Gold continues to show strength by staying above the $1,600 level…as of 7:10 am Pacific, bullion is up $9 an ounce at $1,616 after touching a high of nearly $1,619 (resistance at $1,620)…Silver has jumped 46 cents to $29.28…Copper is off a penny at $3.43…Crude Oil, at $92.91, has lost 59 cents while the U.S. Dollar Index is up one-tenth of a point to 82.92…

Today’s Markets

Asian markets were mixed overnight but Japan and China both showed strength…the Nikkei average hit a new 4.5-year high, climbing 167 points or 1.3% to close at 12636…the Shanghai Composite, meanwhile, edged 7 points higher to finish at 2324…after a mild correction, the Shanghai is now at a one-month high…signs of growth have returned to China’s manufacturing sector after the latest HSBC Flash PMI rose to 51.7 for the month of March, recovering from February’s weaker holiday-impacted reading…sentiment was also lifted after the Federal Reserve reaffirmed its commitment yesterday to leave interest rates unchanged near zero and continue buying $85 billion in debt each month…the correction in the Shanghai that started in February appears to have run its course, and that would be a positive development for global equities in general…below is an updated 6-month daily chart from John through yesterday’s trading…today’s action confirmed the breakout from the recent downtrend…

European markets are weaker today, generally off about 1%…in North America, the Dow is off 66 points through the first 40 minutes of trading while the TSX has declined 59 points to 12767…today is budget day in Canada with Finance Minister Jim Flaherty expected to deliver a stay-the-course plan after the markets close at 1 pm Pacific today…the Venture has given up a point to 1105…

Four-Week Average For U.S. Jobless Claims Falls To Lowest Level In Five Years

The number of Americans filing new claims for jobless benefits edged higher last week, but a trend reading dropped to its lowest in five years and pointed to ongoing healing in the labor market…initial claims for state unemployment benefits rose 2,000 to a seasonally adjusted 336,000, the Labor Department said this morning…economists polled by Reuters had expected 342,000 first-time applications last week…the four-week moving average for new claims, a measure of labor market trends, fell 7,500 to 339,750, the lowest level since February, 2008, which could bode well for job growth in March…

Screws Tighten On Cyprus

The European Central Bank set Cyprus a Monday deadline to agree a bailout plan, threatening to cut off funding to the islands’ cash-strapped banks if a program is not agreed by then with the EU and the IMF…the decision by the ECB’s Governing Council, announced this morning, gives Cyprus a last chance to agree a bailout that bears the EU/IMF stamp, or else succumb to financial meltdown…Cyprus has faced the prospect of bankruptcy since Tuesday when its tiny parliament voted unanimously against a levy on bank deposits to raise 5.8 billion euros ($7.51 billion) demanded by the EU under a 10 billion euro rescue…

Euro Zone Economic Downturn Deepens

Surveys compiled by Markit show the euro zone’s economic downturn has deepened this month, even before the Cyprus debacle erupted, creating another headache for policy makers battling to revive the bloc’s fortunes…the Flash Euro Zone Composite Purchasing Managers’ Index, which makes up about 85% of the final reading and is seen as a reliable economic growth indicator for the bloc, fell from February’s 47.9 to 46.5 in March…that was lower than all forecasts in a Reuters poll of 23 economists and far short of median expectations for a small rise to 48.2…the Index has been below the 50 mark that separates growth from contraction for all but one of the past 19 months…having already contracted since the second quarter of last year, Markit said the latest PMI data suggested the euro zone economy would shrink 0.3% in the current quarter…most survey responses were received before news of the Cyprus deal, including an unprecedented levy on all bank deposits, broke. Survey compiler Markit, who released the preliminary data and will issue final responses at the start of April, said the picture could be even worse by then…“Events that hit business confidence can have a very rapid effect on the data and so there is good reason to believe that responses we collect this week will on average be more negative,” said Chris Williamson, Markit’s chief economist…“It’s really quite disappointing…given the deterioration in the political and financial market outlook there is really little hope from what we see that there is going to be a turnround in the second quarter, and in fact more likely an increased weakening”…

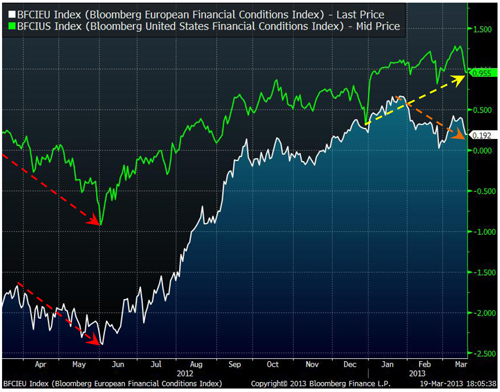

EU Financial Conditions Index

Below is an interesting snapshot from Bloomberg of overall financial conditions across the EU…the Bloomberg European Financial Conditions Index (BFCIEU) combines real-time measures of credit spreads, money markets, bond markets and more…as shown in the graph below, when financial conditions are tightening – a sign of growing risk and volatility in markets – the Index value declines, as it did in mid-2012 when Spain required a bailout…as you can see, financial prospects in the U.S. and Europe have been following diverging paths since February especially, even before the Cyprus problem…financial conditions in the U.S. remain much stronger than in Europe, and neither Index is anywhere near the lows of 2012…it’ll be important, however, to keep a watchful eye on the EU Index to see if the downward trend continues…if it starts to fall off a cliff, then that would mean contagion is spreading in the EU…

GoldQuest Mining (GQC, TSX-V) Updated Chart

Weak technicals continue to put pressure on GoldQuest Mining (GQC, TSX-V) while the company continues with its 30,000-metre drill program on the Las Tres Palmas trend in the Dominican Republic…in addition, recent comments by President Danilo Medina regarding Barrick’ Gold’s (ABX, TSX) Pueblo Viejo Mine have unnerved some investors who are now concerned about the threat of resource nationalism in that country…it seems politicians everywhere are very good at killing the goose that laid the golden egg…GQC is up half a penny in early trading at 39 cents…below is a 2.5-year weekly chart from John…the next major support level is 35 cents…

Lumina Copper Corp. (LCC, TSX-V) Chart Update

Gold Canyon Resources (GCU, TSX-V)

A support band between 30 and 43 cents continues to hold with Gold Canyon Resources (GCU, TSX-V) which has outlined more than 5 million ounces of Gold (indicated and inferred) at its Springpole Project in northern Ontario…RSI(14) appears to forming an important bottom below 30 as shown in John’s 4-year weekly chart below…

Note: John., Jon and Terry do not hold share positions in GQC, LCC or GCU.

3 Comments

V.MEK has 2.5 mil cash and a drill program with Goldcorp in Timmins I mentioned here yesterday @ .04 is moving with volume . V.SUP has 8.5 mil cash and a drill program near QIT and LOT . Both look great even in this piss poor gold jr market ….

Finally some upward movement in the HUI, I can start to wipe some of the blood thats been pouring out my eyes for the last few months! 🙂

Frank speaker = I Internet troll and spammer