Gold is getting hammered today but that’s not surprising after the recent run-up…as of 9:05 am Pacific, the yellow metal is down $41 an ounce at $1,788 after falling as low as $1,775…Gold came within 1% of John’s Fibonacci target of $1,938 and really needs to take a breather and consolidate for a period of time in order to set the stage for the next leg up…there’s no reason to panic…John updates the Gold chart below and the various support levels…

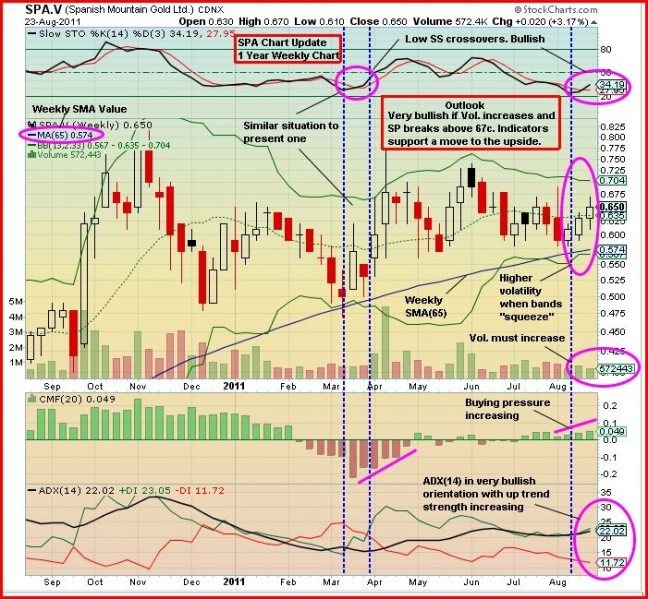

Silver is off $1.20 at $40.60…Copper is up a penny at $4.01…Crude Oil has gained 55 cents to $85.99 while the U.S. Dollar Index is up slightly at 74.06…new orders for long-lasting U.S. manufactured goods surged in July on strong demand for transportation equipment, government data showed this morning…the Commerce Department said durable goods orders jumped 4% after a 1.3% drop in June… economists had expected orders to rise 2% last month…though durable goods orders are extremely volatile, the data eased fears the economy was slipping back into recession after a raft of weak sentiment surveys…economic weakness in the euro zone continues to be a concern…German business confidence tumbled this month at the fastest rate since the aftermath of the Lehman Brothers collapse, as the country felt the impact of financial market turmoil and fears about the global growth outlook…a Munich-based institute said its “business climate” index dropped more than expected, from 112.9 in July to 108.7 in August, the lowest level since June last year…the monthly fall was the biggest since November, 2008, when economic confidence was plummeting globally in the wake of the Lehman Brothers investment bank failure…the fact Gold is settling down suggests the equity markets may start to gain traction and reverse some of their steep August losses…this will also be a good opportunity in our view to pick up some quality Gold producers whose share prices will correct somewhat as Gold consolidates…the TSX Gold Index has already fallen from a high of 432 Monday to a low of 397 this morning…meanwhile, the exploration stocks should soon start to play some “catchup” to the overall higher Gold price environment in the event of an improved equity market…as of 9:05 am Pacific, however, the CDNX has backed off 17 points to 1744…Currie Rose Resources (CUI, TSX-V) has completed 20 holes at its Mabale Hills Project in Tanzania and drilling is set to begin at Sekenke, which is a project we’ve been very bullish about since we first discovered CUI about a year ago…assay results are still pending from Sisu River and Dhahabu at Mabale Hills but it’s interesting to note that disseminated sulphides were intersected in each and every hole drilled at both properties…that was not the case in the initial Phase 1 program at Sisu River last winter…drilling has yet to commence at Mwamazengo which is certainly a property of considerable merit given CUI’s previous drilling success there…CUI has gained a penny-and-a-half to 18 cents…we received an email from one of our regular readers yesterday concerning Spanish Mountain Gold (SPA, TSX-V) which we haven’t mentioned for a while but we like this company’s project a lot…we first started paying attention to SPA last fall when we interviewed legendary British investor Jim Slater…the Spanish Mountain low-grade deposit in central British Columbia is an advanced project with a significant 43-101 resource…it certainly could be very profitable with $1,500 Gold and higher…the stock has held up well in recent months during the CDNX correction and has a current market cap of approximately $110 million at the current 66 cent price (up a penny for the day)…John updates the SPA chart below…

Richmont Mines (RIC, TSX) dropped as low as $8.71 this morning given the weakness in the TSX Gold Index…on Monday, RIC hit a new all-time high of $9.98…the stock has very strong support in about the $8.40 to $8.60 range, a zone of previous resistance…given its earnings momentum and developments at Wasamac, John’s next Fibonacci level of $12.16 for RIC seems very achievable over the coming few months…RIC released some drill decent drill results from its Monique Property this morning as the company continues to evaluate the possibility of a small open-pit operation there…by small, we believe they’re probably thinking in terms of about 20,000 ounces per year as a possibility for Monique…the ore could be processed nearby at the company’s Camflo Mill which has unused capacity…a 43-101 technical report on the property is expected by year-end and more drilling will be taking place…an exploration update on Wasamac, where RIC currently has five rigs in action, is expected soon…Visible Gold Mines (VGD, TSX-V) has two rigs in operation immediately adjacent to Wasamac at Wasa Creek…more assay results are pending and President and CEO Martin Dallaire appeared very confident about the project in his Smartstox interview with Stanlie Hunt…VGD is currently off a penny-and-a-half at 34 cents…the VGD chart looks very positive and is certainly one of the better ones on the Venture at the moment…Silver Quest Resources (SQI, TSX-V) dropped yesterday for the first time in 11 sessions…it fell as low as 99 cents this morning but is now bouncing back, up 3 pennies for the day at $1.05…SQI’s chart continues to look very strong and the fundamentals also suggest SQI should remain of the top performers on the Venture…GoldQuest Mining (GQC, TSX-V) has just released an update on its activity in the Dominican Republic…among other developments, the company has engaged Micon International, a highly respected Toronto-based mineral consultancy firm, to carry out preliminary economic assessments (PEA) on GoldQuests’s La Escandalosa Sur and Las Animas projects…

14 Comments

Forgive my ignorance, but what is the significance of disseminated sulphides? Does it have to do with the geological processes associated with the deposition of gold?

absolutely, ian…….those geological processes are heat-related and the sulphides carry mineralization……..I think this looks positive for CUI’s pending assay results…….by the way, speaking of mineralization, I just noticed that VGD has posted a few drill core photos on its web site….the one on the home page looks quite impressive…..

Gold down over $90.00. I never thought i would ever wish it to continue

down, but here i am, wanting it to test John’s first support level of

1762.

Ian

Sulphide strongly indicates there may be gold & copper in them there holes.

Hello Ian, that’s an interesting question and I’ll look forward to Jon’s response. Here’s a link that may be of interest: http://ygsftp.gov.yk.ca/publications/yeg/yeg07/16_mackenzie2.pdf

Thanks for the link and the responses!

Gold down 100 pts. on BNN & below John’s support level 1762, now we

wait to see if it closes above support. Better days ahead. R !

Floor trading for gold finished for the day, we are now on electronic

trading. Gold is coming back somewhat, around $10.00 off it’s low for

the day. Can one imagine seeing a time when we can say gold is off it’s

low by $10.00 but still down around $95.00.. Just as well get it over

with. R !

Yahoo headline . “Gold tumbles 5.6%, are mining stocks the next big trade?”

I guess we will see in the next few weeks

My favorite stock BER shines again today… high at 17 cents and closed at 15.5 cents…. another 50% profit if you have bought some in the last couple of days. Remember, it is not over yet…. my sixth sense of this stock is worth in high thirties. GBB showed its weakness to drop further. SD is still in sleeping mode for two days and I am losing my patience. I am reducing my holdings… CQX will shine soon….. NAR … nothing has happened at 16 cents.

New info on VGD – featured on SmartStox

Visible Gold Mines (TSX.V: VGD) is pleased to announce that Mr. Martin Dallaire, President and CEO, has been interviewed by Stanlie Hunt of the Smartstox Online TV Talk Show. Visible Gold Mines is one of the most aggressive gold exploration companies in northwest Quebec and expects to complete 24,000 metres of drilling between now and year-end as work intensifies on its most promising properties.

Additional assay results from Visible Gold Mines’ optioned Wasa Creek Property are pending after the first hole intersected several zones of gold mineralization in a previously unexplored area as reported by the Company August 11, 2011. Wasa Creek is immediately adjacent to Richmont Mines’ Wasamac deposit approximately 15 kilometres west of Rouyn-Noranda. Two rigs continue to drill for a potential discovery at Wasa Creek.

Meanwhile, Visible Gold Mines has identified numerous high-priority gold targets that will soon be tested with approximately 14 drill holes in a 7,500-metre Phase 1 drill program at the Joutel Extension Property, 150 kilometres north of Rouyn-Noranda, as reported in a news release August 16, 2011. Drilling will take place in the immediate vicinity of five significant past producing mines.

Smartstox.com provides investors with investment-related content through video and audio interviews with the management of small-cap companies. In the interview with Smartstox, Mr. Dallaire discusses the depth of the Visible Gold Mines’ exploration team and the company’s key projects which include Joutel, Wasa Creek, Wasa East, Stadacona-East and Silidor. Visible Gold Mines has $6 million in working capital and is focused exclusively on northwest Quebec where it controls a strategic land position of more than 20,000 hectares. The interview is available here.

Visible Gold Mines has the focus, experience, commitment and resources necessary to rapidly emerge as a leader in the vibrant Quebec gold sector and build shareholder wealth in the process.

To learn more about the exciting potential of Visible Gold Mines’ current exploration programs, and what is unique about this company’s approach, please see the new VGD corporate presentation at Visible Gold Mines website.

Gold is now closed for the day & sorry to state, we closed below John’s suggested support level.

Do we continue to the next support, or do we move up ? Stay tuned !

Theodore

Because your stock closed up .05 on a day like this, would suggest you have the ability to perceive

through your senses, in particular your sixth sense. R !

Just checked the new Gold spot price, we are already down another $15.00. Watch out below. R !

Bert

Just about to retire for the night & for now anyway, i am pleased to state that gold

is up over $9.00 on BNN. R ! Good night !

Bert, 5 cents up means some big players are there… the new directors of the company may be another indication that this stock can climb higher… This stock had a recent high of 39 cents after correction of their announcement and I mentioned before, their price should be much much better than now after recovery of this incorrect figures. In the next two weeks, BER will challenge the next resistance point 20 cents… but I am sure that this can easily pass it if the volume is there. The lowest point in my opinion is now 13-14 cents … it may go down a little bite … I sold quite a bite today 16-17 cents … You probably will not see a lot of stocks with high return in short period of time. For GBB, I will still collect if it goes down below 35 cents… still possible… NAR is one of the stocks need more patience… I am still collecting at 15.5-16 cents level… even if there is a bigger lot at 17 cents… SD as I said, I reduced my holding to 30% from my peak… but I scooped at 3.5 – 4 cents level…. I will put this 30% in the safe… will not touch it. CQX … I am collecting slowly at 10-11 cents…. it can easily hit 15 cents level… I am hoping that tomorrow, my sixth sense helps me to have some cheaper price for BER… I probably scoop it first thing in the morning… I expect the opening price will be 15 cents…. with closing a little bite lower than today… 14 cents….