Gold appears headed for a second straight weekly decline as improving economic data from the U.S. to China has helped dampen speculation of more government stimulus…support for the yellow metal is holding so far, however, at the $1,730 level…as of 8:30 am Pacific, Gold is down $8 an ounce at $1,734…the next major support below $1,730 is $1,700…Silver is off 53 cents at $32.40…Copper is 6 pennies lower at $3.65…Crude Oil is down 33 cents at $91.77 while the U.S. Dollar Index has gained over one-quarter of a point to 79.61…

Will Silver See A Major Supply Squeeze And Massive Price Increase:

Interesting article this morning at www.mineweb.com that we encourage our readers to check out…

Today’s Markets

Asian markets were mixed overnight with China’s Shanghai Composite Index cooling off 3 points to 2128…Japan’s Nikkei share average topped the 9,000 level to log its best weekly gain in nearly a year as expectations of easing from the Bank of Japan and robust risk sentiment on the back of an improved global outlook continued to soften the yen…European stocks are mildly lower…another EU summit has produced an agreement on a timetable to set up a single euro zone-wide banking supervisor run by the European Central Bank…however, leaders have so far failed to agree on the second key step in the bank rescue process: when the euro zone’s rescue fund will be able to start injecting cash directly into failing European banks, giving in to German resistance…it’s a weak day on the major North American exchanges with the Dow down over 100 points and the TSX off 60 points as of 8:30 am Pacific…stocks are extending their losses today, with all key S&P sectors in negative territory, pressured by several disappointing quarterly results and after a report this morning showed existing home sales dipped…

The Venture Exchange bucked the trend yesterday by gaining 8 points to 1312, its third straight positive day…and it’s bucking the trend again so far today with a 2-point gain as of 8:30 am Pacific…

Commodity Markets Showing Strength

One way to gauge the strength of the commodity markets is to analyze the relationship between different currencies…below is a 6-month chart from John that shows the performance of the Canadian dollar vs. the U.S. dollar (blue line), and the Australian dollar vs. the Japanese Yen (black line)…the trend at the moment certainly remains bullish for commodities which helps to explain why important support levels on the Venture have held this week…

Galway Resources (GWY, TSX-V) Takeover

The Venture was given a lift this morning with the news that Galway Resources (GWY, TSX-V) has agreed to a takeover by AUX Acquisition 2 SARL and its wholly owned Ontario subsidiary…under the transaction, Galway shareholders will receive $2.05 in cash and 0.9 of a share in a new company to hold the Vetas Gold project and one share in a new company to hold the Victorio tungsten-molybdenum project…the new companies will be well capitalized with $18-million (U.S.) of cash and $12-million (U.S.) of cash, respectively…upon closing of the transaction, existing Galway shareholders will hold 90% of the Vetas SpinCo and 100% of the Victorio SpinCo…the $2.05-per-share cash consideration represents a premium of approximately 47% over the volume weighted average trading price of $1.39 per Galway Share on the Venture for the 20-trading days ending October 18…it’s anticipated that the arrangement will close on or before December 31, 2012…GWY, which had enjoyed a very good week coming into today, is currently up another 53 cents to $2.12…

Rainbow Resources (RBW, TSX-V)

Rainbow Resources (RBW, TSX-V) has just come out with some interesting Gold assay results, albeit from sampling at two prospective properties in its Big Strike package in the West Kootenays…hopefully this is an omen of things to come for the International and Gold Viking…Rainbow seems to have made some prospecting discoveries at the Whitewater and Referendum properties near the Nelson Gold Camp…two grab samples from a trench exposing numerous quartz veins in a mafic host rock at Whitewater returned 2.06 oz/t Au (64.1 g/t) and 0.86 oz/t Au (26.9 g/t)…the samples were taken from different veins 30 metres apart and have re-submitted for total metallics analysis which will also give a better idea of the nature of the Gold…this part of the Whitewater property, a former underground producer, has seen little exploration other than an access road and trench as reported by Rainbow this morning….meanwhile, an even better sampling result has come from the Referendum Property – 2.51 oz/t Au (78.1 g/t)…this is a sample containing quartz with banded tourmaline from a trench…it is also being reviewed using total metallics analysis…these results merely underscore the potential of RBW’s 13,000-hectare land package which includes half a dozen properties in addition to the recently drilled International, and the Gold Viking Property where a drill program is set to begin…we’ll have much more on Rainbow Monday morning in a special report…RBW is currently off half a penny at 20.5 cents…

Cascadero Copper (CCD, TSX-V)

We’ve been bullish on CCD over the past few months in particular after Lumina Copper (LCC, TSX-V) started reporting excellent drill results very close to CCD’s properties adjacent to 1.7 billion tonne Taca Taca Cu-Mo-Au deposit in northwest Argentina…yesterday, the two companies announced a joint-venture agreement on CCD’s Francisco 1 and Francisco 2 properties, and drilling begins at Francisco 1 as early as this weekend…CCD was one of the most active stocks on the Venture yesterday, climbing 3 pennies to 14 cents on total share volume (all exchanges) of 5 million…the deal is very much a game-changer for Cascadero and ultimately, we speculate, could result in a takeover of the company by Lumina given the strategic location of these properties…there hasn’t been much liquidity in CCD during its lifetime, and yesterday was by far the biggest volume day ever in the stock’s nearly decade-long existence…so some shareholders are just content selling into the volume and moving on…more volume will be required to push Cascadero through stiff resistance in the upper teens, but patient investors could easily get rewarded with this play in the coming months…stock is moving from weak hands into strong hands, and some recent private placements by the company indicate some serious money is placing a strong bet on this deal…below is an updated chart from John on CCD…

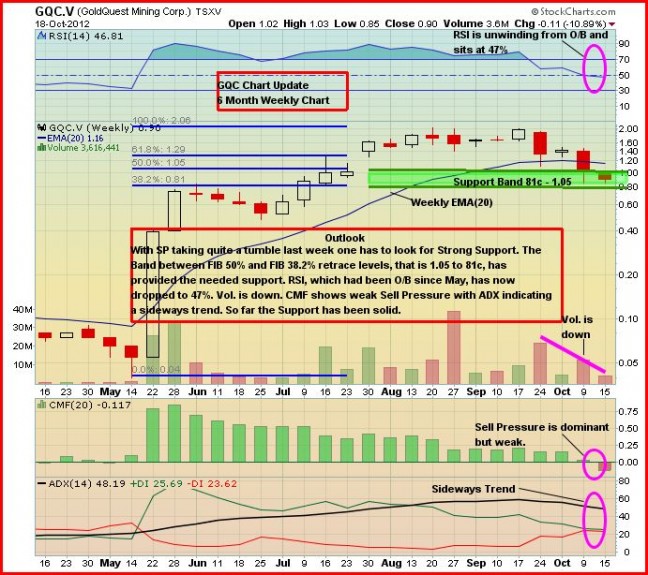

GoldQuest Mining (GQC, TSX-V) Updated Chart

GoldQuest Mining (GQC, TSX-V) appears to have found strong support beginning in the low ’80’s, a little above the rising 200-day moving average…below is an updated 6-month weekly chart from John…

High Desert Gold Corporation (HDG, TSX-V) Updated Chart

Nevada Sunrise Gold Corporation (NEV, TSX-V)

Nevada Sunrise Gold Corp. (NEV, TSX-V) is a new situation that is worthy of our readers’ due diligence…below is a 2.5-year weekly chart from John that provides an overview of the current technical picture…

Note: John and Jon both hold share positions in RBW.

27 Comments

Looks like Gold will drops over $20+ today, and USD going up. Commodity such as oil, silver are down. I’m expecting the markets to drop until the November 6th – US election. Anybody knows if the market will goes up after US election?

it is now more clear than ever to me that rbw results are in hand and are a dissapointment. that is why they are now pumping up these two other properties. ive seen this show many times. hope i am wrong but ill be amazed if assays are good.

Hi Heath, I also have the same concern. RBW did say “While drilling proceeds at Gold Viking, extensive prospecting continues at various Big Strike properties including the recently drilled International Silver Property in an effort to uncover additional high priority potential discovery areas. Results will be released as soon as they are received and reviewed by Moose Mountain Technical Services, Rainbow’s resource consultants.” RBW is saying that once the results are in, they will make them public ASAP. RBW indicates that they do not have the results at hand.

@heath Hope you’re wrong too

One more point to calm my nerves, RBW did indicate that they were a multi season operator, exploring and drilling many sites semultaneously.

Everyone is missing the big story today. Gold down $20 an ounce. TSX Gold Index up. Looks like Venture will also finish up on the day, even with Gold down and the major markets down. This is interesting and perhaps very bullish.

I agree too Heath. Definately cause for concern when companies start pumping other properties while awaiting drill results. I’ve been burnt a few times with companies pumping other properties while waiting for drill results (v.tsu. v. cjc) Doesn’t mean rbw will follow suit, but history has a tendency of repeating itself on the venture. But as Jon pointed out, its great seeing the venture up when all other markets are bleeding red.

Well typically you would see a stick firm up and run a bit before results are released but in this case we are treading water and selling is increasing. And now it’s like all the pumping has left our current property thst was just drilled and is onto the next two. I’m undecided now whether to try to bail now or wait. Can’t even break even and get out if I wanted to on a day like today.

It’s a hit and miss with BMR. I bought KEX, SD, CUI, GBB when BMR were promoting them so heavily and I’m in the RED with those stocks. Down a few thousands bucks… still holding on, hopefully it recovers some day. Have a feeling RBW is in that same group in my portfolios. Have a nice weekend.

sanp taking off

Jon/BMR

have been noticing lately how the stock prices are not reacting to the metal itself, silver down 80 cents and the one stock that has always reacted up and down to the price of silver is SLW which I watch closely. It is unchanged right now as I type, it normally would be down over a dollar at least with silver down 80 cents, this is very bullish for the stocks in my opinion.

That’s an important point. A few months ago, if you had a day when the Dow was down 200 points, and gold was off $20 an ounce, you’d see the Venture in a free-fall. What happened today? The Venture went up. That speaks volumes for where this market is headed but a lot of investors still don’t get it.

BMR

GG actually is up today with gold down over 22 bucks, again very bullish for the stocks.

With this kind of news from RBW, support has fallen to 17 cents according to level 2. Massive sellers have come in from 21.5 cents to 24.5 cents. This one is not going up in the near future. Get ready to acumulate more in the 15 to 17 cent range.

To be exact 167000 shares down to 15 cents and 585000 shares up to 24.5 cents.

Lets just hope that RBW goes up with it?

The RBW CEO promoted the international property, mainly by going around and showing his big shiny silver rock to anyone who would look. I would tend to hope that the assays from the holes should be good. They did expand the program to 15 holes, which should be another indication the results should be good. Nevada is good for year round drilling but it now seems to be overshadowing what is supposed to be a “star” property (International). Its good to have several star properties but they are going to have to focus on one and prove it up before moving on to the other. It it happens that the holes are indeed not good and seeing that they are now “heavily” promoting the other properties, then what Heath says would make sense. There has been every indication that drill results should be good if they are not I would be of the opinion that shareholders were being sent the wrong signals. Lets all hope for excellent drill results and a move up in the SP.

Hi BMR – yes it all looks great and promising when the ventures move up on a day that has seen nothing but bleeding on all the other major indices, no doubt. But you haven’t at all addressed the numerous comments around the concerns expressed by some of the posters pertaining RBW’s release this morning on the progress of their other land packages. The International is the only site everyone ACTUALLY cares about. All the others are icing on the cake and you know it.

In any case, like one of the posters already mentioned, if history is any indication of what’s happening with RBW, it sounds like assays could come back short of expectations (which are lofty) You used the word “OMEN” in your musing this morning, which by the way has a very negative connotation to it, and that’s exactly what today’s news release embodies – an omen of something bad that lies ahead.

Have a good weekend people – I haven’t seen a rainbow quite yet and sorry for being a Debbie downer – I don’t sugar coat.

gils stock picks off 15 percent since oct 1

I would much rather have them prospecting and producing results instead of sitting on their hands waiting for drill results. There are plenty of companies on the venture barely doing anything and just drifting along, would you rather RBW be one of those companies?

I am heavily invested in PTA and RBW. PTA has excelent management. Best investment I have ever made, Bought at .12c and it is pushing to .30 right now. RBW I bought at 23cents. I was so excited about this prospect. So much negativity around this play. Multi mineral assay testing takes about 4 to 6 weeks. I know the first 3 holes should have been done by now. The more I read peoples comments speculating the worst in the company the more I am reminded (however hard it is) to be unemotional about investing. I am staying in it. Jon if can give a honost opinion about the International Play.

What everyone seems to forget is; RBW stated before the International drilling started they would be drilling the other 2 properties right after the International property. In fact, they drilled more holes at the International than originally planned……..that has to be positive? And they are now moving to the next property. Why wait until assays are back before drilling again? Simple, they can’t afford to. The drill is contracted and they must make good use of it. You cannot continue to drill a property that has never been drilled before without knowing the results. Make sense? Also, winter is fast approaching and it makes sense to drill right away.

To add to my comment above, Kudos to management for being agressive in this tough market. Other companies are like cold molasses running up hill.

I guess there is 2 ways to look at it, they drilled more holes than planned 15, that has to be positive, or they drilled more holes than planned because they did not find what they were looking for in the first 10? Who knows, couldn’t get out now if I wanted to, just have to wait and see what happens?

Thanks for your voice of reason and truthful comments Dan. You’re absolutely correct when you say that RBW stated before International drilling started that they would be drilling the other 2 props immediately after drilling International. It’s refreshing to read your “common sense” comments regarding RBW’s activities and the so-called “long” wait for assays. Good luck with your investments.

My sixth sense report card of this week:

====================FORECAST ====================================== ACTUAL===========================================================

RBW.. Low 20 cents High 22 cents, Close at 22 cents ** ——-Low 19.5 cents High 21 cents Close at 20.5 cents – not close

GQC.. Low $0.85, High $1.05, Close at $0.91 ——————Low $0.84, High $1.03, Close at $0.86 — pretty close

GBB.. Low 12 cents, High 14.5 cents, Close at 14 cents **—–Low 9.5 cents, High 12.5 cents, Close 10.5 cents – not good

EVR.. Low 8.5 cents, High 9 cents, Close at 9 cents ———-Low 7.5 cents, High 9.5 cents, Close 8 cents —– not good

SFF.. Low 12 cents, High 14.5 cents, Close at 14.5 cents **—Low 13.5 cents, High 15.5 cents, Close 15.5 cents – better than expected

SF .. Low 2.5 cents, High 3 cents, Close at 2.5 cents **——Low 1.5 cents, High 2 cents, Close 2 cents ——– not close

TYP.. Low 15 cents, High 20 cents, Close at 20 cents **——-Low 15.5 cents, High 16 cents, Close 15.5 cents — my choice to buy

NAR.. Low 3.5 cents, High 4.5 cents, Close at 4 cents ** —–Low 3.5 cents, High 4 cents, Close at 4 cents —– pretty close

** hold a portfolio

@Bert. Hello, are you looking at this site by any chance? I see that Mary March property to finally start a drill going. Canstar ROX-V. Its out your way and could be the barn burner of the yeaar. There was a very, very good hole drilled in 1999/2000 followed by all these years of litigation. Company will start in few weeks, results around Christmas. Worth D.D. I also agree with Dan about RBW richard l