A rough ride for Gold during this first week of July, though keep in mind that historically the July-August-September period is bullion’s strongest of the year…Gold has traded between $1,229 and $1,207 so far today and is down $16 an ounce at $1,209 as of 11:45 am Pacific after finishing last Friday at $1,241…a brief dip below $1,200 next week is certainly possible as weak traders always panic and dump at the wrong time…Silver has plummeted 58 cents to $15.45…Copper is flat at $2.63 while Nickel has slid 8 cents to $4.02…the U.S. Dollar Index has added one-fifth of a point to 96.00…

Crude Oil took a hit today, sliding $1.36 a barrel to $44.16…it was dragged lower after Baker Hughes reported its weekly count of U.S. Oil rigs resumed its rise after falling for the first time in about 6 months last week…the number of rigs operating in U.S. Oil fields was up 7 to a total of 763…

Gold is now at its lowest levels since March and has shed about 6% since touching a 7-month peak of $1,296 on June 6…a modestly stronger U.S. dollar and higher yields are weighing on the market today after the headline U.S. non-farm payrolls number beat expectations, although the critical wage growth component was a disappointment…

Nervous nellies should keep in mind that the current action is very much a replay of December – Gold is on pace for its 5th straight negative week for the first time since December 23…what a great buying opportunity it was in late December, just as the masses were giving up on the yellow metal…if you’re not a contrarian in this business, you will get fleeced most of the time…

There are tremendous opportunities to make money in the current market, but perhaps Omar Khadr is smarter than all of us – he has just proven that all you have to do is become a convicted terrorist, especially if you’re a Muslim, and you’ve got a great chance at sucking multi millions of dollars out of the Canadian government (taxpayers) for “violating” your Charter rights (and an apology to go with the loot!)…the federal government is targeting hard working Canadians for having too much success with their TFSA’s, yet it has no problem writing a check to Khadr for $10.5 million…it’s an upside down world we’re now living in, as evidenced also by the fact that British Columbia just issued a gender-neutral birth certificate for a new baby…

Fischer: Productivity Growth Is Key

Federal Reserve Board Vice Chair Stanley Fischer is calling on U.S. government policymakers to do more to boost business investment, spur innovation, and train and educate workers to jumpstart a “dismal” record of productivity growth…

“Reasonable people can disagree about the right way forward, but if we as a society are to succeed, we need to follow policies that will support and advance productivity growth…governments can take sensible actions to promote more rapid productivity growth,” Fischer said in a speech yesterday…he did not address the current state of the U.S. economy or monetary policy, but focused instead on the importance of output per worker as a fundamental driver of economic growth and standards of living…

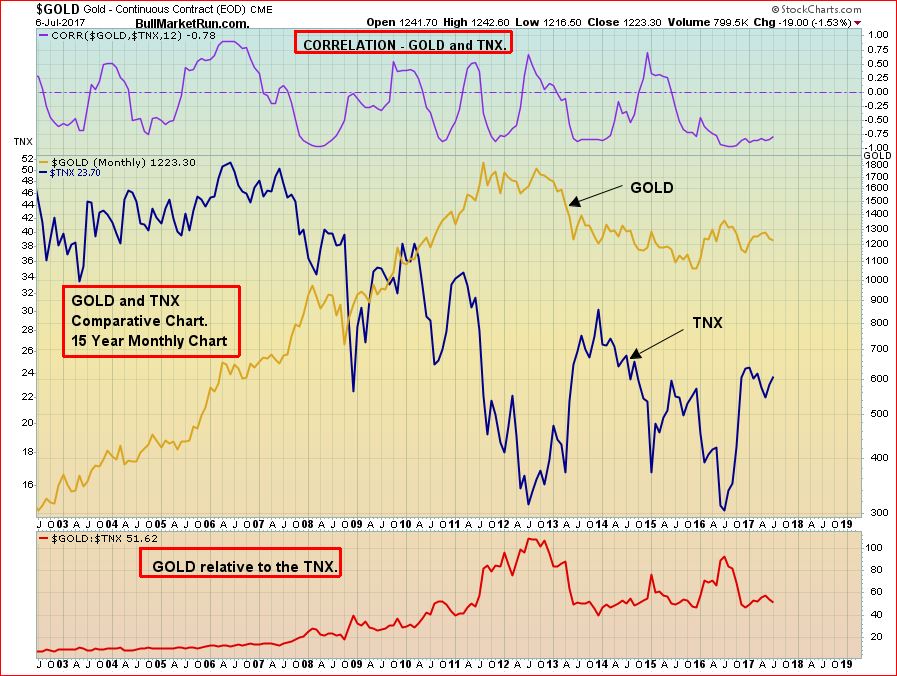

Gold vs. 10-Year U.S. Treasury Yield

Global bond yields have been increasing recently with U.S. 10-year Treasury notes no exception as they inched up slightly again today…

Though not always the case, there’s typically a close correlation between Gold prices and the benchmark 10-year Treasury notes (TNX) which are yielding 2.389% as of 11:45 am Pacific…

From a relative standpoint, Gold is neither overbought or oversold vs. the TNX…one of them should move strongly higher during the 2nd half of the year, and we suspect it’ll be Gold…

In today’s Morning Musings…

1. Venture update – contrarians will soon reap their rewards…

2. Cobalt plays heat up…

3. Frank Giustra is buying this 32-cent Gold junior in the Yukon…

4. Daniel’s Den – “Friday Footnotes” and the newest name in Zinc…

Did you know that for as little as just over $2 a day, you can be a BMR subscriber and tap into the best analysis and picks for the junior resource sector that you’ll find anywhere? Last year’s BMRTop 50 List returned a whopping 118% and we are delivering market-trouncing returns again in 2017. BMR was the first to call the new bull market in the Venture in early 2016, and our coverage of the commodities space gives you valuable daily insights into price movements and critical trends. BMR is daily information that puts you ahead of the crowd!

We also give first-time subscribers an industry-leading 100% money-back satisfaction guarantee. If you don’t believe BMR has helped you make money for your first 6-month subscription period, we’ll refund your subscription fee in full – no questions asked!

Did you know that for as little as just over $2 a day, you can be a BMR subscriber and tap into the best analysis and picks for the junior resource sector that you’ll find anywhere? Last year’s BMRTop 50 List returned a whopping 118% and we are delivering market-trouncing returns again in 2017. BMR was the first to call the new bull market in the Venture in early 2016, and our coverage of the commodities space gives you valuable daily insights into price movements and critical trends. BMR is daily information that puts you ahead of the crowd!

We also give first-time subscribers an industry-leading 100% money-back satisfaction guarantee. If you don’t believe BMR has helped you make money for your first 6-month subscription period, we’ll refund your subscription fee in full – no questions asked!

To read the rest of today’s Morning Musings, sign up NOW or login as a current subscriber with your username and password.

16 Comments

Hi Jon you shared photos of Csr adit a few months ago with cobalt bloom and metal detector . We are still waiting for update on drilling and Sgs test work ?…

Yes, it’s looking very good at Castle for the discovery of new mineralized vein structures, Donald, especially since Agnico Eagle ignored everything except Silver above 3 oz per tonne…I’m anticipating we’ll get an update from Castle sometime next week…

Hi Jon, any plans to visit GGM in the near future? And what is your current view and timeline on GGM. Thank you and have a good weekend.

Regards,

Arjan

It would certainly be worth checking out new drilling in the high-grade area to the north when that begins, Arjan. The bottom line is that there’s a very significant resource at Granada, near-term mining potential and a high-grade component to the north that I’m sure some majors are looking at. The stock performs best, obviously, when Gold prices are rising, so patience is required until the metal reverses back to the upside. In the meantime, 6.5 to 7 cents has proven to be a favorable range for accumulation.

Cxo starting to wake up Jon

Jon..do you know if GGM is currently drilling, and if drill results

are pending despite the delay due to the lab bankruptcy, and re-shipping

of core samples?

This coming week has to be the week we hear from GGI. It’s almost mid July and no drill in the ground yet at E&L. . I expected them to be drilling at least by the end of June.

They remain on schedule in terms of the ground game, Dan1, even a little ahead I would say because I wasn’t originally expecting drilling until August sometime. Like other players in the area, they’ve also had to deal with a slow melt of the snowpack…and the E&L is even a little higher up than the KSP or SIB. GGI camp is fully set up and first crews are already there.

The only reason for a delay in news from GGI in my estimation is double/triple checking by Geotech of the critical conductor beneath the known mineralized zone. You can see the diagram in the E&L presentation based on the preliminary readings – astonishing. In part, this is why Dr. Lightfoot and others in the know are so excited. You have a bull’s eye massive sulphide target here involving known historical zones adjacent to a large undrilled area defined by a VTEM conductor that represents the best chance any company in Canada has had for the largest high-grade magmatic Nickel sulphide discovery in at least a decade, since Noront in 2007, and perhaps since Voisey’s Bay.

It’s safe to say that news is imminent, so stay tuned. Anyone who knows their geology and understands the market should be able to discern what’s about to occur here. I added more to my position Friday, thank u.

Yes, I heard that the delay was due to Geotech final VTEM data. I listened to Dr. Lightfoot in part 3 of your interview with him. His words seem to indicate he’s almost certain they missed something big in the late 60’s when they drove the adit in the mountain and drilled without proper geophysics and didn’t follow the mineralization. Do you think they will be able to drill before end of July? I’m locked and loaded as well Jon. Can hardly wait.

Today’s geos are too polite to say this, Dan1, but Sumitomo screwed up big time when it went underground before understanding the geometry of the system. They should have drilled more holes from surface, in all directions, and they should have gone deeper. It’s highly, highly likely that the conductor represents massive sulphides, given all that’s known now about the E&L.

The top of the broad conductor appears to be around 140 to 150 meters’ depth, meaning Sumitomo drilled to a vertical depth that was probably only 20 or 30 meters shy of the beginning of the conductor. Incredible. Each of those shallow holes by Sumitomo hit very nice mineralization, including 30 meters grading 1% Nickel and strong Copper numbers. Their deepest hole of 121 meters ended in massive sulphides in the final meter. It’s absolutely stunning, in retrospect, that they didn’t just keep drilling from surface. The conductor not only suggests this system is much more expansive than originally thought, but the grades could very easily become more spectacular – what Sumitomo hit may have just been the halo of a fabulously rich system.

This has “major new Nickel sulphide discovery” written all over it, and it’s in the heart of one of the most mineralized parts of the planet with an operating mine just off to the east.

The Ring of Fire won’t match up to this.

GGI – Either people will laugh at me or I will laugh at them – I’m staying to see how this unfolds!

The build up for Ggi initial drilling are so high now – can we assume if drilling starts in July then results in September?

Where you have it wrong, donald, is that the build-up in GGI hasn’t even started yet considering the paltry $11 million market cap and the potential market-wide significance of this—-Nickel Mountain is very much on the verge of becoming Canada’s most important Nickel magmatic massive sulphide discovery in at least a decade, in the heart of one of the most mineralized parts of the planet near Eskay Creek and Brucejack. Also, since this is a massive sulphide system, results will come very quickly – won’t be a case of waiting until September…you’re either in the massive-semi-massive-disseminated sulphides, or you’re not…for GGI, right off the bat, they have a bull’s eye target, as they can cut right through the known zones and then reach into the conductor…

Consider this:

Sumitomo hit on all of its shallow drill holes from surface at Nickel Mountain including a 33 m section grading 1% Nickel and 0.70% Copper – included in that particular hole were sections up to 3.3 m grading up to 5% Ni and 1.5% Cu…

Deepest hole was 121 m, and it ended with massive sulphides in the final meter (why would u stop there?)…

Half a century later, it’s discovered that there’s a broad VTEM conductor – believed to be massive sulphides – beginning at a depth of 140 to 150 m…so 33 m @ 1% Ni and 0.70% Cu came immediately above what could be the guts of this system…

A grade 5 student can understand what that means…Sumitimo missed the meat of this system, perhaps many, many millions of tonnes and possibly even richer grades if you study the diagram on the known deposit and the target area based on preliminary VTEM…as it was, they outlined 3 million tonnes grading 0.80% Ni, 0.62% Cu, plus Au, Pt, Pd, Co and Ag…10 to 20 million tonnes can give you a very nice mine, depending on grade and the quality of the mineralization…

We also know now, half a century later, that the E&L has world class sulphide tenors (4.8% to 8% Nickel and 2.1% to 10.9% Cu) which means the quality of the mineralization is very high, which would make it easier to process…suggests a strong pentlandite component (you want a lot of that mineral in your Nickel sulphide deposit)…

Nothing is small in this Camp, Donald – grades are spectacular, tonnages can be world class…all the more reason to believe there’s much, much more to Nickel Mountain than was originally discovered half a century ago…it hasn’t been looked at seriously for nearly 50 years, for factors related to market cycles and because Sumitomo made an unwise decision to go underground before understanding the geometry of the system…in their defence, they didn’t have today’s tools and not nearly as much was known back then about Nickel sulphide deposits, especially in smaller intrusions which can be be like “magma highways” hosting incredible amounts of Nickel-Copper-rich sulphides…

Reuters: Investors have pulled an estimated $26.7 billion from Goldman Sachs Asset Management’s mutual funds so far in 2017, according to Morningstar data, the Financial Times reported Sunday, making Goldman the world’s worst-selling fund manager globally.

The nearly $27 billion of outflows from GSAM represent more than half of the asset manager’s strategies globally, FT said. Goldman’s outflows were almost twice the level of withdrawals experienced by Federated Investors, the second-worst selling fund house.

Revenues at GSAM dropped nearly 7% in 2016 and profits fell close to 17%.

Revenues were down 7% in the first quarter of 2017 compared to the previous 3-month period.

How many drill holes minimum to confirm the conductors are the right metals ? How deep is the planned drilling since VTRs suggests metal below 130 m or 390 ft?

The host rocks are known to extend to at least 400 meters, Donald. Near-surface historic drilling, which hit on every hole, went to a depth of only 121 meters with massive sulphides in the final meter of that hole. The top of the VTEM conductor begins at a depth of approximately 140 meters.

The obvious strategy here is to cut through the heart of the historic resource and simultaneously drill into the previously undrilled target area defined by the VTEM to a depth of at least 300 meters. One hole could therefore blow this wide open, just as it did with Noront at Eagle’s Nest in 2007. The outcropping at the top of Nickel Mountain is impressive and led to the original drilling discovery. First-ever sulphur analysis has revealed very high tenors.

One would have to believe in the Easter Bunny and the Tooth Fairy to think that the Nickel Mountain deposit suddenly ends at 121 m depth. Not a chance, especially in this district, and that’s what the VTEM and all the other evidence are suggesting.