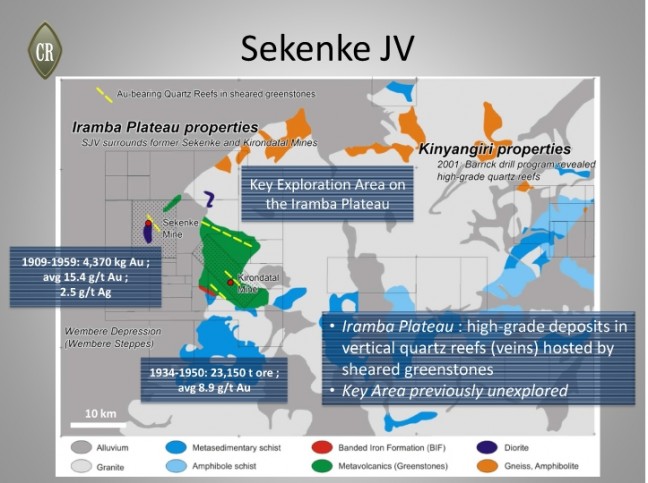

Gold has traded in a range of $1,487 to $1,500 so far today…as of 7:25 am Pacific, the yellow metal is off $4 an ounce at $1,493…Silver is up 35 cents at $35.37…crude oil is up slightly at $100.13 a barrel while the U.S. Dollar is flat at 75.30…Gold demand continues to be strong…first quarter world Gold demand grew 11% from the same period a year ago to 981.3 metric tons, though there was a 2% decline from the fourth quarter of last year, according to the World Gold Council (WGC) in its quarterly supply/demand trends report released yesterday…much of the increase was due to investment demand with a 52% increase in purchases of bars and coins more than offsetting a decline in holdings of exchange-traded funds …jewelry interest also rose with China and India collectively accounting for nearly two-thirds of the global jewelry demand…the WGC issued a included a separate section on China in the quarterly supply/demand trends report…data was compiled by the consultancy GFMS…in the spring of last year the WGC issued a report stating it expected Chinese Gold demand could double over the next decade…”With the sustained momentum in Chinese Gold demand, this target will probably be achieved in a shorter time scale,” according to Eily Ong, investment research manager with the WGC…Gold demand grew by a whopping 32% in China last year despite a concurrent 25% rise in the average local currency Gold price…the CDNX, trying to reverse a nearly 20% slide since April 11, is up another 11 points to 2003 after 50 minutes of trading this morning…a close above 2000 would certainly be encouraging…one company that has held up very well recently despite the market weakness (it’s unchanged over the past month) is Currie Rose Resources (CUI, TSX-V)…one of the major reasons we added CUI to the BMR model portfolio in late October last year (at 16 cents) was because of the potential of the company’s Sekenke Gold Project in the prolific Lake Victoria Greenstone Belt of Tanzania…Currie Rose rocketed to a high of 47.5 cents in December, thanks to a buoyant overall market and a drill program at the company’s Mabale Hills Project which is approximately 200 kilometres northwest of Sekenke…CUI is now gearing up for its first-ever drill program at Sekenke and this is going to be a situation to watch very closely…the company’s large land package (nearly 300 square kilometres) runs in between and surrounds two former producing high-grade Gold mines…that’s sweet music to any geologist’s ears…extensive ground work along with airborne geophysics have given Currie Rose quality drill targets for a 5,000 metre Phase 1 program expected to commence shortly…a picture tells a thousand words and the map below, from Currie Rose, shows a highly prospective structure (12 km x 800 metres) within a shear zone on the margins of a large granite intrusion that hosts numerous quartz reefs (broken yellow line) of the same type and even larger than those that developed at the nearby historic mines…

While Currie Rose is targeting a Gold discovery, we would be amiss in not pointing out that some surprises are possible given the geological make-up of this area…the Archean greenstones also have potential for the discovery of rare earths, copper, uranium and much more…little exploration has been carried out for these commodities (the Sekenke camp has certainly been under-explored) and it’s only in the past decade that the potential for these type of discoveries through Tanzania has been recognized…Currie Rose has a major land package in a proven Gold camp…of course there are never any guarantees in the exploration business but one has to like the risk-reward ratio here…the stock has clearly found support at its rising 300-day moving average (SMA), currently at 14.5 cents, and at 12 cents is a rising 500-day SMA…as of 7:25 am Pacific, CUI is unchanged at 16.5 cents…Gold Bullion Development’s (GBB, TSX-V) 50-day moving average (SMA) is beginning to flatten out and that’s a positive technical sign…the 50-day has been in a sharp decline since the last half of February and a reversal to the upside in this moving average would be a very bullish signal…fundamentally, with an initial 43-101 on the way that should be very reassuring to investors, it doesn’t take a rocket scientist to figure out where GBB could go from here given its current market cap of only $60 million…John’s chart below shows support needs to hold at 35 cents which is just slightly below the current 500-day rising SMA…

GBB is currently up a penny at 38.5 cents…Osisko Mining Corp. (OSK, TSX) has purchased 8.6 million common shares of Threegold Resources Inc. (THG, TSX-V) on the open market which now gives Osisko a 9.2% stake in Threegold along with the option agreement announced earlier this year to acquire up to a 70% interest in the Standard Gold Property…Levon Resources (LVN, TSX-V) has announced the closing of a $40 million financing with the issuance of 20.6 million shares at $1.95…Levon‘s Cordero Project in northwest Mexico (porphyry Silver, Gold, zinc and lead) is looking very promising and the company now has plenty of capital behind it…LVN is up 2 pennies at the moment at $1.81…Gold Canyon Resources (GCU, TSX-V) has recovered to $3.20 after hitting a low of $2.84 on Tuesday…traders/investors should be watching this one closely for a possible reversal soon in the 20-day SMA which would likely signal the beginning of a new uptrend…

8 Comments

It is VERY nice to see all the patient investors scoop up the millions of shares today in VGN..LOL This will be $ 1.00 by June.. Funny thing, 1st BMR stated that VGN will see HIGHER highs than the last run up by the 1st quarter of 2011, then BMR says it will be ” sometime in the 1st half of 2011″. Well by my calander the 1st half of 2011 is only a few weeks away, so does BMR STILL STAND by thier prediction, or has it been moved back, yet AGAIN?? Maybe 2012??

Is it safer to invest in someone like CUI who has the “potential” of finding something OR invest in a company who HAS 43-101 VERIFIED resources and INFASTRUCTURE in place to mine it…not to mention a pocket full of cash after ABI’s recent financing!!!!!!

I think there are alot of great companies right now on the Venture that are getting hammered. Of those, I think Kiska Metals (KSK) has huge potential especially after today’s news release. Plus they have millions in cash and a huge drilling program for 2011 as well as good management. I think we need to focus on stocks with large drilling programs, cash to warrant the drilling, and solid management. VGD, ABI, BYV are another one of those companies. I also think CUI, BKT, Douglas Lake Minerals (DLKM) have great potential in Tanzania….not SD.

to all of the people who commented on INT. Gene simmons (Kiss), guiness book of world records, and microsoft will be at the beverly hills hotel on Friday and the show will be broadcast live around the world. The fact that Steve Nash just moved in gives it some staying power. The selling pressure is decreasing. This should be interesting anyway to see how it affects the share price.

Jon,

I mentioned ZOO.H the other day and I know you say it is not relevent, interesting that they are acquiring property in Zimbabwe however, a country that is now about return to a Gold Standard after years of hyperinflation – LOL. I wonder just what Roodenburg is up to with that one! I dont doubt that he is shrewd, its a fairly brave frontier to be entering given its history. Hope it doesnt detract more focus from VGN.

Hugh, it is interesting and I didn’t mean to suggest it wasn’t relevant…the context of my point was that I don’t see why Roodenburg becoming a director of another company is going to negatively impact his ability to re-focus on Greencastle…Roodenburg had a lot on his hands as President and CEO of Seafield, which now he is free from…not sure how ZOO is going to trade but it’s worth investigating as Roodenburg wouldn’t bother with it unless it had considerable merit…just another situation to put on the radar screen…I do expect Roodenburg is going to split VGN into two separate entities and create an aggressive Gold play and a more conservative oil play…

Well Its just my opinion that I think the miners are a coiled spring right now, I expect a sideways summer and expect to see some fireworks in the fall. I hope Tony lines up VGN for this period, that would be good timing!Thanks as always for all the TA on this site. In particular the CDNX charts.

If you guys wanna make some cash in tech stocks for the next few weeks…. take a look at VV.v and YOO.v

Your welcome in advance..

ML