Gold fell as low as $1,640 overnight but has recovered somewhat…as of 6:00 am Pacific, the yellow metal is off $7 an ounce at $1,652…Silver is now up 7 cents to $31.57…Copper is unchanged at $3.65…Crude Oil is 29 cents lower at $102.54 while the U.S. Dollar Index is down slightly at 79.98…

Bullish Contrarian Sign For Gold

For the fourth time in the past year, Gold bears outnumbered the bulls in Bloomberg’s weekly Gold Bull/Bear Sentiment Survey…in fact, the bears had the bulls outnumbered by almost 2-to-1…

Today’s growing sloth of Gold bears is a “buy” signal for contrarian investors…research from the Gold team at Canaccord Genuity, as reported at www.usfunds.com over the weekend, found that Gold rallied about 10% on average during the month following each of these sentiment “cross-overs”…this historical increase means that Gold could potentially rally to the “high $1,700’s per ounce”, which Canaccord believes “would breathe some new life into the Gold equities”…

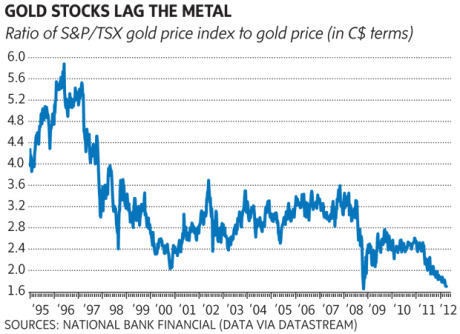

Another interesting chart this morning, from National Bank Financial that appeared in the Globe and Mail, shows how the TSX Gold Index, in relation to Gold itself, has nearly touched the panic-driven oversold lows not seen since the 2008 meltdown…either we’re in a new realm for Gold stocks or we’re about to see a major turn to the upside…

Spanish Yields At Highest Level This Year

Spanish 10-year government bond yields broke above 6% for the first time this year today as concerns over the country’s ability to keep its finances under control pushed debt markets back into “crisis mode”…Spanish yields are expected to rise further toward the panic-triggering 7% level beyond which debt costs are widely seen as unsustainable unless the European Central Bank resumes its bond purchases after a two-month break…

China Currency Move

A move by China Saturday to double the size of the yuan’s trading band against the U.S. Dollar is a strong signal that Beijing is comfortable with economic growth and believes it has avoided a hard landing…this was also a milestone step toward turning the yuan into a global currency…

The Shanghai Composite Index was essentially unchanged today, closing at 2357…the chart for the Shanghai is very interesting and shows strong potential for a major breakout in the coming weeks…such an event would be positive for global equities as a whole…

Today’s Markets

European markets are higher today while stock index futures in New York as of 6:00 am Pacific are pointing toward a strong open on Wall Street…the TSX and the TSX Venture Exchange have each declined for seven consecutive weeks, so a turnaround very soon is likely in the cards…

U.S. retail sales rose more than expected in March as Americans shrugged off high gasoline prices and bought a range of goods, suggesting that economic growth in the first quarter did not slow as much as many had feared…the rise in sales last month (0.8% vs. a forecast gain of 0.3%) was broad-based, even though Americans paid 27 cents more per gallon of gasoline than they did the prior month…so far, Americans appear to be taking rising gasoline prices in stride, thanks to a mild winter that has cut household heating bills…

Rainbow Resources (RBW, TSX-V)

John has several individual company charts to share this morning beginning with Rainbow Resources (RBW, TSX-V) which has pulled back into an zone of strong support…on Saturday, we spoke briefly with RBW President David Johnston who was checking on his recently-optioned Jewel Ridge Property in Nevada along with senior geologist Bob Morris…Johnston’s tone was very upbeat, and what we see potentially unfolding in Nevada is a terrific appetizer before the main course to be served in the West Kootenays this summer…the chart shows declining volume during a consolidation (normal) and consistent accumulation…the overall technical picture remains very attractive…

Note: John and Jon hold positions in RBW (Terry does not).

RJK Explorations (RJX.A, TSX-V)

The Blackwater Gold District in central British Columbia, which BMR has been following since Richfield Ventures‘ discovery in late 2009, could really heat up this summer, and a leader in that area is unquestionably RJK Explorations (RJX.A) which started a 2,000-metre drill program at its Blackwater East property in early February…the stock has broken out from a horizontal channel as John details below…

Note: John, Jon and Terry do not hold positions in RJX.A.

Golden Predator (GPD, TSX)

Note: John, Jon and Terry do not hold positions in GPD.

Canaco Resources (CAN, TSX-V)

Note: John, Jon and Terry do not hold positions in CAN.

9 Comments

WHEN ARE THE 15 CENTS P.P. FREE TRADING? THAT COULD BE GOOD TIME TO ACCUMULATE RBW?

Thanks for the updates on all of the above companies. Appreciated the alert on RBW this morning too.

Todays smile, Itseems very few things remain the same.There is even a new version of Mary had a little lamb MARY had a liile lamb and now the lamb is dead She takes it to school each day between two slabs of bread

GBB… my favorite subject again. Why people bought at such a high price…. 150,000 shares bought at 13 cents above the asking 12 cents … too high and I am expecting the 11 cents lot will be filled very soon. Do not touch it unless you really want to bet …. . The dilution of the stock will make it float at 10 cents level… .

Thanks for the tech update on Golden Predator.

Whats your long term view of GBB Theo? You’ve called it best so far!

Hey Jon,

What do you make of the recent performance by RBW? You mentioned support is strong at 19, but this looks like it’s about to breach that and some more. Though the volume is laughable, this is aggressively being sold a few thousand shares at a time. It’s back to its December levels and has given back all it’s gains during the past 4 months.

Any thoughts for the nervous nellies out there, me being one?

thx

Hi Alex, the current weakness obviously has everything to do with a messy market and poor investor sentiment across the board…..there has not been aggressive selling with RBW……..weak hands/nervous nellies unloading small amounts of stock………the stock is actually still up for the year – a lot of others can’t say that…….I have a ton of this and I’m very content to ride out the current market downturn and scoop up some more along the way…….the progress this company has made on the ground and in every area over the last few months speaks volumes about RBW’s potential and where this is ultimately going to go……..

RGX STILL GOING STRONG