Gold has traded between $1,259 and $1,293 so far today…as of 10:30 am Pacific, bullion is down $11 an ounce at $1,267…Silver, showing its industrial side, has jumped 26 cents to $18.72…Copper has soared another 10 cents to $2.54…Crude Oil is off 48 cents at $44.79 while the U.S. Dollar Index has jumped nearly one-fifth of a point to 98.75…

Treasury yields have jumped to the highest levels since January, a signal that markets believe President-elect Donald Trump’s policies could spark a rise in inflation, more growth and ultimately an era of higher interest rates…the Fed has struggled with a “fiscal vacuum” in Washington during the Obama presidency, but it appears that’s about to change with the historic election of Trump Tuesday evening…

Treasury yields have jumped to the highest levels since January, a signal that markets believe President-elect Donald Trump’s policies could spark a rise in inflation, more growth and ultimately an era of higher interest rates…the Fed has struggled with a “fiscal vacuum” in Washington during the Obama presidency, but it appears that’s about to change with the historic election of Trump Tuesday evening…

The blue collar billionaire’s victory speech included a pledge to spend on a massive rebuilding of America’s infrastructure…at the same time, Trump and the Republican Congress will sharply reduce corporate and individual taxes, reverse a multitude of growth-killing government regulations, ramp up military spending, and accept higher deficits on a “temporary” basis on the assumption that stronger growth will allow the government to tackle the debt problem later during his term…depending on what happens on the uncertain trade front, the Trump agenda has potential significant inflationary implications…

Billionaire investor Stanley Druckenmiller told CNBC this morning that he sold all of his Gold Tuesday evening just before Trump was declared President-elect…that has proven to be a smart move from a very short-term perspective but once the market starts digesting higher government deficits and the possibility of a ramping up of inflation, money could start flowing vigorously into Gold…investors will need time to sort out all the potential ramifications of a Trump presidency…

McEwen: Streamlined Regulations Will Be Positive For Mining Sector

Mining entrepreneur Rob McEwen says he’s “delighted” with the outcome of Tuesday’s elections which he believes will be supportive of the mining and investment sector. “I think we’ve allowed our regulators, accountants and our stock exchanges to steal money from investor under the guise of good corporate governance,” McEwen told Kitco News. “It makes investors question why they should buy into this system that isn’t working.”

On the mining side, McEwen said that not only will streamlined regulations attract more investors, but projects will be able to grow and build shareholder value…this is of particular importance for McEwen as his company is in the process of developing two mines in Nevada – the Gold Bar Project and the Tonkin Project…

“I hope that now there will be an attitude of, let’s get sensible regulations in place, let’s get money working faster and let’s not have these very protracted period of time where you are waiting for multiple level of bureaucracy to pass on a project. This isn’t about to take away the integrity but to get things done faster,” he said…

Dow Long-Term Chart

The “squeeze” is still on with the Dow…the index has surged to a new all-time high of 18810 today but is still maneuvering within a tight range between key long-term resistance and critical support…which way will it go?…

The latest look at the Big Board comes in this 35-year monthly chart from John…at current levels, the Dow is fighting resistance again (just like at other times since 2014) and threatening to break out as indicated by the dotted blue line…meanwhile, one major level of support is the rising 200-day moving average (MA-10 on this monthly chart) just below 18000…

The Dow needs to make a decision fairly soon – will it blast off to the upside, overcoming stiff resistance, or will it retreat significantly and potentially break below key support?…how this “squeeze” sorts itself out will be fascinating to watch, but current momentum and political dynamics do appear to favor a breakout (at some point)…

In Today’s Morning Musings…

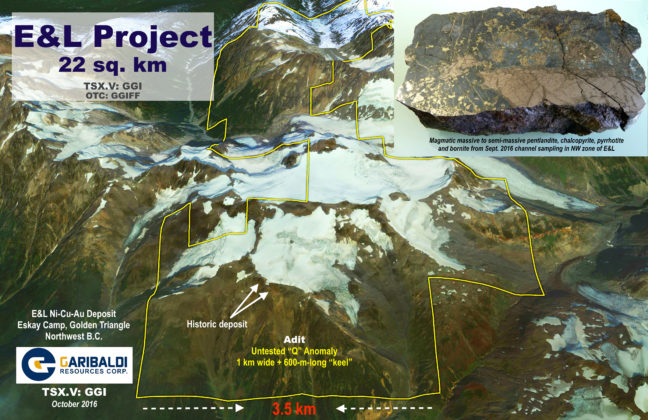

1. Garibaldi Resources (GGI, TSX-V) shows high-grade Nickel and Copper, plus exceptional tenor and other metals, at E&L deposit in Heart of Gold Camp…

2. American Manganese (AMY, TSX-V) soars on proof of concept test results for upcycling and recycling Lithium-ion battery cathode material…

3. Canadian Zeolite (CNZ, TSX-V) continues to march higher…

4. A 5-cent non-resource play that has a good chance of delivering some Christmas joy…

Plus more…click here to read the rest of today’s Morning Musings and all BMR exclusive content, through a risk-free Pro, Gold or Basic package, or login with your username and password…

In Today’s Morning Musings…

1. Garibaldi Resources (GGI, TSX-V) shows high-grade Nickel and Copper, plus exceptional tenor and other metals, at E&L deposit in Heart of Gold Camp…

2. American Manganese (AMY, TSX-V) soars on proof of concept test results for upcycling and recycling Lithium-ion battery cathode material…

3. Canadian Zeolite (CNZ, TSX-V) continues to march higher…

4. A 5-cent non-resource play that has a good chance of delivering some Christmas joy…

Today’s Equity Markets

Asia

Asian markets were up sharply overnight, led by Japan’s Nikkei which soared nearly 7%…

Europe

European indices were modestly lower today but Copper giant Antofagasta climbed more than 10%…

North America

The Dow is 220 points higher through the first 4 hours of trading with stocks adding to their gains after a meeting at the White House this morning between President Obama and President-elect Trump…the TSX is up 41 points while the Venture is trying to hold support at the bottom of a downsloping channel…it’s off 7 points at 746 as of 10:30 am Pacific…

Gold stocks are in a rut at the moment and that’s putting attention on other types of plays…American Manganese (AMY, TSX-V) has soared 11 cents to 27 cents on total volume (all exchanges) of more than 16 million shares after announcing that Phase 3 testing conducted by Kemetco Research has confirmed that rechargeable Lithium-ion battery coin cells can be successfully produced from Lithium-cobalt cathode material regenerated using American Manganese’s proprietary process…

Canadian Zeolite (CNZ, TSX-V) gapped up again this morning and came within 2 pennies of John’s measured Fib. resistance of 91 cents…we’ll have an updated chart tomorrow…the stock is up 4 cents at 83 cents as of 10:30 am Pacific…

Almadex Minerals (AMZ, TSX-V) is off 8 cents at $1.62 as of 10:30 am Pacific after disappointing results released last night from drill hole EC-16–13 at the Norte zone (414.4 m @ 0.11% and 0.16 g/t Au including 74.5 m grading 0.19% Cu and 0.38 g/t Au)…the stock ran to the $2 level yesterday as we speculated it would based on John’s charts and we hope subscribers have locked in at least some profits…drilling continues at the El Cobre Project which has outstanding potential, but today is the first loss of momentum as far as the geological story is concerned since the announcement of the original discovery in August…the stock now likely needs to unwind from temporarily overbought conditions…

Duane Poliquin, Chairman of Almadex, commented: “We started drilling again at the Norte zone to follow up an old hole that ended in important mineralization. The Norte Zone has room to grow from the recently reported intersections. Nevertheless, the extensive geophysical and alteration work we have done in the past show this area to be an offshoot of a much bigger target which may represent the intrusive core of this large porphyry system. This untested bigger target along with the untested Villa Rica zone will be drilled in the weeks and months ahead. To that end, a new more powerful drill was recently built for the company. It was shipped from Vancouver this week and should be in Mexico within 2 weeks.”

Garibaldi Resources Corp. (GGI, TSX-V) Update

A new era is emerging for Garibaldi Resources (GGI, TSX-V) in light of very significant news this morning (there is much more to come regarding this story) as the prolific Heart of Gold Camp flexes its muscles again…keep in mind, this is arguably the most mineralized part of our entire planet with Eskay Creek, Brucejack, KSM, Snip and other potential deposits that are being explored…so why would it be so unusual for a Voisey’s Bay 2 to be hiding somewhere in this very rich neighborhood?…

It’s becoming clear now that the ingredients for a major high-grade magmatic Ni-Cu-PGE deposit(s) in the Heart of Gold Camp exist at GGI’s E&L Property…Ni-Cu-Au mineralization found at the E&L in the 1960’s was one of the important original discoveries in the district and led to the construction of the area’s first airstrip…explorers walked away in the early 1970’s, however, after they got surprised by a drilling “miss” from an underground tunnel after successful holes were drilled from the top of Nickel Mountain (they misinterpreted the dip of the pipe-like structures)…what they lacked back then, of course, was district “context” (all the major deposits in the region weren’t discovered until the 1980’s and later) as well as the knowledge geologists now have of Nickel-Cu-PGE systems after developments elsewhere around the world including Voisey’s Bay…

Rick Mills (Ahead of the Herd) is a Nickel enthusiast and has written a lot about Nickel tenor…we suggest you check out some of his work…

This morning, GGI reported exceptional tenor values determined from channel sampling at the top of Nickel Mountain…a 12-m trench sample returned grades of 1.6% Ni and 1.6% Cu including 8 m of 2.3% Ni, 2.2% Cu, 0.32 g/t Pt, 0.39 g/t Pd and 0.10% Co…

Significantly, sulphur values averaged 12.8% for the 12 m and 14.3% over 8 m (including 22% in 3 m of massive sulphides)…this provides an impressive tenor/grade range of 4% to 8% Ni and 2.1% to 10.9% Cu in 100% sulphide as confirmed by GGI…tenor would be consistent wherever sulphides have accumulated at the E&L, making the broad “Q” magnetic anomaly with a 600-m-long keel a Voisey’s Bay-type target…the “Q” is 800 m south of the original deposit and at least 400 m below it as per this Google Earth map…

We believe there is much, much more to flow from what GGI is now finding out about the E&L which is consistent with what’s happening elsewhere in the district…just a few weeks ago, for example, Seabridge Gold (SEA, TSX) gave a fascinating new interpretation of the past producing Johnny Mountain mine and the immediate area which rests about 15 miles northwest of GGI’s E&L deposit…quite simply, Johnny Mountain is now believed to be on the margin of a larger mineral system…the same applies to the E&L deposit that was outlined in the late 1960’s…

Last night, we had a question from one of our astute readers which we promised we would answer in today’s Morning Musings…

“The Chinese group that you have been referring to that may have an interest in GGI and the E&L Property, do you know if that group is already involved in Nickel mines elsewhere? When will be able to know the name of this Chinese group?.”

The Chinese group we’re referring to is the one that holds key claims contiguous to the border of GGI’s E&L…we’ve learned that they’re a very well-funded group out of Richmond, B.C., with an obvious interest in the Camp as well as Gold…it is our belief that an important deal is in the works between this group and GGI which ultimately may have significant implications for the development of some of GGI’s other assets, in addition to the E&L…in terms of Nickel expertise, no – this Chinese group doesn’t have it, but that doesn’t matter as we’re certain that Nickel industry experts have already been in discussions with Garibaldi given the numbers and information regarding the deposit and property…as Regoci stated in the news release this morning, “Further updates will be provided shortly”…there appears to be much going on behind the scenes…next week could be even more interesting…

The dictionary defines “catalyst” as a “person or thing that precipitates an event.”

We go back to what we have been saying all along…

The E&L is going to be a MAJOR catalyst for GGI, triggering not just one event but a series of events in our view that will fundamentally change this company and deliver shareholder value…we recommend continued accumulation in advance of what could be even better news very soon…

GGI 4-Year Weekly Chart

Technically, GGI is looking better than most stocks on the Venture at the moment and it also does not have any issues with regard to free-trading paper from a late spring or summer financing…so when momentum starts coming into GGI, it should run very quickly…

GGI is currently on the edge of a pending major breakout as defined by the downsloping channel in effect since late last year…the 300-day SMA, not shown on this chart, is just beginning to reverse to the upside…

GGI is unchanged at 8.5 cents as of 10:30 am Pacific…continue to accumulate as a high-grade Copper-Nickel situation like this is certain to attract growing attention…

Colorado Resources Ltd. (CXO, TSX-V) Update

The trading action in Colorado Resources (CXO, TSX-V) continues to be favorable with the stock having shown unwavering support (and a probable bottom) at the Fib. 21-cent level…the rising 300-day SMA at 24 cents is also serving as support…SS remains very oversold which further underscores how it’s highly likely that CXO has completed its correction from the summer high of 71 cents…

From a fundamental standpoint, the company is still crunching through data from the huge amount of work carried out at the KSP Project from June to September and an updated overview of the Inel target should be highly favorable…in the meantime, we do expect Colorado to broaden out its project base with a near-term acquisition of a property in a southern climate that will allow for winter exploration to complement summer activity in the Heart of Gold Camp…plenty of cash in the bank (at least $2.5 million) and strong investor support from Kinross and others, so the 2017 outlook for CXO is exceptional…much of the free-trading paper from last May’s financing has likely been cleaned up…

CXO is off half a penny at 25 cents as of 10:30 am Pacific…

Hit Technologies Inc. (HIT, TSX-V) Update

Subscribers looking for another non-resource play that has a great chance of accelerating before Christmas should consider Hit Technologies (HIT, TSX-V) between a nickel and 5.5 cents…a week ago, HIT announced that it will be launching its newest Hitcase, the Shield for iPhone 6 and 7, into 64 Best Buy stores across Canada in time for the Christmas season…that should help inject some speculation into the stock as we draw closer to Christmas…

Technically, HIT is looking strong and is on the verge of a confirmed breakout above a downtrend line…RSI(14) continues to push to the upside while the next Fib. resistance is 7 cents…hard not to make money on this one, in our view, if you’re positioned at current levels…

HIT is off half a penny at 5 cents as of 10:30 am Pacific…

Note: John and Jon both hold share positions in GGI and CXO. Jon also holds share positions in CNZ and HIT.

16 Comments

Looks like some tax loss selling today with CLE.

Dave, what you make of the news today with PMA?

Nice move in AMY.V today. looks like still a good buy

Mj stocks seem quite over valued at the moment?

I noticed “recent staking” in lime green on the GGI map – is this the company from Richmond? Any chance you can share the name? Hard to find on the BC government website…..Thanks.

GGI looks like it will move next week…feeling it. Added to my position as well. Not a stretch to be comparing to Voisey Bay

Cheers

Foz

Interestingly, Foz1971, ground was dropped at the very beginning of the year at the bottom of the bear market contiguous to what is now GGI’s E&L Property as per their latest map, and this is when the Chinese stepped up to the plate with some strategic staking (about 5 months before GGI completed its deal to acquire the E&L deposit)…spectacular (even lucky) timing on the part of the Chinese group…given the discovery of the “Q” anomaly including the associated “keel” or potential conduit, and the growing realization that the main system is likely to the south/southwest/southeast of the original deposit (the keel trends south-southeast), the Chinese all of a sudden have much more valuable real estate but you can be sure they’re very curious about their neighbor and the E&L…this makes for some very interesting dynamics…look at the tenor/grade range provided by GGI today plus the whole suite of Ni-Cu-PGE-Au-Co within the 12 meter trench…South32 jumped in on NRN on far less than what GGI has at the moment at the E&L…this is the highest grade Ni-Cu-PGE system in British Columbia in a proven high-grade district and, yes, the tenor is already Voisey’s Bay comparable…this is a known deposit that could be far, far bigger and richer in grade than anything the historical prospectors could have imagined in the 1960’s given what geos know now about the area and these types of deposits, half a century later…the mineralization outcropping at the top of Nickel Mountain rose up from somewhere (3 million tonnes of it near-surface)…a lot more makes sense after looking at today’s numbers from GGI…looking fwd. to seeing the next step here, probably next week…

Foz1971, I have the same feeling and have also added to my position in GGI, sounds like a steady news flow coming, base metal prices looking strong which I think the Trump election will help, maybe, finally, things are lining up for GGI.

GGI 198,261 cash end of July when will they announce a pp has to be coming?

There could be some pleasant surprises on that front as well, TheSkipper, in terms of who could be dealing with them at the moment re: the E&L.

JON: did you look at LIX today? weren’t they drilling in Nevada??? up 40 cents! any comments? This could help the lithium sector!!

Yes, Steven1, LIX looked great today on no news and John completed a chart after the close that we’ll be posting tomorrow. The stock has been a great buy since the spring anytime it has dropped into the $1.60’s.

Jon, what kind of a deal would this Chinese company be trying to do with GGI that makes sense for all involved?

Greg, what do the Chinese have? Money (lots of it) and key ground (40 sq. km) next to E&L. What does GGI have? The highest grade and most prospective Ni-Cu-PGE system (with Gold and Cobalt) in the entire province in a prolific district that features one of the world’s highest grade Gold deposits going into commercial production next year. Plus, of course, GGI has other very attractive Gold-Silver-Copper assets in B.C. and Mexico. I see great opportunities for both parties, Greg. Let’s see what may develop (“further updates will be provided shortly” on E&L as news mentioned this morning). Obviously there are things cooking. Helps with the way Nickel and Copper are trading these days.

Jon

I guess what I meant to ask is what do you think GGI will have to give up to get the money that the Chinese have to further GGI projects, joint venture 50/50?

I don’t think it’s a question of “giving up” anything at this point, Greg, in terms of an interest in the E&L if that’s what you’re referring to. I suspect Regoci will hang on very tightly, lock, stock and barrel, to 100% of it. He’s in a position of strength that he hasn’t been in for quite some time given how good this looks, which means being able to avoid situations like Secutor and bring in higher quality players like the Chinese and others. There are some big fish who are really bullish on the outlook for Nickel (and Copper) going forward.

GGI. Nice. Are there anyother juniors who will benefitfrwom E+Ls new news?

David, how about the entire camp in due course?…anyway, I would suggest investors keep on eye on Metallis Resources (MTS, TSX-V) directly below GGI with its Kirkham Property as not only does the Kirkham have some very under-appreciated high-grade Gold and Copper-Gold porphyry targets, but there’s a mafic package on the northern part of their ground that could be some sort of an extension of what GGI has at the E&L. MTS has a tight share structure and drill-ready targets for next year. This is going to turn out to be a very hot corridor in this Camp, and of course KSP is immediately next door to the west.

wow. copper up 14 cents!!