After losing over $60 last week, Gold continues to slide but has to be nearing a bottom…as of 4:30 am Pacific, the yellow metal is off $18 an ounce at $1,562 after dropping as low as $1,558…Silver is down 55 cents at $28.34…Copper is 6 cents lower at $3.61…Crude Oil, after declining nearly $9 a barrel over the last two weeks, has given up another $1.95 a barrel to $94.18 while the U.S. Dollar Index has strengthened again to 80.50…

Today’s Markets

Asian markets were generally weaker overnight with China making some early gains but finishing 14 points lower at 2381…European markets are down sharply by over 2% while stock index futures in New York as of 4:30 am Pacific are pointing toward a weak open for Wall Street…

China Moves To Boost Growth, “Austerity” Is Losing

China’s central bank cut the amount of cash that banks must hold as reserves on Saturday, pumping out more funds that could be used for lending to head off a sharper slowdown in the world’s second-largest economy…the People’s Bank of China delivered a 50-basis-point cut in banks’ reserve requirement ratio (RRR), effective from May 18…the latest RRR cut – the third in six months – came a day after a flurry of data showed that the Chinese economy was slowing faster than expected, with industrial production weakening sharply in April and investment slowing to its lowest level in nearly a decade…

Given recent elections in France and Greece, plus elections in Germany’s most populous state yesterday with Chancellor Merkel’s Conservatives suffering a crushing defeat, it appears “growth” is going to win out over “austerity” around the globe and China will lead the way…this has to be considered bullish for Gold and commodities…even in Alberta, one of North America’s most conservative jurisdictions, voters last month turned down the fiscally conservative Wildrose Party and re-elected a bunch of liberals (“Progressive” Conservatives) who are spending like drunken sailors and have run five consecutive deficit budgets…this bodes well for President Obama and the Democrats in November, especially if Republican Mitt Romney can’t deliver the conservative message in a powerful way…conservatives around the globe lack an effective messenger…

One should not underestimate China’s ability to fire up its monetary and fiscal firepower – it has the ability to do so in “shock and awe” fashion (its debt as a percentage of GDP is lower than that of any G-7 country), especially now that inflation is less of a concern…there are political motivations as well…the flow of money is already sending Chinese stocks higher, and commodities will soon follow…monetary stimulus is already in full swing…on the fiscal side, expect faster, fatter spending on infrastructure and social housing, more tax breaks for business and incentives to boost consumer spending over the second half of the year…China has the money to do it…

Shanghai Composite Divergence With The CRB – Bullish For Commodities

We have three very revealing charts this morning, two from John and another from CEBM Group which specializes in Chinese market research…

The main point we want to get across with these charts is that there appears to be a definite correlation between the Shanghai Composite Index and the CRB Index…over the last several years, the Chinese stock market has been a very reliable leading indicator of commodity prices…check the chart below and see how a sharp rise in the Shanghai in the summer of 2010 occurred before a very strong advance in commodities…conversely, the Shanghai broke down in December, 2010, suggesting trouble was on the way for commodities…what’s highly interesting at the moment is that there’s another major divergence between the Shanghai and the CRB Index – in otherwords, the current bullish action in the Shanghai suggests that commodity prices are likely bottoming out and will start to climb this summer…John’s first chart, a 2.5-year weekly chart, compares the Shanghai with both the CRB Index and the CDNX…

Chart #1

Chart #2

John’s second chart is a 10-year monthly chart that also shows how the Shanghai broke down prior to the 2008 commodity crash, led commodities higher beginning in late 2008/early 2009, gave another warning signal in late 2010, and appears ready once again to cross above the CRB Index which is bullish for commodities going forward…notice also how the CRB Index is approaching a strong support band…

Chart #3

Our third chart is from CEBM Group which shows the Shanghai Composite led economic growth in China by four months in 2009 and appears to have bottomed out again recently prior to an important low in economic growth, likely during this second quarter…

Greece and the Euro Zone

Greece’s exit from the euro zone “would be possible”, even if not in Europe’s interest, and countries should have a democratic right to quit, according to a member of the ECB’s governing council (Luc Coene, the central bank governor of Belgium)…that makes perfect sense…in fact, Greece should be thrown right out of the euro zone for what amounts to incompetent as well as criminal behavior with its finances…a chain is only as strong as its weakest link, so cutting Greece loose from the euro zone is exactly what that country deserves and the world won’t come to an end as a result – in fact, it’ll be better off…

Coene’s interview with the Financial Times highlights how euro zone policy makers are losing patience with Athens after an inconclusive election threw into doubt Greece’s commitment to reforms demanded under its international bailout…the European Union estimates that the economy of the 17 countries that use the euro is in recession in the wake of a debt crisis that has prompted savage spending cuts and a jump in unemployment to record highs…the European Commission, the executive arm of the EU, forecasts that the euro zone economy will contract by 0.3% in 2012 and grow by 1% next year…its prediction for 2012 is far weaker than the one it gave last November, when it predicted growth of 0.5%…a year ago it was predicting growth of 1.8%…

Friday’s forecasts provide clear evidence of the impact of Europe’s debt crisis on the euro zone economy over the past year as governments have struggled to introduce deficit-reduction measures and business and consumer confidence has taken a dive…Olli Rehn, the EU’s monetary affairs chief, said the recession is likely to be “mild” and “short-lived”…

Given the political winds that are blowing, expect the euro zone and the ECB to pull out all the stops to try to kick-start growth…

BMR Exclusive – Slocan Valley Staking Rush

Publicly-available mineral files show a staking rush is unfolding in the Slocan Valley in southeastern British Columbia, in the area between privately-held Eagle Graphite’s flake graphite deposit, Rainbow Resources‘ (RBW, TSX-V) Gold Viking Property, and more than 20 kilometres south beyond Anglo-Swiss Resources‘ (ASW, TSX-V) Blu Starr Property…we believe a major resource story is developing here, and additional parties are staking ground though it’s impossible to tell exactly who as sometimes a company for strategic reasons will “mask” its staking by doing so through another name…

Over the weekend, Eagle Graphite (they operate one of only two flake graphite mines in all of North America) gobbled up approximately 100 square kilometres of additional claims in what’s called the Valhalla Metamorphic Complex (they already had an extensive land package, including ground very close to Rainbow’s Gold Viking Property)…what’s interesting is that some of the ground Eagle staked actually falls outside what has been considered to be the eastern boundary of this system…if Eagle is thinking this system extends a little farther to the east, then Rainbow could be looking at not only Gold and Silver targets at Gold Viking but flake graphite targets as well…Gold Viking is just over 20 kilometres to the east of Eagle’s graphite deposit…the fact Rainbow reported very strong conductors over Gold Viking suggests the possible presence of graphite as the mineral is known to produce off-the-chart conductors…

Eagle Graphite is now pinching up against Gold Viking from the west and the south…

The bigger picture, however, as we have been stating recently, is that the Valhalla Metamorphic Complex could prove to be North America’s flake graphite hot spot which 99.9% of investors aren’t even aware of as Eagle Graphite has been operating in obscurity as a private company in Canada’s western corner…that may not last for long…rumors on the street are that Eagle, which produces flake graphite at its processing plant near Nelson at a purity level ranging from 93% to 99%, is in advanced discussions regarding an IPO…whether they remain private or go public, it appears Eagle could dramatically transform the exploration scene in the Slocan Valley and the West Kootenays in general…Rainbow and Anglo-Swiss are two sure big winners in that scenario…

Speaking of Rainbow, John has a chart alert this morning – RSI(14) momentum, CMF(20) buying pressure and MACD are all increasing…this could be an interesting week for RBW, especially if the Slocan Valley flake graphite situation continues to heat up…Rainbow is also drawing closer to the start of drilling at its Big Strike Project in the West Kootenays…

Note: John and Jon both hold positions in RBW (Terry does not) with Jon increasing his position Friday.

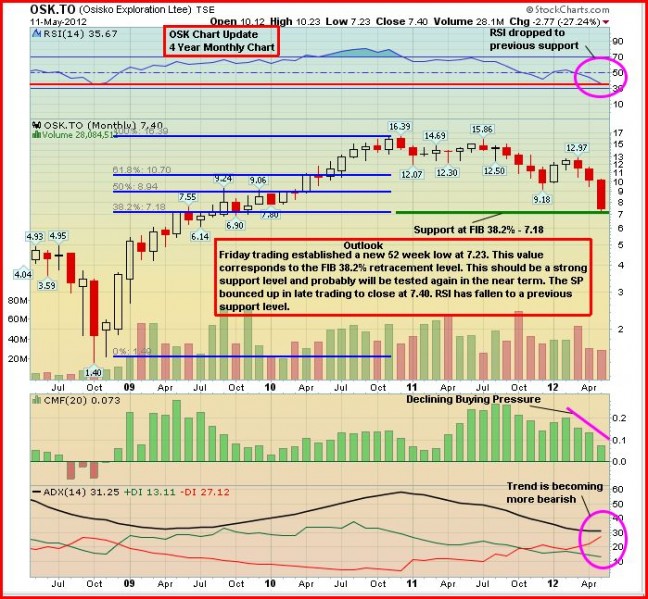

Oh Oh, Osisko (OSK, TSX)

Things are heating up at Osisko Mining’s (OSK, TSX) Canadian Malartic Mine, literally…it was a rough week for Osisko last week as a mill fire and disappointing Q1 results, combined with a drop in Gold prices, sent the stock tumbling 24% to $7.40 a share…that’s a 50% drop from last summer…this serves as a reminder how difficult it is these days to bring a Gold deposit (especially a low-grade one) into production and operate it efficiently…

Calculating the all-in costs to produce an ounce of Gold by taking net income minus the revenue and dividing by the number of ounces produced showed Osisko’s all-in-cost to produce an ounce of Gold was $1,399 and this number was even higher than the average cost in 2011 of $1,366…the company ended the quarter with $144 million of cash and equivalents but one analyst, Daniel Earle of TD Securities, noted the balance sheets looks tight…given the obvious risks, the analyst expects the company’s cash balance to decline to $47 million in the third quarter with $245 million in long-term debt…

The Osisko chart shows there is support above $7 a share with RSI(14) now at its lowest level since late 2008…

Note: John, Jon and Terry do not hold positions in OSK.

Richmont Mines (RIC, TSX)

Another Gold miner in Quebec whose share price has taken a beating recently is Richmont Mines (RIC, TSX), one of our favorite smaller producers…Richmont, too, is having some mine problems as their Francoeur operation has yet to commence commercial production (one year behind schedule)…higher exploration and administration costs in the first quarter cut Richmont’s earnings-per-share to just 6 cents…the company’s Wasamac Property holds excellent potential, as evidenced by a recent drill result of 52 metres grading 6.4 g/t Au in the Main Zone, but the potential economics of that project need to be improved after the initial IRR was calculated at just 7%…Richmont, which has a book value of $4 per share, closed Friday at $6.04…below is John’s chart update…we see superb technical support in the vicinity of RIC’s 1,000-day rising moving average (SMA) just above $5 per share…

Note: John., Jon and Terry do not hold positions in RIC.

25 Comments

The lack of comments on this site would indicate a sell in May & gone away

Haha Bert – either that or everyone is speechless. Looks like we’re going to be toasted if not already! Oh well, I’m pretty emotionless about this game these days, so that’s a positive!

as predicted, CEV filled gap at .48 – However is it done. tsx.v looks like 1300 is more and more imminent. Breaks below that and its a market crash. Even the graphies with news (ZEN)(SRK) cannot hold there gains. Glad I’m in all cash.

Bert, I increased the post to 3 for the day. hahahahaha

Dave – as predicted, CEV filled gap at .48 –

Bert – No doubt, you suggested it would happen. Anyway, i was ready & bought a few at 0.465 & by the

way, i am in the money on that trade already. As for being in all cash, you could be one of the few

lucky ones. I sold a few awhile back to pad my possible future winners. I am still hanging in there,

because i have seen it all happen before. That reminds me, I should relate this story.

My first stock ever was Arequipa, bought through a broker, 600 shares at $12.00. It went to $33.00

& i called the broker admitting to him that i didn’t much about the stock market , but i felt he

should sell my stock at $33.00… He was very intimidating & told me to wait for him to tell me

when to sell, as they expected $35.00. I backed off & would you believe, the stock slowly but surely

moved back to $11.00… My first re-action was to never ever use that broker again, but with time,

the stock started moving up & word got out that BARRICK was to make a offer & they did, offering

$35.00 a share. The market reacted quickly, showing a bid of $33.00 & i called again & i think i

may have been the intimidating person that time. Anyway, my stock was sold for $33.00 on the open

market. Those were the days my friend, i thought they would never end.. By the way, no more brokers

for me. R !

brokers = bankruptcy

It a typical slow monday. Tomorrow should be interesting…

SG is back… but lost almost 50% … trading at 13 cents… I am just wondering why it dropped so much. This stock should be in 20 cents range… I am waiting at 10 cents range! GBB is unlikely to hold on at 9 cents… perhaps, someone may buy a couple of thousand shares to make it 9.5 cents. The buying lot is getting smaller and smaller…. Hopefully, this will not lead to massive dumping.

Wow the bottom came earlier than expected. I was expecting it to hit bottom in early June when Operation Twist expires. Time to come out of hibernation. Summer has come early and it should be a hot one.

Factual comments are fine, and so are opinions written respectfully. Rude rants are not fine. It’s our site – we set the rules. Take it or leave it.

The bottom must be near, Andra has lost his cool. Take it easy Andre, you may regret this

if & when the good old days return. I would suggest the BMR folks gave it their best, but pray

tell me who can be right, when the elements are against us. I am sticking this out, til death

do i part. R !

To all my friends, BMR …. Rainy days will not last forever and we will see the sunshine again with flower blossom … we are coming here to write express our views and I respect every comments/ feedback. Although we never meet each other, I always read every lines … agree or disagree … just a forum not a battle field.

1303 close. Tuesday will be interesting, we are not even through May yet. How is that Terry?

Anyone else notice RBW boasts to be a silver,gold, and FLAKE GRAPHITEcplay on their hompage now?

I noticed that too this morning, as well – a subtle or maybe not too subtle change. Something is definitely cooking here. And what does it tell you when a privately held graphite company stakes claims right up against Gold Viking? They’ve parked right on RBW’s doorstep. If there’s an unexpected graphite discovery at Gold Viking, guess who’s getting gobbled up? Eagle is already showing it will be aggressive. I hope Rainbow has a few surprises for Eagle Graphite. I spoke to Johnston yesterday and asked him about all the staking going on. He wouldn’t comment on anything, other than to say that yes, there’s a lot of activity and a buzz going on in the area. He sounded quite happy and upbeat. My gut tells me this could be a very interesting and important week for Rainbow.

Dave – 1303 close. Tuesday will be interesting, we are not even through May yet.

Bert – The day, the week, the month, is not to blame for us being at 1303 or going

lower, it’s all about the critical times we face, the uncertainty that is. This

market can turn positive at the blink of an eye, if something really positive should

happen. Although i lose faith every once in awhile, i still believe that we will

turn around, it’s the nature of the game we play & the nature of the people, who

play this game, to ensure the game continues……….. We have been struggling for

months now & it’s even showing in a small way, by the number of participants frequenting

this board. Give us a few real good days & watch the participants & the chatter increase,

as the posts stand out, as if nothing negative ever happened. Anyway, at 08:45 Nfld

time, it looks positive out there, but we will have to wait to see, whether or not, it

reflects in a positive manner, on the lowly man’s exchange. R !

Rainbow seems to chase the flavor of the week.

Jon – Is it possible that Rainbow staked some of those claims or would that have to be made public knowledge?

Yes, Andrew, it’s definitely possible but no way of knowing for sure at the moment because Rainbow’s name or David Johnston’s name doesn’t show up on any of the recently staked ground…..however, companies often initially “mask” their identity………my gut instincts tell me Rainbow has struck.

Thanks Jon.

Joey, RBW has held Gold Viking since last fall so you can hardly say they are “chasing the flavor of the month”

It’s not accurate to say RBW is chasing the flavor of the month….the flake graphite story has come to them……Eagle could have one of the world’s largest flake graphite deposits and has aggressively staked right next to Gold Viking, 20 km from one of only two operating flake graphite mines on the continent…….it would be irresponsible for RBW IMHO to just sit back and do nothing……this is their backyard and they can’t ignore what’s going on….my bet is on Johnston making an important move…

Jon – my gut instincts tell me Rainbow has struck.

Bert – My gut feeling tells me that Jon & David J. are very close & being very close,

tells me that Jon knows more than he is willing to put forward on this board. Deny

it if you wish Jon, but my gut, when full, is very seldom wrong. R !

not to throw any cold water onto anything…. being responsible is not something that company CEO’s have had a history of doing or being/…. many examples of that… CQX, VGD, Goldquest, and more…

Why would Johnson be any different.??? Just asking!

Jeremy, you raise a very good and valid general point. One of the big problems in the industry right now is what I would call “lifestyle” companies – companies that are run by CEO’s and Presidents whose focus is really not on creating shareholder wealth, but raising a bunch of money (quite often flow-through), collecting their pay checks every month (usually from more than one company), maintaining their leisurely and comfortable lifestyles, and going through the motions on the ground. These prove to be bad investments. There is NO evidence that this is the case with RBW, and I personally wanted to make sure of that when I did my DD on the company over a few months late last year. They’re focused on creating value and wealth, and I think the action in their market has proven that over the first several months of the year. It has certainly been one of the better performing Venture stocks, and they have added layers of value to the company since the beginning of the year with the move into Nevada and the building up of their Big Strike Project, and now it appears there’s a graphite element to this as well.

thx Jon… and since I totally agree with you.. re the lifestyles… dong the right thing is becoming a rare commodity. and we hope MR Johnson is the integral man that u think he is….