Gold has traded in a range between $1,719 and $1,732 so far today…as of 8:15 am Pacific, bullion is up $1 an ounce at $1,726…Silver is 16 cents higher at $32.66…Copper is off a penny at $3.44…Crude Oil is up 36 cents at $85.74 while the U.S. Dollar Index is up slightly at 81.11…

U.S. Retail Sales Down

U.S. retail sales fell in October for the first time in three months as Superstorm Sandy slammed the brakes on automobile purchases, suggesting a loss of momentum in spending early in the fourth quarter…sales dipped 0.3% (economists polled by Reuters were expecting a 0.2% drop), the Commerce Department said this morning, after an upwardly revised 1.3% increase in September that was previously reported as a 1.1% rise…

Fed Leans Toward Clearer Guidance

The Wall Street Journal reports this morning that the Federal Reserve is inching closer to revamping its communication strategy by stating more explicitly than before what would get officials to start raising short-term interest rates…under a new approach being considered by senior officials, the Fed would state how high inflation would have to rise or how low unemployment would have to fall before it would begin moving rates, which have been near zero since late 2008…

Business Roundtable Lobbies For Congressional Deal

With a heated election season in the rear-view mirror, executives are calling on the White House and congressional leaders to head off a self-imposed deadline that could bring $600 billion in spending cuts and higher taxes early in 2013 if they are unable to reach a deal on cutting the federal deficit…the Business Roundtable yesterday kicked off a print, radio and online ad campaign on which it plans to spend hundreds of thousands of dollars featuring the chiefs of Honeywell International, Xerox and United Parcel Service calling on lawmakers to resolve the “fiscal cliff”…in an opinion piece published last night on the Wall Street Journal’s website, Goldman Sachs Chief Executive Officer Lloyd Blankfein urged the business community and the Obama administration to compromise and reconcile so as not to derail the fragile recovery…one of the more dramatic warnings of the consequences of allowing the U.S. economy to go over the fiscal cliff came from Honeywell CEO David Cote…”If the last debt ceiling discussion was playing with fire, this time they’re playing with nitroglycerin,” Cote said in an interview…”If they go off the cliff, I think it would spark a recession that’s a lot bigger than economists think. Some think it would just be a small fire. I think it could turn into a conflagration”…

One of the biggest problems with the “fiscal cliff” is the mainstream media and its handling of it…as one writer stated the other day, the mainstream media is “a bunch of egomanical ringmasters in search of a circus”…indeed, they always tend to inflate an issue and engage in outright fear-mongering…ironically, the way the media is playing this story actually enhances the chances of a resolution…

U.S. Deficit Rises In October

Despite higher tax revenues, the U.S. deficit increased significantly in October which further underscores the point that Washington primarily has a spending problem, not a taxation problem (though the tax code does need to be completely overhauled)…the deficit rose to $120 billion in October, bigger than forecasts for a $114 billion gap and up from $98 billion in the same period last year…growth in expenditures outpaced rising receipts, deepening the deficit…outlays grew to $304 billion from around $262 billion in the same month last year while receipts rose to $184 billion from $163 billion…meanwhile, the Wall Street Journal reports that President Obama will begin budget negotiations with congressional leaders Friday by calling for $1.6 trillion in additional tax revenue over the next decade, far more than Republicans are likely to accept and double the $800 billion discussed in talks with GOP leaders during the summer of 2011….

Today’s Markets

Asian markets edged up overnight with Japan’s Nikkei Index ending a 7-session losing skid…European shares are marginally lower today while North American markets continue to be under pressure…the Dow, which has hit a 3-and-a-half month low, has retreated 57 points to 12699 while the TSX, down in six out of the last eight sessions, is off another 115 points to 12020…the Venture Exchange suffered its worst session – a loss of 19 points – since October 23 yesterday, albeit on fairly light volume…as of 8:15 am Pacific, the Index is down 17 more points to 1270…the range since the beginning of September has been 1236 to 1349 and the rising 100-day moving average (SMA) is currently sitting at 1260…since October 15, the Index has traded in a narrow 44-point range between 1278 and 1322…as John shows in the 3-month daily chart below, the Index could not sustain a break above the SMA-20 yesterday which means a test of the 100-day SMA at 1260 is highly likely…

SilverCrest Mines (SVL, TSX-V)

SilverCrest Mines (SVL, TSX-V), a strong performer this year and certainly worthy of our readers’ due diligence, reported third quarter results this morning that included 152,000 ounces of Silver sold (558,000 Silver equivalent ounces) and earnings of $2.2 million or 3 cents per share on total revenues of nearly $17 million…record Silver production in the third quarter has enabled SilverCrest to increase annual Silver production guidance from 435,000 ounces to 535,000 ounces…the company is on track to meet its annual production guidance of 33,500 Gold ounces…as of 8:15 am Pacific, SVL is off 9 cents to $2.81…below is an updated 2.5-year weekly chart that shows resistance at $3.17 and very strong support at $2.37…

SantaCruz Silver Mining (SCZ, TSX-V)

We continue to keep an eye on SantaCruz Silver Mining (SCZ, TSX-V) which is focused on advanced-staged projects and near-term production possibilities in Mexico…the stock has a good run since the early summer when it was trading slightly below $1 per share…from a technical perspective, what’s interesting to note is that SCZ may have formed a “cup with handle” pattern though this interpretation would be invalid if the share price were to fall below $2.17 on a closing basis…it’s currently just above $2.20…in any event, this is an interesting situation to keep on one’s radar screen over the coming weeks and months – especially, of course, is Silver takes off…as of 8:15 am Pacific, SCZ is up 3 pennies at $2.27…

Parlane Resources (PPP, TSX-V)

Parlane Resources (PPP, TSX-V) has commenced a 1,500-metre drill program at its Bear Big Property in the Blackwater district, strategically situated between New Gold Inc.’s (NGD, TSX) Blackwater and Capoose deposits…five target areas are being tested…

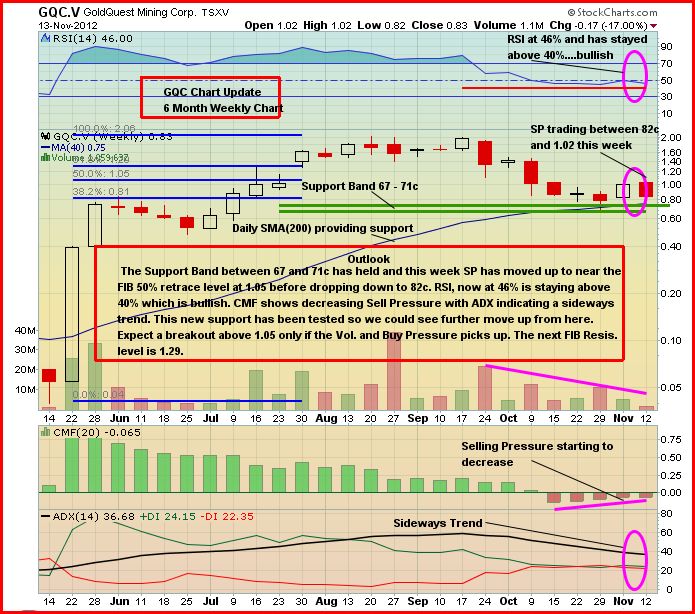

GoldQuest Mining (GQC, TSX-V) Chart Update

GoldQuest Mining (GQC, TSX-V) found resistance at $1.05 recently, as expected, and that is certainly a critical level from a technical standpoint that it must overcome in order to resume its upward trend…as of 8:15 am Pacific, GQC is down a penny at 82 cents…the rising 200-day SMA (75 cents) continues to provide support…

CB Gold Inc. (CBJ, TSX-V)

An interesting out-performer recently has been CB Gold Inc. (CBJ, TSX-V) which has been generating some positive drill results from its Vetas Gold Project in Colombia with success at targeting and expanding numerous vein systems…resistance is strong at $1.10, just above the rising 300-day SMA (it moved briefly above the 300-day earlier this year and then retreated to 80 cents)…a good Gold play to keep on one’s radar screen over the coming weeks in the event of a breakout or a pullback…as of 8:15 am Pacific, CBJ has gained 4 cents to $1.07…

Note: Jon holds share positions in GQC and PPP.

7 Comments

Yet again the CDNX refuses to break through the downtrend established since Feb 11 and has yet to invalidate the H&S pattern – not good. But somehow the CDNX is faring better than the HUI, GDXJ, and GLDX…….strange!!

Nice to see GBB is, at last, starting to paint a pretty picture though.

@ bmr. What exactly do you think will propel the venture? We have the US facing fiscal cliff, Europe in a huge mess. People selling off their stocks because of taxes… You guys keep mentioning we’re in the beginning of a bull run yet venture keeps selling off…. thanks for your time

People were asking the same questions in the spring and early summer. A few weeks from now, investors may be saying, gee, I wish I had been a buyer during that all that “fiscal cliff” stuff that the media was scaring everyone about (the “fiscal cliff” is a serious problem, but the media is certainly getting a lot of mileage out of it). Yes, there are definitely growth issues and debt issues around the world and the only way out is to inflate. That means much higher Gold and Silver prices, continued money printing and aggressive easing measures from central banks, who will not let the markets collapse. There will also undoubtedly be more discoveries and takeovers, so all these factors combined – plus just a much healthier technical picture – provides an excellent foundation for a solid run for the Venture as 2013 begins. The Venture still needs to break out of its downtrend and there’s no reason why that shouldn’t happen by year-end or at the beginning of January. Patience is key. Again, I believe the reversal in the 1000-day SMA is highly significant and indicative of the new long-term trend.

Hi Jon, are you at all concerned about the insider selling at this point in the RBW game?

Nov 7/12

Nov 2/12

Falconer, Alexander

Direct Ownership

Common Shares

10 – Disposition in the public market

-40,000

$0.215

It seems unusual that an insider would be allowed to sell with so much drilling going on and pending results. This is the kind of thing the BCSC should look into. I am concerned but still holding. Thought about buying more, but the insider selling made me stop and think. I know we have more than a good shot with Nevada as there was a historical hole with good results…..are you still confident or are you selling as well?

Regards, Dan

I always looks for trends and patterns in terms of insider selling, not an individual trade, and this appears to be a one-off transaction that could have been related to anything…and it wasn’t much, just 40,000 – not 400,000….maybe he needed some cash to fix his roof, exercise options, who knows…the optics aren’t great but the amount is small and there’s no pattern….to answer your second question, RBW has three plays in action right now and I’m personally confident in at least one of them – anyone’s guess – panning out in the near-term, and I’ve added slightly to my position (about 35,000 shares) in the last week between .16 and .17.

BMW, may I ask what your backgrounds are?

Absolutely. This is my personal blog and I’m a paramedic with an interest as well in financial issues while working toward a degree in pastoral studies. John is a retired civil engineer and has become very good at technical analysis. He is also a investor along with Jon whose background is also in the sports industry and marketing. As we have stated, we are not registered securities advisers. This blog simply expresses our opinions, which you may agree or disagree with.