Gold fell as low as $1,750 overnight but is rebounding, showing the current strength of this market…as of 6:15 am Pacific, the yellow metal is up $1 an ounce at $1,764…Silver dropped just below $34 an ounce but is now 16 cents higher for the day at $34.41…Copper is off 2 pennies at $3.74…Crude Oil, which fell $3 a barrel within minutes yesterday due possibly to a high frequency trading glitch, is down 61 cents at $96.01 while the U.S. Dollar Index has rallied just over one-tenth of a point to 79.11…high prices notwithstanding, consumers in India are stepping into stores and purchasing Gold coins and bars which is a good sign…jewelers and retailers say sales across India have shot up by 10-20%…contributing factors include several major Gold-buying festivals and an improvement (more rainfall) in the monsoon season…

76% Of U.S. Gold Production From Nevada In First Half Of 2012

U.S. Gold mining production for the first half of this year declined slightly from the same period last year, according to the the U.S. Geological Survey…for the first half of 2012, the agency reports there was a total 3,633,034 ounces of Gold production, down 3% from the same period last year…of that January through June, 2012 production, 2,761,750 ounces were mined in Nevada while 395,454 ounces were produced in Alaska…

Greenback Outlook Is Grim – Venture Exchange Breaks Out Relative To U.S. Dollar Index

As we mentioned yesterday, and although it could rally marginally out of current oversold conditions which would create another great shorting opportunity, the U.S. Dollar Index is in serious trouble both technically and fundamentally…it has fallen below an important uptrend line that started in September of last year…one key support level (81), as John has already pointed out, has been breached, and some others are in jeopardy looking out into the fourth quarter…fundamentally, QE3 is a killer for the greenback and that’s of course hugely bullish for Gold and Silver and commodities in general…

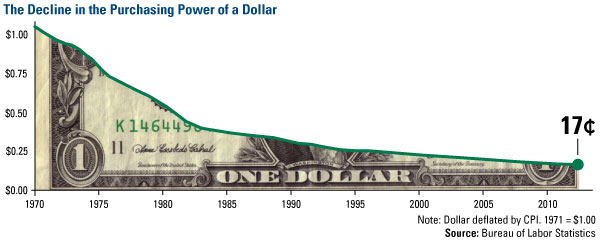

The overall decline in the purchasing power of the U.S. Dollar over the last four decades is stunning and certainly strengthens the case for Gold as a store of value…

The Venture Exchange performs best under weak U.S. Dollar conditions, so that’s another reason why we’re so bullish regarding the CDNX over the next six months at least…below is a very important chart from John, a 5-year weekly comparative showing the Dollar Index in comparison with the Venture…if there’s just one point that sinks in with our readers from today’s Morning Musings, it’s that the Venture has broken out relative to the U.S. Dollar (check the bottom right hand corner of the chart) which is a major trend change…the reverse occurred in early 2011 which kicked off a bear market that wiped 53% off the value of the CDNX…

As you can also see in the above chart, the Venture Exchange has not yet actually broken above its downtrend line in place since the second quarter of 2011…we’re speculating that’s likely to occur within the next few weeks, and then watch the volume pick up again as it did last week…strategically, now is the time to be accumulating quality junior exploration plays, particularly of course on any minor weakness or a normal slight pullback…the CDNX‘s 10 and 20-day moving averages, currently at 1287 and 1264 respectively, can be expected to provide strong support throughout this uptrend…

Currency Wars To Heat Up Again?

The Federal Reserve and the European Central Bank’s new rounds of quantitative easing could herald a new era of “currency wars”, according to Bank of New York (BNY) Mellon research…the dollar has fallen to a seven-month low against the yen and a four-month low against the euro in the wake of QE3 announced by the Fed last Thursday…adding insult to the greenback’s injury on Friday, the ratings agency Egan-Jones cut the U.S. sovereign rating to AA-minus from AA, saying the Fed’s QE3 would reduce the value of the dollar rather than reduce national debt…”The Fed’s QE3 will stoke the stock market and commodity prices, but in our opinion will hurt the U.S. economy and, by extension, credit quality,” the firm said…central banks such as Brazil and others around the globe are already moving to mitigate the effects of the “debasement” of the dollar by taking “measures to prevent excessive currency strength”, according to BNY Mellon…

Today’s Markets

Asian markets were mildly negative overnight with China again leading the way, falling another 19 points to 2060…Automakers Nissan Motor Co., Honda Motor Co. and Mazda Motor Corp., who collectively employ thousands of Chinese workers, each announced they were temporarily suspending production in China after a week of anti-Japanese protests around the country that saw Japanese-owned businesses looted and Japanese cars and restaurants attacked over a China-Japan spat over some disputed islands in the east China Sea…other industries, including electronics, food and retail, were also affected and the dispute put global supply chains for Japanese products produced in China under threat…the Chinese need to back off on this one…

With China’s leadership transition set for the middle of next month, we’re expecting new stimulus efforts in that country and a gradual rebound in the Shanghai Index and the economy in general…the Chinese do have their work cut out for them as the financial system is struggling in part with bad loans from the property sector and local governments…meanwhile, average property prices in 70 Chinese cities rose for a third straight month in August on a sequential basis, pointing to a continued turnaround in the once-ailing market…the latest gains in housing prices, shown in a government survey issued today, extend a trend that emerged in June after eight months of decline…the figures come on the heels of improving housing starts and show a bright spot in a generally weakening economy…

European shares are weaker this morning as investors continue to wait for Spain to decide whether to ask for help from the ECB’s bond-buying program…Spain, however, had a successful debt auction this morning and yields eased a bit…stock index futures in New York as of 6:15 am Pacific are pointing toward a flat to slightly negative open on Wall Street…

CRB Index Chart Update

A minor pullback in the CRB Index to its weekly EMA-20 seems quite possible given John’s updated 1-year weekly chart below, but this will merely set the stage for another powerful leg up during the fourth quarter as the primary trend remains very bullish…

New Gold Inc. (NGD, TSX)

New Gold Inc. (NGD, TSX) is performing well, as expected, and any pullback to or slightly below the supporting 20-day SMA (currently around $11.20) would be an ideal entry point for those who are not yet positioned in this quality opportunity…once the $12 – $14 resistance band is cleared, which could easily occur during the fourth quarter, NGD is off to the races in our view…on Thursday, the company will be releasing its Preliminary Economic Assessment (PEA) for the massive Blackwater Gold-Silver deposit in central British Columbia…NGD closed up 50 cents yesterday at $12.01, and has climbed from a low of $10.63 over the last four sessions…

Parlane Resource Corp. (PPP, TSX-V)

Speaking of Blackwater, Parlane Resource Corp. (PPP, TSX-V) staged a confirmed breakout yesterday, closing at 19.5 cents on volume of 250,000 shares…the steady increase in volume in this stock since the beginning of August is a very bullish sign…Parlane will soon be drilling its 14,000-hectare Big Bear Project, strategically located between the Blackwater and Capoose deposits, and the company as we’ve been mentioning has to be considered as another potential Blackwater-area takeover target for New Gold…below is an updated 2.5-year weekly chart from John…notice the recent clear break above the downtrend line in place since the spring…

ATAC Resources (ATC, TSX-V)

This slow-moving train may be starting to kick into gear after release of encouraging assay results yesterday…the company reported a discovery hole (8.5 metres grading nearly 20 g/t Au) from a prospecting find located approximately 10 kilometres west of the Conrad, Osiris, Isis, and Isis East Gold zones in a new area not previously drill tested…this helps confirm the district-wide potential of the 40-kilometre-long Nadaleen Trend located at the east end of the 185-km-long Rackla Gold Belt…ATC has broken above its weekly EMA-20 but this time we don’t believe it will be a “bull fake” as was the case in June…below is a 15-month weekly ATC chart…

Notes: John and Jon both hold positions in PPP.

54 Comments

GBB on the move today… finally… hopefully, it keeps on moving up with strong support.

CRE.V is definitely testing its resistance…….

Bought a bunch of RBW stocks this week. Sold 25% of my Xtierra’s yesterday to finance the last RBW-trade.

The case for RBW is very simple and the stock will not move significantly until drill result is released from International:

Bad result-> 5-10c

Good result->30-40c

Stellar result->100% gain in one trading day, my guess is as good as yours 😉

The risk is high, (or if u have read all the information that BMR has provided to us, the last 6months)… is it!?

Game is on!

Can you profile SAM.TO? A junior gold miner in Mexico run by Robert Eadie, who is also the CEO of Parlane. One of the top performers on the TSX this year and has been in a long consolidation since early 2012.

GQC… I doubt it can keep at its current high… it may only close at $1.71… GBB… 11 cents sell lot can go quick.

Jon- if you wouldn’t mind. I have asked in the past but if you could please provide your lasted TA and opinion on ABI.V and DIT.V it would be much appreciated by your readers.

BMR what do you guys make of all the insider selling going on with RJK this past month? It is only one person selling but still.. before drilling is even announced? I can’t imagine why.

Cam, this doesn’t concern me, and I wouldn’t refer to it as “insider” selling – it’s typical Pinetree stuff…..again, back to my point yesterday, we’ve been through a tough liquidity crunch and there’s certainly some paper overhang in this market…volume will eventually look after all of that….in this case, Pinetree has sold some stock they bought some time ago, to raise additional cash, and it’s not even a large amount of stock……they may have some more to sell, who knows, and I don’t really care as it makes sense to me, and should make sense to everyone, that RJK should strengthen further during the drilling process and as the Blackwater story garners more attention as I’m sure it will……….Parlane has a tighter share structure and is doing better as a result at the moment, but at 13 cents the risk-reward ratio on RJK is quite attractive IMHO……patience is the key……

Nice volume so far in Gbb, eating away .11

It’s in the air, fall that is, my favorite season. A time when leaves change

its colors, as we witness nature at its best. We are seeing the most magnificent

colors, as the leaves show their luster, before falling to the ground & lay

dormant, before becoming a nuisance. Also in the air is the Venture exchange,

as i see signs of better days ahead. Unlike the leaves which will fall, the

Venture will rise. The prices on some beaten up stocks are beginning to show

signs of buyers interest, as they slowly but surely take on a life. R !

Thanks for the reply Jon! I’m already in RJK with quite a few shares, I bought before the big drop and a bit after to balance out. All these bits of Pinetree selling were my only worry, other than that I have confidence that RJK will rise back up soon.

GBB is picking up speed……

When is Parlane drilling next and how many meters are they drilling?

They have a permit in hand for 10,000 metres. I suspect they’re starting almost anytime now, though news on the start of drilling is still awaited.

GBB has a head of steam, Ask 0.13 currently, nice to see!!

well,if gbb gets through the 200 day I’ll take that as a sign from God that the bull market is back!

Rbw – wow is all I got to say right now. Didn’t see this coming.

Press release from CNW Group

Gold Bullion releases results from 43 backlogged Phase III Granada drill data including 1.76 g/t Au over 58.0 M

Tuesday, September 18, 2012

VANCOUVER, Sept. 18, 2012 /CNW/ – Gold Bullion Development Corp. (TSXV: GBB) (OTCPINK: GBBFF) (the “Company” or “Gold Bullion”) is pleased to announce results from the backlogged Phase III drill data at Granada. With over 80% of the expanded LONG Bars zone yet to be systematically explored, these ongoing, consistently strong drill results are suggestive of a potentially massive deposit similar to other existing world-class deposits in the region.

Should bold well for the share price!

Somebody drooped a bomb on RBW…. it will close at 20 cents today… my guess!

RBW at 18 which means no matter where we close today, the support at 20 is officially breahced folks. This will continue hovering around the 17-20 range at best until results. Don’t hold your breaths for a breakout about 25 blah blah blah because nobody is going to break the 20’s wall until results are announced. There simply isn’t any hype around RBW – just accumulation with an ever so slowly down-trending share price until we see results.

Sorry BMR, I know you’re excited and all, but this has to hit big to move. Otherwise, it’s just another, CUI, GBB, SD, and the many others that have come and gone like the wind.

Don’t tell me that’s the final dump

I think it is

I told you not to tell me

BMR-readers moving from RBW to GBB 😉 not me though, bought another 20k RBW today. Now I will wait until drill result is released.

Risk factor in GBB’s favor:

RBW: 0Moz Ag

GBB: 1,5Moz Au

Long way up to .25! Guess I don’t have any choice but just sit down and wait, again.

Sold some shares today in RBW. With the amount of volume and coincidentally news coming out soon I wouldn’t be surprised if this was insider trading suggesting bad news to be released in the next few days. More often than not this is what usually happens in these cases.

What kind of bad news would you expect? All drill holes so far at the International are hitting the vein structure, and assays aren’t likely ’til October sometime, and drilling is being lined up for two other properties….so that doesn’t wash….some inexperienced investors hit the panic button when the big bid at .20 got sold into….as simple as that…I love it when investors panic and run because that’s always a great buying time…….

Very good drill results from GBB! Now it’s just a question of time until we are back trading at +20c

The difference between 200,000 shares in volume on RBW and 400,000 shares in volume is $40,000 at current prices. $40,000 doesn’t sound like much to get worried about to me.

gbb up to .14 at the close:) i think the whole sector is starting to get some attention and traction…. patience is truly the key!

So BMR did you buy more at these panic sale levels?

Gbb closed 0.14 on nice volume!

Wow GBB +33% today, I am so happy 🙂 regarding RBW, the day to day trading SP is almost irrelevant. Wait for drill results and the SP will take care of it self. The chanses for initial good results is hopefully in our favor.

As BMR suggests, do your own DD. Seems some the of posters here are relying solely on BMR for DD. Others post hunches (seemingly with no posted DD to back up said hunches/feelings) As part of DD Pick up the phone and talk to IR, there is a lot going on with RBW. You will learn the drill program was expanded to 15 holes, this is up from a planned initial three holes, which seems to be a huge positive. There should be an update concerning RBW soon. BMR has had it’s share of dogs,(and successes) but I doubt RBW will be one of the dogs. They are the messanger, don’t shoot them if the SP is not going as we would all hope. Don’t rely on gut feelings or senses. if you liked the fundamentals of RBW at .20+ you should really like it at .18 because from talking to IR, it sounds like the fundamentals are even better than before.

rite on jon i agree,all i can say is lets not forget who’s in charge here,jim decker is one of, if not thee best in the business,a small drop like today doesn’t worry me,i sleep at nite knowing he’s in charge,i hold a big amount,and thats what im going to do,hold on.i dont think mr decker became a billonaire on stupidity,i just keep thinking what he did with his last company,,,,sleep well,,,gqc finely done with stock options,keep goin up,rbw is next.

rbw looks like they drilling program won’t produce great results

big volume and down

Nothing to do with results, because there are none yet, other than the fact we know that all holes drilled so far have intersected the vein system (good news actually)…..Here’s my take on what happened today……someone with UBS wanted 200,000 shares at 20 cents, which drove the market up yesterday, and today that bid at mid-day got hit……a couple investors got scared and sold a bit of stock below .20, which then in turn panicked a few others…….that’s all it takes……..given the volume today and recently, there are most definitely pro traders involved in this market and they are playing some retail investors as complete suckers……..so all you need to do to get fleeced is fall for the trap and dump some stock out of fear…there are plenty of buyers around, and they’re looking for the best price they can get….the major moving averages (50, 100, 200, 300) are still rising and intact, which confirms the primary trend, though the short term technicals weakened recently after a substantial run-up which has contributed to some selling…very normal technical behavior…..to answer an earlier question, yes I picked some up personally on the way down at .19…..investing rule 101, buy on weakness……market is going up, RBW is drilling for a near-surface silver discovery at the International, and more drill programs are just around the corner at Gold Viking and Nevada……that’s a good recipe, and the market cap is back down to just $7.5 million…..gotta love it.

great day for GBB!

I don’t have a list of sales, but i managed to get the last

hour and a half from a site i follow. The big sellers during

that space of time were, TD 14,500, Jitney 12,500, & Scotia

41,000…. I actually thought it would be Anonymous, who

finally decided to cash in & have it over with, but i was

wrong. Anyway, i have had my bad days & good days, but i

still believe that Jon has it right & as a result, bought a

few more during the sell off at 0.185.. I will soon own the

company.. Hopefully it will bounce back past 0.20 tomorrow.

R !

Nice GBB, nice. Just waiting for all those to come on here and say they were always confident in GBB and bought more at 8 cents, whilst selling and saying the opposite, just saying………

My guess in GQC is very wrong today. But still, I will not enter the market at this price…. Day trade will be best for this one. RBW dropped below my cost …..140,000 shares at 19.5 cents … no panic … continue to keep. GBB finally had a good bounce today and same for tomorrow I believe… 20 cents? My other favorite stock SFF… still waiting for the players to come back….

BMR

Like Doug Casey likes to say, this RBW is not just a one trick pony, lots of kicks at the can…

Anyone that says anything negative towards Bmr gets their posts deleted so Jon your take on Rbw has been wrong for so long now 6 months it has done squat i own a quite a bit havent sold not 1 share shuda sold at 0.24 wall that couldnt be busted big big mistake all the writers,cashed up,US listing positive nr nothing positive for the share price.I really doubt you are making any profit on rbw the reason im still holding is for the holes not for your cheerleading and constant chart pumping on rbw if you were so great with your charts you shuda told your posters that 0.24 was overbought we know what that would have done to the sp.So your take dont mean anything no more im sure others feel the same.Delete this or not you have deleted other messages of mine & others thats why people get ticked off you should man up to your bad calls.I remember the 0.15-0.16 area being stuck in it for so long ages now its almost there so so sad.

Wrong, Gerry. Fair and respectful comment about any company or any situation is welcome here. Just for the record, so our readers know, some of your posts have been deleted because they were simply rude and offensive and crossed the line. You’re lucky you’re allowed the privilege of still posting here.

Kalkan – If I knew this was coming.

I mentioned about a month ago that RBW COULD see .17 to .18 again before its next run up (maybe). The fact they are hitting the vein structure is good, but it is not assays. Funny, DB was the one who told me I didn’t have any call right with RBW. 38 posts and not one by DB. Guess he’s under the covers. Now I can sit here and tell you why I felt this was possible, but no one would listen to me, as usual.

Tom,

I know little about Decker, but if he has accepted to be VP for RBW, he must recognize some, if not great, potential in this project. He probably minds about not wasting his time and reputation with a weak project. There is a similar situation with Richmont. On their board they have Bob Buchan, another huge success story in the mining industry. Richmont wanted him so badly that they borrowed money from him at 7.5% per year. Obviously Bob Buchan feels secure that RIC will pay back the loan.

As for me, TA has its limits. Fundamentals are more my interest.

Gerry you can’t blame anyone at BMR for your losses, in the end its all your decision. BMR are kind enough to give this info they have researched as well as provide charts. It’s up to you what you do with it.

I remember your call Dave you was spot on you should open a site,Cam my cost is at 0.20 so not losing much sleep im not blaming Bmr for that,whats your next call Dave im listening.

(Yogi Berra) It ain’t over til it’s over.

I have to admit being frustrated at times, but should i be

blaming RBW ? i don’t think so, instead, some of the blame

must be placed on the messenger, who gave us an impression

that RBW was off to the races YESTERDAY. When it didn’t

happen & instead, we were confronted with a big seller or

sellers, on a daily basis, it would test the nerves of the

most patient souls. I would suggest that the company knows

what is going on, but are content to wait for results,

especially if they have a good idea that results will be good

enough to propel the stock price forward.. How else can i

look at it, where i am not privy to enough information to

base a solid decision on. I do know that being very negative

do take it’s toll on others, as i have been there & seen it

all. Yesterday when the stock dropped, i bought more & like

most all stocks on the Vulture exchange, you put your cash

forward & take your chances. Life is one big gamble, i go to

bed nightly, not knowing if i will wake up, but here i am

typing & glaring through the window, at the beauty of nature

& realizing, i have been given another chance, to appreciate

life & yes, even to watch RBW mark time or bounce back & i

know, we all prefer to see the latter. R !

Of course we can’t blame bmr. Some are perhaps doing that. I like their work, this site and some of the readers posts. But as you said Bert I am frustrated too some times. Some of you talking about pending news regarding rbw. What’s the time frame, anybody knows? Can we expect results in october or do we have to wait more like to nov/dec…

Rainbow is hitting the vein in every hole and they are up to 13 now. If they weren’t liking what they saw you’d think they would move on to GV seeing as summer is quickly ending. Nevada can wait. People that are losing faith need to take a step back and look against RBWs portfolio.

International – Rock sample assay results as high as 1,148 g/t Ag and 68% Pb

Gold Viking – nice silver samples plus graphite wildcard

Jewel Ridge – historical drilling results, including 2.1 g/t Au over 39.6 metres near-surface

Referendum- 10000 tonne bulk sample planned,

I could keep going on about the granite claims they picked up in the heart. Of Eagle Graphie claims, the 1 producing graphite mine in Western North America. It’s easy to see that ppl are accumulating and some investors are getting scared or impatient. 2-3.weeks tills resuts, worst case a month. Anything under 20c is a steal IMO. Mgt got options at 25c…no brainer.

Dave, I guess you were right but to me it’s just another buying opportunity….

My 2 cents is that this these pennies whilst showing signs of life, wont really take off until we hit new highs in gold. The current short covering in the mining shares suggests that new highs is coming and soon! 🙂

Hey Dave..maybe you can have a look at ABI for us and offer your opinion since the boys at BMR don’t really seem give a sh&% about it anymore.I’ve been asking for some kind of input for the last month on it and still nothing.

Much appreciated.

Actually, Michael, we still like ABI very much, as the company’s silver resources/reserves are substantial…..two concerns with regard to ABI….management, and Mineral Fields…….we’ve stated all along that ABI is a potential takeover candidate, and if new management were to step in, things could change in a hurry….so it definitely has potential…….we’re not ignoring it. I like the Elder Project a lot too. In the near future we’ll do another ABI chart.

Like I said above RBW is not a one trick pony, they have alot of kicks at the can…