Gold pushed to a new 3.5-month high today, reaching $1,265, on momentum and further weakness in the U.S. Dollar Index…as of 11:00 am Pacific, the yellow metal is now flat at $1,257 after reacting at its 200-day moving average (SMA) which is at least temporary stiff resistance…Silver is unchanged at $18.33…Copper is up a penny at $2.69 while Nickel has climbed 8 cents to $4.98…Crude Oil is 19 cents higher at $54.18 while the U.S. Dollar Index has slipped one-fifth of a point to 101.08…

Bets on higher Gold prices can be seen in data from the Commodity Futures Trading Commission, showing hedge funds and money managers holding the largest net long positions in COMEX Gold in nearly 3 months during the week ending February 21…

Bets on higher Gold prices can be seen in data from the Commodity Futures Trading Commission, showing hedge funds and money managers holding the largest net long positions in COMEX Gold in nearly 3 months during the week ending February 21…

Russia increased its Gold reserves by 37 metric tons in January, according to Sputnik News (more reliable than CNN), which is equivalent to more than a million troy ounces…last month’s purchase comes after a pause in December when Russia did not buy any Gold…

Silver has posted 9 straight weekly gains, its best weekly streak since May 2006…a 9.6% drop in supply over a 36-month rate of decline in supply for the metal is the steepest production decline since the World Bureau of Metal Statistics began tracking such information in 1995…

The last time U.S. inflation rates were this high (2.5%) was back in 2012 when Barak Obama was in office while Gold was $1,800 per ounce…

Markets Brace For President Trump’s Speech

President Trump’s first budget will seek a sizable increase in military funding but won’t make changes to the largest future drivers of government spending: Social Security and Medicare…work to prepare the President’s first budget proposal, expected to be released in mid-March, ramped up last week following the February 16 confirmation of Mick Mulvaney as director of the Office of Management and Budget…Trump will preview some of the budget priorities in his speech to Congress tomorrow night and release a budget outline in mid-March after gathering information from federal agencies…

Markets also hope Trump will provide further details on his tax plans and other policy positions in tomorrow night’s speech…White House Press Secretary Sean Spicer said, “The address will particularly focus on public safety including defense, increased border security, taking care of veterans, and then economic opportunity including education, job training, health care reform, jobs and tax and regulatory reform.”

Odd’s ‘n Ends

Australian Gold output hit a 17-year high of 298 tonnes in 2016 as higher bullion prices drove mining companies to dig deeper, a sector survey released yesterday showed…a robust world Gold price and favourable foreign exchange rates for most of the year that boosted prices for local producers were the factors behind the increase, according to the survey by Australian mining consultancy Surbiton Associates…

Societe Generale sees continued robust demand for Palladium. “The average Palladium loading on a Chinese gasoline car is set to grow again next year, as Chinese standards for light-duty gasoline vehicles are implemented nationally,” said Societe Generale analyst Robin Bhar. “The demand outlook remains less compelling for Platinum due to its exposure to diesel technology, which remains under scrutiny from the emissions scandal.”

Billionaire investor Warren Buffet told CNBC this morning that U.S. stock prices are “on the cheap side” with interest rates at current levels…the chairman and CEO of Berkshire Hathaway said he put $20 billion into the market since just before the November U.S. elections…“We are not in a bubble territory” in the stock market, he said on “Squawk Box“…if rates were to spike, however, then the market would be more expensive, he added…

If the Canadian federal government were a business with a listing on the TSX, the stock would be in a nose dive…it was reported late last week that the Feds ran a budgetary shortfall of $14 billion over the first 9 months of the fiscal year, compared with a $3.2 billion surplus over the same period a year earlier…that’s what will happen when direct program spending jumps an astonishing 11.3%…the Liberals in Ottawa are spending money like drunken sailors, acting very differently in fact from the Liberals who were in power in the 1990’s…Canadian taxpayers, ultimately, will be ones who get screwed…

The Trudeau government is projecting a $25.1 billion deficit for 2016-17 as part of its plan to run several double-digit shortfalls over the coming years (those shortfalls, Canadians were assured during the election campaign, were not going to exceed $10 billion a year) in an effort to “lift” the economy…

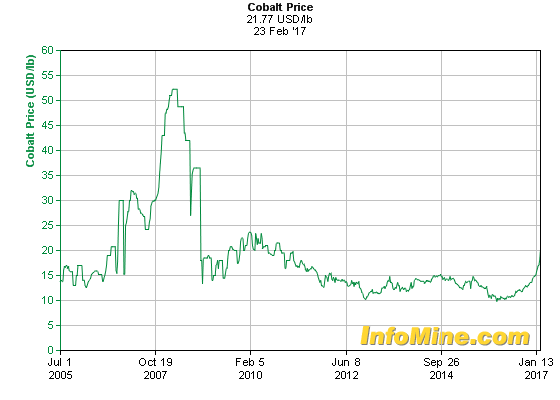

Cobalt Chart Update

Cobalt prices are at multi-year highs, approaching $22 a pound U.S. with key resistance around $24 to $25, the late 2009-early 2010 high…note how the price spiked to more than $50 a pound in 2007 – who’s to say that can’t happen again, especially given today’s dynamics?…

In Today’s Morning Musings…

1. TSX Gold Index update – 6 straight down sessions while Gold climbs into the $1,260’s?…

2. The opportunity in Transition Metals (XTM, TSX-V)…

3. Checking in on Chibougamau…

4. Daniel’s Den – KOPN gets ready to heat up again…

Click here to receive, via email, BMR’s “Who’s Who” List of the Greater Cobalt Camp – the top dozen or so companies active in the district.

Did you know that for as little as just over $2 a day, you can be a BMR subscriber and tap into the best analysis and picks for the junior resource sector that you’ll find anywhere? Last year’s BMR Top 50 List returned a whopping 118% and we are delivering market-trouncing returns again in 2017. BMR was the first to call the new bull market in the Venture in early 2016, and our coverage of the commodities space gives you valuable daily insights into price movements and critical trends. BMR is daily information that puts you ahead of the crowd!

We also give first-time subscribers an industry-leading 100% money-back satisfaction guarantee. If you don’t believe BMR has helped you make money for your first 6-month subscription period, we’ll refund your subscription fee in full – no questions asked!

Sign up NOW or login as a current subscriber with your username and password.

12 Comments

thanks raymond james drive that price down GGI

Hopefully there’s a few more where that came from, bcguy…

Jon, I would appreciate your read on ZJG (BMO Junior Gold Index), at $8.83 this afternoon, down .54 cents today. You are bullish on gold. Is this a buy?

Speaking of Chibougamau – hearing a surprise coming on CBG.

Jon, regarding GGI. If too many more apples fall from the tree I might start to think they know more than I do. There is also that perception (some truth to it for sure) that PDAC is generally the peak for the run in the juniors so I expect some people are positioning themselves accordingly.

Thanks to TD as well. Had a buy order in for ten days and finally filled it. Wow did the gold ETF’s ever get wacked today. JNUG dropped 27%. Looks everyone bailed today when gold hit resistance.

Fed Kaplan spewed … Int rate hike back on the table for nxt month.. any excuse to burn the little guy eh!!

GGI

Well tomorrow is the last day of Feb will Regoci keep his promise?

Further to yesterday’s Morning Musings, re-entered the HGU double bull Gold ETF at $17 this morning…that’s our 8th ETF trade, 6-for-6 so far with 1 position (HOU) still open…

James Nelson is the CEO of Cruz Cobalt as well…just sayin…

Spearmint Resources Inc. (“SRJ” or the “Company”) (SRJ—TSX.V)( SPMTF—OTCBB) (A2AHL5–FSE) is pleased to announce that further to a news release dated February 17, 2017, it is now fully listed and trading on the Frankfurt Stock Exchange. Management had received numerous requests from European shareholders, other individuals and prospective institutional European investors to list the Company’s shares to trade on their local market.

James Nelson, CEO of Spearmint states, “Having attained a German listing enables Spearmint to vastly increase its global audience. The German marketplace is one the world’s largest exchanges. In 2017 the German markets have seen incredibly active trading of Canadian junior mining companies listed in Germany, and we feel it makes sense to for Spearmints shares to trade on this major marketplace with its knowledgeable investors.” ”

Yesterday Spearmint entered into an agreement to acquire a 100-per-cent interest in a property located in the Windfall Lake Urban-Barry Gold area in Quebec bordering Osisko.

I don’t trust James Nelson. His companies never actually do anything to benefit shareholders. They change the companies direction to whatever is hot at that time along with the name.

GGI – I don’t expect news(or anything new) this week

Jon – I like that HGU trade. I’m also in today.