Gold is attempting to claw its way back after falling as low as $1,565 overnight…as of 6:00 am Pacific, the yellow metal is down $12 an ounce at $1,576…Silver is 38 cents lower at $28.21…Copper is off 12 cents to $3.29 on fears of poor economic data out of China due tomorrow…Copper is about to post its 6th straight weekly decline, its longest losing streak in two years…Crude Oil has lost $2.28 a barrel to $82.54 while the U.S. Dollar Index is up more than half a point at 82.83…

Today’s Markets

Asian markets were down significantly overnight with the Nikkei falling 2%, though it managed – just barely – to snap its longest weekly losing streak in 20 years…China’s Shanghai Composite lost 12 points to 2281…industrial production, retail sales and inflation data are all coming out tomorrow from China and the traders believe yesterday’s rate cut in China – the first since the 2008/2009 financial crisis – was aimed at pre-empting weak numbers…European shares are lower today while U.S. stock index futures are pointing toward a modestly negative open on Wall Street…

News reports say Spain is expected to request European aid for its ailing banks tomorrow to forestall worsening market turmoil…this would make Spain the fourth and largest country to seek assistance since the euro zone’s debt crisis began…

TSX Gold Index – Chart Of The Day

There are several reasons we’re not concerned by Gold’s drop since yesterday, not the least of which is how the TSX Gold Index has behaved over the last several weeks…the Index has shown strength on days when Gold has not, and appears to be forming a bullish inverted head and shoulders pattern…a mid-May bottom is very obvious on this 6-month daily chart from John, and notice how buying pressure as measured by the CMF is the strongest it has been all year…there are two areas of major support – 310 and 300, so the downside in the Gold Index from current levels is very limited in our view which fits the narrative of a bullish new phase in Gold itself…

Venture Exchange

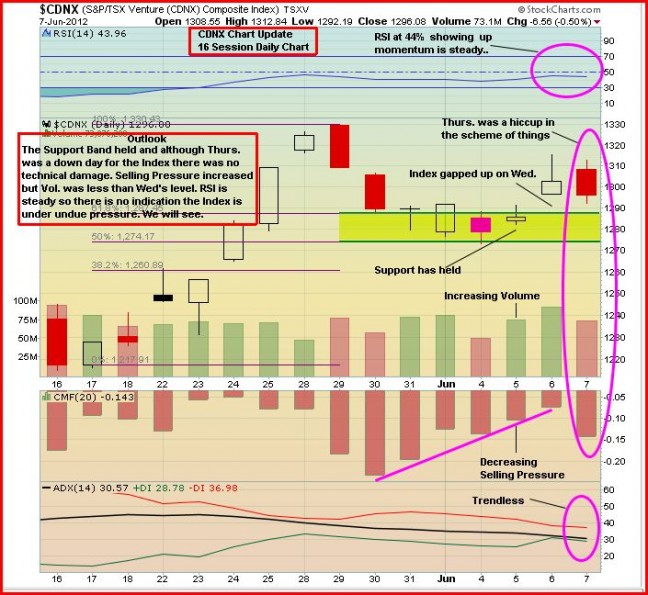

The Venture Exchange held up very well despite Gold’s drop yesterday, losing just 7 points to 1296…how the Venture behaves over the next week or so will be very interesting to watch…the Index is up 7% since its mid-May low of 1215 while the TSX Gold Index has climbed 20% during that time…an important support zone has been holding for the Venture as John outlines in this 16-session daily chart…

GoldQuest Mining (GQC, TSX-V)

GoldQuest closed at 70 cents yesterday after hitting a multi-year high of 83 cents Wednesday…a technically overbought condition is being cleansed, and that’s always a positive development…we expect to post the second part of our interview with Chairman Bill Fisher on Monday…

Gold Standard Ventures (GV, TSX-V)

Gold Standard Ventures (GV, TSX-V), which we put on our “Watch List” in February, is expected to begin trading on the NYSE next Tuesday under the symbol “GSV“…it will retain its primary listing on the Venture Exchange…

Gold Standard has made a significant discovery in Nevada and could enjoy a stellar second half of the year as more results come in and the company attracts wider attention…the chart for GV is terrific, and a move through resistance around the $3 level would be extremely bullish…

SilverCrest Mines (SVL, TSX-V)

SilverCrest (SVL, TSX-V) is making money and its chart shows steady progression since late 2008 when the stock bottomed at 20 cents…SVL closed at $2.02 yesterday which puts it in between its rising 200 and 300-day moving averages (SMA)…we’re expecting a strong Silver market during the last half of the year, so SVL is definitely worth watching closely…

Note: John, Jon and Terry do not hold positions in GV or SVL.

26 Comments

To put emphasis on how bad things are out there, i have picked a few words from just

two paragraphs of this morning’s musings & by the way, after reading two paragraphs,

i stopped reading.

Claw it’s way back

Is down

Is lower

Is off

Losing streak

Has lost

Just barely

Longest losing

Negative open

I was told sometime ago that is was being too negative, but i am only posting,

what i & others see out there. When and if things turn around, i may be accused

of being too positive. One good thing is though, you can please SOME of the people

SOME the time. Have a good day. R !

Bert, you seem to be so focused on the day-to-day, minute-by-minute trading of the markets….you’ve got the day trader syndrome….

Jon

Come on my Buddy, this has been going on for months. I have the ”gloom” syndrome & i didn’t think

it was catching. It’s time to call a spade a spade. I am sure you folks, like me, want to see the

market turn around, but it ain’t going to happen for sometime yet, so long term has to be one’s

mind set. R !

Bert, moves off a bottom are never straight up…….this morning is another great example of the interesting activity in the TSX Gold Index over the last several weeks….Gold is a little weak again this morning….the Index dropped a few points and is now up slightly on the day….this pattern of gold stocks outperforming the metal has been consistent over the last few weeks……even the Venture has been outperforming gold which is what you want to see…..open your eyes my friend to this significant pattern……is it any surprise then that the commercial traders have scaled back their short positions in gold and silver to levels not seen for over a year??? we could be looking at monster moves in gold and silver….

BMR

I won’t respond, except to say, you have your thoughts & i have mine & i respect yours. R !

I certainly respect your views, too, but this is so obvious, Bert……..are u saying we should all go against the commercial traders??? I’m just encouraging you to look at the big picture – it’s as obvious as the day is long….the gold stocks are saying unquestionably that gold’s next major move is up……..and perhaps up A LOT……commercials are saying the same thing…..

@bert. Yes you are entitled to your opinion for sure, but your negative rants are horribly repetitive. If that is how you feel, then sell and move on.

Heath, we encourage everyone to express their news here and Bert is a very valued poster, as you are, so while we may disagree sometimes with what each other may say, let’s always stay respectful and I say that in a general way to everyone….

I don’t know Bert but I do respect his opinions and enjoy his postings, he is just frustrated like most of us are with the action in the markets and our investments and he is expressing his views and frustration, personally I think he has been right alot of the times, however right now I think that gold and silver are on the verge of a major break to the upside. The fundamentals are there and more importantly the negative views of investors towards gold and silver and the stocks is the most negative I have seen since 2008, last summer when BMR called the bear market on the venture everyone on here was not happy and did not agree and they were right, now I see the opposite, they are positive and people here are all over them for being positive. It is not just BMR either, every newsletter writer I follow is saying now is the time to be buying the good gold and silver stocks, I hope they are right and we see what we all here are hoping for, our investments make us some money. Please don’t stop posting Bert, most here enjoy your posts and your internet friendship.

Heath

I am generally a laid back person, but i just can’t tolerate your lack of respect

for members of this board. I have taken notice of your tendency to take no prisoners.

If you feel proud to behave the way you do to others, you can have this board to yourself

& stick it… If you do intend to reply, it will not be read, i am so tired of people like

you. May the devil take a liking.

Sorry BMR ,but i just can’t cope with guys like that. I have tried once before to refrain

from posting, now i have to give it another try. If i may, i will suggest that his behavior

is typical of some on Stockhouse, who under the guise of an alias, show no feelings for others,

and if one could meet them face to face, they would shiver with fear.

To the good folks on this board, Good Luck.

Bert – I just ignore those types of posts and posters, they’re always going to happen. Heath Robinson has directed his ignorance at me previously. Ignoring is the best way because they receive no reinforcement and if you stick with that they will eventually go away! 🙂

‘The fundamentals are there and more importantly the negative views of investors towards gold and silver and the stocks is the most negative I have seen since 2008, last summer when BMR called the bear market on the venture everyone on here was not happy and did not agree and they were right, now I see the opposite, they are positive and people here are all over them for being positive.’

Greg, I enjoy reading BMR, but lets not rewrite history. BMR stayed bullish on the venture all last summer, while stocks lost 50,60,70%…..then turned bearish almost to the day when the Venture bounced and a decent rally started.

I agree tho, now is not the time to be bearish. Many things point in my opinion to a good second half of the year on these beaten down stocks. US election so they will print more money soon, Europe will print more money, probably Japan, UK and China will join them…there is no other alternative unfortunately! It may be a bumpy road to recovery tho, as there are so many people sick of holding loss making shares they will sell on the way up, and hope they never see another junior again..

If you dont want to buy stocks at the prices being offered now, then people must believe that a majority will go out of business in the next year or two. I may be wrong but I dont agree, the greedy will come piling back in when they smell money to be made….when that will be is anyones guess, but to buy some good juniors now and hold until Xmas looks like one of the best bets Ive seen on the market in years.

What I really do want to see tho is takeovers of juniors by cash rich companies, Im amazed that isnt happening now on a much larger scale. When that starts it should give the kick up the arse they need.

On a lighter note

RBW- the bollinger bands are slowly tightening and a pendant is formin. the drill campaign must be getting close which should get this train rolling…

on a more realistic note

most indicators that I follow are pointing/trending downward

annotated chart

http://stockcharts.com/h-sc/ui?s=RBW.V&p=D&yr=1&mn=0&dy=0&id=p37136996334&a=259900223&listNum=34

hope you can see it

I’m not so sure that we’re going to see any money printing by the US for a few more months. The US is moving along well enough that it doesn’t support any need for money printing or Operation Twist 2. In addition, once the FED meeting in June comes up and there is no additional stimulus/program announced then we could see some fruther downside in equities.

On another note, the 30yr bond has touched 2008 lows and formed a double bottom. In the next few months (Aug/Sept) if the 30yr bond rally’s I think that may justify Operation Twist 2, but not at present conditions.

Also, China’s stimulus will not kick in for another few months from the recent cuts in interest rates and infrastructure programs (some expect no changes until Aug), which is another reason why we may not see any bull market until Aug/Sept timeframe.

Obama today was urging for more decisive action by European members to stimulate the euro-zone crisis because its impacting global growth including the US economy. This to me means that the US knows their hands are tied for now on stimulating their economy because of current conditions and would rather have Europe stimulate global growth then result to stimulus from the FED once the market has significantly dropped.

All of this news bodes well for gold come Aug/Sept and it will also be in its cyclical bullish timeframe. I don’t think we will see much upside in gold stocks until Aug/Sept and instead we should see consolidation for the next couple months.

Don’t try to catch the falling knife.

BNR, thanks for the chart on SVL. With a huge inferred containment and phase 2 of drilling currently going on at their Lajoy property hopefully they can release some positive news to confirm their estimates.

BMR **

Graphite – Anyone have an opinion on which is the better play at current share prices, SRK (which must be at or near a bottom) or ASW at .045 (next door to Eagle Graphite. Graphite seems to have lost some of its flavour recently. I wonder how market conditions will affect Eagle Graphite and a potential IPO? Have a good weekend everyone. 🙂

@bert. I call it like I see it. And I’m not hiding behind anything. If you can read you will clearly see my name. I treat those who deserve respect with respect. Thing is you have shown me nothing that would incline me to think that you deserve any!! You come on here everyday posting over and over and never actually say anything of any significance. You just like to hear yourself talk. The creation of the Internet and social media has been a wonderful thing although as with most progress its not without it’s negative effects. It has become a breeding ground for people with your ” condition” to hide behind a keyboard and be heard where you would have otherwise just sat in your chair drooling all over yourself making your noises

@Heath, having a bad day???

U R a jerk-o**

@mar. Thank you. Your intelligent mature comments are always appreciated

Hey guys, had a question about the graphite sector. The great run the most graphite stocks had between jan-apr was it just a big hype? Will it ever recover? Appreciate any comments.

Thanks in advance

Bgds

The better graphite plays should do well IMHO going fwd……I think the enthusiasm over graphite (and graphene) is justified, given its growing uses and how it could revolutionize the world as we know it. So this is not a story that going’s to end anytime soon. Investors, however, will likely be more selective in the graphite plays they look at, as opposed to the more general “grab them all” mentality we saw in the first quarter.

Jon – Thanks for your thoughts on graphite. I know that SRK was added to a watch list recently but I’m not sure if ASW was too? Is there an http link to see the watch lists and play lists?

ASW was added to our watch list, yes. The reason for that is because of the company’s Blu Starr (flake graphite) Property in the West Kootenays. The CEO’s, prospectors and geologists I have spoken to recently, Andrew, say that if Eagle Graphite’s deposit is the largest in the world (yes, THE LARGEST IN THE WORLD), then ASW could have the second largest at Blu Starr. Blu Starr has yet to be drilled, though, so that’s premature – but it’s quite a statement nonetheless given the fact it hasn’t been drilled yet. I suspect the whole graphite situation up there in the West Kootenays is going to blow wide open over the summer as analysts, brokers, newsletter writers and investors descend on the area. Right now, few people know about it. This is obviously bullish for ASW and a few others including of course RBW.

Thanks Jon – I have a position in ASW and may add to it. The northern part of their claim is just a stone’s throw from Eagle Graphite’s mill. At a year low the SP is attractive. I’m loaded with RBW 🙂