Gold has traded between $1,704 and $1,716 so far today…as of 7:15 am Pacific, the yellow metal is off $3 an ounce at $1,710…Silver is down 32 cents to $32.95…Copper is off a penny at $3.65…Crude Oil has gained 33 cents to $85.89 while the U.S. Dollar Index is down one-quarter of a point to 80.06…

FMOC Begins Two-Day Meeting

The Fed kicks off its two-day policy meeting this morning, and economists expect the central bank to announce a new round of Treasury securities purchases when the meeting ends tomorrow…the program would replace its “Operation Twist” stimulus which expires at the end of the year…”Operation Twist” was balance-sheet neutral, so any sign of new money creation tomorrow from the Fed should be market and commodity bullish…Fed Chairman Ben Bernanke could be reluctant to go “all out” at this time, however, if he thinks for some reason that this may dampen the urgency of lawmakers to resolve the so-called “Fiscal Cliff” issue by year-end…he may indeed use his podium tomorrow to put politicians on the spot…

China Posts Record Resource Production

China ramped up production of industrial materials including copper and oil products in November, suggesting smelters and refiners are gaining confidence that the world’s second-largest economy is on a recovery course…Copper output set a record in data issued today, reinforcing an optimistic outlook based on record crude-oil throughput, announced Sunday…the data also support indications of an uptick in industrial demand as measured by China’s official Purchasing Managers’ Index, a measure of nationwide manufacturing activity, which rose to 50.6 in November from 50.2 in October, marking its third straight monthly gain – and second consecutive month in expansionary territory…Copper production rose to 531,000 metric tons in November, up 2.1% on month and 11.6% on year, data from the National Bureau of Statistics showed today…this followed data from the bureau that showed Chinese refiners processed 10.17 million barrels a day of crude oil in November, up 4.2% on month and 9.1% on year…Beijing’s unveiling of a trillion-yuan ($160 billion) package of infrastructure stimulus projects in September provided the catalyst for confidence among resource producers, stabilizing steel and copper prices and encouraging mills to restock, analysts said…

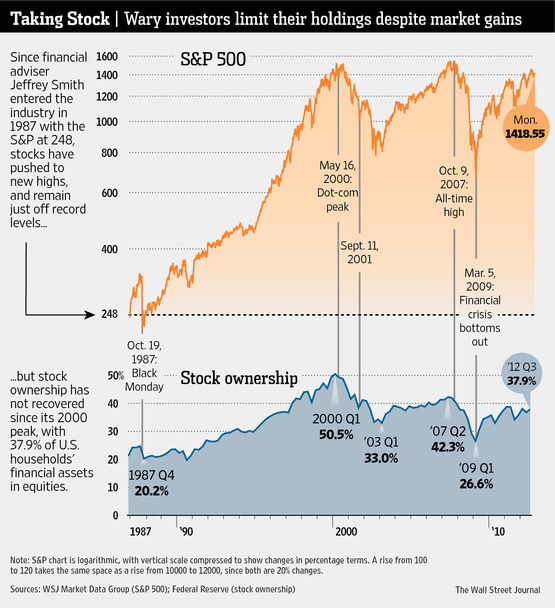

An interesting chart in the Wall Street Journal this morning shows how stocks and stock mutual funds now make up just 37.9% of the average U.S. household’s financial assets, down from 50.5% during the height of the tech-stock boom in 2000, according to the U.S. Federal Reserve…

Today’s Markets

Asian markets were mixed overnight with China’s Shanghai Composite shedding 9 points to 2075…European shares are in solid green territory, thanks in part to a survey that showed a sharp improvement in German investor and analyst sentiment…the Dow is up nearly 100 points as of 7:15 am Pacific, the TSX has climbed 53 points while the Venture is down 6 points at 1181…

Rainbow Resources (RBW, TSX-V) Update

Following last week’s news from Rainbow Resources (RBW, TSX-V), BMR conducted an interview with President David W. Johnston yesterday who expressed a great deal of optimism heading into 2013…below is Part 1 of the interview with Part 2 coming later this week…

BMR: David, we’ll get to Jewel Ridge and some pointed questions on the International in a moment, but first, congratulations on your acceptance into the PDAC Core Shack for the convention in March. What does this say about Rainbow in your view?

Johnston: It was a great honor, and probably one of the rare occasions when a company in just its second year of existence made it into the Core Shack display. It’s not like we have some shiny core from a multi-million ounce discovery, but the selection committee clearly saw a lot of merit in our property package and that’s very encouraging. Our crew has been riding the Rainbow brand very hard all year and in the Kootenays we’ve made a lot of progress with some early stage opportunities, particularly at the International, Gold Viking, Referendum, Whitewater and Rhea properties. We have some excellent samples and drill core to show from the Big Strike Project at PDAC. I was at the event last year and over 30,000 people attended. It was insane. The great thing about the Core Shack is that it’s limited to a select few companies so the exposure is tremendous. And we’re in Session “A”, which is the best session to be in as it covers the first two days. A very significant development for Rainbow and our shareholders.

BMR: As you know, David, at BMR we’ve been very strong supporters of Rainbow this year and we’ll continue to be because we see a young company with some very interesting properties and the right people to achieve success on the ground. Exploration, however, is a risky business with no guarantees and we just saw an example of that with one of your properties, the International, as results came in below expectations from the first phase of shallow drilling. What do you say to investors who were hoping for a lot more from the International, based on your own words earlier this year, with regard to this first-ever drill program?

Johnston: We always strive to exceed expectations, and I wish the grades had been better. So I feel we let investors down in that sense. But let me say this. In no way do these results reflect on the overall merit of the International. We drilled a showing over just 80 or so metres which is just a tiny fraction of the total strike length. You don’t write off a 40 square kilometre property because of that after just 750 metres of shallow drilling. We did intersect the vein and lower grade mineralization in each hole. What we have to do now is move along strike and try to find the source of the high-grade samples we’ve uncovered. Where we drilled was about a kilometre south of the Forgotten claims where the original discovery was made at the International. So the best is yet to come in my view in terms of our drilling success at this property. Discoveries don’t happen overnight. I’m not making excuses, but ground conditions were challenging during our drilling and we have to investigate what we may be able to do in the future in order to improve our core recovery. So we learned a lot from this initial drilling that we’ll be able to apply to future programs.

BMR: Why would you start by drilling a secondary target like the “Cabin” showing when maybe you could have drilled the Forgotten area?

Johnston: The Forgotten claims just weren’t drill-ready and we had to spend some time in terms of improving access to that area, which we did. We felt it was important to complete some initial drilling this summer in order to get a better understanding of everything. This puts us in good shape for next summer.

BMR: You do seem to be making some interesting progress with Jewel Ridge. What are you figuring out there that others may have missed previously?

Johnston: A couple of important points with regard to Jewel Ridge. First, yes, there was a fair amount of historical work done but in this business it’s often the fourth or fifth operator of a project that ultimately makes it successful. When Greencastle for example got some good results about eight years ago, Gold was trading at $400 an ounce. So what was not economic previously may very well be economic now. In fact, Timberline’s Lookout Mountain Project just to the south of us is a great example of that, the progress they’ve made by revisiting that property beginning two or three years ago. Also, we’re doing something which just hasn’t been done before with Jewel Ridge. We’re pulling together all the historical data into one data base for a conceptual geological model. Geologist Sean Derby, who learned his trade in Nevada and knows that area like the back of his hand, he was onsite for our entire drill program and he’s putting together this geological model for Jewel Ridge. I believe it’s going to be incredibly helpful in terms of moving this project forward. We’re finishing the year with something we didn’t have at the beginning of the year – an advanced Gold-Silver exploration project in one of the best jurisdictions in the world.”

Kaminak Gold (KAM, TSX-V)

Support at $1 is holding so far for Kaminak Gold (KAM, TSX-V) which has been under intense selling pressure recently…KAM touched a low of 98 cents yesterday before recovering to close up 8 cents for the day at $1.08 on volume of nearly 2 million shares, the busiest day since mid-2011…below is an updated 2.5-year weekly chart from John…as of 7:15 am Pacific, KAM is up a nickel at $1.13…

Unigold Inc. (UGD, TSX-V) Chart Update

Great Panther Silver (GPR, TSX)Chart Update

Note: Both John and Jon hold share positions in RBW. Jon also has a position in KAM.

15 Comments

BMR can you do an update on SVL and CPN?

SVL for sure very soon.

Great interview there! I still have lots of faith in RBW and I think the Core Shack might bring a lot of new investors in.

Thanks for the morning update as always!

Hi Jon,

I’ve looked at the latest financials on SEDAR and it seems RBW is running low on cash. How are they going to refinance the company without diluting the existing shareholders excessively? Seems like a monstrous job to me, especially in the current market environment.

One of the things we like about RBW is that it proceeds cautiously on financings, and only when they need it which keeps paper in the market to a minimum. They also have the ability to raise money, and that’s the important thing because a lot of companies don’t. There are only 41 million shares outstanding and that compares very favorably with a lot of companies. If you have a project of size and merit, gradual dilution is not a problem as long as the project is advancing. RBW’s Big Strike Project in general is advancing, but I think the real key is going to be Jewel Ridge which I believe is going to surprise a lot of people. It has the size and the merit to move RBW forward very nicely, and attract a lot of investment interest. Nevada is one jurisdiction where it’s a lot easier to attract interest and raise money.

‘ Where we drilled was about a kilometre south of the Forgotten claims where the original discovery was made at the International. ‘

Honestly you couldnt make it up! This obviously was a major blunder, and doesnt show Johnston in a good light in my opionion

That’s one way to look at it, but I would disagree with your conclusion. It was Moose Mountain that made that decision, and I think by drilling the lower showing first, they have a much better grasp on this property now than they had before, which actually enhances the chances of success when they drill further north. Keep in mind, this property has never been drilled before. Knowledge is power. They have knowledge they didn’t have before which will aid a lot in terms of tackling the original discovery area.

an interesting NR today from Pure Nickel (NIC TSX) for a significant gold discovery in Alaska

and a funny NR from Curie Rose with drill results from Tanzania but no one can trade the stock any time soon… hahaha!!

Yes that may be true, but wouldnt you want your first drill program to have high impact….hopefully increase the share price and raise a good amount of money for next years programme at a higher price. If it was just a case of needing more time improve access to an area, then its very poor judgement to drill a second class target first, just to gain knowledge of the area.

You make an excellent point, Mark. Having said that, I think they did expect better grades out of the Cabin showing – at least something that made a statement. In our interview, Johnston referred to some core recovery issues. Some of the mineralization could have been lost due to this, something they’ll have to look into.

I think that jewel ridge will raise the share price of this stock enough to do a decent private placement say at 50 cents or so. 🙂

hi, i dont see the chart for KAM.

Thanks for your chart updates on Unigold, Great Panther Silver, and Kaminak. All companies I have an interest in.

moneyweek.com/investments/precious-metals-and-gems/when-will-gold-stocks-take-off-61800

Looks like RBW is going to try another shot at breaking the 15 cent level today. Level 2 is showing not much for sale past 15 until 19 or 20 cents. Getting some strength before assay results come out will go along way to show shareholder confidence and possibly an indication of good results. Also the sooner the results the better they will be i believe. Hoping for results next week just before christmas would be perfect.