Gold is looking solid so far today and is up $4 an ounce to $1,767 as of 5:50 am Pacific…Silver, which seems to have found support at its 20-day moving average (SMA), is up 14 cents at $34.12…Copper is up 4 pennies at $3.73…Crude Oil has gained $1.28 to $92.53 while the U.S. Dollar Index is off one-fifth of a point to 79.84 after again encountering resistance overnight just above 80…

U.S. Silver Output Down 12% In July

U.S. mined Silver output was down 12% in July from the same month a year ago, according to figures released by the U.S. Geological Survey…total July production this year was 2,588,140 ounces…Silver holdings in exchange-traded products (ETP’s) reached their highest level in 14 months in mid-July, and provided a short-term boost to silver prices, the agency stated…physical holdings in major Silver ETP’s increased to levels last seen in May, 2011…

U.S. Jobless Claims Drop To Lowest Level In Four Years

Weekly jobless claims fell to their lowest level in four years, while the U.S. trade deficit widened and import prices rose more than expected, according to economic numbers released at 5:30 am Pacific…the number of Americans seeking unemployment aid plummeted to 339,000 last week, the lowest level in more than four years…the sharp drop offered a hopeful sign that the job market could pick up…the Labor Department said weekly applications fell by 30,000 to the lowest level since February, 2008…the four-week average, a less volatile measure, dropped by 11,500 to 364,000, a six-month low…

Romney Narrows Gap In Presidential Race

Mitt Romney’s strong performance in the first presidential election debate has drawn him closer in the race for the White House against President Barack Obama, according to new NBC News/Wall Street Journal polls of three swing states…in Virginia, Romney leads Obama by 48% to 47% among likely voters…before last week’s debate, Obama held a slim 2% lead…in Florida, the Democratic incumbent leads his Republican challenger by 48% to 47% among likely voters…that 1% margin was unchanged since before the debate…and in Ohio, Romney has trimmed 2% off Obama’s pre-debate lead…Obama holds a 51 to 45% edge among likely voters in that state…all three surveys were conducted for NBC/WSJ by the Marist College Institute of Public Opinion with margins for error of 3.1 percentage points…

Today’s Markets

Asian markets were mixed overnight with China’s Shanghai Composite pulling back modestly (down 17 points to 2103) after several days of strong gains…European shares are stronger this morning while stock index futures in New York as of 6:00 am Pacific are pointing toward a positive open on Wall Street…

Stay Focused On The Big Picture

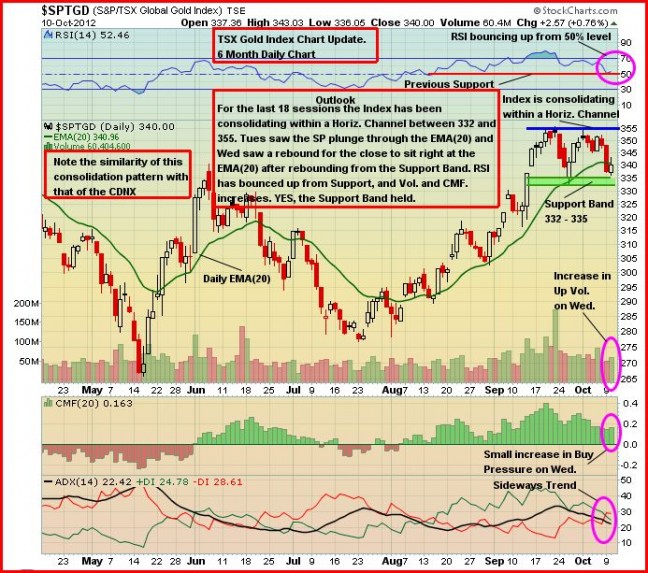

John has charts this morning on both the Venture Exchange and the TSX Gold Index which should put any nervous nellies at ease after a bit of a rough first half of a shortened trading week…the Venture has fallen 43 points or 3.2% the last 2 sessions while the Gold Index recovered slightly yesterday after falling 14 points or 4% the previous two days…there are so many arguments in favor of the position that the Venture and precious metal stocks in general are in a major new primary uptrend at the moment that should only accelerate over the coming months…so in our view, minor pullbacks along the way – a couple of steps down the ladder after a few steps up – are great bargain-hunting opportunities in quality situations if you accept that big picture view…there are always plenty of doubters in the very early stages of a new bull market which we contend is what the CDNX is currently in, and that’s entirely normal and healthy…the number of bulls will gradually increase as time wears on and the bull market ultimately gets exhausted when virtually everyone is bullish…

First, let’s take a look at the TSX Gold Index which, in this 6-month daily chart from John, is trading in a horizontal channel and has just bounced off previous RSI support at 50…the recent overbought condition has cleansed itself, and the Index has a very strong support band between 332 and 335…

Venture Exchange

The Venture’s biggest challenge at the moment is overcoming a resistance band between 1350 and 1365, so the market has stepped back slightly to rebuild the energy to do that…the Venture has closed below its 20-day SMA for the first time since early August which is unsettling to some, but from 1250 to 1300 there’s a ton of support based on Fibonacci numbers and rising 50 and 100-day SMA’s…in fact, right now, you’ll notice in John’s 3-month chart below that the RSI(14) is now at previous support after spending much of last month in overbought territory…the consolidation channel is very much intact…

Comstock Metals (CSL, TSX-V)

It was a bad overall market day for Comstock Metals (CSL, TSX-V) to come out with news yesterday, and the stock got sold off sharply despite the fact the company released decent preliminary Gold assay results from two of the first eight holes completed at its QV Project in the Yukon (results from check assays and metallic fire assays have not yet been received)…QV12-001 returned 82 metres (from a depth of 20 to 102 metres) grading 1.02 g/t Au, while QV-002 intercepted 52.4 metres near-surface grading 1.28 g/t Au…this is an encouraging early-stage discovery…all eight holes at QV intersected thick zones of quartz-sericite-carbonate altered gneiss and feldspar porphyry dikes with quartz vein stockworks, breccias, disseminated and vein controlled pyrite, and visible Gold…”The broad, near-surface Gold zones, along with a shallow dip of 30 degree to the northwest, make an ideal open-pittable mining scenario at the VG zone,” stated company President and CEO Rasool Mohammad…”We are also very encouraged by our high-grade Gold zones in the broader low-grade near-surface mineralization, indicating underground mining potential as well”…CSL slid 12.5 cents yesterday to close at 36.5 cents…

AuricoGold Inc. (AUQ, TSX)

AuricoGold Inc. (AUQ, TSX) is a compelling situation to look at, for those interested in producers, after the company announced a $750 million cash deal Tuesday to sell some of its assets in Mexico…the stock jumped $1.34 yesterday on the news to close at $7.60…below is a 2.5-year weekly chart from John that shows an important bottom was put in on this stock in early September at $5.20 per share…

Note: John, Jon and Terry do not hold positions in AUQ.

IIROC Studying High Frequency Trading

The Globe and Mail reports in today’s edition that the Investment Industry Regulatory Organization of Canada (IIROC) is involved in an intensive study to see how markets are being influenced by high frequency trading, which could be positive news for retail investors especially…the Globe’s Noreen Rasbach wrote that what the study has looked at so far is the prevalence of this activity – 42% of all trades in the Canadian market and 32% of the value traded…”High-frequency traders can see things a millisecond ahead of the rest of us, but a millisecond is worth a fortune,” stated University of Toronto’s Rotman School of Management professor Eric Kirzner…Kirzner says high frequency traders “can see what slow moving traders are doing and move ahead of them”…Baskin Financial Services President David Baskin says, “This is sort of a ‘tragedy of the commons’ situation where the high frequency traders have found a way to exploit the market in the short run, but run the risk in the long run of spoiling the markets for everyone”…the Globe describes Baskin as an unabashed critic of the practice…proponents say high frequency trading is actually helping the markets by improving liquidity…

19 Comments

Because i am somewhat combative & although my feelings at

times, were torn between posting & giving it up altogether,

i always return, especially since i seem to always have a

strong desire to respond to what i read. Yesterday, i thought

i had the solution, i decided to contact Terry & request he do

whatever was necessary to disconnect me from his system,

but up to this minute, it has not happened. I therefore

have to believe that, although that my posts seem to offend

some, Terry, the boss, must think they are okay, otherwise

they would not be there for you to read today or i would

already be cut off. Anyway, i will keep on posting & bring

my points forward, whether it is about stocks, politics or

nature. I therefore suggest to those you don’t appreciate

what i post, ignore me. It’s that simple, by responding,it

will tell you are still reading me & that may spur me on,

& surely you wouldn’t want that, would you ? The above is

directed only at those who are sensitive, which, may i add,

seems to be the Minority with a capital “M”. R !

p.s. My vote to do away with high frequency trading.

Why don’t you put your thoughts on a piece of paper which will get them out of your system . Read them a few hours later and you will realize how crazy they are. You can then throw then in the garbage and only you will know .

Thank you frank!!!

Bert I say this with no sarcasm intended and in all seriousness , go talk to a professional shrink and get some help!!!

Frank

We have another Gentleman amongst us. You know what you can do !!!

It’s a little concerning that with pending news, be it only updates but still news, no one is willing to pay more than 20c for RBW shares. If Johnston is telling Shareholders news today( or tomorrow I guess (12th)), the nature of the news must be out there in some ears….still no buying pressure. I realize the sp is constantly manipulated but still. I think you can tell them they don’t need that 230k at 22.5 anymore. No one wants this stock right now even at 20! I am hoping next week things will be different…

CSL should recover its price to the low .40cent range before release of next assaya. Its in an interesting situation regarding favourable results trigering a quick buyout. AZX is another co. with good results and good potential along cadillac break. I look forward to some kind of news from RBW. richard l

I HOPE THAT RBW WONT GO THE WAY OF VGD . COME ON RBW SHOW US THE BEEF TODAY PLEASE

yes, but people are also holding on tight around the 20 c lvl.

Sylvain your timing is excellent. There should be a news release out this

> Thursday. (October 12, 2012.)

Today is Thursday Oct 11th. Very confusing, is it Friday Oct 12th that he meant the NR was to happen?

GQC continues to adjust and current level has no real support. Hopefully , it can stay above $1 mark . Most unlikely it will stay there.

Venture 1296. Is the downtrend now confirmed?

Hey all… Jon/John… can you suggest why were are NOT at the same point as we were in Mar?? in looking at all the metrics, it seems that we could be going back down to 700…. if the same curve is drawn…. just asking…. the volume is dropping off allowing techicals to be hammered and irrational behaviour to come to the front…

thx in advance for your thoughts..!!

GQC down is expected and it only happens late. Do not touch it.

Jeremy please explain how you can say venture is headed to 700. I could see you saying its going down or something of that mature but 700?????? And it seems you have a habit of posting this magical 700 mark of yours. Take your fear mongering over to sh

gils stock picks down 8.7 percent so far this week

Just a friendly reminder… if you want to make some money in GQC… you have to react quick…. tomorrow, it may open higher to $1.05 but will slide back to 90 cents … My guess, it will sink to 60-70 cents mark before the end of the year. Day trade is still the best choice for this one as it has good swings. Remember… do not hold overnight… unless it dropped so much and you managed to scoop some before closing. RBW … we are all waiting… I have not sold a single share yet… Wait for the beef to come. Hopefully, 20 cents is the bottom price from now.

Thanks Theodore, you provided valuable insight. Your postings are now included in my DD

Just a short note, readers, that we’re experiencing some technical problems with the site that we’re currently looking into, but we’re still hoping to post Morning Musings by about 6:15. I’ll note that Sylvain sent a comment that he received a reply from David Johnston that RBW news is expected Monday, so we thank him for that. We apologize for the technical difficulties and appreciate your patience.

Heath… not that I can remember the 700 mark before, but that is the previous low from the crash of 2008… thaT WAS ALL… IS IT IS PURELY CONJECTURE BUT IF YOU PLOT THE CURVE IT COMES CLOSE.. sorry hit ths caps lock!