Some minor profit-taking pushed Gold and Silver down modestly overnight but both are rebounding…as of 5:45 am Pacific, bullion is down just $4 an ounce at $1,766…Silver is now essentially flat at $34.55…Copper is off 6 pennies to $3.71…Crude Oil, which has been hit hard in recent sessions, is down 19 cents to $91.79 while the U.S. Dollar Index has rallied nearly half a point to 79.50 but smart traders are likely using that advance to build short positions as the “big picture” outlook for the greenback is grim given the technicals, QE3 and political dynamics…

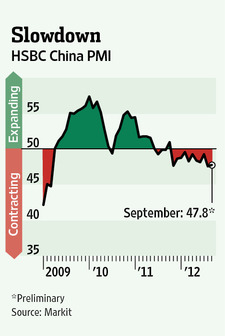

Massive injections of stimulus into financial markets by the world’s largest central banks are creating a domino effect around the globe, and investors are hoping China will be the next to take action – likely following that country’s leadership transition in mid-October…data released this morning showed activity in China’s vast manufacturing sector contracted for an 11th consecutive month in September…the HSBS Flash China manufacturing purchasing managers’ index (PMI) stood at 47.8 in September, a very slight improvement over a nine-month low of 47.6 in August but remaining below the 50 mark that divides expansion from contraction…nonetheless, there was a broad steadying among the sub-indexes in the survey so while manufacturing activity in China is slowing, the pace of that slowdown appears to be stabilizing…

Weak Euro Zone Numbers

Meanwhile, the downturn in activity in the euro zone’s service sector fell unexpectedly to its lowest level since June, 2009, according to a Markit PMI report this morning,pointing to a further deepening of that region’s downturn…French companies performing particularly poorly…a good indicator of economic performance, the euro zone services PMI fell to 46.0 in September from 47.2 in August, below even the most pessimistic forecast of 46.5 in a Reuters poll of nearly 40 economists…the services sector figure came despite a surprise upturn in the related German surveys, suggesting smaller euro zone economies like Spain and Italy have performed especially poorly this month, boosting the case for an ECB interest rate cut in October…

Today’s Markets

Global growth concerns have pushed down markets this morning…in Asia, Japan’s Nikkei fell 1.6% after hitting a four-month high the other day, while China’s Shanghai Composite Index shed 43 points or 2.08% as it closed at its lowest level since February, 2009, at 2025…Japanese exports to China dropped 9.9% in August compared with the same month a year earlier…European markets are modestly lower this opening while stock index futures in New York as of 5:45 am Pacific are pointing toward a slightly negative open on Wall Street…the weekly jobless claims report just came out, and the number of Americans filing new claims fell last week but the underlying tone of the report pointed to some further weakening in the labor market…investors will be eager to take a look at the Philadelphia Fed’s manufacturing index at 7:00 am Pacific…the index is expected to rebound but remain in negative territory…economists surveyed by MarketWatch forecast a bounce to -4.0 from -7.1 in August…

Rebound In U.S. Housing & Construction

U.S. home sales and construction have jumped to their highest levels in more than two years, offering the strongest signal to date that the American housing sector has turned the corner after a six-year rout…”The housing recovery has indeed started,” said Michelle Meyer, an economist at Bank of America Merrill Lynch…single-family housing starts in August rose by 5.5% from July to their highest level in 28 months, the Commerce Department said yesterday…in August, builders started construction on 535,000 homes at a seasonally adjusted annual rate, up 26.8% from one year ago…overall housing starts were up by 2.3%, amid a small drop in the more volatile multi-family sector…meanwhile, sales of previously owned homes in August rose by 7.8% from July to their highest level in 27 months, the National Association of Realtors said… sales climbed 9.3% from a year ago, marking the 14th straight year-over-year sales increase, even as the number of homes listed for sale was down sharply…

Venture Exchange-Gold-CRB Index Chart Update

The Venture Exchange, which leaped past the 1325 resistance area with a 21-point gain yesterday (next significant resistance levels are 1375 and 1425), is getting very close to breaking through a downtrend line that has been in place since the spring of 2011…we must be patient as this important technical event could still be a week or two away, it’s impossible to predict…the CDNX would be following in the footsteps of both Gold and the CRB Index which have already surged above their downtrend lines…below is an updated 2.5-year weekly chart from John that compares the CDNX with Gold and the CRB Index…

Rainbow Resources (RBW, TSX-V) Chart Update – The “Golden Cross” Event

Below is a Rainbow Resources’ (RBW, TSX-V) updated chart that paints a very encouraging picture despite some minor recent weakness that has brought about some healthy consolidation…not only does this stock have rising 50, 100, 200 and 300-day moving averages, and very strong technical support, but notice the recent “Golden Cross” that has occurred this month – the 50-day SMA has crossed above the 200-day SMA…one only has to look at the Venture chart going back to 2009 to understand the importance of the “Golden Cross”…in early 2009, the Venture’s 50-day crossed above the 200-day and this occurred again in the summer of 2010 – on each occasion, this gave advance warning of a major bullish move in the Index…we suspect a similar situation with RBW and the catalyst will be an upcoming “triple play” – speculation regarding pending results from the International, the start of drilling at Gold Viking, and the commencement of drilling at Jewel Ridge in Nevada…yesterday, RBW gapped up and closed at its high of the day, 20.5 cents, after successfully testing its 300-day moving average (SMA) the day before…notice the bullish “W” formation in the RSI(14)…

New Gold’s PEA Shows Very Robust Economics For Blackwater

New Gold Inc. (NGD, TSX) has just released a very powerful Preliminary Economic Study for its Blackwater deposit in central British Columbia, and company officials are in Toronto today to review the report with analysts…over the initial 15 years of its mine life, Blackwater is estimated to produce an annual average of 507,000 ounces of Gold and 2,039,000 ounces of Silver at total cash costs(1) per ounce sold (net of by-product sales) of $536 per ounce…at assumed Gold and Silver prices of $1,275 and $22.50 per ounce, and a 0.94 U.S.$/CDN$ foreign exchange rate, the project is expected to yield a base case after-tax, 5% net present value (“NPV”) of $1.1 billion and an after-tax internal rate of return (“IRR”) of 14.0%…at spot commodity prices of $1,775 per ounce Gold and $34.50 per ounce Silver, and a parity exchange rate, the after-tax, 5% NPV and IRR move to $2.8 billion and 25.8%…

Other highlights include…

Conventional truck and shovel open pit mine with 60,000 tonne per day (“tpd”) whole ore leach process plant

Start of production targeted for 2017

Initial 15-year mine life with additional 1.4 years of processing low grade stockpile at end of pit life

Life-of-mine strip ratio of 2.36 to 1.00 of waste to mineralized material

Life-of-mine Gold and Silver recoveries of 87% and 53%, respectively

Life-of-mine Gold and Silver production, inclusive of low grade stockpile, of 6.2 and 18.6 million ounces from the Indicated category and 1.8 and 13.5 million ounces from the Inferred category, respectively

Development capital costs of $1.8 billion inclusive of 24 percent, or $346 million, contingency

Higher grade initial five years resulting in accelerated payback of capital costs

Keep in mind, these numbers could easily get better…NGD currently has 18 drill rigs at Blackwater and has recently discovered higher grades of Silver in addition of course to more Gold…the company’s total area land package is 1,000 kilometres, and the likelihood of additional deposits (beyond Blackwater and Capoose) has to be considered high…

Keep a close eye on juniors in the area including two of our favorites, Parlane Resource Corp. (PPP, TSX-V) and RJX Explorations (RJK, TSX-V)…we expect both to begin drill programs shortly…

OK Silver Corp. (OK, TSX-V)

OK Silver (OK, TSX-V) has been halted this morning, pending news…the stock has been a strong performer recently, and below is an updated chart from John for our readers’ due diligence…

John has two other chart updates this morning – Richmont Mines (RIC, TSX) which has been recovering as expected, and Scorpio Mining (SPM, TSX)…

Richmont Mines (RIC, TSX)

Scorpio Mining (SPM, TSX)

Chart Notes: John and Jon both hold share positions in RBW with Jon increasing his position Tuesday.

Fool’s Gold: Counterfeit Bars Turn Up In NYC

Fox News is reporting that a jeweler in Manhattan’s Diamond District has learned the hard way that all that glitters is not Gold…Ibrahim Fadl, a chemical engineer who owns a downtown business, bought four 10-ounce Gold bars and decided to check them out further since he heard counterfeits were making the rounds…Fadl, who paid $100,000 for the merchandise, drilled into several of the bars and found gray tungsten, which has nearly the same density as Gold, making it difficult to detect…the same thing reportedly happened in Great Britain earlier this year, and finance blog ZeroHedge.com reported that in 2010 German refiner W.C. Heraeus claimed to have received a 500-gram bar from an unnamed bank that proved to be filled with tungsten…the scheme purportedly involves a genuine Gold bar that is purchased with serial numbers and authentic documents and is then hollowed out to be replaced with tungsten…the bar is then closed up to finalize the sophisticated operation, the website reports…Fadl, who could not be reached for comment, told NY1.com that the shell of the Gold was sold to him by a customer at his Gold refinery business and peeled off like foil on a candy bar…“It’s got to be somebody really, really professional…when I analyzed them, it showed they were tungsten…sick to my stomach, but thank God we didn’t sell this to somebody…people are selling their homes to buy Gold, it’s a big issue,” Fadl told the web site…

25 Comments

nice bid support on RBW so far. big bid at 20 and another at 21…

Interesting chart on snd.vc. It is a streaming company for metals and energy. Management is from silver wheaton. Sister company is sandstorm gold which has preformed very well throughout this meltdown.

I don’t understand this technical mining jargon that RBWs president uses.

How many ounces of silver/lead do an elephant make? How many ounces to make a fat cow?

Rick- thanks for the laugh this a.m. Better than any of the laughs of the day i read on this site..

Rick

You have to read between the lines, the President is

telling us, he thinks they have an Elephant deposit

of silver/lead… As for a fat cow, i don’t know the

answer, not being a farmer. R !

ABI volume has been picking up a little bit of steam. Its a sneaky little company quietly getting down to the business of mining.

TIG.V might be worth a look. PP due to close anytime.

I am glad he didn’t use the Pig anaology, we all know what happens to Pigs! ouch!

Somethings up with CQX Cadillac Mining- up over %50 on no news I can find. Any clue what is going on , I know BMR hwas keen on this stock at one time . THX KD

THE END IS NEAR I have posted todays smile now and then What I dont like to see on any site is a lot of chatter with no worth many may consider todays smile to be just that. SO todays smile may begoing the way of the dodo bird

adillac Mining Reports on Goldstrike Progress and Plans for Additional Drilling

Cadillac Mining Reports on Goldstrike Progress and Plans for Additional Drilling

Vancouver, British Columbia CANADA, September 20, 2012 /FSC/ – Cadillac Mining Corporation (CQX – TSX Venture), (“Cadillac”)is pleased to provide a progress report for its Goldstrike project situated about 35 miles northwest of St. George in southwestern Utah. Cadillac is targeting broad, open pit, Carlin-style, gold mineralization similar to many other gold deposits in the Great Basin of the western United States.

Cadillac has a 100% interest in the 4800-acre property, comprising patented claim leases and 208 contiguous federal claims, covering about 8 kilometers of prospective geology within the former Goldstrike Mining District. Historical modern production at Goldstrike is reported at 209,800 ounces of gold and 197,600 ounces of silver recovered from 12 pits.

Cadillac’s President & CEO, Victor Erickson, commented, “As a result of the difficult economics caused by falling gold prices and high royalties, prior operators Tenneco and USMX focused their exploration almost exclusively on the margins of known zones of gold mineralization and on near-surface targets, This constrained exploration to relatively shallow depths, leaving most of the prospective Tertiary strata on the Goldstrike property largely untested. Cadillac management is confident that the multi-million ounce potential of the Goldstrike project will in due course be realized as a result of the methodical approach the Company has taken in exploring the property.”

The Goldstrike District, situated near the southeast limit of the Great Basin, is a stratiform, Carlin-style setting. Cadillac is currently targeting extensions to the oxide gold mineralization that was mined between 1988 and 1994 from 12 shallow deposits stretching over four miles of favorable geology. The reported average grade of the ore mined from the Tertiary-age lower Claron formation sandstone and underlying brecciated Paleozoic limestone was 1.1 g Au/tonne.

Cadillac’s successful 12-hole Phase One program, tested a zone of mineralization located in close proximity to the Hamburg and Basin pits, intersecting the following mineralized intervals, (as initially released on June 29 and July 18, 2012). Silver assays for GS11-02 and 03 were received recently. See the recently updated drill and pit maps on the Company’s website at http://cadillacmining.com/NR47_CA.php.

-***-

————————————————————————-

Drill Hole Mineralized Intercept

————————————————————————-

Hole # Section AZ/Dip Total From To Interval Au Ag

degrees Depth (m) (m) (m) (g/t) (g/t)

(m)

————————————————————————-

————————————————————————-

GS11-01 660E 180/-70 164.6 No values –

————————————————————————-

GS11-02 660E 360/-72 201.2 24.4 97.5 62.4 1.13 6.27

Includes 24.4 68.6 44.2 1.56 9.50

Includes 45.7 61.0 15.3 2.51 14.33

————————————————————————-

GS11-03 630E 330/-67 201.2 24.4 106.7 82.3 1.25 8.02

Includes 24.4 74.7 50.3 1.58 10.65

Includes 33.5 53.3 19.8 2.88 21.2

and 100.6 106.6 6.1 3.00 9.75

————————————————————————-

GS12-04 690E 360/-67 132.4 27.1 56.1 29.0 0.43 4.01

————————————————————————-

GS12-05* 690E 360/-80 65.8 27.1 63.1 36.0 0.81 7.09

————————————————————————-

GS12-06* 690E 180/-80 55.5 Scattered values

————————————————————————-

GS12-07 730E 360/-67 147.6 70.7 100.9 30.2 1.56 3.80

————————————————————————-

GS12-08* 730E Vertical 102.1 52.1 82.9 30.8 2.05 4.31

Includes 52.1 64.3 10.2 4.48 8.77

————————————————————————-

GS12-09 770E 360/-67 147.0 88.4 131.1 42.7 0.61 3.93

————————————————————————-

GS12-10 770E 180/-70 128.8 54.0 64.3 10.3 1.49 3.00

————————————————————————-

GS12-11 815E 360/-67 150.0 83.8 138.7 54.9 0.86 4.14

Includes 99.7 131.1 31.4 1.23 5.91

————————————————————————-

GS12-12 815E 180/-70 144.6 88.4 138.7 47.3 0.64 4.87

Includes 91.4 112.8 21.4 1.02 9.34

————————————————————————-

*Drill hole terminated before reaching target depth because of drilling conditions.

Boy, rbw’s anon at it again. There goes that nice support db was referring to. Bummer.

GQC surprisely had a strong support today… $2 mark … a tough one to decide for me and you. Only the big guys can tell you. GBB will recover tomorrow and hopefully, the support can be maintained. SFF … my favorite one, hopefully will shine again. RBW … floating at 20 cents mark … just waiting for the day to go up. Turnover has increased and this is a good sign. I will not give up this one… not selling a single share yet…. average price 19.5 cents – even!

All i can state this evening is that Rainbow was up before it was down.

Without news or a rumor of news, we definitely need a positive day for

any chance of an increase in price. We continue with the waiting game. R !

KD – Cadillac came out with drill assays on stockwatch. 82m of 8g/t ag.

Micheal – As expected, ABI closed up above resistance of .13 and at the high of the day. She should give a correction soon. Be watching for that shooting star or hangman candle. If your not sure what they look like, google them. They usually occur intraday around 11 a.m. to 1 p.m. Support is now .13 but very weak and can be breached very easy. Strong support remains at .10

RBW – One thing that I find strange is that she trades very good volume 300k to 600k almost daily the last week, but her high and low of the day moves very little. If you study level 2 daily, you would think that a bigger varience would take place, especially with the low market cap. Jon, I know you may not agree and you may or may not have an answer, but its kind of odd. I noticed Jitney joined the anon party at the end of the day. My previous experiences with houses says this is not good. Time will tell.

I am not an expert at all in TA, but I would say that the 20, 50 and 200 MA have failed at supporting RBW share price.

Excellent liquidity and some accumulation on RBW today, despite the 1 penny drop…this is a good sign. In terms of moving averages, whenever you see a stock with rising 50, 100, 200 and 300 day moving averages, not to mention a Golden Cross with the 50 moving above the 200, this is confirmation of an ongoing bull market in the stock……it is entirely normal to see the stock, very briefly, not only touch but dip very slightly below those moving averages……that’s when there is such a great buying opportunity, and tremendous support…..as long as these moving averages continue to trend higher, that’s what’s critical, that’s what you need to look for. That’s certainly the case with RBW. The 10 and 20 day are declining slightly, but that’s just a very short-term trend. We’re not far off from seeing this breakout IMHO. The action we’re seeing right now is very positive and what it’s also doing is building an even stronger foundation of support.

Jon, you mean to say you “hope the action is very positive”. It is a complete and utter coin flip with RBW, plain and simple. Technical support can be broken at any time

There are never any guarantees in the market. However, what a smart investor will do is weigh probabilities after examining all technical and fundamental evidence. In the specific case of RBW, I love the probability factor in terms of a breakout to higher levels, and the risk-reward ratio—–meaning the upside potential outweighs the downside risk. You have to put every stock or commodity to that test.

Jon, there is really one question. Is anyone who is on the inside selling his or her shares in RBW? Or are they accumulating?

First off, who qualifies as being “on the inside” and what do you mean by that? Personally, I know a number of people who are very committed investors with this and are familiar with the RBW story and people, and they are adding to their positions right now. Buyers and sellers make up any market. There’s one reason for buying a stock – you think it’s going to go up – and many reasons for selling.

Hi Jon,

I was referring to the Insider Ownership from the RBW Corporate Fact Sheet, dated 4 September 2012.

Capital Structure (As of September 1, 2012):

Shares Outstanding: 41,227,719

Fully Diluted: 52,710,972

Insider Ownership: 17% (approx. 7,000,000)

They hold a solid position in the stock and they’re all long-term players, continuing to hold. Insider reports confirm that.

Note: Morning Musings at to be posted at approximately 7:00 am Pacific (10 am eastern) this morning.

Jon – First off, who qualifies as being “on the inside”

Bert – If anyone knows the meaning of an insider, it’s our buddy Jon, but

because he asked the question, i will give him an answer. Anyone owning

more than 10% of a company, makes him/her an insider & if it’s any one

person or company presently selling RBW, he, she or it, qualifies as being

an insider, considering the amount of selling taking place so far. I still

maintain it’s someone, who owned 0.15 paper. Whomever, they are trying

to sell for above 0.19, which would give them a minimum 25% profit. My

guess may be as good as anyone else, but one thing is certain, we shall

overcome, because it will end. If there’s anything positive about it all,

is the price is holding around 0.20. Anyway, with 3 hours to go before the

market opens, everything is in the green & it it holds, we should be in for

a good day & we shall see if RBW (Real Big Worry) surprises us or not. R !