Gold has traded between $1,647 and $1,660 so far today…as of 6:15 am Pacific, the yellow metal is up $10 an ounce at $1,657…Silver is 26 cents higher at $30.42…Copper is flat at $3.64…Crude Oil has gained 44 cents to $93.63 while the U.S. Dollar Index is up one-quarter of a point at 80.36…

Today’s Markets

Asian markets ended lower today as investors took a break from the the recent rally with caution setting in ahead of corporate earnings season for the last quarter of 2012 and the European Central Bank’s policy meeting later in the week…Japan’s Nikkei average lost 90 points to 10508 while China’s Shanghai Composite fell 9 points to 2276…European shares are up slightly despite some mixed economic data this morning.. retail sales for the bloc showed a 0.1% rise for November from the previous month, but a -2.6 percent drop from the same month the previous year…economic sentiment data showed the business climate in the euro zone was at its highest level since July, climbing to a figure of 87.0 from 85.7 in November…unemployment data was released showing another record high for November with 113,000 people losing their jobs…futures in New York as of 6:15 am Pacific are pointing to a slightly negative open on Wall Street…the Venture Exchange finished down 4 points yesterday on low volume at 1224, several points above the 10-day moving average (SMA)…the rising 20-day moving average (SMA) at also expected to provide strong support…

U.S. State & Local Governments In Best Financial Shape Since Recession

Interesting article from Bloomberg this morning…U.S. state and local governments are in their best financial shape since the recession, giving them leeway to cushion the U.S. economy from federal budget cuts with spending and hiring of their own…after slashing their workforces by about half a million in the past five years, state and local authorities will add employees in 2013, according to Pennsylvania-based Moody’s Analytics…their payrolls in the fourth quarter will be 220,000 larger than in the same period for 2012, Moody’s projects…other expenditures including investment will also be higher, rising by 1.8%, triple the increase last year, according to projections by St. Louis-based Macroeconomic Advisers…the shift will help the U.S. weather the blow from federal tax increases and spending cuts, keeping the expansion on course…states and municipalities accounted for 12% of GDP in 2011 and won’t be a drag on growth this year for the first time since 2009..

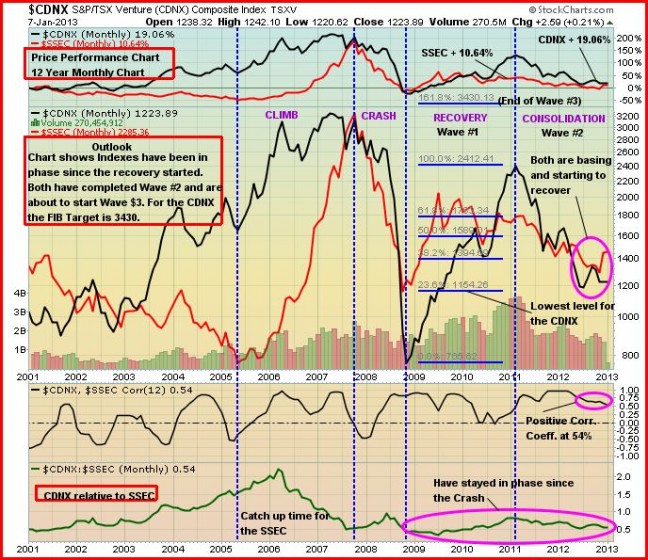

Venture-Shanghai Comparative Chart

As we’ve been pointing out, there are some interesting parallels in chart patterns the last several years between the Venture and China’s Shanghai Composite…below is an updated chart from John comparing the two markets in a monthly chart going back to 2001…note the different phases – the climb, the crash, the recovery and the consolidation…it appears China has finally turned the corner, breaking out of a downtrend that had been in place since early 2011, and we believe that bodes well for the Venture as 2013 progresses…

Canadian Dollar Updated Chart

Another good indicator for the Venture is the very healthy state of the Canadian dollar which is underpinned by a very strong support band as shown in John’s chart…the dollar is trading above the weekly EMA(20), and the 300-day SMA at $1.00 is rising…all indications are, the Canadian dollar should continue to gradually gain strength…

Tinka Resources (TK, TSX-V) Chart Update

Tinka Resources (TK, TSX-V) was halted about 30 minutes ago (5:45 am Pacific), at the request of the company, pending news…we’ve been watching Tinka closely over the last few months as it has been making steady progress with its 100% owned Colquipucro Silver-lead-zinc project in Peru..the stock was a strong performer in 2012 and showed impressive strength in the final quarter when many other stocks were under pressure…we’ll see what this morning’s news brings…the EMA(20) has provided excellent support and is currently at 91 cents…the stock closed yesterday at 96 cents…

Corvus Gold (KOR, TSX)

Corvus Gold (KOR, TSX) has backed off marginally from an all-time high of $1.83 in early December…it closed at $1.62 yesterday, a penny or two above its rising 50-day moving average (SMA) which is significant as the 50-day has provided unflinching support for this stock since mid-September…the rare occasions when KOR has dropped below its 50-day over the past year have proven to be smart buying opportunities…the stock has traded within an upsloping channel since the beginning of 2012…the bottom of that channel, as John shows below in a 2-year weekly chart, and the EMA-20 at $1.44, are also areas of very strong support…

Note: John, Jon and Terry do not hold positions in TK or KOR.

2 Comments

Intelligent investors must need a couple more days to digest rbws last nr!!!

intelligent investors will short the dow – not invest in the garbage ventures

wake up guys – you’re beating a dead horse

can’t believe I bought into bmr’s pump and stuck with a pile of sh#t.

we sit at 14 cents and anon is dumping at every opportunity

intelligent investors – lmao