Gold continues to find strong support in the low $1,700’s…as of 5:35 am Pacific, the yellow metal is up $10 an ounce at $1,731 after falling as low as $1,721 overnight…Silver is 31 cents higher at $33.89…Copper is flat at $3.80…Crude Oil has added $1.28 a barrel to $102.02 (didn’t a Saudi official recently say they wouldn’t let Crude go over $100?) while the U.S. Dollar Index has reversed and is now up nearly one-fifth of a point at 79.55…

Stock index futures as of 5:35 am Pacific are pointing toward a positive open on Wall Street…European shares are rallying on the back of economic data that was not as bad as expected while Asian markets closed sharply higher today…

The Empire State survey, the monthly gauge of manufacturing in the state of New York, came out with very positive numbers (better than expected) just a few minutes ago…industrial production figures are coming out at at 6:15 a.m. Pacific while the National Association of Home Builders’ Survey will be released at 7:00 am…

Meanwhile, minutes from the last Federal Open Market Committee meeting will be released at 11:00 am Pacific, and traders will be watching to see what Fed members had to say about more quantitative easing…

Euro zone officials have called off an emergency meeting of finance ministers to approve the next bail-out for Athens amid a growing fight among the country’s European creditors about the merits of allowing Greece to go bankrupt…Jean-Claude Juncker, the Luxembourg prime minister who chairs the euro group, said the delay in today’s scheduled meeting had been prompted by the continued failure of Greece’s political leaders to commit to the bail-out’s tough terms after April elections…

A long-awaited report that’s expected to provide a road map to austerity for deficit-plagued Ontario will be released later today and will contain some controversial recommendations on health care, according to Ontario Finance Minister Dwight Duncan…Big Government Ontario is going in the direction of Greece and needs a major wake-up call…hopefully Don Drummond’s report will provide that today…

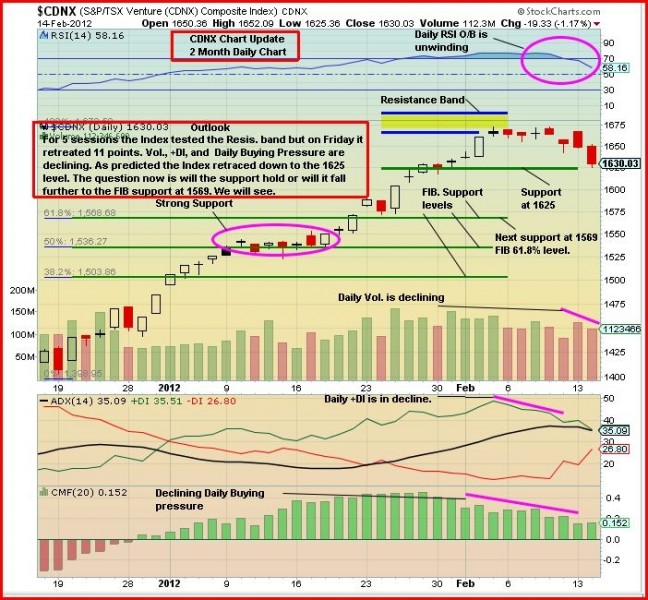

The TSX Venture Exchange, which has declined in six out of the last seven trading sessions, hit support at exactly 1625 yesterday…that was our initial minimum target level and we’ll see if that holds…the Venture’s daily overbought technical condition is unwinding in an orderly fashion…based on technical patterns and Fibonacci and other support levels, we highly doubt the CDNX will fall below 1575 in this anticipated minor pullback that started February 6…in fact, yesterday’s intra-day low of 1625 may have been an important bottom…below is John’s updated chart for the Venture…

We believe it’s just a matter of time – perhaps by month-end – when the CDNX blasts through the resistance band highlighted in John’s chart…now is definitely the time to be positioned in the right situations to take full advantage of that anticipated breakout in the Index…

One of those situations, we believe, is Rainbow Resources (RBW, TSX-V) which has beefed up its treasury through a strategic financing with news imminent on the official closing of that private placement…Rainbow has a current market cap of just $5.4 million and a barnburner of a project (Silver and Gold properties) in the West Kootenay region of British Columbia…a major report on that project is forthcoming from the company’s geological consultant, Moose Mountain Technical Services, as RBW has already indicated…with PDAC coming up in the first week of March, it wouldn’t surprise us if Rainbow is gearing up to hit the ground running by that point with a tsunami of information which should clearly reveal the potential of its 7,000-hectare land package that was created through privately-held Braveheart Resources over a period of several years…Rainbow, listed just a year ago, was essentially a “shell” up until the Braveheart transaction last fall…this is precisely the kind of low market cap opportunity that has “home run” possibilities…the stock is just starting its first major “run”, as one can tell on John’s updated chart below, with the sharp increase in volume since December an obvious clue that good things – perhaps great things – are in store…the Rainbow chart is indeed a picture of beauty as it continues to trade in an upsloping channel in place since November…

Note: John and Jon continue to hold positions in RBW (Jon added to his position yesterday). Terry does not hold a position in RBW.

In late breaking news, Abcourt Mines (ABI, TSX-V) has intersected 4.7 metres grading 1,386.16 g/t Ag (approx. 45 ounces per tonne) and 5.57% zinc at its Abcourt-Barvue Silver-Zinc Property near Val-d’Or (from 240 to 244.70 metres depth)…that 4.7-metre intercept (true width estimated at 80%) included 1.30 metres grading 4,696 g/t Ag and 11.75% zinc…Abcourt closed yesterday at 10.5 cents and will be very active today given that news which was released pre-market…

Golden Predator (GPD, TSX) has been halted this morning, pending news…

One reason for our optimism regarding the CDNX is how so many individual junior mining stocks (on both the Venture and the TSX) have broken out of downtrends on significant volume…the latest example is Volta Resources (VTR, TSX) which jumped 38 cents yesterday on total volume (all exchanges) of nearly 6.4 million shares…Volta reported the discovery of new high-grade mineralization through RC drilling at its Kiaka Gold Project in West Africa…momentum should carry Volta higher to the resistance levels John has highlighted…

Note: John, Jon and Terry do not hold positions in VTR.

28 Comments

gbb issues shareholders rights program, cancels castle ipo, bmr is silent. was not long ago they pumped this stock hard every single day. anyone buying rbw should take note.

Mike – I think a shareholders rights programme is ‘normal course of action’ – it protects the shareholder in the event of an unfriendly takeover bid? I would perceive it as good news and good management?

I’m pretty sure ISD is looking good for the run that John mentioned a week or so ago. It’s been consolidating and looks ready to breakout again?

Adopting the poison pill is a good thing…Mike if your jumping in stock on a whim because of BMRs recommendations alone without any DD you’re gunna get burned. BMR just brings stocks to your attention its your perogitive if your buying, holding or selling…

There’s a good definition of “Poison Pill” and related terms at: investopedia.com/terms/p/poisonpill.asp

“gbb issues shareholders rights program”

That’s a good thing mike…

Next time you bash someone you should know what your are talking about.

Regarding RBW.

I don’t think the CEO should go out an promise PR on closing of PP if he can’t make good on it. I just looks bad. It’s better to not say anything instead. Let the action talk, not the mouth…

I agree Steve but its not even lunchtime yet. Give it time.

My point is that BMR pumps a stock relentlessly then stops covering it. If that seems okay to you then hurry up and buy lots of RBW. I wonder when BMR started buying that one?

mike,

Their service is for free. If YOU don’t like, don’t read. Keep walking fella…

Hey Steve, yes it’s free, did you hear me asking for my money back? I did not know that I was not allowed to post anything but constant chatter about RBW, my mistake, won’t happen again. You should think about being a chat room enforcer full time as it is so much safer than doing it in the real world, where no doubt, you are a twerp. Enjoy this, as it is no doubt your sole outlet to be “the man”. Good luck with RBW

FMS hit $1 – moving up

Here it is:

Rainbow Resources Completes Private Placement

(via Thenewswire.ca)

TORONTO, ONTARIO, February 15, 2012 — Rainbow Resources Inc. (TSX VENTURE: RBW) (“Rainbow” or the “Company”) is pleased to announce that it has closed the second and final tranche of its non-brokered private placement financing (see the Company’s news release dated January 5, 2012 for details on the closing of the first tranche). Together with the first tranche, the Company issued 6,612,001 units at $0.15 per unit and 600,000 flow-through units at $0.20 per unit for total gross proceeds of $1,111,800.15.

Each of the units and flow-through units comprise one common share and one-half of a common share purchase warrant. Each full warrant will entitle its holder to acquire one additional common share of Rainbow at a price of $0.25 for 18 months.

In connection with the offering, the Company paid finder’s fees totaling $22,300 and issued 140,000 finder’s warrants. Each finder’s warrant is exercisable into a common share at $0.15 for a period of 18 months.

The gross proceeds from the sale of the flow-through units will be used for continued exploration including a drill program at the Company’s recently acquired Big Strike Project (gold-silver-lead-zinc) in southeastern British Columbia. The net proceeds from the sale of the units will be used for the upcoming drill program at the 7,000-hectare land package and for general corporate purposes.

The offering is subject to certain conditions, including but not limited to, the receipt of all necessary approvals, including the TSX Venture Exchange and applicable securities regulatory authorities.

David W. Johnston, Rainbow Resources’ President, stated: “This financing allows Rainbow to enter a new stage in its development as a junior resource company. We’re looking forward to a very busy and exciting 2012 with strong news flow in the weeks and months ahead.”

The Company has agreed to issue 1,160,000 options to officers, directors and consultants of the Company with an expiry date of two to five years at a price of $0.25.

Rainbow’s shares are listed for trading on the TSX Venture Exchange under the symbol RBW.V. Rainbow currently has 32,138,138 common shares issued and outstanding.

For further information: David W. Johnston (403) 701-2781

Visit our website at rainbowresourcesinc.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of his release.

Copyright (c) 2012 Thenewswire.ca – All rights reserved.

Nice. Almost all hard dollars and very oversubscribed on the hard dollars. They probably easily could have gone to Mineral Fields or Industrial Alliance for a whack of flow-through money but decided not to, which is good. Shows they know what they’re doing in terms of trying to build shareholder value. Not many finder’s fees so mostly done on the inside.

RBW financing, sure does not seem like much money, 1.1 million, how long is that going to last them before more dilution?, they are up to 49 million shares now fully diluted. Did they have a big chunk of cash in the bank already, cannot find this info on their website, says financials coming soon?

Greg, I think you need to understand this business a little better….I don’t think it was their intention to raise millions at 15 cents….this is a former shell and this is how these plays start and begin to build out…….will explain in more detail later….

RBW has a new factsheet,15 feb, on their homepage.When I first read it (1 hour ago),it stated that the PP was closed and outstanding shares was about 32 mill,fully diluted I don´t remember and insider ownership was approx 21 %.My original question for this board was-Why announce the closed PP only at the homepage and not get out a NR.

Before I posted, I checked back on RBW homepage and the factsheet is now altered and does not state the PP closed,outstanding shares is back to 26 mill and insider ownership is now 23 %.Anyone care to comment on this,any thoughts are appreciated.

Tommy – I didn’t see your original post. The fact sheet looks good to me and the fully diluted shares is what I worked out in my head as I read the nr. It’s back to what you originally read (32m Sh OS and 21% Insider). I think they’ve had tech issues as emails have been bouncing or undeliverable and I’ve got a response from David Johnston with a completely different email address.

rainbowresourcesinc.com/pdfs/RBW_fact_sheet_web_FEB15.pdf

JON , I understand raise a little now to get things going and raise more later when the share price is higher, however there is no guarantees that the share price will be higher if the drilling does not go well, it could actually be lower, just did not seem like enough money to me to really do much, but like you said JON what do I know…

Greg……you have to look at the big picture here (with RBW) and understand how these plays evolve.

1. Company completes “strategic” PP at 15 cents – usually in a situation like this, some key people take major positions;

2. Lots of news to come out – I suspect, given all the historical work on these properties, the work completed by Braveheart and also by Rainbow (in the 4th quarter), we’re going to see some impressive numbers from the geological consultant when their report is issued soon. Appears to be plenty of high-grade, near-surface mineralization at all of these properties (6 in total);

3. Speculation ramps up;

4. Company raises more money at higher levels;

5. Juicy drill targets, drilling begins and market is in a frenzy

In this case, I think Rainbow’s chances of pulling out some nice drill holes in the beginning stages of their drilling are above average – the International in particular appears to have a lot of well-defined, high-grade, near-surface targets.

At 20 cents this is how money is made in the markets. A double from here seems highly likely (just on speculation), and we could easily see an additional double following that by the summer. Keep in mind the current market cap is only $6.4 million. A run to $15 million in market cap, which is still pretty modest, would put the share price at 47 cents. It’s a no-brainer at these levels and that’s why, Greg, we’ve been pushing this so hard. We want our readers to make some money. I’ve accumulated a large position myself (I picked up more today) and my target is at least 75 cents come summer. The CDNX looks very bullish, and so does Silver. So the wind should be at Rainbow’s back.

Greg – The SP should go higher without a drill bit touching the ground. 🙂

IR called me today expect LOTS of news next couple weeks on RBW….hold on, its go time!

Look at TinCity’s historics and then think what internationals potential could be.

Hi Jon,

You seems pretty bullish on the Rhea property, what can you tell us as there are nothing to look at on their web site.

Looking fwd to seeing the geological report on Rhea – it’s primarily a gold target, immediately south of Nelson, and surrounded by some former producers which is encouraging……the Silver King Shear which is quite prolific runs through that general area, and perhaps thru part of the Rhea property…….we’ll just have to wait and see what Moose Mountain comes out with……the fact that RBW expanded their Rhea package recently tells me they must have gotten some good showings in rock/soil sampling………

Thanks Jon for taking the time for the detailed explanation

You’re welcome, Greg. I know I have been beating the drums on RBW since mid-December (it has gone up 40% since then) but I’m only doing that because I’m so convinced this is a huge potential winner at these levels. I bought more myself yesterday, so I’m putting my money where my mouth is, and I wouldn’t think of selling until this is much higher. I want to make money and I want our readers to make money, so I’m suggesting backing up the truck and loading up at 20 cents like I’m doing. For a situation like RBW to climb from a market cap of $6.4 million to a market cap of $20 million, for example, would be a very logical and realistic move. So at a minimum, that’s the potential one has to keep in mind here. I’m also convinced the Venture will break out very soon above 1675. Then the party’s on. So now is when huge profits are born. The timing is perfect.

Yes, thanks Jon 🙂