Gold is up $3 an ounce at $1,623 as of 6:05 am Pacific…Silver is 8 cents higher at $29.51…Copper is up a couple of pennies at $3.42…Crude Oil has gained $1.46 to $86.48 while the U.S. Dollar Index is off slightly at 82.09..

China Cuts Rates, Fed To Act Soon

As we have been speculating, central banks are going to get aggressive in tackling any signs of a significant economic slowdown…China cut benchmark interest rates by 25 basis points this morning to shore up slackening economic growth, its first rate cut since the depths of the 2008/09 financial crisis…the PBOC has cut the required reserve ratio (RRR) for the country’s biggest banks by 150 basis points from a record high of 21.5% in three moves since November last year, after a two-year tightening campaign to rein in inflation and cool steaming economic growth…

Meanwhile, Federal Reserve Vice Chair Janet Yellen yesterday laid out the case for the U.S. central bank to ease monetary conditions further to shield a fragile economy as the euro zone debt crisis intensifies…Yellen’s views carry great weight with Fed Chairman Ben Bernanke, and her comments suggest the Fed may be close to taking more easing steps this month (the Fed meets June 19-20) in response to ongoing housing problems, a weak jobs market and the overall global macro economic picture…

Bernanke, himself, will be speaking on the economic outlook in testimony to Congress this morning though he may keep his cards close to his chest in advance of the Fed meeting…

Today’s Markets

Asian markets were mostly higher overnight though China’s Shanghai Composite fell 16 points (prior to the rate decision) to 2293…European stock markets have extended gains this morning after the Spanish government sold more debt than it had targeted in a keenly watched auction, while stock index futures in New York suggest a positive open for Wall Street…

The Bullish Big Picture

This morning, we’re taking a broad look at the improving technical picture for Gold, Silver, the CDNX, the Canadian dollar and the euro…what this tells us is that the world is not about to come to an end anytime soon – in fact, at the very least, a strong rally in the markets appears much more likely as summer approaches – precisely at a time when most brokers are hiding under their desks and many investors are or have been too scared to pick up bargains because of mainstream media fear-mongering…

Gold

Gold has broken above its downtrend line and could really pick up steam over the summer like it did the last couple of years, especially if the Fed gets more aggressive on the easing side which seems more likely than ever now…the positioning of the Slow Stochastics in John’s chart below (among other indicators0 confirms the bullish trend…

Silver

Silver is really gathering momentum after becoming quite oversold in mid-May on the 6-month daily chart below…what we’re likely to see now is Silver outperforming Gold like it did during the first quarter of the year…

Important note…the COT structure for both Gold and Silver at the moment is VERY bullish – commercial traders have sharply cut back their short positions to levels not seen in quite some time…this kind of a set-up almost always precedes a major upside move in these markets…

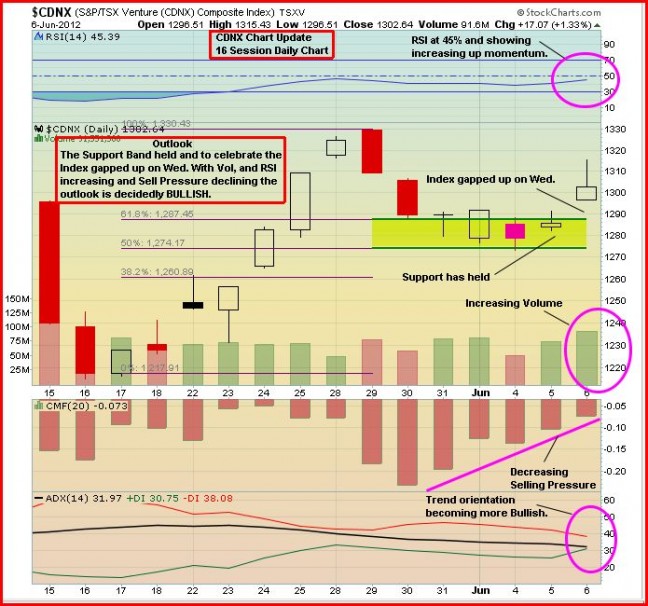

TSX Venture Exchange

Important support has held for the CDNX which closed above the 1300 level yesterday after a 17-point gain on increased volume…a reversal to the upside in the 20-day moving average (SMA) by next week is appearing more certain now which will add fresh fuel to the fire…in short, the CDNX is showing signs it’s about to gain some traction…Gold and Silver should lend some support…

Canadian Dollar

May was a horrible month for the Canadian Dollar but the technical outlook is improving…this is good news as the Canadian stock markets often move in tandem with the Dollar…watch for a possible summer breakout above the blue line resistance…

Euro

The battered euro seems to have found support, and being on the short side of this trade right now might not be such a smart idea…short-covering alone in the near future could give the euro a significant lift…this is positive for Gold and negative for the U.S. Dollar…

20 Comments

…and RBW continues the inverse climb…

Time to drop this dog and start recommend some real companies like EDR, AUN…?

That’s funny, and a good sign that somebody would say that. GQC was supposedly a dog at a nickel. With RBW, you have a company that will be drilling into known high-grade massive galena. I like the odds.

RBW

Maybe i get bothered by their choice of words at times, but i still believe in BMR/RBW,

enough so, that i managed to get just 4500 this a.m. at 0.175. I now have a substantial

position since, unloading my first position to ??? my memory is failing me, was it you

Jon ? R !

I’m in RBW. Like Jon says, I like the odds. Time will tell!

Any thoughts on why gold just reversed to the downside so sharply

No worries, Heath, the action in Gold is very bullish and a testing of the $1,600 area is to be expected. I think there was a knee-jerk reaction to Bernanke…as we stated this morning, he’ll keep his cards close to his chest in order for an announcement later this month to have the maximum effect. There’s a lot to weigh over the next couple of weeks and different options for the Fed, but come the 20th of June we’ll see a game-changer….

Bernake spoke – No QE3 yet

Any rumours about gold Viking permits Jon? I heard anyday but maybe you know more specifics….Bert, the last 5-9 trading days have been great for loading up under 18.5 on RBW. As Jon says, one honey hole and this thing will take off.

A “honey hole” – that’s a great phrase and sums it up well…..I wish I was the fly on the wall at the cranbrook mines office…..that’s who will be issuing the permits…….I haven’t heard anything other than the fact Johnston is apparently heading up to the Kootenays tomorrow……….

DB – one honey hole and this thing will take off.

Bert – As mentioned earlier, i may be too particular about words being used, but since

you mentioned HONEY hole, it immediately reminded of the truck cruising our area, with

the name”HONEY WAGON” across the side. Guess what they do,— give up ?— they

clean out septic tanks & you know what septic tanks contain ? Enough said ! R !

Bert, my friend, I just had my breakfast, that wasn’t nice! I’ll definitely take the honey hole over the honey wagon…

Bert I know WAY too much about septic tanks! I live with four women and the last time our “honey wagon” came to empty it, he pulled out a soccer ball sized hair ball on his “churner”…sorry Jon.

Jon, no offence but it seems that you always see bullish signs in gold, tsx-v, rbw etc etc, not matter what.

John has been remarkably accurate on Gold calls and Silver as well – bullish AND bearish I might add…..including last year’s $1,900 high and the recent $1,800 resistance….we are in an overall bull market – that’s the continuing long-term trend in our view – but within that we’ve had significant pullbacks, and I believe we’ve called those quite accurately….right now, we have a new trend to the upside despite the weakness we’re seeing this morning…….with RBW, yes, makes total geological sense so that’s been a consistent call…….the movement of a few pennies, or the range up to 30 cents, will look like child’s play if they hit some of these targets, and the International has already been described as a deposit in the first technical report that came out in 2007 by Snell…….

I have posted before about this stock. Has anyone taken a look at it? (SVL) Silvercrest mines. It is a Canadian company but the mine is in mexico. The company is in the early stages of production and is poised for future growth. I am long on it and since BMR is pushing a bull market in silver, you should all take a look at it. With a good earnings report and good news on one of their future development properties, I will be holding this for the long haul. Check it out: silvercrestmines.com/

I’m beginning to think the markets’ will take a long while to rebound, too much uncertainty,

not only in one part of the world, but all over. The world has changed, we have too many

media outlets, who thrive on bad news & often spin something half decent to make it look bad.

We may see a scattered stock move, but who will be the lucky ones’, to hold one of the

scattered ones’. You take RBW for example, although i bought a few today, consider how long we

have been waiting for it to go to 0.70, now 0.175…. I’m not really judging the market by RBW,

because they have not drilled yet, but take two of my most precious stocks, CEV, advanced enough

to have a PEA completed, now 1/2 price. Then there’s SGC, advanced enough to start a mine,

1/2 price…..The bad news today, Spain has been downgraded, down 3 notches , China has reduced

interest rates, which leaves the experts at their best, claiming things are slowing in China,

then there’s the most despicable thing i have seen for awhile, members of the Greek parliament

fighting, & to make things worst, it was a male, throwing & landing several punches to a

female’s face, shame !!!I could go on & on, but that will give one an idea how down i feel

today. Good night ! zzzzzzzzzzzzzzzzzzzzz !

Correction

The fighting in Greece was during a talk show & not in Parliament—————— Sorry about that.

Calibre minimg corp – v.cxb.

rumour has it news out soon on drill hole close to the one that shot the stock to 60c a while back.

Grandich Client Sunridge Gold

Despite the absolute worse junior resource market I ever had the “displeasure” to be in, Sunridge managed to secure a $9.25 million private placement at $0.37 per unit – a 10% premium to market.. This investment with the Shanghai Richstone Investment Group out of Beijing demonstrates a strong vote of confidence in the company and the excellent economics of the Asmara Project as announced in their PF study on May 2.

This shows that large, sophisticated Chinese companies are still looking for great projects that are undervalued in this current market. The Sunridge team has accomplished what juniors are supposed to do – explore, discover, increase size of resources, complete economic studies and develop to production. This success is being recognized by groups like Shanghai Richstone and if there’s justice in the resource world, be by the market again one day.

Sunridge can now focus on completing the Feasibility Study on the Asmara Project, which showed very strong economics in a Prefeasibility with a 10% discounted Net Present value of over $555 million.

Shanghai Richstone appears to fit for a financial strategic alliance for Sunridge as they should be able to assist Sunridge with future financing the capital cost of building the mine and greatly increasing their exposure to the aggressive mining markets and investors in China. Shanghai Richstone is a private energy and mining company based in Beijing, with oil and mining production in China as well as interests in oil recovery technology, metal trading, and strong ties to an influential Chinese investor base.

On a side note, I continue to believe the Chinese are going to expand their interests in Eritrea, including possibly taking a run at Nevsun Resources.

RBW… I like this stock and this is good time to load this one. SFF … as I said last week, this one will go up… not crazy as GQC but it will be a 50% profit if you entered at the time I mentioned…. More to go for SFF… Believe it or not.