Precious metals are waking up this morning…as of 6:10 am Pacific, Gold has jumped $21 an ounce at $1,602…Silver is 34 cents higher at $27.30…Copper is up 4 pennies at $3.39…Crude Oil has added 53 cents to $89.03 while the U.S. Dollar Index has slipped one-third of a point to 83.63…a European Central Bank council member this morning suggested the possibility that Europe’s rescue fund (European Stabilization Mechanism) could get a banking license, allowing it to tap cheap ECB funding…this has given a boost to the euro and precious metals…

Britain’s Economy Continues To Slide

The UK economy contracted much more sharply than expected in the second quarter of the year, prolonging and deepening the country’s double-dip recession…output fell 0.7 per cent between the first and second quarter, more than the 0.2% fall economists had expected…the UK economy has contracted for three quarters in a row and is now smaller than when the coalition government took office in 2010, providing fuel to critics of its austerity measures…

O’Neill Sounds Off On Euro Zone

Jim O’Neill, Chairman of Goldman Sachs Asset Management who famously coined the term BRIC – Brazil, Russia, India and China – to describe the stars of the emerging markets in the 1990’s – told CNBC this morning that euro zone policymakers need to take a “United States of Europe” attitude to solving the debt crisis…“All 17 leaders could get together and commit to a euro bond some time in the future and hey presto, that would be the beginnings of a major resolution,” he stated…he admitted this was unlikely and policymakers would opt for their usual route of “muddling through”, saying their actions thus far were “not good enough”…he added that the markets were now priced for “almost permanent disaster”…

Today’s Markets

Futures in New York as of 6:10 am Pacific are pointing toward a strong open on Wall Street this morning after three consecutive triple-digit losses by the Dow…while Apple had a a rare earnings miss yesterday, Caterpillar – an industrial bellwether – reported quarterly earnings this morning that solidly outpaced analysts’ expectations…Asian markets were down slightly overnight while European shares are higher this morning…

Venture Exchange

The CDNX has fallen 30 points so far this week, but remains within a support band as shown by John’s chart below…while a select number of individual stocks can still perform well in this environment, the start of a broad-based uptrend will only begin once the Venture is able to climb above resistance at its daily EMA-20, currently at 1197…the Venture closed at 1166 yesterday, 12 points above its late June low…

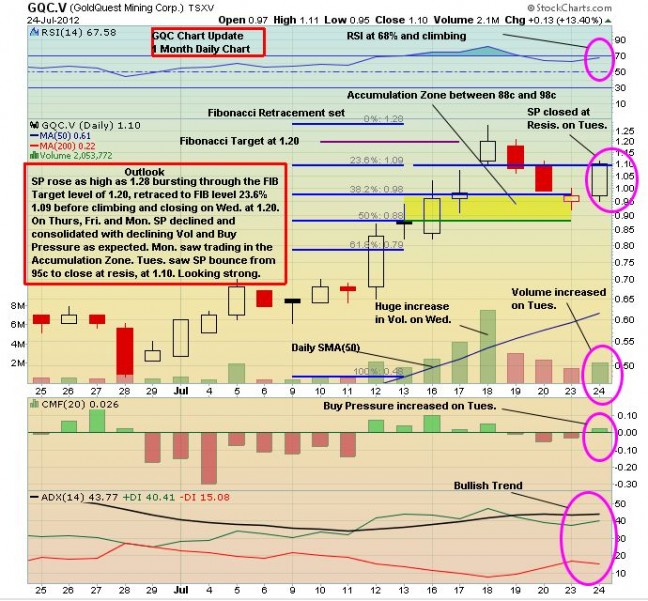

“Discovery plays” is where the safety, excitement and upside potential is at the moment in the CDNX…GoldQuest Mining (GQC, TSX-V) is the best example of that, but certainly not the only one…John’s GQC chart was bang-on again yesterday as the stock ended a three-day slide with a gain of 13 cents to $1.10…over 33 million GoldQuest shares have traded over the last 9 sessions (all exchanges) for an average daily volume during that time of 3.3 million shares…

Also in the Dominican Republic, keep a close eye on Unigold Resources (UGD, TSX-V) which jumped a nickel yesterday to 37.5 cents…UGD has been reporting solid results from a property along the same belt as GQC’s Escandalosa to the north…

Canamex Resources (CSQ, TSX-V)

A stellar drill result last week from its Bruner Gold Property in central Nevada sent Canamex Resources (CSQ, TSX-V) flying from a low of 9.5 cents to a high of 44 cents…over 80 million shares have traded on Canadian exchanges over the last 5 trading sessions…the company has 68 million shares outstanding but 29 million warrants are also now in the money between 15 and 25 cents (23 million expire at 15 cents by December 31 of this year) which is likely helping to keep a lid on the stock price at the moment…CSQ closed yesterday at 31.5 cents – it has declined in three out of the past 4 sessions after last Wednesday’s news of an intercept grading 4.08 g/t Au over 118.1 metres…expect more consolidation in the near future as the stock continues to deal with the warrant issue, but CSQ could get more interesting as the summer progresses…below is a chart from John that gives a good picture of the current technicals…the stock appears to be in the early stages of a flag formation which we’ll continue to keep an eye on…

Rainbow Resources (RBW, TSX-V) Chart Update

Discovery plays is where the action is in the market right now, and Rainbow as we’ve been stating is in an excellent position to drill into a near-surface, high-grade discovery in the near future at its International Silver Property in the West Kootenays which has never been previously drilled…in the updated chart below from John, notice how RBW has outperformed the CDNX (thick blue line) this year and in the last five weeks in particular – a very encouraging sign…RBW has broken out above its daily EMA-20 as well as a recent downtrend in advance of the CDNX hopefully doing the same…

Note: Both John and Jon hold share positions in RBW while Jon holds a share position in GQC (Terry does not).

34 Comments

GOOD UPDATE! GOLD/SILVER MOVING UP TODAY!

One of the stocks I mentioned last week is AIX – My info source on this one is 50 – 50, so invest at your own risk. I understand the cores look good and have been rushed to the lab. The news release today did not state that.

My number 2 stock, I am not sure if I can give it at this time due to the info source. I will ponder it over in time.

By the way, AIX, the TA looks good and the chart looks good. The 20 and 50 sma have turned up and there is still room to run. I have nibbled at .09 with some cash.

AIX has half the Mrk Cp of RBW, looks like an ascending triangle on the weekly chart with increasing volume past three weeks, large jump in volume yesterday. Thanks for sharing, dave 🙂

I scooped a little more at .08 – off to work – later

Wonder if RBW already received the permits and are waiting for the drills to be transported and on site before issuing a NR? Thoughts?

Something is negative out there, the Canadian markets are not performing as i

had expected. Hopefully it will turn around this afternoon.

RBW – I don’t think they have the permits, otherwise they would be lying & i

don’t think they would resort to that. R !

Bert, they wouldn’t be lying if they didn’t say anything….which they haven’t for at least a couple of weeks. Never the less, the company should come forward with an update as permits were expected before now.

Hello Dan

They would indeed be lying, because i was told even yesterday, that they didn’t have

the permits. Although i am very disappointed, i would never ever think they would lie.

Have a good day. R !

Dan

My previous post needs a few more words, here again:-

They would indeed be lying, if they did have the permits, after telling me yesterday,

that they didn’t have them. Although i am very disappointed, i would never ever think

they would lie. Have a good day. R !

Thanks Bert. All we can do is wait then I guess.

Ripleys believe it or not

I just got off the phone with RBW, no permits yet… I was asked if i could

make a call to see if i can make any sense out of it all..I flatly said ”NO”,

i will not be working on behalf of RBW, but that i would be selling. My

average cost is 0.19, so anything above that & i may not be responsible…

I usually keep matters of this nature to myself, but remember what i stated

recently, all for one & one for all. R !

Bert

Bert – were you speaking with Pierre or D. Johnston?

Andrew

I posted more than i wanted to, i will not give names.. I can see why you were worried though.

I don’t suppose it has anything to do with the financing, i was asked much earlier if i wished

to participate & that told me they ”MAY” be struggling to raise cash. It’s been a long, long

haul since we were told that permits were imminent. R !

Okay, thanks Bert.

BMR, do you have any comments regarding the delay in receiving permits? Everyone expected them two weeks ago.

Dan – The permits were actually due 4 weeks ago with drilling starting 3 weeks ago. If you’re on the RBW mailing list, something stands out like a sore thumb, at least to me.

Time for a little common sense here. The reason I started loading up on RBW months ago, and continue to add more (even today), is because of the opportunity represented by the International Property which is a gem of a property and I’ve been there myself, so I believe I can speak with some authority on this. It’s just screaming to be drilled. RBW has also added a lot of other layers of value over the last number of months including Jewel Ridge and other assets in the Kootenays, which have given this deal even more blue sky potential. Would we all have liked RBW to have received its permits a month ago or 2 months ago? Absolutely, but keep in mind it took Richfield Ventures 4 months to get permitted for a second drill rig at Blackwater in 2010. If you were an investor in Richfield at that time, and got pissed off because it took the government 4 months to issue a permit, and sold your stock at $1.50 as a result, you would have lost out on a massive profit. So it’s important to keep emotion out of this. The government is the government and they will sign off on something when they’re ready. My other point, and I mentioned this over the weekend, is that this is not an RBW management issue. The permitting process has been steered by MMTS – Bob Morris (as Andrew also recently stated) is highly respected in the industry, and he and his group understand the permitting process and what needs to be done. Morris is a pro. I’ve spoken with him myself and this guy knows what he’s doing. Rest assured, all the “I’s” have been dotted and all the “T’s” have been crossed. They’ve done this before and successfully. End of discussion.

As BMR understands it, the ministry has already accepted both the International and Gold Viking drill plans. The way the process works in B.C., once that occurs, the proposed drill program goes out for a 30-day referral process. That process ended for the International July 7 and from what I’ve heard, there were absolutely no objections to the drilling (there are also no native issues at the International). When I spoke with some Rainbow people just recently, I was told that they were given guidance by the ministry that the International permit would be issued at the earliest by mid-July and at the latest by the end of July. So, literally, it could come later today or by month-end – but that’s the “guidance”. Gold Viking will follow shortly afterward. The driller has been contracted and paid to start drilling. My understanding is that as soon as the International permit is issued, the rig is mobilized and drilling will commence within a week.

Regarding another point that was brought up, as Johnston mentioned in the BMR interview, one of the big advantages with RBW is that it has several Alberta multi-millionaires (including a part-owner of the Calgary Flames) as shareholders. Raising money will never be a problem for RBW, which is one reason we have put this company forward so aggressively with our readers. They could have raised twice as much as they did in February but didn’t want 14 million free trading shares coming into the market over the summer (which would have given shareholders something else to complain about and deal with). Building a company and controlling the share structure is top of mind with these people, and as shareholders that’s what we want to see in a good deal.

With the most brutal sell-off in the markets since the 2008 Crash, the fact RBW has held up so well – Rainbow shareholders should be extremely grateful. This speaks volumes about the potential of this deal. Personally, I know several people who say they plan to aggressively add to their position once the drill program is announced. So, relax everyone, and enjoy the summer sunshine. Rainbow will deliver and everyone will soon be jumping on the bandwagon from near and afar.

BTW, it’s us retail guys who are positioned to win the most from this deal. RBW has kept the brokers away up to this point – interesting, isn’t it? I suspect their strategy is to bring in the brokers after a hit at the International, and at much higher prices. It’s usually the other way around. Brokers get in first, load up cheap, and then retail takes the greater risk at much higher levels. This is one of the most well-thought out deals I’ve ever come across.

just remember, rbw is all about promotion and that is it. This is nothing more than your typical junior company that will line the pockets of the insiders and the retail will be left in the dust.

Jon

I appreciate your post & thank you ! I will though, take exception to the last line quote Rainbow

will deliver and everyone will soon be jumping on the bandwagon from near and afar unquote Only

the LORD himself knows whether or not Rainbow will deliver & he ain’t talking.

That’s my humor for today. R !

Good comment, Bert, thank you, but I’ll pipe up and say this is one He’s led me to….so it’s going to be a barnburner!

The drill rig is indeed the truth machine, and who knows what Mother Nature will bring us (maybe even more than we expect), but if you saw what I saw – the “Wall” along the roadside at the International – you’d be doing cartwheels, even at your age, my friend! The way I see it, RBW can’t help but hit high-grade near-surface on these initial holes. Right into a honey zone. This hole structure SHINES (even more than my nearly bald head on a sunny day).

Good to hear from bmr Thanks for keeping us informed .

You have all read Jon’s post # 19 & i have been thinking, like one would. No

doubt, he is putting his credibility & that of BMR on the line, by speaking out

in such a positive manner about RBW & their projects, which hasn’t as yet seen a

drill. If they hit, i can foresee BMR overtaking Stockhouse as a place to be. If

they don’t, i can foresee Jon, John & Terry serving coffee at Tim Hortans’. I

stated this afternoon that i am a goner, if i can see a few pennies above 0.19,

but that won’t happen until the permits are received & that may be the incentive

i have been looking for. The truth of it all is, that RBW has taken it’s toll &

i am all shook up (Elvis). R !

bmr- you sure are sticking your neck out on a pure spec play in RBW. For the sake your site, you better hit on this one. I would imagine your never worry attitude plus your incredibly inaccurate TA has lost a lot of people money. Unfortunately, we are in a bear market that might get a little bump from some FED action but that is about it for the foreseeable future. I would love to read some morning in your musings a negative outlook instead of always trying to see the light at the end of the tunnel. Don’t get me wrong there will be a light one day but I really can’t see it any time soon. Cash is king and you need to be prepared to jump in and out of the market cause we are one headline away from a nose dive. You always say that the venture is a reliable indicator of future market direction, well what does the current index tell ya. Let me guess, your bullish.

Sentiment indicators for the PM sector are at their lowest levels since the 2008 Crash trough, so how can one NOT be bullish at the moment? “One headline away from a nose dive” – that’s the kind of fear you WANT to see near a bottom. Gold and Silver are poised for a sharp move higher – that’s also what the commercial traders are saying, and I for one don’t wish to be on the wrong side of that trade. With regard to RBW, just the chart itself should tell you this is going to run. I’ve seen for my own eyes what they’re going to be drilling into. As Bert rightly pointed out, we can’t profess to know for certain Mother Nature’s secrets. But we look at geological probabilities based on various indicators. A lot is known about this vein structure in this particular area of the International. The look (and smell) of the rock, the type of mineralization, vein widths, geochemical analysis, the historical adits – these are all clues that point to a strong probability of success in initial drilling at least. They are aiming for something – these aren’t blind holes. And all it takes is 1 hole that hits and RBW will gap up severely. That’s been the thinking behind this since Day 1, and so far – so good. Common sense tells you that just on speculation alone during the drilling and prior to results, a breakout in the share price is virtually guaranteed. These early stage plays are where investors have the best chance for the biggest gains – just ask the likes of Rick Rule and John Kaiser. Would you rather hold a company right now that has a 43-101 resource, dwindling “blue sky” and in need of tens of millions of dollars to advance a property toward production, or a company with a potential discovery situation where the homework has been done to confirm exceptional drill targets? Call it a pure spec play if you wish, but that’s where the HUGE upside opportunities are in the current market. Look what happened with GoldQuest, and there are other examples recently. Fortunes are born in bear markets, not bull markets, and the time you really should be fearful is during a raging bull market. I was buying in late 2008/early 2009, when few people wanted to, and I am so glad I did. And now is no different. Gold and Silver are ready to pop.

good post joey.

I may post too often & i may do this & i may do that, but no one can argue, that going

negative on Rainbow, wasn’t just what we needed to entice Jon to give us a much deserved

Rainbow boost. Thanks must also go out to Joey.

As for the markets, when i turned on the TV this a.m., everything was red but all of a

sudden, an headline from Europe, turned everything around. I would suggest that the

direction today will depend on the U.S. job’s report, later this a.m. Have a good day. R !

the way I see it is that this bear market can go on for years. BMR thinks that we are going to turn on a dime. I do believe in buying when people are most fearful, just don’t think that we are there yet. The american markets have barely even corrected yet. I find it quite interesting how defensive BMR will get if there is any critizism towards RBW yet we absolutely nothing with regards to the many stocks they have constantly touted in the past.

Here we go, imminent breakout time for Gold and Silver. Enough said.

BMR your track record is not the best. Enough sad

You’re entitled to your opinion, Joey. Our readership levels continue very strong, so that must say something. We’re certainly imperfect and not always right – no one is in the markets. But among some bad calls we have made some very good calls over the last three years, the most recent of which was GQC and of course Gold and Silver. John’s charting of the precious metals markets IMHO has been second to none.

Everything up this a.m. I will suggest, we will have one of the best trading days of the year..

As for BMR, i am not ready to give up on them yet, no one & i repeat no one, is able get it

right, all the time, during troubling times. Give them a good market & they will guide us to

better returns. R !

Joey – “The American markets have barely even corrected yet.”

Historically gold stocks tend to have an inverse relationship to the main indexes. But yeah, in a panic the lot would be dragged down which will give them cause to print a whole lot more. But from what I can see this has already been grindingly priced in.

Have you heard of Hobson’s choice – a choice, but really no choice. Print or face complete financial and social breakdown.

And here we are, sat at the levered end of the scale – It’s just a matter of time.

i have been a huge advocator of RBW and even i took the opportunity the other day to get out at a small profit at 20c. Until i receive an NR that drills are turning, there are man y other places my money could sit where they actually have permits. as Jon said they have some big millionaire backers in Alberta…how come they aren’t buying the pp at 18c if they are so confident? No matter what happens i don’t think we will travel too far from 18c until that pp closes..