Gold is steady this morning after climbing to a three-month high yesterday…as of 5:35 am Pacific, the yellow metal is unchanged at $1,780 an ounce…Silver is 6 cents higher at $35.43…Copper has gained 3 pennies to $3.83…Crude Oil is up another 55 cents to $108.38 while the U.S. Dollar Index is down marginally at 78.51…

Stock index futures as of 5:35 am Pacific are pointing toward a flat to positive open on Wall Street this morning…European markets are up while China’s Shanghai Composite closed 30 points higher today at 2440…the move through 2400 is technically significant as the Index has broken through a resistance band…we’ll be posting an updated chart on the Shanghai Composite by tomorrow…

Fraser Institute rankings for the world’s most attractive jurisdictions for mineral exploration and development (in the view of the international mining industry) are just out…top 10 jurisdictions are New Brunswick, Finland, Alberta, Wyoming, Quebec, Saskatchewan, Sweden, Nevada, Ireland, and the Yukon…

The TSX Venture Exchange is within shouting distance of 1700 as a breakout looms…it posted its sixth straight daily advance yesterday, closing up 9 points at 1694…over the past two months at BMR, we’ve written about 50 or so Venture companies…many have performed extremely well, from Rainbow Resources (RBW, TSX-V) to Arian Silver (AGQ, TSX-V) to Focus Metals (FMS, TSX-V) and Cap-Ex Ventures (CEV, TSX-V)…on Monday we’ll be pulling all of that coverage together so we can provide our readers with a “Strong Play” group and a “Watch List”…

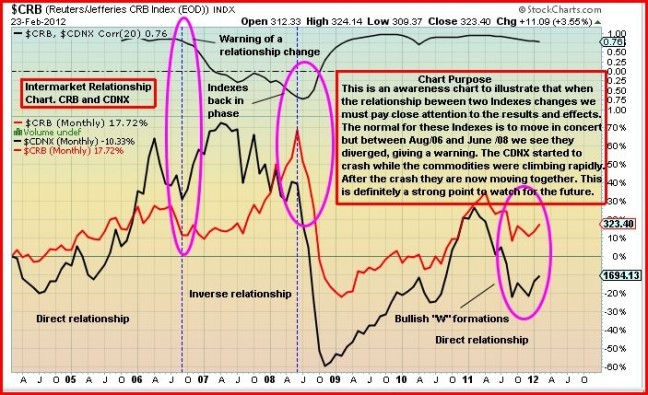

Before we provide an interesting update on Rainbow, below is a chart from John that tracks the Venture Exchange and the CRB Index together (intermarket relationship chart)…first, notice the very bullish “W” formation on both (the CDNX is in black while the CRB is in red)…they are also both moving in tandem at the moment, as opposed to being in an inverse relationship, which is good…based on the patterns below, going back to 2005, now is the ideal time to be positioned in good quality Venture stocks…

Rainbow Resources (RBW, TSX-V) Update

A publicly available geological report from 2009 on Rainbow Resources‘ (RBW, TSX-V) International Property, found by one of our astute readers on the B.C. Mines and Energy web site, contains some impressive assay results and other revealing information that speaks to the potential of this 4,000 hectare property in the prolific West Kootenay region of British Columbia (just one of six RBW properties in the area)…if the December 16, 2009, report from Paul A. Hawkins and Associates Ltd. is any indication, the upcoming NI-43-101 compliant report from Rainbow’s resource consultant (Moose Mountain) should be a powerful document in terms of providing important geological details concerning RBW’s 7,000 overall “Big Strike” land package…highlights of the Hawkins report, which we caution is only an assessment report and not 43-101 compliant, and was completed more than two years ago (work on the property has occurred since then), include the following:

“Recent grab samples collected in 2008, returning an average 54.35% lead and 19.80 ounces per tonne Silver, confirmed the previous high-grade Pb-Ag mineralization present on the property…this material was likely representative of the material mined in the 1930’s from the property”…

“The earliest work recorded on the property was by Blue Lake Consolidated Mining Company…a sample taken at that time from a small streak of galena, about 10 cm wide and 4.6 m long, assayed 445.72 g/t Ag (14.3 opt), 37.7% Pb and 1.2% Zn (MEM & PR, 1918)…

“A trench exposing quartz veining and lenses in Horsethief Creek Group rocks was discovered outside the crown grants…the discovery of this trench indicates additional potential beyond the known mineralization on the crown grants…numerous other outcrop exposures were also noted during the soil sampling program”…

“A review of data for the property indicates it has never been comprehensively examined for economic mineral deposits…a review of the outcrop pattern for the ledge (mineralized vein) indicates it is unlikely to be just one vein responsible for all the mineral showings on the property…the actual situation is likely more complicated with faulting, folding and multiple zones”…

The International Property land package was assembled by Braveheart Resources, a privately-held Calgary company that was acquired by Rainbow last fall…Braveheart commenced exploration on the property in 2007 (no drilling has yet taken place) and also upgraded road access which is now excellent…Rainbow has conducted some groundwork and geophysics over the last few months in preparation for a major drill program…with PDAC just around the corner, we wouldn’t be surprised if Rainbow was pressing Moose Mountain to complete its full report by sometime next week…things could get much more interesting in a hurry with RBW…on Monday, we’ll have Part 2 of our report and interview with Rainbow President David Johnston who was carrying around an incredible 24-pound massive galena (Silver and Lead-rich) rock sample from the International Property at the recent Resource Show in Vancouver…below is the picture we took of Johnston with The Rock…

Rainbow hit a new all-time high of 27 cents earlier this week on record volume…it closed yesterday at 26 cents, half a penny above its previous high where this is now strong technical support…with a current market cap of just $8.3 million, the upside potential continues to significantly outweigh the downside risk in our view…based on the Hawkins’ 2009 assessment, and other historical information such as the work performed by Kaslo Mines of Spokane in the 1930’s and 1940’s, Rainbow definitely appears to have a near-surface high-grade structure (albeit not fully defined yet) at the International to drill into…that excites us as well as Rainbow’s overall approach to its development in the junior exploration space…

Focus Metals (FMS, TSX-V)

John made a fabulous call on an FMS technical breakout early this month, and yesterday the stock jumped a dime on strong volume to close at $1.14…while it may need to briefly digest its recent gains, the overall chart continues to look very bullish with the next major resistance area at $1.40…yesterday, FMS announced a $6.5 million private placement financing (flow-through) at $1.30 per share that could increase up to $10 million…the offering, through Comark Securities and Byron Capital Markets Ltd., is expected to close by March 14…Focus is aiming to develop one of the lowest cost producers of industrial and technology-grade graphite in the world with its Lac Knife deposit in Quebec…below is John’s updated chart on FMS…notice the change in buying pressure this month…

Note: John, Jon and Terry do not hold positions in FMS.

McEwen Mining Inc. (MUX, TSX), formerly U.S. Gold Corp. (UXG, TSX), is up 36% since January 12 when John highlighted it in a chart as a stock in the early stages of a breakout…MUX closed at $5.76 yesterday and continues to look strong in this update…

Note: John, Jon and Terry do not hold positions in MUX.

Adventure Gold (AGE, TSX-V)

Adventure Gold continues to inch higher and closed yesterday at 48.5 cents…AGE remains one of our favorites and deserves more recognition for its Pascalis-Colombiere Gold Property near Val-d’Or where it has outlined a system over at least a three-kilometre strike and up to 900 metres depth and 500 metres wide…strategically, Pascalis is in an ideal location – immediately adjacent to Richmont’s (RIC, TSX) Beaufor Mine…AGE has commenced a 15,000 metre drill program, part of which will test a promising new zone (see picture below) to the north that was discovered through prospecting last summer…this is a fabulous property that the market should truly begin to appreciate in 2012…

“

18 Comments

Best graphite junior right now looks like LMR.V, big block of sellers at .14 but after that… clear sailing!

If you had new money to put to work would you favor RBW or GBB which will soon have the long delayed 43-101?

If already invested in RBW I’d go for the proven resource, but probably GCU and hope that I could cash out with profits and get into GBB before the SP moves too much and before their 43-101.

But I know you’re not asking me, but I just thought I’d point out the possibility of a quick double whammy! 🙂

Trouble is Ive been running into a lot of those double whammy’s lately. that may be why my head don’t feel so well my stomach either.

A .025 jump in RBW’s price, due no doubt, to the RBW report

put forward by BMR today. I give BMR credit for that,

especially since it’s a negative Friday. Whatever, better

days ahead. R !

Hi Bert … can’t seem to locate the report. Can you provide a link. Thanks

Paul

It’s included in today’s musings. R !

Graphite is the ‘in’ thing right now. Lots of companies picking up graphite properties

Ive bought 4 and all have taken off, any whiff of graphite brings in the buyers. Although most have already doubled theres still some value there I believe

Prefer the juniors with tight share structures. Check out SOL,CED,LMR….also RA and GXY have picked up graphite properties in the last day. GXY only seems to have 12million shares, tho dyor as Im just doing some digging myself.

Edit: SOR.V not SOL

Thanks Bert should have read your post … clearly stated! Thanks

Good to see AGE hit .50 again – it’s been a long time since early November!

I’m not sure that I agree with BMR outlook regarding the CDNX in the short term. I think we’re in a consolidation period that could be followed by a significant correction in Mar-Apr time period. At least all the good investors notably Phil’s Stock World and Cam Hui agree with this market movement whom of which are quite good at predicting market movements.

I think scaling back in risky investments right about now would be a prudent move. The only way I think we see further upside is if QE3 comes out, but I don’t think we’ll see that until we get a significant drop in the market which would lead Bernenke to prop the markets. The current market run up is an inflationairy run up which will be followed by a correction because fundamentals don’t support these overbought conditions. This correction should lead to negative signs of inflation which would support a round of QE3.

I agree with you on a minor correction (perhaps 10%) at some point in the spring but not before the CDNX shoots significantly higher in March…….CDNX Theory was correct last March in predicting trouble ahead for the markets…it’s correct now in predicting what will amount to be a “reverse capitulation”…

guys.. just to put this on your radar… GNH is a gold explorer .. good property in Quebec BUT…. there is a good possibility of graphite…. more below

is the hottest ticket lately…and it COULD be why gnh management have been so excited lately. Here is a paragraph from a research report I found online:

T h e B e a u c e v i l l e f o r m a t i o n c o n s i s t s o f p y r i t e o u s b l a c k a r g i l l i t e s

i n t e r b e d d e d w i t h b l a c k t o g r e e n n a f i c a n d f e l s i c v o l c a n i c l a s t i t e s

a n d r a r e s i l i c e o u s c l a y s t o n e s . T h e a r g i l l i t e s n e a r t h e b a s e o f t h e

B e a u c e v i l l e f o r m a t i o n a r e r i c h i n g r a p h i t e ( u p t o 15% )

The whole article can be found here:

goldenhopemines.com/_resources/pdfs/ATT00856.pdf

If we do have some solid graphite drill results, then this thing will take off like last year, maybe faster. However, we do not have assays yet, only some obscure research paper that was written when graphite was not a very interesting material.

I just noticed the formatting there was not great but the important statement is that the Beauceville formation where the Champagne zone is has been described as rich in graphite with up to 15% recordings.

Andrew M

It’s elementary my buddy, no one knows with certainty what the future has in store for us,

except that is, the Man above. We have two opinions, BMR vs Phil & Cam, that leaves a 50/50%

chance that one or the other will be correct. Whooppppps, hang on there Andrew, don’t leave

yet, i am not finished, i want to support BMR’s call, now the odds’ are in our favor that

things will improve as we move along.

TRR just had a resource estimate update, 5.9 million ounces inferred, and 900 000 ounces indicated. Any comments?

Andrew, GCU is a good one, but also NES for a potential double whammy, 43-101 supposed to be out by end of 1st qtr. Lots of big houses in on the financing today too.