Gold has traded in a range between $1,532 and $1,552 so far today…as of 7:35 am Pacific, the yellow metal is down $6 an ounce at $1,540…Silver, which got hammered yesterday, is off another 29 cents to $43.64 after dropping as low as $43 overnight…a close below yesterday’s low of $42.20 would certainly be near-term bearish for Silver…volume in the Proshares UltraShort Silver ETF (ZSL, NYSE) reached a new record yesterday of 43.2 million with the ETF climbing 16.5%…keeping an eye on the U.S. Dollar Index is important and it’s showing signs of a potential imminent reversal, though this would likely be just a short covering bounce as the “big picture” outlook for the greenback remains grim…below is John’s updated U.S. Dollar Index chart through yesterday…the Index is currently off one-tenth of a point at 73.06…

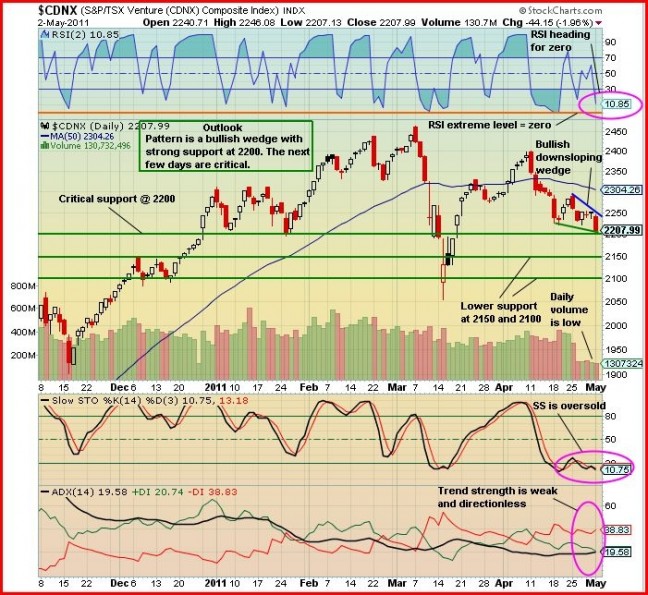

The CDNX has not been looking healthy lately in the midst of Gold’s powerful move to a new record high of $1,577 yesterday…after out-performing Gold throughout 2009 and 2010, there is now a noticeable divergence between the CDNX (down 3.5% for the year) and the yellow metal which is up nearly 10% for the year…Gold surged 8% higher just last month while the CDNX fell 1.9% for April…since the CDNX has proven to be such a reliable leading indicator, it appears to be telling us that we’re close to seeing a near-term top in Gold if that hasn’t occurred already…however, the CDNX bull market remains firmly intact and of course Gold remains very bullish long-term as well…John’s updated CDNX chart shows additional support levels at 2150 and 2100 if the market fails to hold 2200…

As of 7:35 am Pacific, the CDNX is down 17 points to 2190….the TSX is down 117 points but the business community has to be breathing a sign of relief that the Conservatives have managed to pull off a solid majority government in yesterday’s elections…Stephen Harper has clearly become a transformative figure in Canadian history and a majority Conservative government does bode well for long-term economic growth in this country which is obviously market positive…Richfield Ventures (RVC, TSX-V) released results from another six holes at its Blackwater Gold Project in central British Columbia this morning….all results were from the southern part of Blackwater where Richfield has demonstrated more continuity of mineralization…hole #130 intersected 226 metres grading 0.92 g/t Au while hole #134 returned 91 meters grading 2.04 g/t Au and 9.01 g/t Ag…Richfield is moving in step with New Gold Inc. (NGD, TSX) which releases its first quarter results Thursday…Baosteel Resources International Ltd., a subsidiary of one of the world’s largest and most profitable steel companies based in China, is making a strategic (9.9%) investment in Noront Resources (NOT, TSX-V) by way of a private placement at 86 cents…Baosteel also has the right to nominate one individual to the Noront board and can also elect to increase its interest in Noront over time…the stock has been a disappointing performer over the last year-and-a-half but Baosteel’s investment is an interesting development and also demonstrates China’s continued aggressive grab for resources…Abcourt Mines (ABI, TSX-V) has dropped another penny to 14.5 cents this morning…the company just completed a $6.3 million financing at 18 cents and is in good shape to continue to aggressively explore two excellent properties in Elder-Tagami (Gold) and Abcourt-Barvue (Silver-Zinc)…it should be noted that at 14.5 cents, ABI has touched its rising 500-day moving average (SMA)…the long-term trend remains positive for ABI which has a current market cap of just $21 million…even in a sluggish or weak market, certain stocks will outperform and we’re very optimistic regarding the outlook this month for Currie Rose Resources (CUI, TSX-V) and Visible Gold Mines (VGD, TSX-V)…Currie Rose, which has a favorable chart, is expected to start drilling its highly prospective Sekenke Gold Project in the Lake Victoria Greenstone Belt of northwest Tanzania this month…Visible Gold Mines is drilling two properties at the moment with more results pending from its Silidor Gold Property near Rouyn-Noranda after encouraging initial assays were reported April 20…VGD is armed with $8 million in its treasury and is quickly emerging as an exploration leader in northwest Quebec…in our view it has higher-than-average potential for making a significant discovery with Robert Sansfacon as the company’s senior geologist…Sansfacon was instrumental in the discovery of Osisko’s (OSK, TSX) Canadian Malartic deposit…

13 Comments

CQX bidding 0.155, VGN bidding 0.18, pathetic !!! I have decided to leave & on to

greener pastures, hopefully ! My last remark before i remove this site from my

bookmarks is that BMR rid themselves of their so called chart, they are drifting too

far from shore. Good luck to everyone !

R !

Bert

BMR – What are your thoughts on TYE and RJX.A as better investments to VGN?

I would say TYE would be attractive at it’s current .17 but it’s approaching being oversold – then again so are most of the junior precious metals! I may switch my VGD to TYE when/if it becomes oversold and then turns upwards. Nothing to lose those by doing it now, I’m pretty confident that TYE would give quicker return than VGD. CDNX down 2% yesterday, there is a major correction in the making in my opinion – play it carefully and I don’t see the point of “being patient” and watching your money disappear. Move to cash and then buy back in at a lower sp if you really like your stock.

As I stated last week. We will see at least 2040, possibly 1920 on CDNX by July. The “M” formation has to be completed. Although akward looking, it is an M in the making. You can chart and draw support all you want. All one experienced at reading charts has to do is look at the yearly chart. No rocket science here. As to the poster who doubted me last week, watch and see. Gold and silver are at overbought levels, the dollar is way oversold, the dollar will move up temporarily as gold and silver and the CDNX does its thing. Come August, we will have one kind of a late summer fall party.

Right now – cash is king – save your pennies.

David,

I am inclined to agree with you. The dollar may have a little rally here. But if gold and silver are overbought, the miners are way oversold so I am at odds to the timing as to when we may get a rally in the miners. Big money should rotate into the mines as soon as PMs demonstrate some stabilty at their support levels and any (crazy) notion of a blow-off top in PMs is dispelled. The CME tricks to curb silver at the moment indicates just how explosive this market is right now. But the low volume on the miners remains a mystery, to me at least. Patience really is a virtue when you portfolio gets cut down by 30-40% – still PMs have much longer to run and I think the miners will have their day in the sun. I dont think its too easy to call the timing in this crazy market.

correct herb. I am hearing rumors that silver will/could take a $15 hike south before resuming. The bull market will be with us for years to come. But for now corrections and adjustments need to take place. It could be a rough may/june/july. But what this reminds me of is a thunderstorm building. Eventually it builds so strong and a tornado hits. I believe we are around the corner from the mania and it will be a tornado. I saw one source state that gold could go up $1,700 in one day on Dec. 19, 2012. The gain would put it at $5,800 an ounce. Time will tell, but I believe seroius spikes in most gold stocks will be here this fall.

Support at 2150 was broken; down 2.5% and TSX down nearly 2%. Looks like a sign to cash out and wait it out.

Hi Andrew

IMHO it is always more reasonable to look at the closing price rather than the intraday with regard to resistance levels. The old Japanese traders put far more emphasis on the EOD price than the intraday because the closing price represented committment overnight.

I do not consider a resistance level broken by intraday values.

Hello John, thanks for those comments on intraday levels. So just one support level was broken (the critical one @ 2200).

Hi Andrew, yes that is right. The 2200 had been tested several times and the only time it failed was in mid-March and then it immediately reversed. Betweem 2200 and around 2450 we had a “topping” in which a lot of distribution took place so if the 2200 had held the short term trend up would still be valid. Now it is broken we have to wait for the Index to find it’s level. No-one can tell the Index what it is going to do, it has to show us probabilities via patterns and indicators.

Hope this helps.

Yes, thanks John – I shall look forward to your TA in the coming days.

Rock and a hard place, I like Herb am down 30 -50% in some of my positions, looks like it could go lower, Now I understand what Rick Rule means when he says “volatility is either your friend or your enemy, buy your favorite things when they go on sale, most investors miss out on making any money in bull markets, they buy high and sell low”, mentally it is very difficult to watch the companies that you have bought and believe in get cut in half and then buy more of them, the reaction is to get out before they go lower, then you lose money and you get disgusted and discouraged and do not get back in again until they have gone back up and the cycle repeats itself until you have no more money. In case you haven’t noticed I am basically giving myself a pep talk by printing this message, after the last few weeks I really need one, I came real close today to just selling everything out of total disgust. Thanks for letting me vent.

Goood to vent Greg …and write it down. Helps you not make the same mistake twice. Keep a written record of your trades and rate your trading decisions honestly. If its any consolation, nobody can time the market perfectly, the world of pannies is very violent but that aside the mining shares are down across the board right now. I am in other mid-tier companies like AUY and EGO and they have not been performing either which is surprising given that they are great plays on the price of gold. I think after PMs correct and consolidate we see a big upswing in the miners, plus the big funds and banking cartels are playing games. Hold tight – PMs are going to go much higher and companies proving up impressive resources will attract great interest and ultimately be the biggest winners. JMHO