An assault on the $1,700 area by Gold in the near future appears almost certain given recent trading action, and this would also be in accordance with John’s bullish technical outlook even in the midst of the plunge to almost $1,500 in late December…so many fundamental factors continue to support Gold including negative real interest rates which are in place for some time to come…the euro zone crisis appears to have stabilized and the ECB is providing necessary liquidity with the IMF also seeking to double its war chest by raising $600 billion in new resources to help countries deal wiht the fallout of the crisis…what has also been impressive lately is how Gold has fared in the face of a stronger U.S. Dollar…watch out for Silver as we mentioned yesterday…technically, Silver is now breaking out – just refer to John’s latest chart on Silver that we re-posted yesterday…it’s up another 32 cents as of 5:45 am Pacific to $30.84 and has pushed through the top side of a wedge…Silver is looking very bullish at the moment which is why it’s time in our view to be gobbling up good Silver plays like the three we mentioned yesterday – Rainbow Resources (RBW, TSX-V), Wildcat Silver (WS, TSX-V) and Great Panther Silver (GRP, TSX-V)…

As of 5:45 am Pacific, Gold is $2 an ounce higher at $1,661…Copper has gained 4 pennies to $3.78 and hit a 17-week high this morning – very bullish…Crude Oil is up $1.26 cents to $101.85 while the U.S. Dollar Index has lost one-quarter of a point to 80.23…

Spain passed its biggest test of market sentiment so far this year today, selling far more longer-term debt than expected as the government pressed ahead with efforts to tackle its problems with the help of an ECB backstop…in Paris, meanwhile, France also drew strong demand at its first bond auction since Standard and Poor’s stripped the country of its triple-A credit rating…

The number of Americans who filed requests for jobless benefits sank by 52,000 last week to 352,000, the lowest level since April, 2008, the U.S. Labor Department reported just a few minutes ago…now if only the Americans would have a President who wouldn’t pander to environmental radicals and understood Wealth Creation 101…

Dow and S&P 500 futures are pointing toward another positive day…the S&P broke above its late October high yesterday, finishing at 1308, which bodes well for the broader market…the Dow and TSX have to yet to do so but aren’t far off…the Venture Exchange should really begin to accelerate once it pushes through resistance around 1575…it’s interesting to note, by the way, as pointed out this morning in a Globe and Mail article by David Rosenberg, the forward price-earnings multiple for the S&P is just very slightly below 12…there has only been one other time in the past quarter-century when it was this low on a one-year forward basis, and that was the first quarter of 1988…a year later, the S&P rallied 15%…there’s plenty of cash sitting on the sidelines right now to fuel a major market move to the upside…

The Venture Exchange’s 30-day moving average (SMA), which has mostly been trending lower since last March, is now reversing to the upside which suggests the current rally is going to pick up some steam…by early February, we expect the 50-day will reverse decidedly to the upside for the first time since last spring – in otherworks, folks, this market is about to “turn the corner” as John showed in a chart last weekend…

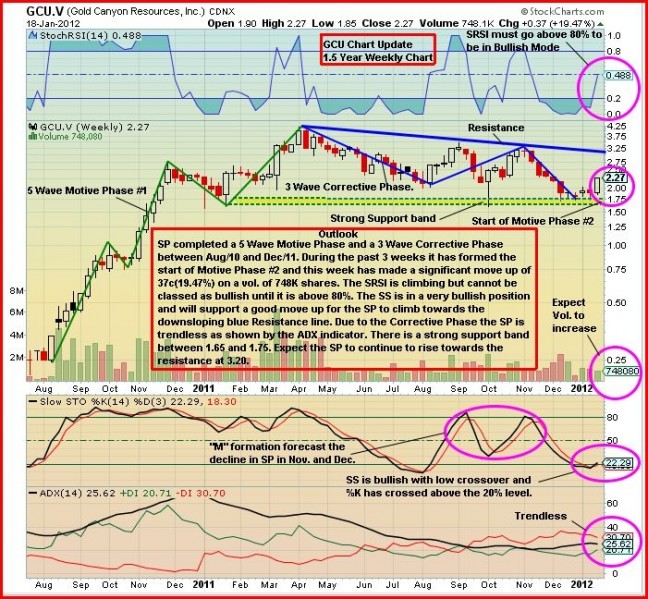

We have charts this morning on Gold Canyon Resources (GCU, TSX-V) as well as Cap-Ex Ventures (CEV, TSX-V) which released more positive drill results yesterday from its iron ore discovery near Schefferville, Quebec…John also has another updated chart on one of our favorite opportunities for 2012, Rainbow Resources which continues to motor along…given the scenario we see unfolding in the markets as the year progresses, and all the fundamental factors concerning Rainbow, we strongly believe RBW is one of the best opportunities we’ve put forward over the last two-and-a-half years and we’ve had several 10-baggers during that time including another B.C. play, Richfield Ventures, which was taken over by New Gold Inc (NGD, TSX) last year…

Gold Canyon, which is expected to release an updated 43-101 resource estimate for its Springpole Project in Ontario any day now, jumped 39 cents yesterday to close at $2.27…the stock fell from just above $3 in early November to the $1.70’s in December and January where it was obviously a strong buy considering Springpole is believed to be at least a 5 million ounce deposit…from a technical perspective, there’s a good chance GCU will move higher but keep in mind there is overhead resistance (the declining 100 and 200-day moving averages are currently situated between the $2.40’s and the $2.60’s) including major downsloping resistance at $3.20 as John shows below…

Note: John, Jon and Terry do not hold positions in GCU.

We remain bullish with regard to Cap-Ex Ventures which is clearly developing a world class iron ore deposit and has a strong management team in place to succeed…more solid results came out yesterday, in the wake of the closing of a $10 million financing, but the market took a “sell-on-news” approach and CEV fell 8 cents to 90 cents…there is plenty of fundamental value with CEV and John’s chart shows various areas of strong support, so we would regard any additional weakness as an opportunity…CEV has tremendous long-term potential, so stay focused on the “big picture” with this one…there will be swings and smart traders can take advantage of periods of weakness and strength…

Note: John and Jon hold positions in CEV (Terry does not).

Rainbow Resources has overcome important resistance at 17 cents and the technicals and fundamentals are in powerful alignment…RBW was essentially a shell just six months ago and its fortunes changed dramatically once it acquired privately-held Braveheart Resources last fall…we’re eagerly awaiting what should be a very interesting and detailed geological report on the land package the Braveheart group assembled in the West Kootenays, with Rainbow having completed some exploration work on the properties during the fourth quarter…airborne geophysics are also now taking place…the company has aggressive plans including other potential Silver and Gold property acquisitions…this one has a lot of “legs” and we expect it’s going to generate a lot of interest in 2012…at 18.5 cents, the current market cap is only $4.8 million…John updates the chart below…

Note: John and Jon hold positions in RBW (Terry does not).

3 Comments

If you are looking for a certain silver play check out SVL (silvercrest mines). They are already in early production phase and are sitting on a boat load of the shiney crap. I have been long on SVL for a year now and it is paying off. Have a look…I don’t think it’s too late to get into it yet. The upside looks strong….to me anyways. Anyone else look at SVL?

V/SGC

I recently brought SGC (Sunrise Gold) forward, as a potential mover.

Please be advised that the indicators are perking up & in particular,

we had a good volume day, with the stock closing as it’s high for the

day.

You have once again been reminded. Good luck ! R !

Bert

someone may want to do some DD on TFER ….. nasdaq stock.. but seems like a winner, but also could just be a boilerhouse play…. really not sure but wanted to at least bring it to the attention of the ‘crew’.

SGC=Sunridge .. a Grandich fav pick… same area as Nevsun.. both are depressed due to Eritrea … but a chinese company bought into a base metals company there big time.. but who knows….

Happy Thursday to all