Gold pushed through a minor resistance level around $1,620 this morning and is up $26 an ounce as of 6:00 am Pacific to $1,637…Silver is going along for the ride and has jumped $1.11 to $30.16…Copper has gained a dime to $3.49, Crude Oil is $2.04 higher at $103.35 while the U.S. Dollar Index is off slightly at 80.81…

Dow futures are pointing to a strong opening thanks in part to a positive outlook from aluminum giant Alcoa after the bell yesterday, and some optimism surrounding China…although overall Chinese trade data showed exports and imports grew at their slowest pace in more than two years, it also boosted hopes that Beijing would engage in additional monetary easing to contain a slowdown in the world’s second-largest economy…China’s broad M2 money supply is increasing, as we pointed out yesterday, and the market is also encouraged by a report today of a jump in Chinese copper imports for December which is contributing to a strong performance for the metal today…

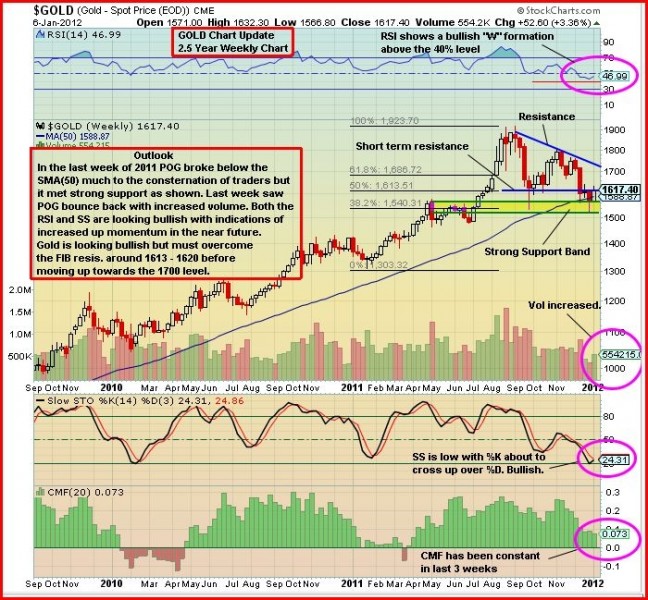

John’s chart on Gold we posted Sunday really put things into perspective, so we refer our readers to it again this morning…barring an unlikely intra-day turnaround, the yellow metal has overcome short-term resistance at the 50% Fibonacci level ($1,614) which is easy to see on the chart below…RSI and SS are both looking bullish…there’s a very good chance the bulls and the bears will have a major showdown around the $1,700 level which coincides with Fibonacci resistance and a downsloping trendline (the blue line) that Gold must (sooner or later) push through…

We’re convinced at some point in 2012 Gold will make a new high, but the timing of that is uncertain…a combination of events will bring that about, not the least of which will be when the euro zone debt crisis reaches the boiling point and the ECB is forced to bring out the Big Bazooka and starts printing money faster than rabbits can make bunnies…

As far as the Venture Exchange is concerned, it’s poised to post its 10th winning session out of the last 11 today but the volume during that run has been unimpressive…what we’re looking for is a confirmed break above the down trend line AND the weekly EMA(20) as John showed in Sunday’s chart (re-posted below)…it’s always nice to see the Venture moving higher but one has to ask, is it doing so with conviction and can the move be sustained?…

The TSX Gold Index, which closed yesterday at 377, has staged a nice rebound since late December when it nearly touched its 1,000-day rising moving average (SMA)…below is an updated Gold Index chart through yesterday’s trading…given the move in Gold today, the TSX Gold Index is likely to push through resistance around 380…there’s a big wall in the low 400’s, however, so chasing producers on a day like today is not necessarily a money-making strategy…as the saying goes, buy on weakness and sell into strength…

A few weeks ago we posted a chart on Armistice Resources (AZ, TSX-V) which is developing its McGarry Project in Virginiatown, Ontario, immediately adjacent to the former Kerr Addison Mine which produced over 11 million ounces of Gold…at the time, AZ was trading at 21 cents…it closed yesterday at 23.5 cents and continues to look interesting…below is an updated AZ chart from John…

Note: John, Jon and Terry do not hold positions in AZ.

Seafield Resources (SFF, TSX-V) came out with positive drill results from its Miraflores Property in Colombia yesterday as the company continues to add ounces in the ground at Quinchia…we’ll have more on Seafield later in the week…it closed yesterday at 16.5 cents…

12 Comments

Bonjour Martin – C’est un miracle! VGD complète update cette semaine – many samples still at the lab. à bientot.

Where did you get this info Andrew? they have to come with something they have their anual meeting on the 19th of january.

Bonne journée 🙂

de M. Dallaire ce matin.

Bonne nouvelle pour nous tous, peut-etre.

Was he positive?

Difficult to say, Martin without being able to read his body language – maybe he should do IR via Skype! 🙂 He stressed to notice how many samples were still at the lab, so my guess is that what they do have is not spectacular?

Hope everyone got out of CJC without too much damage. CEV looks like it wants to make a double bottom after the double top, which would take it to .77 – maybe a sell on news for this one? John, if you have time for a chart it would be appreciated. Thanks

Jon – How about this Party to replace President Obama? http://youtu.be/BrhA0sEkuaM 🙂

Curious what you think of silver stocks at this point. Seem to be up nice today.

Andrew – CEV looks like it wants to make a double bottom after the double top, which would take it to .77 – maybe a sell on news for this one?

Bert – Oh no ! my buddy is losing faith already. The financing is not yet closed & you seem to be

preparing yourself to sell on the first news, which no doubt, will be the closing of the financing

this week. Do anyone really think that Forbes & Manhattan would put up 10 million 200 thousand dollars

on a dud (emphasis on the amount, 10 thousand thousands’ + 200 thousand dollars). I have done fairly well

in the market over the years & it’s because i just can’t help it, but i always want to follow the money.

It’s all about money & Forbes & Manhattan are no different than you & me, they want to profit all the time

& no doubt, for $10,200,000.00 they know much more about this project than us. My shares will follow this

play for sometime yet, it’s called gambling, but i do hold a good hand. Good night ! R !

CEV is a sure deal. Theyshould see the $3 mark in 2012. CJC wow, shaking my head on this one. Something has maybe gone wrong that we just don’t know yet.

Good to hear from you, Bert! I wouldn’t sell on news, I was just putting that question out there. I would be out on a stop before it sold on news. 🙂 Financing is thought to close on Friday and then followed by drill results. I’m long on CEV and picked up some more shares yesterday when it dropped.