Gold has traded in a range between $1,662 and $1,672 so far today…as of 6:00 am Pacific, the yellow metal is up $1 an ounce at $1,670…Silver is up 24 cents at $32.52…Copper is 2 pennies higher at $3.85…Crude Oil is off 32 cents to $102.70 while the U.S. Dollar Index is up slightly at 79.02…

The Dow and the S&P 500 logged their best first quarters in 14 years while the Nasdaq, which climbed over 18%, enjoyed its best first quarter performance since 1991…

The CDNX came out of the gate very strong in January and February but struggled in March as Gold dropped significantly…the Venture was up 5.5% in Q1, essentially mirroring Gold’s performance while the TSX Gold Index lagged behind with a loss of over 6% as many producers are battling cost pressures…below is a first quarter comparative chart from John…Silver snapped out out of a three-quarter losing skid with a strong 2012 Q1 performance…

A Busy & Shortened Trading Week

As well as surveys covering global manufacturing and, later, service sector activity, tomorrow sees the release of the U.S. Federal Reserve policy meeting minutes, while Wednesday and Thursday have the European Central Bank and Bank of England rate decisions, respectively…

But possibly the biggest concern for traders is that crucial U.S. non-farm payrolls data will be released on Good Friday, when most markets will be closed for Easter…liquidity is not being helped, either, by Shanghai being closed for a holiday until Thursday…

China – More Monetary Easing Likely

A stronger reading for a Chinese manufacturing gauge failed to end predictions for policy loosening as analysts described the gain as seasonal and a separate survey showed exporters struggling…a Purchasing Managers’ Index rose to a one-year high of 53.1 in March, China’s logistics federation and the National Bureau of Statistics said yesterday…however, the gauge has a pattern of rising each March…in contrast, a PMI from HSBC and Markit Economics showed manufacturing contracting and export orders falling…the latter report has a greater proportion of smaller companies, but the divergence between it and the official figures raised some eyebrows…China will continue efforts to boost growth as the year progresses, and that’s certainly positive for commodities…

U.S. Dollar Technical Update

The U.S. Dollar Index has been showing some signs of weakness recently…right now it’s at support, but a further drop could be one of the catalysts that sends Gold higher as the second quarter begins…

Greenlight Resources (GR, TSX-V)

We suggest investors do their due diligence on a company called GreenLight Resources (GR, TSX-V) which we’re adding to our Group “A” Watch List…GreenLight is following the “project generator” model and has a plethora of interesting properties in Atlantic Canada, covering everything from Silver and Gold to base metals, rare metals and graphite…its recently acquired Christmas Island Property is a nearly 6,000-acre land package that features multiple near-surface target areas for Gold, copper and graphite…the company has about 33 million shares outstanding for a total market cap of $4 million after Friday’s close of 12 cents…

Below is John’s technical perspective on GreenLight…

Note: John, Jon and Terry do not hold positions in GR…

Rainbow Resources (RBW, TSX-V)

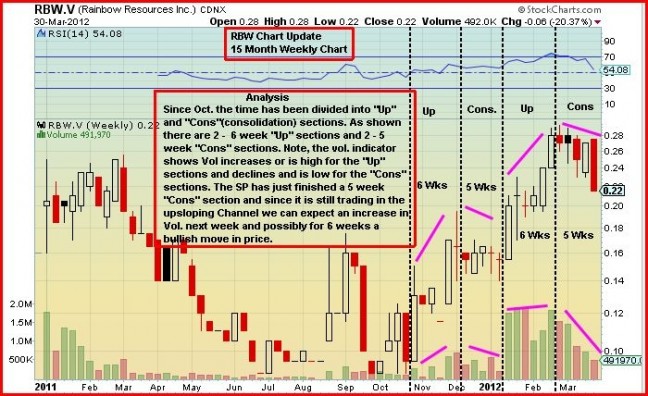

John has another revealing chart regarding Rainbow Resources (RBW, TSX-V) which fell Thursday and Friday but on low volume…investors may still be digesting the deluge of news Thursday which confirmed the deposit potential of the International Property for Silver, lead, zinc and now even Gold, to go along with seven other properties including the past producing Ottawa Property that churned out incredible grades of 60 opt Silver (2,100 g/t) in the 1900’s…what may have been overlooked Thursday is the fact Rainbow has some juicy targets to pursue at the Jewel Ridge Property in Nevada, another former producer (historical open-pits) with an impressive near-surface drill result (2.1 g/t Au over 39.6 metres) that President David Johnston said, at Thursday’s presentation, the company will be following up on as quickly as possible…a repeat of that kind of a drill result could send RBW flying in a hurry…below is another RBW chart from John that shows some very interesting technical patterns in the stock…

Note: John and Jon both hold positions in RBW (Terry does not).

17 Comments

Jon – No comments on CEV’s long awaited results? Thanks

Good luck to all GBB holders – stock halted pending news. 🙂

OK I ITS TIME TO REVEAL THE STOCK THAT IS FINDING GOLD AT ONE DOLLAR AN OUNCE, PLEASE LET ME KNOW WHAT YOUR THOUGHTS ARE ON IT, I THINK IT MAY NOT SOAR TILL 2012 RESULTS START COMING IN.THAN LOOK OUT. THE TICKER IS NFR

GR – I’ve been doing some research, they’re in my backyard. My info shows they have a double dose of Mineralfields as insiders (Joe Dwek and Consolidated), does anyone know if either of these have reduced their insider status? Anyone else have any comments of holding GR? Thanks.

GR’s Golden Grove Graphite property is very close to my home – I’ll see if I can make a site visit! 🙂

NFR – lotsa likers our there, 28cent FT isnt pretty, and drilling in may is likely to start mid to end i would guess with results coming in sept or oct if last year is any indication, which means all that FT will be open for trading on top of any that may stil be held by dwek et al. may want to nail down what shares are where since this is upwards of 110MM shrs as of today. a fund outta the US is an insider as of the last PP.

Gold Bullion Provides Mineral Resource Estimate for Granada

VANCOUVER, April 2, 2012 /CNW/ – Gold Bullion Development Corp. (TSXV: GBB) (OTCPINK: GBBFF) (the “Company” or “Gold Bullion”) is pleased to provide an independent NI 43-101 compliant gold mineral resource estimate on its Granada Gold Property, located along the prolific Cadillac trend in North-western Quebec, 5 km south of the city of Rouyn-Noranda.

Highlights include the following:

The in situ measured resource is 97,700 ounces (3.02 million tonnes grading 1.01 g/t), indicated resource is 543,400 ounces (17.04 million tonnes grading 0.99 g/t), inferred resource is 846,600 ounces gold (23.93 million tonnes grading 1.10 g/t Au) using a cut-off grade of 0.40g/t.

The selected base case in-pit measured resource is 95,300 ounces (2.9 million tonnes grading 1.02 g/t), indicated resource is 435,600 ounces (12.49 million tonnes grading 1.08 g/t), inferred resource is 135,600 ounces gold (3.4 million tonnes grading 1.24 g/t Au) using a cut-off grade of 0.40g/t based on a Whittle-optimized pit shell simulation using estimated operating costs, a gold price of CAN$1300 per ounce and a corresponding lower cut-off grade of 0.4 grams per tonne gold.

Remaining underground resources under the selected base case in-pit surface above a cut-off grade of 2.0 g/t is 273,200 ounces (2.32 million tonnes grading 3.66 g/t).

Previous small open pits have been taken into account and are starting surfaces of optimization while the historical production of 51,476 ounces (181,744 sT @ 0.28 oz/sT) from 1930 to 1935 are included in the resource statement (cannot physically remove from measured, indicated or inferred).

The mineralized system is still open at depth and laterally.

PMs are up and gold and silver stocks, in general, as usual go the opposite way – just seems like we can’t win. I’m beginning to think that this sector is done with for the time being and it started a year ago?

You are right Andrew – this sector is toast.

Sell everything and buy blue chips at or near 52-week highs.

No brainer.

Alex – I wish I had put everything in AAPL at the beginning of the year – I wouldn’t have to keep watching the screen and responding to low price alerts! 🙂 YHOO, GOOG, MSFT have all done well.

TIME TO BUY WHEN EVERYONE WANTS TO SELL

GR- I’ve been in touch with IR and Golden Grove is not active. However, they think that Mineralfields (Joe Dwek and Consolidated) have sold most of their position. They have two joint venture projects about to commence, Keymet silver base metal project with Elmtree (ETM) and Porcupine Poperty REE’s and Base Metals jv with Explorex (EX.P). They will be commencing work shortly on their recently acquired Christmas Island property – Gold and Graphite.

THREE STOCKS I OWN MADE FOR A GREAT DAY SOV FDN WS

Well done, Gil – I didn’t see SOV’s nr go by this morning. CJC also up at the close but that’s not a stock I would touch! FDR and GR had a good day too and RGX finished green. CEV disappointing but low volume. This was news that’s been long awaited too. Have a good evening.

I have discovered a stock trading a 2 dollars per ounce ofgold Equ in the gound.PERHAPS THE MOST UNDERVALUD GOLD STOCK OUT THERE

Today’s GBB rebound… not good enough… 18 – 20 cents may stay for awhile but I believe that it will drop soon. Volume is too low to support future move.

Agree with you Theodore