Gold has traded between $1,219 and $1,233 so far today…as of 10:45 am Pacific, bullion is down $7 an ounce at $1,226…Silver is off 11 cents at $17.82…Copper is up slightly at $2.77…Nickel is flat at $4.82…Crude Oil has slipped $1 a barrel to $52.86 while the U.S. Dollar Index is flat at 101…

Analysts say global Gold ETF inflows have surged over 40 tonnes so far this month after a plateau in January, with large daily builds of around 10.5 tonnes on February 1 and 7. “In light of recent ETF builds, we suspect a similar positive trend in U.S. Gold Eagle coins could also emerge this month,” Citi says. “However…we caution that further Gold price increases could accelerate scrap rates. This in turn could dent fabricator demand for ‘new’ doré in the coming months, especially in Western and Middle Eastern markets.”

Analysts say global Gold ETF inflows have surged over 40 tonnes so far this month after a plateau in January, with large daily builds of around 10.5 tonnes on February 1 and 7. “In light of recent ETF builds, we suspect a similar positive trend in U.S. Gold Eagle coins could also emerge this month,” Citi says. “However…we caution that further Gold price increases could accelerate scrap rates. This in turn could dent fabricator demand for ‘new’ doré in the coming months, especially in Western and Middle Eastern markets.”

Gold traders await key testimony from Fed Chair Janet Yellen before Congress this week…Ma Yellen is slated to testify before Senate and House committees on the state of the U.S. economy and traders will be watching closely for clues on the timing of the next interest rate increase…the market is pricing in expectations for a June 14 interest rate hike, with odds seen at 48% for a 25 basis point increase at that time, according to the CME Group FedWatch tool…currently, the market is only pricing in an 18% chance of a rate hike at the March 15 meeting…

Oil Update

The Paris-based International Energy Agency (IEA) said Friday that global Crude supply dropped by 1.5 million barrels a day in January month-on-month and 730,000 a day year-over-year…if the nearly 1 million-barrel decline by OPEC is confirmed later today by the cartel in its February bulletin, it would mean a 90% compliance with the production cut pact agreed last year…OPEC’s January production fell to 32.06 million bpd according to the IEA…

However, burgeoning production from non-cartel players could impede the rate of decline…collective production from Canada, the U.S. and Brazil is expected to grow by 750,000 barrels a day in 2017 and the net change for non-OPEC producers next year is close to a growth of 400,000 barrels a day, the IEA said…

Analysts say that even though the pace of growth in U.S. production is currently not fast enough to offset the declining rate elsewhere, a rapid improvement in drilling technology and increased investment in innovation means production from the U.S. remains a threat that ultimately could derail OPEC’s plan to move the market into a deficit…American oil drillers activated 8 more Oil rigs in the week ended February 10, bringing the total U.S. count to 591, the highest number since October 2015 according to Baker Hughes…

John’s Oil charts are calling for significantly higher prices this year, so expect some “surprises” like a major international (Middle East) incident to disrupt the market…

In Today’s Morning Musings…

1. Eskay Mining (ESK, TSX-V) teams up with Silver Standard Resources (SSO, TSX)…

2. Doubleview Capital (DBV, TSX-V) hits a new 18-month high…

3. A Gold junior under a nickel that deserves some love…

4. Silver update…

5. Daniel’s Den – investing in stocks as a business…

Stay tuned for an important announcement from BMR…

Plus…coming soon…specific permanent section (24/7) for Eskay “Heart of Gold Camp” coverage!…

Silver Short-Term Chart

Silver faces a couple of important tests now on its short-term chart…

- RSI(14) is brushing up against overbought territory and potential resistance at 70%

- The metal’s price has touched the 200-day moving average (SMA) at $17.95 which can also be expected to provide resistance, at least temporarily

Buy pressure (CMF) remains steady while the ADX indicator confirms a strong bullish trend…it wouldn’t be unusual at this point for Silver to back off a little and consolidate for a brief period before ultimately pushing to new 2017 highs…

On any pullback, look for strong support between the now-rising 50-day SMA, currently $16.85, and the $17.25 level…

Today’s Equity Markets

Asia

Asian markets were up modestly overnight…China’s Shanghai Composite jumped 21 points to close at 3217…

Europe

European markets were strongly higher today, aided by broad strength in the base metals sector…

North America

The S&P 500 has reached $20 trillion in market cap for the first time ever…it needed to break above 2,324.22 to reach the milestone…the Dow has jumped 166 points to a new record high, the TSX has added 27 points while the Venture is flat at 836 as of 10:45 am Pacific…

Certain Cobalt stocks are extremely attractive, particularly on any weakness…

Capitalizing On Cobalt (Part 3) – Overlooked Opportunities!

McEwen Mining (MUX, TSX) is acquiring Lexam VG Gold (LEX, TSX) at 31 cents per share in all-share transaction…Lexam’s assets include multiple advanced exploration projects located in the prolific Timmins Gold Camp and will add Measured and Indicated resources of 1.5 million ounces and Inferred resources of 954,000 ounces to McEwen Mining’s resource base…

Columbus Gold (CGT, TSX) has started a 5,500-m drill program at its 100%-owned multi-million ounce Montagne d’Or Gold deposit in French Guiana…in anticipation of the forthcoming completion of a Bankable Feasibility Study on the deposit, an exploration focused drill program will assess expansion potential…36 core holes, for a total 5,500 m, are designed as a first pass investigation of exploration targets on strike and in very close proximity to the currently defined mineral resources…3 separate targets will be tested outside of the deposit envelope…

Doubleview Capital Corp. (DBV, TSX-V) Update

Doubleview Capital (DBV, TSX-V) continues to firm ahead of drill results from the Hat…again, DBV is yet another example of how astute technical analysis can produce some terrific gains in the market…

What John was closely monitoring was the anticipated breakout above the downsloping channel that stretched all the way back to late 2014…after multiple attempts to overcome that stiff resistance over a period of more than 2 years, the stock finally conquered that wall early last week and DBV quickly gained momentum as a result…

DBV, up a penny at 18 cents as of 10:45 am Pacific, is now attempting to overcome Fib. resistance at 17 cents with the next resistance levels indicated on this updated 3-year weekly chart…

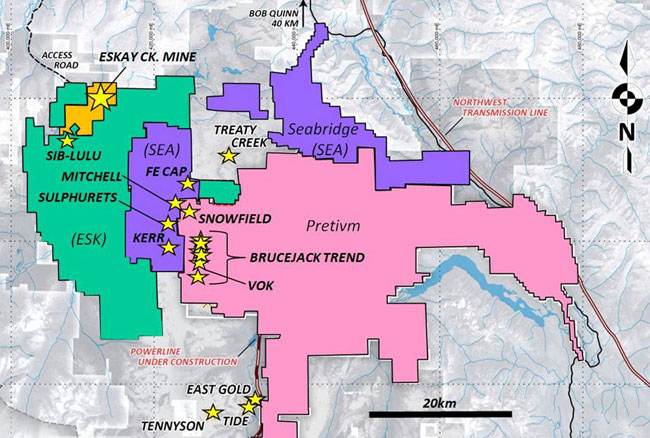

Eskay Mining (ESK, TSX-V) Partners With Silver Standard Resources (SSO, TSX-V) For SIB Exploration-Development

Big news this morning in the Heart of Gold Camp (it’ll be talked about a lot at PDAC!) as Silver Standard Resources (SSO, TSX) is returning robustly to the district to pursue a major discovery at Eskay Mining’s (ESK, TSX-V) highly prospective SIB Property contiguous to the prolific past producing Eskay Creek mine…it was confirmed this morning that Silver Standard is the “mystery” senior mining company ESK referred to in its January 26 news release when it revealed that it had signed an LOI to option a majority interest in the SIB for $12 million in exploration expenditures over 3 years, including as much as nearly $4 million this summer…that’s a game-changer for ESK and the stock has responded accordingly…

ESK and SSO will now proceed to convert an LOI into a formal agreement for SSO to acquire an option to earn up to a 60% undivided interest in the SIB with Eskay Mining and St. Andrew Goldfields, a wholly-owned subsidiary of Kirkland Lake Gold (KL, TSX), holding the balance (KL has waived its first right of refusal on the SSO deal with ESK)…

The SIB is very much a jewel of British Columbia’s entire Golden Triangle – if there’s another Eskay Creek in B.C., it’s likely at the SIB for multiple sound geological reasons…we’re convinced, and so are some highly respected geologists, that there is another Eskay Creek (perhaps more than one) at SIB given all that’s now understood about this amazing property after more than $30 million in exploration expenditures since the 1980’s…the rocks and stratigraphy at SIB match Eskay Creek and there’s now a solid theory on where to find the “motherlode”…that’s clearly why Silver Standard has stepped in…

As exciting as the SIB is, that property represents just under 10% of ESK’s entire land package in the district…parts of that are also prospective for another Eskay Creek discovery in addition to other deposit types…overall, this is PRIME REAL ESTATE strategically positioned in one of the richest mineralized areas of the planet…

The ESK–SSO SIB deal is yet another lucky break for Garibaldi Resources (GGI, TSX-V)…GGI acted aggressively last year to acquire the largest land position of any junior surrounding ESK when it assembled its sprawling Palm Springs Project (PSP)…worked was carried out over the summer at PSP and we wouldn’t be surprised if GGI has made some interesting surface discoveries that will carry much more importance now that Silver Standard has stepped into the area and will be drilling aggressively by late Q2…GGI’s prime focus, of course, will be its E&L project to the southwest – the first Ni-Cu-rich massive sulphide system in the district – which Silver Standard holds an NSR on…

Eskay “Heart of Gold Camp” Update & The “Q” vs. The “Ovoid”

Candente Gold Corp. (CDG, TSX-V) Update

Continue to keep a close eye on Candente Gold (CDG, TSX-V), an inexpensive Mexican Gold play that Daniel uncovered in his column February 6 when the stock was trading at 3.5 cents (just over 100 million shares outstanding)…CDG’s flagship asset is the El Oro Project, a district-scale Gold project encompassing a well-known and prolific high-grade Gold-Silver epithermal vein system in Mexico…El Oro covers 20 veins with past production and more than 57 veins in total, from which approximately 6.4 million ounces of Gold and 74 million ounces of Silver were reported to have been produced from just 2 of those veins…

Daniel covered CDG’s fundamentals exceptionally well…

Technically, the stock has been under steady accumulation since early 2015 and momentum is starting to pick up with CDG now threatening to push above its 200-day SMA at 4.5 cents…expect some additional resistance at a nickel but after that the coast is clear until the 7 to 7.5-cent area…

CDG closed at 4.5 cents Friday on higher than usual volume…we’ve added the stock to our “Pure Gold play” list at 4 cents…

Daniel’s Den by Daniel T. Cook

Investing in stocks as a business…

Is it riskier than any other type of business?

From my perspective, the conventional wisdom among the general public is that stocks are risky. Investing into stocks for them is akin to gambling at a casino. Yet at the same time many of these same people wouldn’t think twice about investing into real estate with little or no money down. Or investing nearly all of their time and money into building a business.

Surely, there are vast sums of money to be made with all three – stocks, real estate, and private corporations. I’m just thinking for many people there’s an illusion of safety when investing into real estate or a private corporation because they are more tangible.

Of course, stocks (or equity) are also tangible. There is a business underlying every stock (surely, not all businesses are created equal, but you get the point). That was Warren Buffett’s epiphany and it is inevitably one of the most important epiphanies every extremely successful investor must have, in my opinion.

When buying a stock for investment purposes we’re buying a piece of a business, so regardless of whether we own 1 share or 1,000,000 shares, we are part owners.

So comparing stocks to gambling is not exactly a good one. Perhaps comparing the options market to gambling would be more appropriate, because each has an expiration date, whereas common stocks do not.

On the other side of the spectrum you have real estate and private corporations…

It’s easy to forget that leverage is involved with most real estate investments, major leverage. In fact, for most home buyers this is the most levered purchase they’ll make in their lives. Nothing wrong with that whatsoever. We’ve all got to live somewhere. Point being, real estate is a big commitment and it’s difficult to just dip your toe in and test the water like you can with stocks.

With a private corporation the leverage doesn’t have to be as significant, compared to real estate, but the time commitment often does. And time is valuable, is it not?

Many small corporations aren’t even corporations at all, they are jobs. If a corporation does not operate on its own while the owner is sun bathing in Maui, it is more job than corporation.

That last statement may sound a bit harsh, but I can say this because I’m a small business owner and the business would not exist without me (it’s a job, I just happen to be the boss). Point being, the business world is extremely competitive and building a successful business consumes a phenomenal amount of time. Wouldn’t you agree?

Here’s what’s so great about investing in stocks for a living!

Bullet point style…

- Inventory can be stored for free

- No office or facilities are required, so no rental fees

- Freedom to work your own hours

- Freedom to work from any location

- No employees needed

- Shipping costs are next to nothing if trading online

- Little to no liability risk

- Scaling up the business is quite simple

Obviously, trading stocks and investing in stocks for a living isn’t easy or everyone would be doing it. Does it require lots of time and effort? Of course it does. Are there risks involved? Of course, but if one is willing to accept those risks the market can be very rewarding.

Bottom line, trading and investing in stocks for a living requires effort, time, and strategic thinking, but the work can be done from anywhere in the world and the schedule is flexible.

6 stocks that put food on the table…

As you know, I’ve consistently covered the companies below on your behalf for some time now, and that’s because these 6 stocks are among my top holdings. One of the special things about BMR is that we eat our own cooking. So when you invest alongside us our interests are aligned, therefore we feast or famine together.

If your stock portfolios looks anything like mine you’ve been eating like a King lately.

Just don’t forget to set some rations aside in the event winter sets in early.

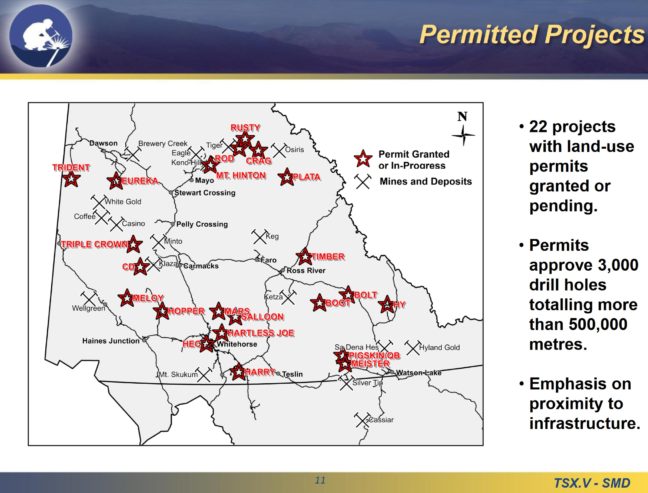

1. Strategic Metals Ltd. (SMD, TSX-V)

Strategic Metals is a project generator at a very-large scale and currently has interests in more than 130 properties assembled by an accomplished exploration team utilizing a proprietary database. Through project farm-outs, investments, and royalty sales, the company has grown its cash and shareholdings to more than $40 million.

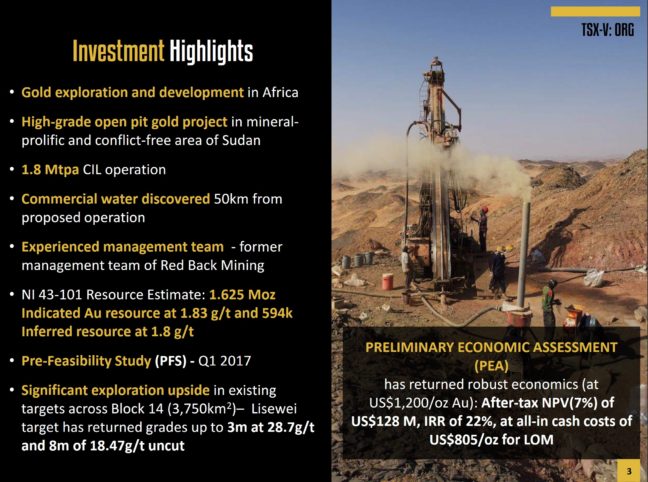

2. Orca Gold (ORG, TSX-V)

Orca is engaged in the acquisition and exploration of mineral properties in Africa. Its primary focus is the Block 14 Project which constitutes a large landholding of 3,750 sq. km. Situated in northern Sudan near the border with Egypt, the tenement overlies the Arabian-Nubian Shield.

Despite regional pharaonic Gold mining, there has been little if any modern commercial exploration activity at the property, although the ground is considered to be highly prospective by artisanal miners.

3. K92 Mining (KNT, TSX-V)

K92 Mining has commenced Gold production from the Irumafimpa Gold deposit which, together with the Kora Gold deposit, is part of the company’s Kainantu Gold Project located in the Eastern Highlands province of Papua New Guinea. K92 is operated by an experienced team of mining company professionals who, combined, have been involved in building over 20 mines and $5 billion in buyouts.

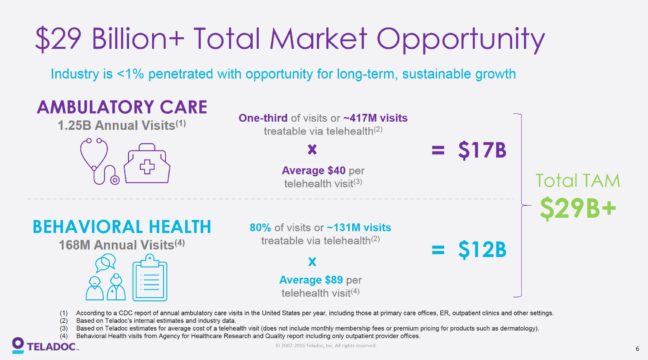

4. Teladoc (TDOC, NYSE)

Teladoc is the nation’s leading provider of telehealth services and a pioneering force in bringing the virtual care visit into the mainstream of today’s health care ecosystem. Serving some 7,500 clients – including health plans, health systems, employers and other organizations – more than 17.5 million members can use phone, mobile devices and secure online video to connect within minutes to Teladoc’s network of more than 3,100 board-certified, state-licensed physicians and behavioral health specialists, 24/7.

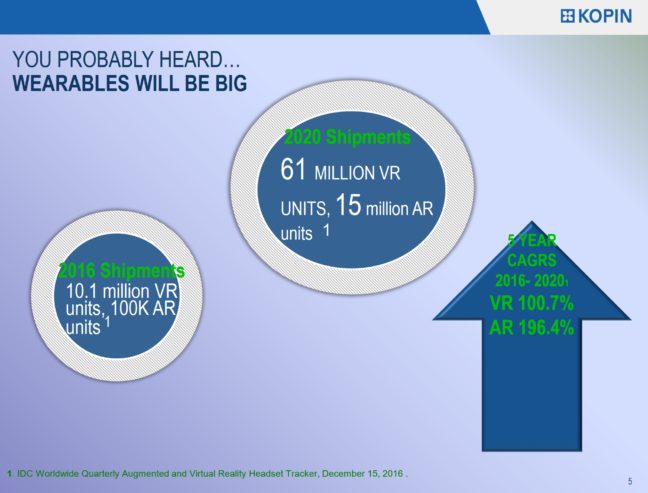

5. Kopin (KOPN, NASDAQ)

Kopin is a leading developer and provider of innovative wearable technologies and solutions for integration into head-worn computing and display systems to military, industrial and consumer customers. Kopin’s technology portfolio includes ultra-small displays, optics, speech enhancement technology, system and hands-free control software, low-power ASICs, and ergonomically designed smart headset reference systems. Kopin’s proprietary components and technology are protected by more than 300 global patents and patents pending.

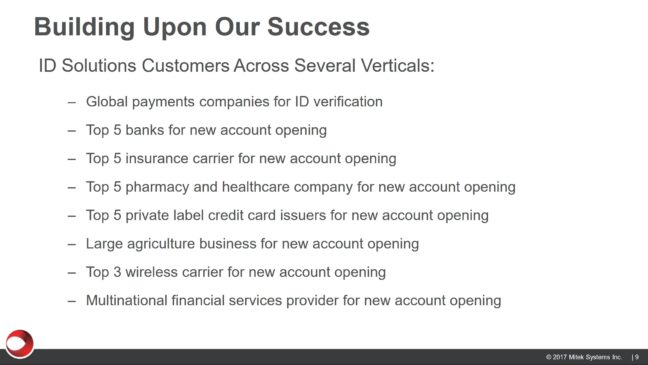

6. Mitek Systems (MITK, NASDAQ)

Mitek is a global leader in mobile capture and identity verification software solutions. Mitek’s ID document verification allows an enterprise to verify a user’s identity during a mobile transaction, enabling financial institutions, payments companies and other businesses operating in highly regulated markets to transact business safely while increasing revenue from the mobile channel. Mitek also reduces the friction in the mobile users experience with advanced data prefill. These innovative mobile solutions are embedded into the apps of more than 5,400 organizations and used by tens of millions of consumers daily for new account openings, insurance quoting, mobile check deposit and more.

About the writer: Daniel T. Cook, the newest member of the BMR team, is from the great state of Texas and now resides in beautiful Arizona. Daniel has a strong passion for the junior resource sector and has followed the Venture and broader markets with great interest since he bought his first stock 18 years ago at the age of 12. He’s also a licensed investment professional who was a Bright Future’s Scholar at the University of Central Florida, graduating in 2010 with a major in Finance. We know our readers will enjoy his material and benefit from his wisdom and insight. We welcome him aboard!

Note: John, Jon and Daniel hold share positions in GGI. Jon also holds share positions in DBV and ESK. Daniel also holds share positions in K92, KOPN, MITK, ORG, SMD and TDOC.

14 Comments

You guys are awesome! Daniel, I’m curious about your thoughts on If we could see a deep market (speaking of the major indexes) correction or even a crash in the 2nd half of this year?

Thanks!

Testing

Does the comment section work

No comments today?

Jon

Do we know for sure that GGI is going to drill the E&L this summer ? Do they have the permits? At what point do they do a PP?

Thanks

Of course they’re drilling, Greg, that was repeated in Friday’s news release and their new VP Exploration Canada would not have come on board if they weren’t. They got a quick start on the paperwork with the ministry, so no issues there.

Feb. 10 NR: “Garibaldi eagerly anticipates releasing and presenting the E&L 3-D geologic model this month, coinciding with final preparations to execute a major 2017 exploration and drilling program at the E&L beginning with a heliborne electromagnetic survey that can detect conductive sulphide bodies up to 350 metres in depth.”

As far as a PP is concerned, Regoci has been smart to hold out to this point. He’ll pull the trigger at the right moment and get the maximum out of it. Rest assured, there is plenty of interest in GGI paper given the situation with the E&L. This won’t be another one of those cheap, dilutive financing so many companies undertake.

Thanks Jon

I need to read before I speak…

sorry

Charles, great question. Since the Great Depression and nasty downturn this has arguably been the most hated Bull Market in the major indexes. Looking at history, this is often the case, as those who experience a drastic downturn tend to assume the next one is always just around the corner. As they say, markets love to climb a wall of worry, and there’s been no shortage of things to be worried about lately. Does the economy justify a 20,000 DOW? P/E ratios are near historical highs and the “recovery” is one of the longest, although most sluggish on record. How much further can it go? No one knows with 100% certainty. The major averages are being supported by easy money and central banks around the world (and have been for some time). Will they continue to? If the Fed raises rates 3-times, as they’re threatening, in my view that would weaken the housing market and bond market, the averages would likely not do well under that scenario. I think a major publication recently touted DOW 30,000 on the front page. Historically speaking those are anecdotal signs of being near a top.

Lots of thoughts there, but not many answers i’m afraid.

Bottom line, everyone thinks they’ll recognize the (or a) sign and no one to get out. And that’s precisely why downturns are like an elevator, and the ups are like an escalator, because everyone tries to rush out a small door at the same time.

GGI – naw – just saying it doesn’t in an NR doesn’t mean Regocci will pull the trigger and get it done. He has momo behind him now, and he better use it but he has been a poor excuse for the past couple years as an example of follow thru. Permits take 2- 4 months in BC now I think. VTEM before snow goes leaves a 2 month window still is a guess. Feb 20.17 is likely the 3d model NR and the PDA NR could be Tora Tora drilling results. Steve promised updates in the Oct 14.16 NR for PSP. King, and MEXICO in the coming weeks. If one wonders why there are skeptics, well, just saying

Note to readers – final technical issues being addressed today related to last Friday’ server crash, so “look” of site is somewhat off at the moment but content can be accessed. We appreciate your patience and understanding as we restore all site functions.

Subscribers—–no need today to enter username or password. This function should return by tomorrow – we will keep you posted.

Thanks Daniel. You made a good point about the DOW at 30,000 comments; it’s exactly why I asked the question. I watch the headlines regularly just to keep a sense of the ‘market sentiment’ and it seems to me that the pundits on wall street can’t find much of reason to be bearish. Complacency is a dangerous state. However, there were a very large number of traders who shorted the NASDAQ in the late 90s and even into 2000 who go ruined. They were right, but at the wrong time.

I like what you said about always having cash. The smart money is proactive, not reactive.

Thanks Daniel! (my apologies if this gets posted twice, my first reply crashed)

You made a good point about the 30,000 DOW comments; its in fact exactly why I asked the question. I like to keep an eye on the market headlines just to try and keep a finger on the ‘market sentiment’ (even though I trade almost exclusively venture stocks) and it seems to me that the pundits on Wall Street are having a hard time finding reasons to be bearish. That makes me think complacency, and complacency in the stock market is dangerous. Like you said, everyone looks for a top, but very few actually believe it when they see it.

On the flip side, there were a great number of traders who shorted the NASDAQ in the late 90s and even into early 2000 who were ruined because they were right, but at the wrong time. They couldn’t remain solvent.

I like what you said earlier about having cash… The smart money is proactive, not reactive.

David

Your sentiment in my opinion is exactly why GGI is not already over 20 cents and approaching 40 cents, just look at Eskay, they have done nothing except announce a JV, don’t have near the properties that GGI does, we are suffering for GGI’s sins of the past and unfortunately this is what I am seeing on all other forums, no belief that Regoci will follow thru. Hopefully the E&L will make up for all of the past… only time will tell.

No worries, Greg, those of little faith whose minds are trapped in the past with GGI and can’t see the forest for the trees will be very sorry individuals in due course…their paper is being gladly eaten up and stuffed away…shock and awe coming at a time of Regoci’s choosing…will be interesting to see how the naysayers react to a big bought deal (prediction)…they’ll all be scrambling to pile back in…

Can’t wait Jon!

GGI vs ESK – well ESK did secure $3.7MM for drilling this year! nobody else has been given that kind of cash by a major yet. ESK always said they wanted a partner and weren’t willing to go alone. So we know they have the cash to really go big this year and that they have a focus. A big bought deal on GGI would be nice. tic tic tic. Doing such a deal doesnt preclude them from cleaning up their NR’s on other properties that have had work over the past 2 years.