This is an abbreviated edition of Morning Musings due to travel commitments today…Gold has hovered between $1,667 and $1,679 so far this morning…as of 6:00 am Pacific, the yellow metal is off $4 an ounce at $1,671…Silver is off 12 cents at $32.26…Copper is down 6 cents a pound at $3.68…Crude Oil is 28 cents lower at $103.36 while the U.S. Dollar Index is up one-quarter of a point to 79.59…

In economic data just released in the last 30 minutes, the U.S. Labor Department stated that the U.S. consumer price index increased 0.3%, in line with economists’ expectations…

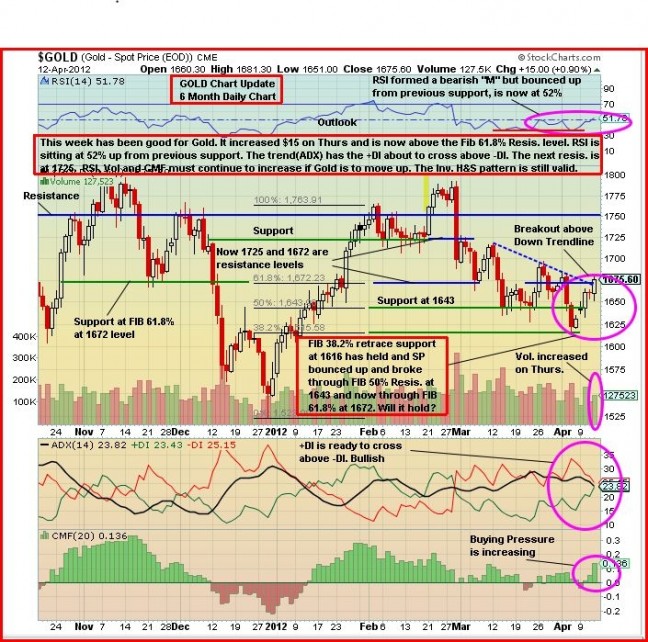

John’s 6-month daily Gold chart shows RSI(14) has bounced up from previous support to its highest level (albeit an area of resistance) since just before the start of the sell-off at the end of February…the bullish inverse head and shoulders pattern, as we’ve been pointing out in recent weeks, is completely intact…what’s important to watch for in the immediate future is whether Gold can break out decisively above a recent downtrend line…

Oil Update

The tale of ever-tightening oil inventories and reduced supply appears to be coming to an end, the International Energy Agency said on Thursday…Saudi supply assurances, market speculation on a potential strategic stock release and hopes pinned on multilateral talks over Iran’s nuclear program have eased fundamentals and prompted falls in prices recently, the report said…

“Acknowledging that data remain preliminary, first quarter 2012 fundamentals nonetheless show a clear shift from the seemingly relentless tightening evident over the prior ten quarters,” the IEA said in its April report…

“Further surprises almost inevitably lurk around the corner for both demand and supply…but for now at least, the earlier tide of remorseless market tightening looks to have turned,” it said…

Chinese GDP At 8.1%

Chinese GDP grew 8.1% in the January to March period, according to the National Bureau of Statistics, missing analysts’ expectations of an 8.3% expansion…that was the weakest quarterly economic growth in China in almost three years, the result of weak exports and of Beijing’s cooling policies…but strong March data left economists and policy makers optimistic that faster growth may be seen in months ahead…

“We are in the middle of a recovery,” said Lu Ting, economist at Bank of America Merrill Lynch, adding that China’s growth rate likely bottomed in January and February…Chinese officials said they were pleased with the data as it furthered Beijing’s goal of re-balancing the economy by boosting domestic consumption…

“We must change the previous practice of relying on resource consumption and lots of cheap labor to bolster the economy,” said Sheng Laiyun, spokesman for the National Bureau of Statistics, in a press conference this morning…“After more than 30 years of nearly double digit growth, several factors that have supported China’s economic growth are beginning to show up in terms of restraining economic growth and supply and demand”…

Consumption spending accounted for 76% of first quarter economic growth, far above historic averages…fixed asset investment growth fell to 20.9% in the first quarter from the previous year, while retail sales growth rose to 15.2% in March from a year earlier…

Beijing has also been quietly injecting cash into the economy, encouraging banks to lend more and easing restraints on credit flows…a larger than expected Rmb1tn ($200 billion) in new loans in March, announced yesterday, was the latest evidence of its shift towards a moderately pro-growth stance…

Today’s Markets

Asian markets were up overnight including an 8-point jump in China’s Shanghai Composite to 2359…European markets are weaker while stock index futures in New York are pointing toward a modestly lower open on Wall Street after yesterday’s strong performance…

Venture Exchange

The CDNX found support at 1425 this week and powered 37 points higher yesterday, though on unimpressive volume, to close at 1472…the next area of resistance is going to be between 1500 and 1513 as John outlines in the chart below…

29 Comments

My sixth sense tells me that GBB will slide today….. I am placing my order at 11 cents!

Seriously Theodore why are you here? My sixth sense tells me that the Lotto Max #’s tonight are 1,2,3,4,5,6,7. Who cares?

It dropped to 11.5 cents… not finished yet…. and my bidding lot is coming. I am reminding people not to take any chances… the slide is not over yet! My sixth sense … today’s number is 1, 19, 21, 33, 35, 47, 48. Pete, you only have one number…

What about tomorrow’s Lotto 649 – there’s only 6 numbers plus Tag? 🙂

My best luck in the Lotto was 5+ bonus…. and I am waiting for my 6 number or even 7 numbers. I think I have good track record than GBB!

Andrew, what are you looking at, I am focussing on HVU, what do you think :-)?

SEI is the play de jour… somethings a brewing there…

Are you in DB?

i was in yesterday at 9c

Hi Jon,

What do you think of Lake Shore Gold Corp as a very therm play?

Thanks and have a great week-end 🙂

yesterday was record 3yr volume today its traded over 600k. must be NR on horizon.

”very long therm play”

i dunno bout that. looks light on ask, may make run into teens next week with right news. RBW is a long term hold…

could go to 0.145$

Still in RBW?

i would love 14.5!! oh yeah im still in RBW. I lightened my load last week but bought some back yesterday at 21.5c

Salut, Martin. I’m still stuck in the same holdings – just not enough volume. I’ve been looking at FMS, SRK, GR, GMX & MOM. HVU is my favourite ETF but don’t think I would risk holding over a weekend at present – maybe when the markets sink. A small holding would be okay now and maybe give a 10 bagger in the Summer. 🙂 Bonne chance!

srk is going to do fine. they will start drilling next week and announce it is my guess.

Dave – what do you think of CEV’s prospects? The long awaited DSOs didn’t move the SP in the right direction. There was so much hype about CEV last year but it seems to have fizzled out and I don’t see what makes them stand out from other iron ore companies in the Labrador Trough. There’s mudslinging too that doesn’t help – the usual Venture games! 🙂 I’m still holding some CEV, do you think there’s a catalyst on the horizon (other than a bull market) that will get CEV moving again? Thanks

Martin, I’ve done a little more due diligence and my short term preferences are SRK (Mkt cap 16.1) and GR (Mkt cap 4.3) – I’m hoping to take a position in these today or early next week.

Let me guess RBW is a buy at 20 cents right? Apparently it has been a buying opportunity since 29 cents. Some people that are down to the 20 to 30 % loss level should probably sell. But maybe it will go up from here and maybe it will go to 15 cents.

TODAYS SMILE . If you need to borrow money borrow from a pessimist he wont expect to be repaid

GBB dilution as expected – chart not a picture of beauty!

S&P500 and DOW look like they are going through their Elliot Wave C corrective phase. We will most likely see further downside to 1300 on the S&P and 12500 on the DOW. I think once Wave C is completed that will the end of the correction and we should be back into rally mode.

If the inverted H&S on the CDNX is not confirmed then expect a final capitulation with a V-shape recovery.

Andrew M – I don’t see an inverted H&S on the Venture – is the inverted head from yesterday? Thanks

Andrew – sorry for the delay. I had to leave the rest of the day. Hope you see this and I will alert on next day posting for you to look back here. CEV has the right people and the right project to stay with it and continue to buy and sell off the TA swings and the chart. My loop with CEV is tight contact which is not the same on CJC. CJC was a different loop that had the CEO steer them in wrong direction. I will post when it is time to enter CEV again. I am privy to some knowledge that I can’t let go, but I will post when to enter.

SEI – Saw the posts here today on it. BUYER BEWARE – the same people that were involved with CJC, BXR, are with SEI. They tried to get me to buy Monday but I elected to stay away. It may go up as a promotion is starting on Monday, but I just did not want in.

marketwatch.com/story/abcourt-mines-inc-advances-toward-reopening-of-past-producing-gold-mine-in-quebec-2012-04-13

Dave – thanks for taking the time to answer my question re CEV – much appreciated. Have a good weekend. 🙂

Hugh – thanks for the link – that’s the best read I’ve seen on ABI. May be worthwhile sitting on ABI, could be a decent return if markets are better at the end of the year.