Gold has traded between $1,290 and $1,307 so far today…as of 10:15 am Pacific, bullion is up $18 an ounce at $1,306, a new 1-month high…Silver has soared 33 cents to $18.67…Copper is flat at $2.22…Crude Oil has fallen $1.47 a barrel to $45.20 on an inventory surprise, while the U.S. Dollar Index has tumbled another half point to 97.26…

The Federal Reserve wraps up its 2-day meeting shortly with an announcement at 11:00 am Pacific…markets will be looking at language as it pertains to a possible rate hike in December…

The Federal Reserve wraps up its 2-day meeting shortly with an announcement at 11:00 am Pacific…markets will be looking at language as it pertains to a possible rate hike in December…

Gold accelerated this morning on the news of a weaker-than-expected U.S. private sector employment report for October of 147,000 jobs…that was the smallest increase since May and the third worst report in the past year…if the Fed actually has the courage to raise rates in December, which we believe it won’t, it’ll be hiking into a slowing economy…

The world’s largest Gold-backed exchange-traded fund, New York’s SPDR Gold Shares, reported its first inflow in just over a week yesterday, 2.7 tonnes…last month the fund reported a net outflow of just over 5 tonnes but Gold reserves remain near their highest levels in 3 years…

According to commodity analysts at Commerzbank, global reserves of Gold ETFs had inflows of 9 tonnes in October…however, that was the second lowest level of monthly inflows so far this year…over the last 3 months, global reserves have increased by only 33 tonnes…

“That is not even half the inflows that Gold ETFs recorded on average per month in the first 7 months of the year,” the analysts said. “This also explains why the Gold price increase ran out of steam in July.”

HSBC: Gold To $1,500 By Year-End?

Gold prices will rise under either a Donald Trump or Hillary Clinton presidency but likely would rise faster under Trump, perhaps hitting $1,500 an ounce before the end of the year, HSBC said yesterday…

“This U.S. election may be particularly important in setting the course of U.S. economic policy and foreign policy and hence for Gold prices, given the severity of the challenges facing the economy (including still-sluggish economic growth, income inequality, high debt levels and low productivity) and foreign-policy entanglements and challenges,” said the report. “Policy proposals from Democratic presidential candidate Hillary Clinton and Republican Donald Trump vary significantly, leading to potentially very different implications for Gold and other assets.”

BHP Billiton Sees Copper Demand Boost Through Electric Car Sales

Did you know that an average American car contains about 55 pounds of Copper wiring…an electric car, meanwhile, has 3 x as much, mostly thanks to their rotors?…

BHP Billiton (BHP, NYSE), the world’s biggest miner, is looking forward to the coming surge in electric vehicle sales across the globe…the Melbourne-based resources giant sees new opportunities in Copper as consumers opt for electric vehicles, or EVs, and other renewable energy technologies…

“As you see more renewables and EVs, we also will see an impact on Copper demand,” Fiona Wild, BHP’s vice president, sustainability and climate change, said yesterday at a conference in Shanghai hosted by Bloomberg New Energy Finance. “EVs at the moment have about 80 kilograms of Copper in them. As they become more efficient, you see a greater amount of Copper in those vehicles, so there’s always upside for Copper.”

Copper accounts for 27% of BHP’s commodity sales, second after Iron Ore at 34%, according to the company website…

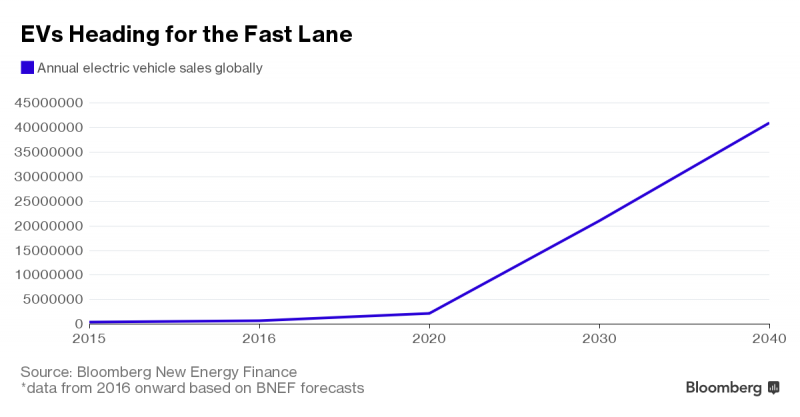

It’s estimated that by 2020, about 2.2 million EV’s will be sold globally, up from 460,000 expected in 2016…as a powerful offset to substitution, Copper is superbly placed to benefit from expanded end use demand on the back of observed trends in technology…

Western Troy Capital Resources (WRY, TSX-V) Awarded $1.25 Million in Genivar Lawsuit

Gold Bullion Development (GBB, TSX-V) is not the only exploration company that has had a major problem with Genivar (renamed WSP Global)…it has been over 4 years since Western Troy (WRY, TSX-V) filed breach of contract and negligence claims against Genivar and one of its employees as a result of Genivar’s work on a feasibility study for Western Troy’s MacLeod Lake Copper Molybdenum Project in Quebec…in an order issued by the Ontario Court, Genivar has been found negligent in a number of instances surrounding its work on MacLeod Lake and Western Troy has been awarded $1.25 million in restitution…the company was also awarded costs and interest, the amount of which will be determined soon…

Rex Loesby, Western Troy’s CEO, commented, “While we are happy this ordeal is finally concluded, we are disappointed with the court’s ruling in that we believe the damages to be far in excess of the award. Throughout the process we have been confident of eventual success in the litigation, but it has been a very long and frustrating effort to get to this point.”

WRY is up a penny at 3 cents on the news as of 10:15 am Pacific…

In Today’s Morning Musings…

1. Benton Resources (BEX, TSX-V) ramps things up and hits a new multi-year high…

2. Bullish possibilities for the TSX Gold Index and the HGU as John updates the Gold chart…

3. Redemption for Prosper Gold (PGX, TSX-V)?…

4. Canadian Zeolite (CNZ, TSX-V) – one of the best charts on the Venture…

5. Daniel’s Den – is it a good sign that Mark Cuban is buying Uranium?…

Plus more…click here to read the rest of today’s Morning Musings and all BMR exclusive content, through a risk-free Pro, Gold or Basic package, or login with your username and password…

8 Comments

I apologize if I get winded early here. I want to mention a stock. I have held off and I feel that I owe it to anyone with interest to have a look at this situation. I think this story is interesting and is going to garnish a lot of attention soon. A recipe for a 10 bagger is to buy and hold (yes, I am a trader, and I said hold), a stock with small share structure and small market cap that no one is buying and is involved in the 2nd biggest staking rush since diamond fields of 1995. Jon has brought BEX and MEK to the board. I think BEX has excellent chances.

Interesting, ALS puts out news about their discovery and it goes by the wayside other than the individual companies and Shawn Ryan. Not one news letter writer has picked up on this yet. My opinion is because gold went into a correction, it is November with tax loss coming up, and they have not one but 2 conferences going on in November and they are busy with these. The rush started prior to the NR by als.

SIC was fast to pick up land to the northeast on the fault. als then went and picked up more land above SIC. Interestingly, everything Shawn Ryan picked up is to the northeast of als discovery and off to the sides of the fault alongside als and sic.

I talked with the CEO of sic last night. He was out of town for a few weeks and the core is now at the lab to their drill program from the antimony drill program. He is leaving shortly for 2 weeks to do some grabs on the property in Newfoundland. He will be updating his web site shortly as it is out of date. Late today, a 100k bid showed up by PI, and they got 7k before the market closed. I talked with some astute investores this week and they feel that every company could have a 20 million market cap in this area as drilling heats up in the spring. SIC at .20 would only have a 4+ market cap. This of coarse is without any financings along the way. I bought a little and it is tucked away. I owned WRR at .025 and .03 and let it go. I thought about buying ICM at .05 in February and 4 months later it was .45. I am content to tuck these shares away this time. You can go to google and check the property staking in Newfoundland and see all the property that has been picked up recently. It is also mentioned in the 3rd paragraph of BEX NR on 10-18. I also have a current map if interested that shows all the property that Shawn Ryan has picked up to the northeast of als discovery. Cheers

I have not done any research, but I just read where there is a renewed interest up in Labrador for iron ore, the price is rising. Also, I forgot to mention that the price for antimony has been skyrocketing and is around $7,000 a ton.

Dave – Nice overview of SIC. SIC management in their release said that the land they picked up next to ALS was very strategic and that the structure runs all the way through their property. No wonder ALS picked up more land continuous to SIC. I would like to see the latest staking claims on a map. I’m sure it would start to peak newsletter writers then. Maybe the newsletter writers are waiting until their coffers are full before covering this story.

NRN- Ian is presenting tomorrow morning at the show in Zurich. 9am Zurich time which is 2am eastern time I believe. Wonder if Ian will have anything new to present? Maybe Se2 and Idefix VTEM results or an announcement when the drill will turn at Sequoi. Huckleberry results still pending as well so you never know. I can’t imagine presenting the same information he presented in May.

Shawn Ryan and SIC were discussed on the Comanus rising podcast Sunday.

Gold looking strong again tonight, $1,300 to $1,310 is the resistance band.

Jon what is your take on sic

I like it, Greg, has a good chance as a speculative play.

Wow – Cubs win World Series in extra innings tonight in dramatic comeback after down 3 games to 1. The curse is broken! Ends a 108-year drought.