael McCarthy, said traders/investors last night were “searching for the least worse option between the two U.S. candidates. One is a known market bad, the other an unknown bad. Any ramping up of populist rhetoric would likely rattle investors. Any perception that the outsider candidate won the debate could bring a market rout,” said McCarthy…

Bank of Japan Governor: “No Limit To Monetary Policy”

More rhetoric from the Bank of Japan which, like other central banks, has a growing credibility problem which is fundamentally bullish for Gold…BOJ Governor Haruhiko Kuroda told business leaders in Osaka yesterday, during a speech on “QQE with Yield Curve Control“, that “there is no limit to monetary policy” and the central bank is prepared to use every policy tool available to achieve a minimum 2% inflation target, including cutting short-term interest rates further into negative territory…

U.S. Consumer Sentiment Spikes

A key measure of U.S. consumers’ attitudes has increased to its highest level since the recession…the Consumer Confidence Index hit 104.1 for September, the Conference Board reported this morning, which was well above expectations for a reading of 99.0…

Oil Update

Crude is under pressure today as optimism fades for an output-limiting deal during an Oil producer meeting in Algeria that so far has failed to yield any agreement to curb one of the worst supply gluts in history…

Goldman Sachs has lowered its Oil price forecast, saying the supply-demand balance for the 4th quarter of 2016 is weaker than it previously expected…

“We are lowering our (Q4) forecast to $43 (per barrel) from $50 previously,” a commodity research team at the bank said in a note published this morning. “Given upside surprises to (Q3) production and greater clarity on new project delivery into year-end, this leaves us expecting a global surplus of 400,000 (barrels per day) in Q4 versus a 300,000 (barrels per day) draw previously.”

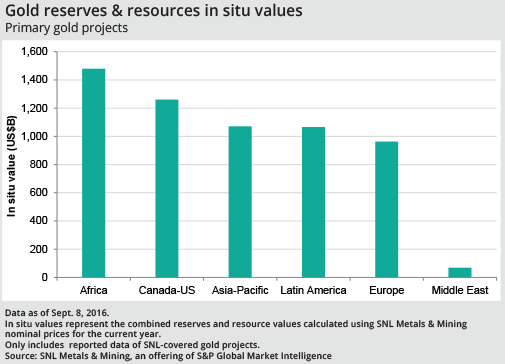

Global Gold Reserves & Resources In-Situ Values

According to a study carried out by SNL Metals and Mining, Africa still has the world’s highest in-situ value for reported reserves and resources at primary Gold projects, with values totaling $1.5 trillion…despite this, it was Latin America that accounted for the largest amount of planned and completed capital spending, with $5.6 billion to be invested in Gold projects announced from the beginning of 2015 through the end of June this year…

Keep in mind that there are multiple limitations to the amount of Gold that will actually become part of the future supply chain based on a calculation of in-situ global reserves and resources…

In Today’s Morning Musings…

1. Venture stock jumps 400% in morning trading on massive volume…

2. Pure Gold (PGM, TSX-V) drills 127 g/t Au over 3.7 m at Madsen…

3. GoldQuest Mining (GQC, TSX-V) releases PFS for Romero…

4. Nemaska Lithium (NMX, TSX) continues to gain momentum ahead of more news from Whabouchi…

Plus more…click here to read the rest of today’s Morning Musings and all BMR exclusive content, through a risk-free Pro, Gold or Basic package, or login with your username and password…

17 Comments

Jon, Wondering if you have talked to Regoci in the last little while.Tried calling today and only got his voice mail. The silence from GGI is deafening. Trying to remain positive for now but its getting harder everyday to keep the faith.Hopefully some news soon.

Yes I have, pole, and I doubt it’ll be much longer before we hear from them. The good news is they’ve been very active on ground up north in particular…silence is golden and patience is a virtue…hang in there. Properties are great and that’s ultimately what’s going to get this going again IMHO.

well that’s somewhat encouraging,waaay to quiet!!

Thanks for that Jon.That just gave my spirit a major boost.Could be a sunny day coming for those of us who chose to hang on.

The Donald got his head handed to him last night during the debate. He and Leona Helmsley, “Only the little people pay taxes”. Such an outrageous, ignorant, dangerous, buffoon. The only thing he would be good for, is causing a sharp gold price rise, because of him scaring the bejeezus out of everyone.

I think “silence is golden” must be Regoci’s theme song, zero respect for shareholders. When was the last Mexico update?

GGI – in the past, Steve has been a big on teasing with pics on the website. Not a one this season and I know he has had at least 2 work sessions w guys in the field . unfortunate he couldn’t communicate that at all (other than they started) to shrholders so that it doesn’t look like he’s squirreled away in his office playing tetris. The rumoured NR from last week is still the rumour. If he took a ‘winky’ drill to one of the props, then say so. But the silence is wrong. Jon may know that something is going on, but the shrholders only know that at the end of June, guys went prospecting at PSP. Nothing since about PSP. Then guys went and prospected and planned drill targets for King in Early July. What ? they couldn’t find any? No follow-up news and chances of a drill next week? Slim. Even the guys at WRR who were called out for not communicating to the mkt what they were up to and when, have done way way better this year than GGI, who have over 6 projects with potential to move their market. WRR up over 100% in the past year. GGI down 20%. Some silence is neat, Steve’s version is well, frustrating and I guess because we have seen what happened in the past with silence on Rambo, Grizzly, and La Patilla. He has given us many reasons to hate silence and the only reason people are here is as you state at the end of you comment Jon, “properties are great”.

I beg to differ on trump, first of all, you shouldn’t watch cnn, and second, that was only round one, check out poles besides the Clinton news network.he’s going to clobber her in round two.

Clinton came across as a professional, scripted politician, exactly what voters are tired of, Laddy…she has definitely “prepared to be President”, as she said, and therein lies the problem…a career politician who has never created a single private sector job…

Jon: do you think Trump deserves to be president and would do a good job at it? thanks!

Trump has a chance to be one of the most transformative politicians in American history, Steven1, and in a good way, if he surrounds himself with wise advisors, listens, adapts, and leads…he has the raw skills…Washington needs a complete shake-up, and that’s why the establishment is so against him…they don’t want change, there are so many vested interests in the status quo…he thinks outside the box, understands money and business, and would bring a much needed, completely different perspective to governing and the major issues of the day compared to the career politicians who have been running the show for so long…in Canada, we have profound examples of what career politicians have done to Ontario (McGuinty-Wynne) and now Alberta (Redford started it, now Notley)…unbelievable…

Also, is ABN’s 5 cent paper free trading now?

Yes it is, Steven1, there were only 22 subscribers and I know several of them…over time that stock (6.5 million) will come out, but the people I know are in no hurry to sell as they got into it for a minimum 10-bagger in 12 months.

Steven

Neither of them deserve to be President in my opinion

But I truly believe that Trump cares about this Country and wants to see it be great again, Hillary on the other hand just wants the power she will do nothing to improve this country she will just make sure that she lines her pockets when she leaves office, pretty amazing how her and Bill had nothing before he became president and now they are filthy rich, how did they do that? What business did they start up how many jobs did they create , that’s right zero!! She and Bill both should be in prison not running for president of the United States .

EXO still on the move this morning, nearest Fib. resistance is 19 cents.

GBB finds gold where they didn’t expect to when stripping for the sump pump . good problem to have.

KIRKLAND LAKE GOLD AND NEWMARKET GOLD TO COMBINE TO CREATE A NEW MID-TIER GOLD COMPANY

Kirkland Lake Gold Inc. and Newmarket Gold Inc. have entered into a definitive agreement to merge the two companies, creating an exciting new mid-tier gold company. The combined company will have a market capitalization of approximately C$2.4 billion and produce over 500 koz of gold annually. Existing Kirkland Lake Gold and Newmarket shareholders will own approximately 57% and 43% of the combined company, respectively, on a fully-diluted in-the-money basis.

The combination of Macassa and Fosterville will form the production backbone of a new mid-tier, high quality gold producer with low cost production and superior free cash flow generation.

Kirkland Lake Gold operates its flagship Macassa Mine Complex in the historic Kirkland Lake gold camp, as well as the Holt, Holloway and Taylor gold mines (the “Holt Mine Complex”) situated along the Porcupine-Destor Fault Zone, all located in northeastern Ontario. With the addition of Newmarket’s Fosterville Gold Mine (“Fosterville”) located in the state of Victoria, Australia and its other gold producing Cosmo and Stawell mines, the targeted gold production of the combined company will effectively be over 500 koz for the full year ended 2016. In addition, the combined company will have comprehensive technical capabilities to exploit its pipeline of development and exploration opportunities across a broad portfolio in both Tier-1 jurisdictions. This growth strategy will be supported by a strong balance sheet with a combined cash balance of over C$275 million along with superior free cash flow generation that amounted to C$92 million, on a combined basis, in the first half of 2016.