Gold is rebounding moderately after dipping below $1,350 overnight…yesterday’s drop of around $125 an ounce eclipsed the rout on January 22, 1980, a day after bullion hit its then-record $850 on global panic over oil-led inflation due to the Soviet invasion of Afghanistan and the Iranian revolution…as of 6:00 am Pacific, Gold is up $43 an ounce at $1,396…Silver has gained $1.14 to to $23.83…Copper is off a penny at $3.27…Crude Oil is down 36 cents to $88.35 while the U.S. Dollar Index is off one-fifth of a point to 82.12…

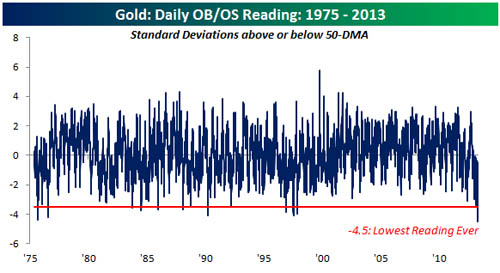

Bullion finished yesterday 4.5 standard deviations below its 50-day moving average (SMA), the most oversold it has been – based on that measurement – since 1975 as the chart from Bespoke Investment shows below…so it’s no surprise we’re now starting to see Gold begin to rebound, especially with some short-covering taking place…however, does this mark a true reversal – has Gold’s decline already run its course?…or is Gold now in the midst of a “sucker’s rally”?…as you’ll see in our comments this morning, this is a very complex scenario that has to play itself out…

RBC: “Significant Pain At $1,300 Gold”

In a study published yesterday, RBC Dominion Securities Inc. predicted “significant pain” if Gold were to trade at an average price of $1,300…“We would expect all the Gold producers in our coverage universe to cut all discretionary expenses, cut capital spending sharply, defer new capital development programs and in some cases cut dividends”, the bank said in the report looking at producers to assess exposure to falling prices at price levels ranging from $1,500 an ounce to $1,200 an ounce…at $1,200 per ounce, the bank said, companies such as Barrick (ABX, TSX), Kinross (K, TSX) and Newmont Gold Co. (NMC, TSX) could be downgraded to non-investment-grade levels…in the falling Gold price environment, the bank said, companies with big projects on the go may require additional debt to complete plans…Goldcorp Inc. (G, TSX), New Gold Inc. (NGD, TSX), Yamana Gold Inc. (YRI, TSX) and Agnico-Eagle (AEM, TSX) are among the miners best able to withstand lower prices because they have lower costs, lower levels of debt and have recently completed new mine development…miners with a higher proportion of Gold production from underground mines are also in better shape because they can change plans to access higher-grade, lower-cost ore, the bank report stated…

Gold 12-Year Chart

John has two long-term Gold charts this morning…the first chart (12-year monthly) shows how Gold has found support – for now at least – in the low $1,300’s, just above the Fibonacci 50% retracement level ($1,306)…RSI(14), however, has broken below previous support during the Crash of 2008 and this is a major concern…in addition, the Slow Stochastics indicator shows additional weakness in the price of Gold is possible…in other words, we need to be careful about trying to catch a falling knife here, or thinking that a bottom in Gold has already been put in…traders are likely going to short any rallies for now…

Gold 20-Year Monthly Chart

Below is an even longer-term chart from John that goes back two decades and includes, of course, the $253 low in 1999 and the $1,924 all-time high in September, 2011…April is the first time that sell pressure has been dominant since 2002…RSI(14) at 39% can fall further while the ADX indicator shows a bearish crossover for the first time since mid-1999…again, this now appears to be more than just a “normal” correction…rallies are going to occur from time to time to help alleviate extreme oversold conditions, but one cannot rule out the possibility of a further drop in Gold to the long-term Fibonacci support levels between $1,088 and $1,286…that is the risk…again, this is a complex scenario…the average “all-in-sustaining costs” for many producers is around $1,100 an ounce, so we little likelihood of Gold dropping below that level…

TSX Gold Index Chart

Gold producers, of course, have taken a beating with the TSX Gold Index down an incredible 24% through just the first half of April (36% for the year) as it closed yesterday at 194…the previous support band between 225 and 240 will now provide very stiff resistance on any move from current levels to the upside…RSI(2) has fallen below 1, the most extreme reading we’ve seen over the last dozen years…there is long-term support at 200, so we’ll see if this can hold in the coming days…there are still significant downside risks (following a rally out of grossly oversold conditions) given the chart damage that has been inflicted…

Today’s Markets

Asian markets trimmed their losses overnight with Japan’s Nikkei average closing down 54 points at 13221…China’s Shanghai Composite closed up 13 points at 2195…European shares are down moderately but off their session lows…German data released this morning shows investor morale has tumbled in April…stock index futures in New York as of 6:00 am Pacific are pointing to a strong opening on Wall Street today…however, as John’s chart shows, a correction in the Dow to at least the 14000 level now seems certain given the current technical picture as overbought conditions begin to unwind…

The TSX fell a whopping 333 points yesterday to close just above the 12000 level while the Venture Exchange plummeted 64 points to 958 – the first time this Index has been below 1000 since early 2009…next major support is at 860…

Commodity Weakness, Deflationary Scenario

The technical deterioration in the TSX is disturbing, and of course the Venture already flashed a warning signal in February when it could not hold an important support level in the 1150’s…this is about more than a sell-off in Gold…there is commodity weakness across the board which is painting a troubling deflationary picture of the global economy…China is a major concern, and its lower-than-expected Q1 GDP growth released yesterday raises alarm bells when viewed in the context of other economic data that has come out of that country recently…a report from the Financial Times showed that the world’s top commodities traders have pocketed nearly $250 billion over the last decade, riding a commodities super-cycle caused by the industrialization of China and other emerging countries…these boom years for China have now been superseded by uncertainty, according to Citi Bank….”Chinese overcapacity remains an issue, as the investment-led boom over the past few years increased plant capacity”, it says…”A tighter financing environment awaits local governments due to the need to contain the expansion of local government debt and re-orient the economic model”…steel, cement, petrochemical, non-ferrous metals and thermal coal power could all be affected due to this belt tightening, according to Citi…

The commodity-sensitive TSX has fallen nearly 900 points over the past month and likely has further to go on the downside which is why we have been highlighting the double-short HXD ETF (S&P/TSX 60) ever since it was trading in the $7.60’s as our “Contarian Call” back in February…it ran into resistance around $8.40 and then found support recently at $8.00 before shooting back up, as predicted…this is essentially the TSX “in reverse”, and the fact this chart pattern is so bullish should be of concern to any TSX “longs”…this is different than the spike last November…the 6-month daily chart of the HXD below suggests there is more trouble ahead for the TSX despite today’s rebound…

3 Comments

so you see the venture actually getting down to 860?

B. Murray, CEO of RBW acquired 60,000 shares of RBW on the public market on 27 March.

2 million shares GBB buy lot at 4 cents dumped. Looking at 3 cents now…. totally collapsed.