Gold continues to show strength this morning…as of 5:30 am Pacific, the yellow metal is up $4 an ounce at $1,622…Silver is 4 cents higher at $28.90…Copper is flat at $3.34…Crude Oil is flat at $82.63 (OPEC meets later today) while the U.S. Dollar Index is up slightly at 82.18…

Gold has been aided in recent sessions by a rebound in the euro which is now up against a resistance band…it would be very bullish for Gold if the euro could overcome this resistance between 126.20 and 126.80 (note the blue line in John’s chart below) in the coming days…as of 5:30 am Pacific, the euro is relatively unchanged at 1.2569…

The U.S. Dollar Index, meanwhile, continues to unwind its recent overbought condition…more near-term weakness is probably likely based on this 6-month chart…

Today’s Markets

Stock index futures in New York are pointing toward a slightly positive open on Wall Street…Asian markets were under pressure overnight, with China’s Shanghai Composite Index dropping 23 points to 2296, while European shares are also modestly lower this morning…

As The Euro Zone Turns

Spanish 10-year government bond yields hit 7% today, marking the first time in euro-era history the yield has hit the level seen by markets as too expensive for a sovereign to borrow over the long-term…the rise follows a three-notch downgrade to Spain’s credit rating by Moody’s, which took it to within one notch of “junk” status…Spanish yields have risen sharply this week after euro zone ministers agreed last weekend on a rescue plan of up to 100 billion euros for the country’s banks that has failed to convince investors it solves Spain’s financial problems…

Meanwhile, Italy’s three-year borrowing costs spiked to 5.30% this morning…

German Chancellor Angela Merkel is standing firm against calls for Germany to ride to the single currency’s rescue…in a speech to parliament today, Merkel repeated her refusal to back calls for common euro zone bonds and a Europe-wide deposit guarantee scheme for banks…“Germany is strong, Germany is the economic engine and Germany is the anchor of stability in Europe…I say that Germany is putting this strength and this power to use for the wellbeing of people, not just in Germany but also to help European unity and the global economy,” Merkel said…”But we also know Germany’s strength is not infinite”…

The German chancellor warned that there were no “miracle solutions” to the euro zone crisis…Standard & Poor’s says the euro zone has entered “a crucial phase” in which the outcome of Greece’s elections on Sunday and upcoming policymaker meetings “will play a significant role in defining its future direction”…

Spain’s foreign minister took a shot at Germany in comments during a radio interview, according to Bloomberg this morning…“It’s true that some countries including Spain lived beyond our means but that’s because banks from the core decided to make lots of money investing here,” Spanish Foreign Minister Jose Manuel Garcia-Margallo told Onda Cero radio…if Germany “throws one country to the wolves that will affect everyone, so they should take a more long-term view”…

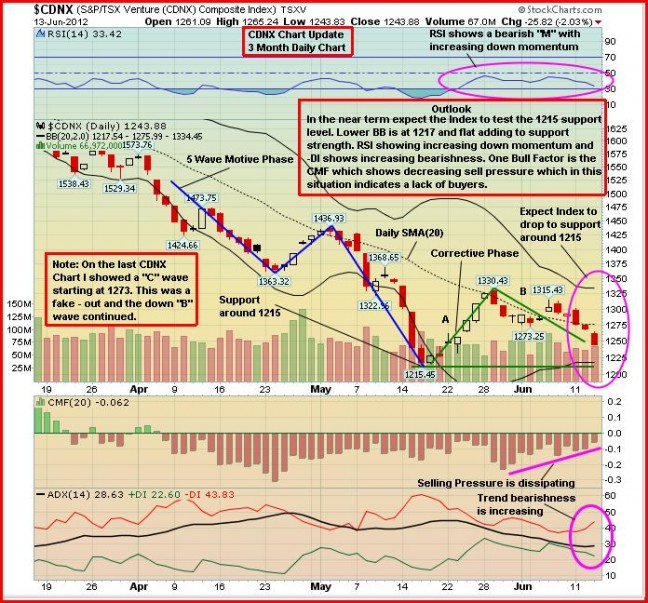

Venture Exchange

The Venture Exchange has had a rough week so far, under-performing Gold and the broader markets…on a positive note, however, CDNX selling pressure as indicated by the Chaikin Money Flow has actually been declining in recent sessions which illustrates the problem at the moment is more a lack of buyers as opposed to aggressive sellers…a double bottom could be in the works which may represent a true turning point – patience is the key at the moment…the Index fell 26 points yesterday to 1244, 29 points above the May 16 low…the ATAC Resources (ATC, TSX-V) chart we showed yesterday is evidence that an important bottom in this market occurred May 16…the next several trading sessions will certainly be interesting…

Alexco Resources (AXR, TSX)

If you’re bullish on Silver, as we are, then Alexco Resources is worthy to watch closely…it’s one of the Silver stocks on our “list”…its rising 1,000-day moving average (SMA) – just above $4.50 – is providing strong support while the stock is well below its rising 500-day SMA which, at the very least, provides a potential trading opportunity…it’s “decision time” in the near future for AXR (will it bust through its downtrend line?) as John points out in this 4-month daily chart below…AXR closed yesterday at $5.20 after hitting a two-year low of $4.27 May 16…

Note: John, Jon and Terry do not hold a share position in AXR.

12 Comments

Greenlight’s Partner Now Fully Listed on TSX-V Based On the Porcupine Rare Earth and Base Metal Property in New Brunswick

gbb.v is giving drill hole results within the next week or so. The stock is behaving nicely for a great gap up. Low volume, raising share price and rumor has..lots of gold in the ground. Frank Basa is back from Sweden and his meeting with investors. Start your engines investors!!!

BERT- where are you? need to know what you think about DVV and there properties, plus the addition of Wengzynowski…

Some small buy lots today for GBB but I am still not convinced to buy this one back. The news may bring a jump of 20% but it may quickly drifting back. Buy at a good price but sell quick… this is my way to handle this stock. RBW is still in the 16 cents range with low volume. My continue buy order is lodged at 15 cents… hopefully, I can scoop some before it turns its way up.

@theodore, dude no one cares about how u handle gbb,,,other day you were yapping about your six cent bid. how is that working out for you?? again everyone is on to you and knows what your motives are with gbb. selling your soul for your 8$hr boiler room bashing job

For thoses interested, there is a new RBW Hub on Agoracom website, Feel free to contribute.

Heath… perhaps, I am bothering you.. I apologize for that. I do not really want to touch GBB now…. my six cents bid has lifted and I only focus on RBW. I am buying and selling GQC daily… get a few hundreds a day…. I got couple of thousands this week…. not bad! I am buying the junior stocks for quick money only…

@THEODORE, yes u are bothering me but not for reasons that you think my friend! in your own words you say you are not touching gbb now yet you have been posting on gbb on here daily for months. yes, u bother me because i am sickened that good people in society are being taken over by greedy little chicken hawks like you. i would rather live in a box on the street than make my money they way your type do. and as for your blowing your own horn about how much money you are making, you are not kidding anyone my friend. why dont you post the transactions where you made all this money. well you cant can you because it only happened in your head.

Hey Heath chill out bud. Your gonna blow a gasket there. I don’t think it’s fair the way you try and run people off. What are you the content sheriff? No one can post something in a polite matter unless Heath thinks it’s appropriate. When you say “no one cares” are you sure you speak for all of us. I like reading Theo’s calls and seeing if they pan out. Even made a little dough off them in the past.

mclatch – good rebuttal to heath robinson’s posts, which have never been the remotest bit positive towards anyone, its best to avoid people with that kind of attitude unless you can help them with cognitive behavioural therapy. Looks like a risk on day is shaping up with major european banks and governments reportedly ready with contingency plans to counter any volatility next week. 🙂

mclatch to the rescue as last time. heath said his peace and let him be. i do find theo so opportunistic at best, he s been wrong as many times as he s been right, so i give him 50%. anyways, good luck with RBW guys, i hope you make it!

True, true Alec. Theo has most definitely not been right all the time, but neither am I. Nor is BMR. But I still come back. I think we are all opportunistic. It’s just the whole bully angle that rattles me a bit. Maybe bully is to strong a term. Anyway when someone voices out stuff like “no one cares”, “you sicken me” or “u bother me” type stuff at a person over a post they made about equities, I just don’t think that is fair or rational. I just want to voice up no one speaks for all of us and I enjoy and look forward to these posts. I don’t agree with a lot of what BMR says or like some of the posters but I still read it and think about it. No need to get all worked up about it throwing insults out. You see something you don’t like then debate it or leave it. Nice thing about this site is it’s civility. Someone was rude to Bert the other day saying nasty things about Bert’s posts, I can’t remember who, and now he doesn’t post here anymore. Now sensitive fella like he is took it personally, maybe Theo does too and he don’t post anymore. After that who? Anyways yes good luck with RBW may she go to the moon! Just remember to get off when you get there.