Gold continues to hold up above $1,400, an encouraging sign – for the short-term at least – as the yellow metal attempts to recover from the recent brutal sell-off…as of 7:35 am Pacific, Gold is up $12 an ounce at $1,426…Silver is 7 cents higher at $23.01…Copper has gained 6 pennies to $3.15…Crude Oil is up $1.12 cents to $90.31 while the U.S. Dollar Index is off slightly at 82.98…

The SPDR Gold Trust, the world’s largest Gold-backed exchange-traded fund, said its holdings fell 0.68% to 1,097.19 tonnes yesterday from 1,104.71 tonnes on Monday, their lowest level since October, 2009…but premiums for Gold bars soared to multi-year highs in Asia after a spate of physical buying ran down supplies, with dealers in top consumer India expecting a surge in imports this month…according to Reuters, sellers in Hong Kong were still quoting premiums as high as $3 an ounce to spot London prices, their highest level since October, 2011…

Global Silver investment rose in 2012 but fabrication demand dipped as the economy remained soft in many parts of the world, according to a report released today by the Silver Institute…total Silver demand rose to 1.048 billion ounces from 1.039 billion in 2011, according to the World Silver Survey 2013 published by the Silver Institute annually since 1990…data for the report was independently compiled by the London-based metals consultancy Thomson Reuters GFMS…total world Silver investment – including both implied net investment plus coins and medals – rose marginally to 252.7 million ounces last year, with this share of total Silver demand remaining steady at 24%, according to the report…total silver fabrication fell 6.6% to 846.8 million ounces in 2012…this accounted for 81% of total demand…despite the fall, this demand was described as still “relatively robust” by Neil Meader, head of precious metals research and forecasts at Thomson Reuters GFMS…meanwhile, Silver mining production rose 4% to a record 787 million ounces in 2012 from 757 million the year before, with the bulk of the increase being Silver that was a by-product of mining operations for other metals…However, the supply from government sales, Silver scrap and producer hedging all fell last year…total Silver supply from all of these sources climbed to 1.048 billion ounces in 2012 from 1.039 billion the year before…Mexico was the world’s largest Silver producing country in 2012 with record output of 162.2 million ounces, an increase of 6% from the prior year. gold, silver, lead and zinc…other top producing countries included China, 117 million ounces; Peru, 111.3 million; Australia, 56.9 million; and Russia, 45 million…

Barrick Gold (ABX, TSX) Reports Better-Than-Expected Q1 Profit

Barrick Gold (ABX, TSX), the world’s largest producer of Gold by sales, reported first quarter profit this morning that beat analysts’ estimates as costs rose less than expected…net income declined to $847 million, or 85 cents a share, from $1.04 billion, or $1.04, a year earlier…earnings excluding one-time items were 92 cents a share, topping the 86-cent average of 21 estimates compiled by Bloomberg…sales fell to $3.44 billion from $3.64 billion, trailing the $3.49 billion average of eight estimates…the company’s so-called total cash costs per ounce were $561, compared with $540 a year earlier and the $654 average of six estimates…all-in sustaining costs, an important metric recently introduced by Gold producers, were $919 an ounce…Barrick is up 57 cents in early trading to $18.58 which is still a nearly 40% drop for the month of April…according to Bloomberg, Barrick is getting 65% less Gold out of the ground when they mine a ton of earth compared to 13 years ago…like many producers, their profit threshold has been growing higher due to rising energy and wage costs coupled with diminishing ore grades…

Signs of Slowdown In U.S. Factory Activity

Orders for long-lasting U.S. manufactured goods recorded their biggest drop in seven months in March and a gauge of planned business spending rose modestly, adding to signs of a slowdown in factory activity…durable goods orders slumped 5.7% as demand fell almost across the board, the Commerce Department reported this morning…economists surveyed by Dow Jones Newswires expected a 2.9% drop in March orders…today’s report echoes other recent data suggesting solid but slowing growth through the first quarter of the year as consumers and businesses became increasingly cautious…business investment rose 6.7% in January but contracted a downwardly revised 4.8% in February…

Today’s Equity Markets

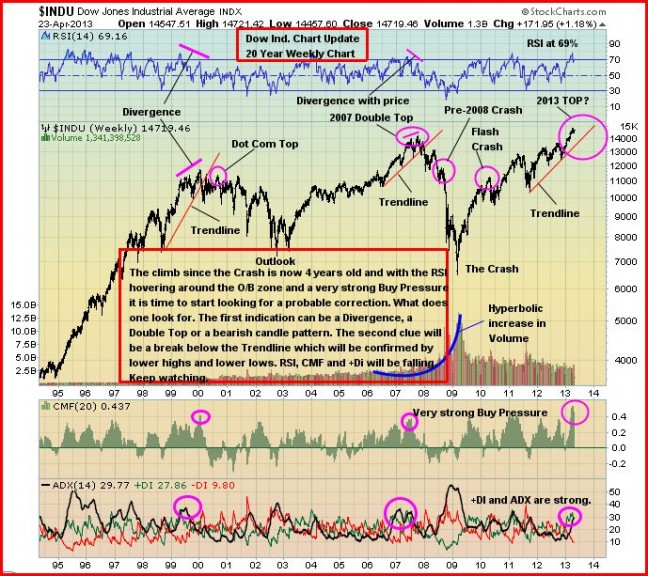

The Dow is off 11 points to 14709 through the 65 minutes of trading today…below is a 20-year weekly Dow chart from John…RSI(14) is beginning to retreat which could be a sign that the Dow is already in the early stages of a correction after pushing as high as 14888 April 11…note the trendline support…another test of that support, perhaps this quarter, is likely…

In Toronto, the TSX is 88 points higher at 12179 which puts it slightly above its 10-day moving average (SMA) which has provided consistent resistance since mid-March…the Venture has gained 2 points to 943…European shares are up in late trading overseas but off their session highs as German business sentiment data came in worse than expected…a growing number of analysts are of the opinion that the ECB will cut its benchmark interest rate at the next policy meeting in May…in Asia, Japan’s Nikkei average surged 2.3% overnight to close at 13843 while China’s Shanghai Composite recovered 34 points of 1.6% to finish at 2218 after yesterday’s big drop…below is an updated 6-month Shanghai chart from John, and it flashing some warning signs…the trend turned bearish near the end of February and remains so…an important support level is 2150…

Robex Resources Inc. (RBX, TSX-V) Update

Few stocks on the Venture so far this year have performed as well as Robex Resources Inc. (RBX, TSX-V) which is working on numerous Gold projects in Mali, West Africa, the most advanced of which is Nampala…a recent feasibility study for Nampala revealed a pre-tax net present value (NPV) of $113.6 million at a Gold price of $1,250 and an impressive internal rate of return (IRR) of 45.45%…Robex is up another penny-and-a-half in early trading today to 21.5 cents…its 52-week high (last month) is 22.5 cents which helps explain a large offer of 2 million shares this morning at 22 cents which is also a Fibonacci resistance level…half of that has been taken out in the last few minutes…below is a 2.5-year weekly chart from John…the upsloping channel is impressive, and RSI(14) at 57% leaves room for a potential breakout to a new 52-week high…as always, perform your own due diligence…

Note: John, Jon and Terry do not hold share positions in RBX.

5 Comments

Rainbow Resources closes $344,580 placement

2013-04-24 14:54 ET – News Release

Shares issued 42,427,719

RBW Close 2013-04-23 C$ 0.05

Mr. David Johnston reports

RAINBOW RESOURCES COMPLETES FINANCING

Rainbow Resources Inc. has completed the first tranche of a non-brokered private placement financing consisting of 1,325,000 units at 10 cents per unit and an additional 1,767,333 flow-through units at 12 cents per unit for gross proceeds of $344,580.

Each of the units and flow-through units comprises one common share and one common share purchase warrant. Each warrant entitles its holder to acquire one additional common share of Rainbow at a price of 15 cents for 24 months.

The gross proceeds from the sale of the flow-through units will be used for continued exploration at the company’s gold-silver-lead properties in southeastern British Colombia. The net proceeds from the sale of the units will be used for exploration of the company’s Nevada properties and potential expansion of the overall land packages, and for general corporate purposes.

The offering is subject to final approval of the TSX Venture Exchange.

We seek Safe Harbor.

looks likes rbw stays alive but no drilling this year

maybe a pp at 1 centscan raisesome doe

Ok,now that financing is done,rbw,has nowhere to go but up.lets get it on.holding and staying positive…

Hi Jon.

What do you make of the shares and warrants acquired by Johnston and Murray at RBW? TIA

Very pleased to see that. Always positive when management of a company participate in a PP.