Gold has traded in a range between $1,596 and $1,604 so far today…as of 5:55 am Pacific, the yellow metal is down $1 an ounce at $1,594…Silver is up 17 cents at $28.70…Copper has gained 6 cents a pound to $3.36…Crude Oil is 95 cents higher at $85.05 while the U.S. Dollar Index is up more than one-third of a point to 82.20…

Today’s Markets

It’s a positive start to the trading week, thanks to the Spain bank bailout over the weekend (many questions remain unanswered on this, however) and some encouraging data out of China on the heels of that country’s first interest rate cut since the 2008/2009 financial crisis…markets were up sharply overnight with China’s Shanghai Index climbing 24 points to 2306…some European indexes hit four-week highs this morning while stock index futures in New York are pointing toward a modestly higher opening on Wall Street…futures are off their highs, however…

China Is Doing Just Fine

There were encouraging signs from economic data released by China over the weekend, suggesting the Chinese are on track for slower but solid growth this year…fixed asset investment, the second-biggest driver of China’s economic growth in the first quarter after consumption, climbed 20.1% in the January to May period from a year ago, just above forecasts for a 20% rise…imports rose more than expected in May, gaining 12.7% from a year earlier, exceeding expectations of a 5% increase in a Reuters poll, and above the 0.3% annual rise in April (this included a big jump in commodities imports)…exports rose 15.3% compared to a forecast of a 6.8% increase…retail sales were up 13.8% in May, slightly under expectations…importantly, inflation receded to 3% in May – the lowest in two years – giving authorities a wide berth to use monetary and fiscal tools to prop up the economy…China has recently fast-tracked infrastructure spending such as investment in railways and energy projects which should help the economy over the second half of the year…

Euro Bond Discussions Intensify

In another positive development in the euro zone crisis over the weekend, German news magazine Der Spiegel reported Saturday that leaders of European institutions are working on a comprehensive plan to rescue the euro that would include the issuance of joint euro bonds in a way that could potentially meet the approval of Germany…the news magazine said European Union Commission President Jose Manuel Barroso, European Council President Herman Van Rompuy, Eurogroup head Jean-Claude Juncker and European Central Bank President Mario Draghi are working on plans for a “genuine fiscal union” in which individual member states would no longer be able to independently take on new borrowing…governments would only be able to decide how to spend money that is covered through their revenues, Der Spiegel reported…any country that requires more money than it takes in would have to report that need to the group of euro finance ministers…the magazine quoted four high-ranking EU planners saying this group of finance ministers would then decide which financial desires at which levels were justified and would then issue joint euro bonds to finance these new borrowing needs…

Copper Chart

The Copper price has declined for six straight weeks but a chart from John this morning shows there is hope for a better second half of 2012…Copper is now resting at its monthly SMA(50) which has provided strong support since 2003 with the exception of the 2008 Crash…the monthly SMA(50) was breached slightly in 2010 and 2011 but recovered the following month…what this chart tells us is that the downside in Copper is limited at current levels and the long-term bull market for the metal remains intact…

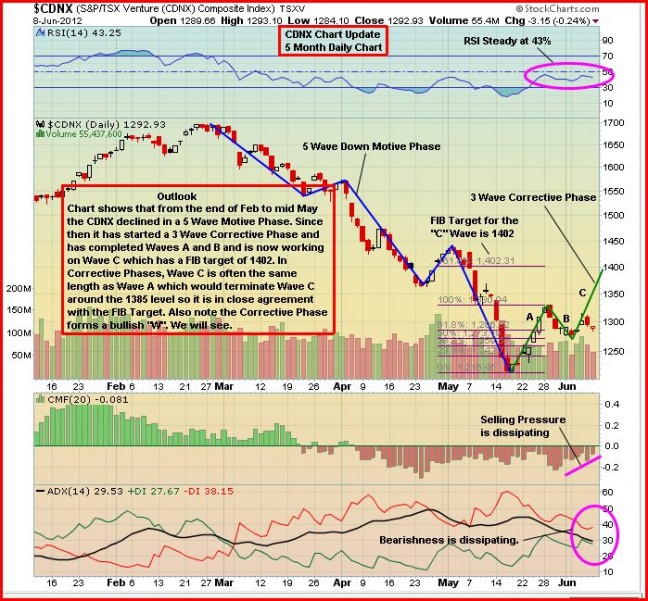

Venture Exchange

With all the doom and gloom circulating over the last several weeks, the Venture Exchange has held up quite well and appears to be in a 3-wave “Corrective Phase” as shown in the chart below…the target for the current “C” wave is about 1400, so we’ll see if this materializes and then we’ll try to figure out what’s next…one bullish possibility is that this “C” wave could turn out to be the first wave of a 5-wave “Motive Phase” – that’s impossible, however, to predict at this point…what could also emerge from this chart is a bullish inverted head and shoulders pattern, similar to what is forming in the TSX Gold Index…a reversal to the upside in the Venture’s 20-day SMA appears to be in the works for this week and that certainly would be a bullish development…

GoldQuest Mining (GQC, TSX-V)

We hope to post the second part of our interview with GoldQuest Chairman Bill Fisher later today…GoldQuest has resumed drilling at its Las Tres Palmas Project in the Dominican Republic with the company testing the lateral extent of the recent Romero discovery with 25-metre step-out holes…what GoldQuest is hoping to confirm is that Romero is indeed a flat-lying deposit (as other deposits are in the region) which would have significant implications as far as tonnage is concerned…the GoldQuest chart, overall, is looking very bullish but some continued consolidation should certainly be expected to help unwind an overbought technical condition and lay the groundwork for a potential move higher…

Rainbow Resources (RBW, TSX-V)

In the surest sign yet that “something is up” and drilling is right around the corner, BMR is part of a group that has been invited to a Rainbow site visit June 23 and 24…it will begin at the International Property and then swing south to Gold Viking/Ottawa, the Referendum, and then the graphite region…the balance of the group is made up apparently of investors and newsletter writers/analysts, so the word will soon be spreading on the Rainbow opportunity…we’ve already seen Gold Viking/Ottawa, so we’re particularly looking forward to the full day that is planned at the International Property plus an opportunity to get a better understanding of the Referendum Property and the flake graphite situation…

19 Comments

It was quite a coup getting the GQC interview. As early followers BMR deserved it. Can’t help feeling that P II will be anticlimactic given that so much time has passed. Wondering if GQC requested the delay. Others, that may believe they are vastly more important, than BMR, could not have been happy that BMR scooped them. Delaying the second part until it is no longer of such great interest might calm them down.

Yes, this from someone that hates conspiracy theories.

Let me guess, bullish signs?

I am thinking of selling my remaining losing positions in VGN and GBB and buying RBW – anyone any thoughts on this strategy? Appreciated

Jon, I highly don’t think RBW will double or triple on the news of drilling and speculation, at least not anytime soon. But that is just my opinion. Themarket will want to see results and that will not be until deep into the fall.

I’ll beg to differ on that one…..also, there’s no reason why results would be “deep into the fall” when drilling is commencing in early summer….keep in mind these are not blind holes….they are drilling directly into known high grade vein systems including massive galena at the International…..they could also report on visuals in a situation like that…..

we shall see, but I don’t think the big money – deep pockets – will be buyers until the results are known.

Cxb – strong buys today. news coming out soon. lots of cash with B2Gold funding exploration at Primavera. expecting a nice pop on news…

for your education:

Galena deposits often contain significant amounts of silver as included silver sulfide mineral phases or as limited solid solution within the galena structure. These argentiferous galenas have long been the most important ore of silver in mining. In addition zinc, cadmium, antimony, arsenic and bismuth also occur in variable amounts in lead ores

Todays smile I believe I am probably the oldest member on this board many of you are young enough to be my children or grand children.Some of my friends are so old that when they were born the dead sea was only sick

So what’s the recycled negative news headline that turned the markets red today after a positive open???

Managed to pick up some RBW at .16 🙂

Just out of interest: GR has 2500 ‘likes’ on facebook and RBW has 13!

I also added some 0.16 but who cares,i have averaged down im down on this looks like its dog ,Bmr raises good points but all in all looks like this is dead money,im thinkin maybe the rcent weakness has maybe to do with warrants,im giving this a few more months till results.What a crappy week this has been.

Andrew- Did u take alook at CXB? Could see a new yr high if the news is right….cannacord and raymond james on the buy all day. Im in at 16.5avg hoping for a big pop on news. A reliable source has told me news soon and after todays trading, I think sooner than later…

RBW…. I am collecting….. this price will not last long and there are not too many there. I am holding a portfolio of RBW.

db – thanks I’ll check into CXB tomorrow before the open. I noticed you mentioned it earlier too. 🙂

looked at technicals on RBW – MACD has crossed down, bollinger bands have opened up, RSI dipping down. The 20 and 50 day sma are moving down approaching the 200 day. No, I am not a negative person in case anyone thinks this of me. Until we find out how Greece pans out, there is no telling where the markets will go. There could be some fire sales on stocks later in the month.

db – thats a good looking chart on CXB. The only downside I noticed is their outstanding shares. But they did run nice a while back with all those shares out. It’s tempting.

Looking at the chart on tsx.v, if the next few days are red, this correction isn’t over.