Gold has traded between $1,198 and $1,213 so far today…as of 11:30 am Pacific, bullion has fought back to even on the day at $1,210…Silver is also now virtually unchanged at $17.53…Copper is off 2 pennies at $2.69…Nickel has jumped 13 cents $4.62…Crude Oil is nearly $1 higher at $53.71 a barrel while the U.S. Dollar Index is up one-fifth of a point at 99.73, backing off from its high of the day…

Fed statement just out…Ma Yellen and her crew see “improved sentiment”, except on CNN, but no need to raise interest rates at the moment…the Fed also alluded to signs of rising inflation which explains the rebound in Gold in the last 30 minutes…

Gold’s strength in recent days can be attributed to uncertainty generated by the busy start to the Trump Presidency (imagine, a politician who actually does what he promised he would do!) and the mainstream media’s hysteria and distortions…meanwhile, Commerzbank pointed out allegations made by President Trump and his economic adviser Peter Navarro yesterday that Germany and Japan are benefiting from currency manipulation (mind you, what country doesn’t try to manipulate its currency?)…it seems the new President would like to see a lower U.S. dollar to help “win” on trade, and that would be bullish for Gold and commodities in general…however, while he can influence the markets, he certainly can’t control them…multiple dynamics will be at play in determining the direction of the greenback…the way the Venture has been behaving, though, it seems unlikely the Dollar Index will break out past key resistance at 104 anytime soon…

Gold gained more than 5% in January – its best month since June of last year – as the dollar suffered its worst start to the year in 3 decades, hurt by President Trump’s comment that every “other country lives on devaluation‘…

Some of Wall Street’s largest fund managers are betting on Gold, wagering that Trump’s governing style and upcoming elections in Europe will combine to create more stock market volatility and boost demand for the metal…the elites in the EU are terrified of Trump – looks good on them…

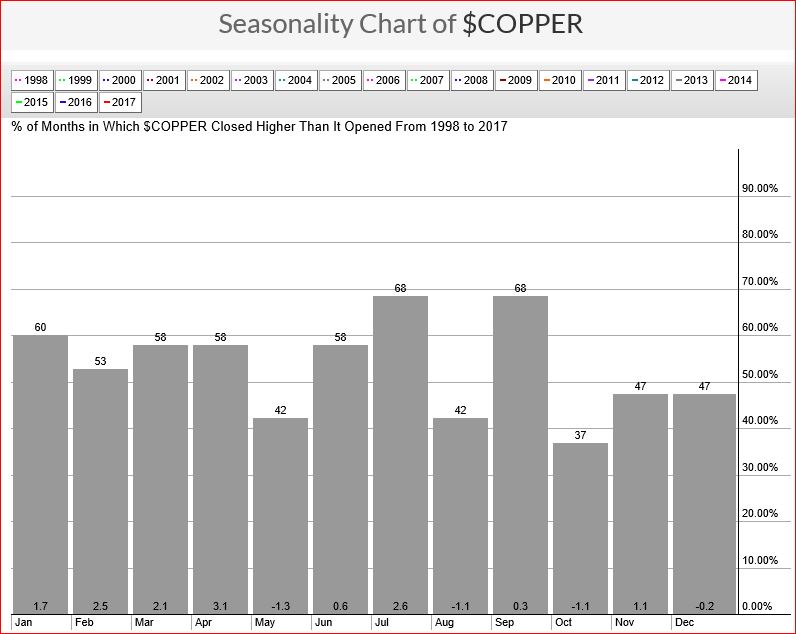

Copper Seasonality Chart

Copper, like Gold, has historically performed very well in February with an average return of 2.5% going back 20 years…only April (3.1%) and July (2.6%) have been better…

Copper normally does very well during the first 7 months of the year before tailing off beginning in August, though last November’s U.S. elections interrupted that historical pattern of weakness in the final quarter…

Oil Update

Oil has been in strong positive territory today, supported by signs that Russia and OPEC producers are delivering on promised supply reductions, although a report showing a large rise in U.S. Crude inventories may have somewhat restrained today’s advance…

Bullish bets on Oil rose to a record in January, reflecting widespread optimism that Crude prices are poised to move higher as OPEC starts cutting production in a bid to ease a global supply glut…

Wagers on rising U.S. Oil prices have more than doubled in less than 3 months…long, or bullish, positions last week exceeded short, or bearish, positions by 370,939, marking the largest net bullish position in 10 years of data from the Commodity Futures Trading Commission…

To put the size of the bullish position in context – the more than 420,000 bets on rising Oil prices in place last week represented nearly all the Crude held in U.S. commercial storage tanks…a sign of faith, one could argue, that the nearly year-long Oil rally has more room to run…we remain bullish on the HOU (TSX) double bull Crude Oil ETF which is trading around $8.50…

In Today’s Morning Musings…

1. Dr. Copper speaks loudly…

2. AU soars on…Au grab samples!…

3. The gem in the heart of the Golden Triangle that an unnamed senior mining company has pounced on…

4. Daniel’s Den – ORG news plus the 6-cent stock Goldcorp and Rob McEwen keep holding…

SAVE 25% on our January Special (extended for a few more days due to reader requests) with a risk-free BMR Basic, Gold or Pro Subscription TODAY – and we’ll show you our proprietary strategies that have delivered unbeatable documented triple-digit returns.

With an industry-leading 100% money-back satisfaction guarantee for new subscribers, you can enjoy unlimited access to all BMR content with a PRO membership.

Sign up NOW or login as a current subscriber with your username and password.

7 Comments

feels like a “redbull” market – things are flying

GGI – Looking good, and the chart is out of any threat of a head and shoulder pattern. Very weak resistance at .17 and nothing after that.

Cmon Jon…

Upload one of those interviews…wet our appetite 🙂

Funny you should mention that, weatheritout…suffice to say, you’ll be wanting to keep an eye on BMR the next several hours…

DBV great day and looks like things are heating up as drill results are pending.Insider buying.

Break the .15 cent level and were on our way to .20

GLTA

Yes, nice to finally see the breakout today, TheSkipper, and on strong volume. Looking fwd to results, especially hole 26.

Sounds good Jon….look forward to it!