Gold has traded in a narrow range so far today between $1,764 and $1,774…as of 6:10 am Pacific, bullion is up $3 an ounce at $1,770…Silver is off 9 cents at $33.91…Copper is down 2 pennies at $3.71…Crude Oil has gained 12 cents to $92.19 while the U.S. Dollar Index has retreated one-quarter of a point to 79.56…

Today’s Markets

Asian markets were mixed overnight with Japan’s Nikkei Index falling to its lowest close in more than two months for the second day in a row…European shares are relatively unchanged while stock index futures in New York are pointing toward a slightly positive open on Wall Street….

Chinese Central Bank Vice Governor Predicts 7.8% Yearly Growth

Peoples Bank of China Vice Governor Yi Gang today defended the central bank’s record in managing the Chinese economy, and predicted full-year gross domestic product growth would be around 7.8%…speaking on a panel alongside the annual meetings of the International Monetary Fund, Yi noted that the PBOC has lowered interest rates and required reserve ratios twice each this year…he said loan growth so far this year is running at around 16%, which he characterized as “fairly robust”…meanwhile, speaking on the same panel, Reserve Bank of Australia Governor Glenn Stevens said the economic slowdown in China was worse than his expectations but remains manageable…the Australian economy is strongly linked to China through raw material exports…China will report its third-quarter economic data next Thursday and it is widely expected to have posted a seventh successive quarterly slowdown, with exports verging on negative growth…

Chinese Currency Continues To Appreciate

The renminbi has been trading at or near its strongest level against the dollar since Beijing revalued the currency in 2005…it was last this high 19 years ago…the renminbi closed on Friday at 6.2672 to the dollar, up 0.16 per cent from Thursday and once again near the top of the 1 per cent range in which it is allowed to deviate from a daily fixing set by the central bank…over the past three months the renminbi has climbed about 2% against the dollar, frustrating many investors who had been betting on the currency to depreciate as Beijing tries to support the country’s beleaguered exporters…“This is something that has been quite remarkable,” Louis Kuijs, an economist with Royal Bank of Scotland in Hong Kong, told the Financial Times…“The PBoC [People’s Bank of China] has surprised the markets but the appreciation is in line with the observation that policy makers don’t seem to be as concerned about the slowdown as some people in the markets and some corporates”…one possible explanation for the appreciation is that Chinese officials have expressed concern that the Federal Reserve’s policy of quantitative easing would fuel higher global commodity prices, and a stronger renminbi would be a way of blunting imported inflation…

China will report its third-quarter economic data next Thursday and it is widely expected to have posted a seventh successive quarterly slowdown, with exports verging on negative growth…

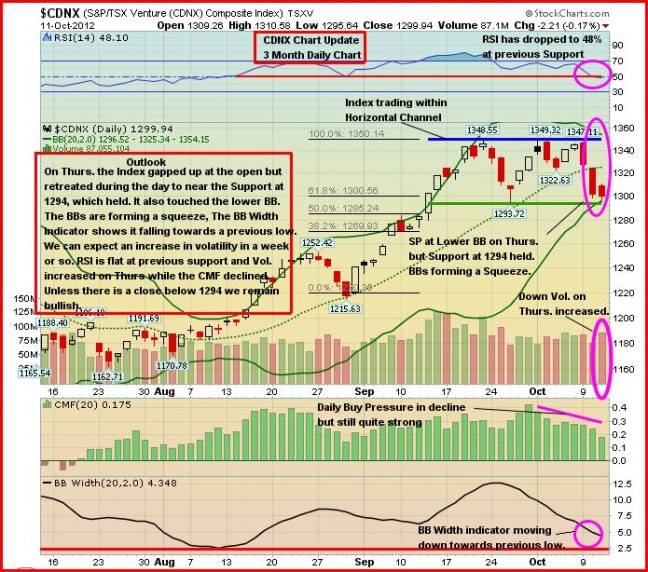

Venture Exchange

The Venture opened higher yesterday but closed down 2 points for the session at 1300, its third consecutive daily loss…the 1294 level is strong support, while beneath that are the rising 50-day and 100-day moving averages at 1273 and 1247, respectively…RSI(14) is at previous support…

GoldQuest Mining (GQC, TSX-V) Update

GoldQuest Mining (GQC, TSX-V) released results from 4 more holes yesterday from its Romero discovery in the Dominican Republic (the best result was 231.6 metres grading 2.04 g/t Au and 0.30% Cu), but the market is starting to see some limitations to the deposit with drilling results not as strong in areas further away from the centre of the main IP geophysical anomaly…the stock climbed as high as $1.46 yesterday but then went into retreat and finished the day below $1 a share at 96 cents for the first time since July 23…ongoing drilling includes the first deep hole below depths (currently at 651 metres), and continues to the south and east of the discovery holes…below is an updated chart from John that shows the stock has a support band between 81 cents and $1.05…

Probe Mines (PRB, TSX-V) Updatre

Probe Mines (PRB, TSX-V) continues to make excellent progress with its Borden Lake Gold deposit in northern Ontario, and the stock is looking much healthier from a technical standpoint with rising 50 and 100-day moving averages for the first time since the beginning of the year…PRB closed up 7 cents yesterday at $1.38, just a couple of pennies below important resistance that we believe the stock should be able to overcome in the near future…

Northern Gold Mining (NGM, TSX-V)

Northern Gold Mining (NGM, TSX-V) has been a very strong performer over the past couple of months with the stock forming a bullish cup-with-handle pattern…this is definitely a situation to keep watching closely as what we now expect is a minor pullback to unwwind current overbought conditions and to allow for the development of the right handle of this pattern…there should be strong support at the EMA(20) as John shows in the chart below…the rising 50-day SMA is at 37.5 cents…this is a nice-looking chart…there are many individual situations in this market that are looking quite bullish from a technical standpoint – another major reason why we believe the Venture will enjoy a strong fourth quarter and experience an acceleration in the uptrend as Q1 gets underway…

Note: John and Terry do not hold positions in GQC, PRB or NGM. Jon holds a share position in GQC.

20 Comments

BMR. I am a little concerned at the way RBW is handling NR’s If you called IR two weeks ago you would have been told to expect a NR by last week at the latest. Another poster was told by David Johnstone via e-mail that a NR would come on Thursday. Then after you suggested Monday would be better now a poster is told that a NR would come by Monday. If Monday is the best day for a NR then that is great, but they need to be more consistent in what they are relaying to shareholders or it leaves them open to questions. ie What are they telling other people and possibly do poeple know more then they should, ie ANNON. I am sure it is just a miscommunication on their part, but it is something they should address for future NR’s.

I think in a general sense, Paul, it’s fair to say that putting out news is probably much more complicated for any company than most investors realize, whether the news is good, bad or in between….personally, as an investor, I prefer it when companies put out good news early in a week…but of course companies can’t always time things that way…..

Rainbow Resources Inc Joins OTCQX

7:00AM ET on Wednesday Sep 12, 2012 by PR Newswire

OTC Markets Group Inc. (OTCQX: OTCM), operator of Open, Transparent and Connected financial marketplaces, today announced that Rainbow Resources Inc (OTCQX: RIINF; TSX.V: RBW), a Canadian based junior exploration company, is now trading on the highest OTC marketplace, OTCQX®.

Photo:

photos.prnewswire.com/prnh/20110118/MM31963LOGO

Rainbow Resources began trading today on the OTC market’s prestigious tier, OTCQX International. Investors can find current financial disclosures and Real-Time Level 2 quotes for the Company on otcmarkets.com.

“OTCQX companies demonstrate their commitment to providing timely and transparent information to investors and maintaining the highest quality standards,” said R. Cromwell Coulson, President and Chief Executive Officer of OTC Markets Group. “We are pleased to welcome Rainbow Resources to OTCQX.”

Soloway Group, P.C. Counselors at Law will serve as Rainbow Resources’ Principal American Liaison (“PAL”) on OTCQX, responsible for providing guidance on OTCQX

Brillo where have you been? Its October bud…

Romney’s move in the polls are getting investors a bit excited because his win will impact QEinfinite. This has created the recent sell off in high beta stocks. I think we’ll see a downward revision in stock markets in the coming weeks since QE3 has already been baked into the market in expectation of a potential Romney win. If Romney does pull off the win, expect a broader market sell off and more pain for Venture stocks to come. If Obama wins then we should see stock markets rally into next spring. For now expect pull backs in stocks as institutional investors reduce equity exposure to reduce risk of a Romney win.

JON/JOHN… I know its about closing numbers… and the venture is now under 1294… again I ask what makes you believe that the CDNX is going up vs down…. i’m just asking because it still feels like there is much fear, and negative sentiment…. I say that since up days Gil’s (just an example) goes up 1%, and on dwn days its goes down 3%…. it seems that QE3 is almost a non-event now… and it is October… but…. thx in advance for your guidance guys!!

It really amazes me how some investors are so day-to-day focused on the markets and so quickly lose focus of the big picture. You get a normal and healthy pullback in the market, one that’s not totally unexpected, with very obvious strong support not far below, and some people go into a panic and think the world is coming to an end. So the Venture drops a point below 1294 on a closing basis. Big deal. I look at the Venture and I see superb support in the 1250-1300 area with rising 50 and 100-day moving averages that aren’t about to reverse. The 1,000 day SMA has reversed to the upside and that’s the new long-term trend (a reversal after a 4-year decline). The Venture obviously bottomed in the 1150 range in an environment of extreme negativity late spring/early summer. So the bottom has been put in. The climb up initially is going to be in small steps, two steps forward and one step back. We saw the same kind of patterns in 2009 and 2010 coming out of the Crash. RSI(14) on the Venture is now at support and SS are in oversold territory. And there’s negativity? Get with it, people – this is when the money is made and now’s the time to be upbeat, not downbeat. A lot of individual stocks have made important breakouts from downtrends in place for well over a year. There are some excellent bargains right now and in 6 months, when everyone is bullish again, that will be the time to sell and bag some huge profits.

QE3 excitement already over? Venture currently down another 10pts today. Would be nice if it vent up as quickly as it comes down.

gils stock picks down 10.94 for the week

Just got off the phone to pierre report will be out monday morning a lot of good things in report according to pierre report on the cores will be another two or three weeks (rbw)

Jon

what do you think about Andrew M’s comments above on the U.S.election, unfortunately I feel he is right on, however I (also unfortunately) think Obama will be re elected in a very close election. Appreciate your comments.

thx

A Romney victory I believe would be bullish for the U.S. dollar and potentially bearish for Gold. Bernanke then better start looking for a new job. This election should have been a slam-dunk for the Republican candidate, but Romney has run a poor campaign. His debate performance however was solid, and Obama’s was awful, and that has kept Romney in the game. At the end of the day, I still believe Obama will win. He has the demographics in his favor including the Latino vote, and Bill Clinton I’m sure will be rolled out in the final weeks to help save Obama for another 4 years. Republicans should be able to hold on to the house and the Democrats are favored to keep the Senate. That’s how I see it at this poi

Jon – Let’s hope that you are right that this is simply a healthy pull back. Typically if the venture is in an uptrend it will fall to the 20dma and find support there. In this case, it clearly broke it. I can only recall one occasion in the last few years where it found support at the 50dma which was in Nov 2010 I believe. Also, recently the venture has not been outperforming the major indicies. Two negatives.

If Romney is voted in, expect QEinfinite to be removed from the books which will most likely cause the Venture to retest 1150 or lower and this is why institutional investors are currently liquidating high beta stocks.

There’s reason for concern at the moment. You’re fooling yourself if there isn’t.

Well if RBw news Monday isn’t assays then it is a non event. Assays will move sp and that’s it and that’s all. Further more I find it odd thst assays will be another three weeks. Should have couple back by now.

NICE POINT JON!

The problem from where I sit Jon your only looking at the big picture from a technical point of view. Bmr has a

Ways maintained that the venture is a reliable leading indicator yet it is under performing the main markets in a big way. At this point it is probably no more than a coin flip which way this thing will turn out.

@andrew m. Our resident fear monger. You have been calling for 700 venture now for months! It’s really quite simple Andrew,,if indeed you believed the garbage you spew then obviously being the self professed expert that you are you would have already sold all you holdings and moved on. So I ask you again why are you here. Just being a Good Samaritan and trying to save us all from dooms day I guess?

Why do I get the feeling that ANNON are the insiders for RBW ??? They had huge amounts of shares and dump it to the unaware retail investors. If the drilling are good, we would have seen the shares jumped up a few weeks ago. My guess is they hit the veins and it’s average.

Dan, it’s a pointless argument with regard to ANON because ANON has been an aggressive seller of RBW since December of last year. In May and June, many on this board were fretting about ANON and terrified that ANON was selling so aggressively from 15 cents on up and look what happened. ANON looked pretty stupid. If someone sold RBW back then simply because they were concerned about ANON, they were foolish too. “ANON” is the most active seller on the entire market. I don’t like the idea that any investor can hide behind ANON anymore than you – I believe that removes transparency from the market, but it’s not something I consider in my investment decisions. It’s a poor indicator and it’s also something that people with far too much time on their hands worry about. People buy a stock for one reason, on the belief that it’s going to go up. People sell a stock for a multitude of reasons. Focus on what matters which are the fundamentals and the technicals. Your suggestion that if the drilling was good, the shares would have jumped up a few weeks ago is strange. How would that happen when the assays aren’t known? That logic implies that because GoldQuest actually dropped to 4 cents during the month of May, following their drilling, that their results must have been bad too. Of course the opposite was the case. I’m hoping I’m making some sense. The way I see it with RBW, so far, so good. Let’s see what kind of news they deliver and evaluate from there. News has been positive all year, and they have a lot going on.

Heath Scotford – I think you’re confusing yourself with the other Andrew. I’ve never considered 700 on the Venture. In fact, I’m still invested in the Venture as I do see a potential bullmarket in the making for small cap stocks, however, this will be dependant on who gets voted into the White House.

I prefer to be invested with the institutional investors rather than the retail investors. Liquidity in the markets are what makes then run up, so when the rug gets pulled out from under let’s hope your still not standing on it.