Gold has traded between $1,375 and $1.388 so far today after Friday’s sharp decline that took bullion back below $1,400…as of 7:15 am Pacific, Gold is flat at $1,385…Silver is up 25 cents at $21.95…Copper is off 3 cents at $3.24 after economic data out of China over the weekend raised more concerns regarding growth in that country…Crude Oil is down 68 cents at $95.35 while the U.S. Dollar Index is up slightly at 81.92…

China has approved 2 domestic exchange-traded products backed by Gold as global holdings of the precious metal in ETPs dropped to a 2-year low…Huaan Asset Management Co. and Guotai Asset Management Co. have received the China Securities Regulatory Commission’s permission to start the funds, which will be denominated in yuan…they will be traded like stocks on the Shanghai Exchange, tracking movements of spot Gold…

Deutsche Bank has launched its second-biggest Gold-storage vault in Singapore that can hold up to 200 tonnes of the metal as it looks to capture surging global demand for physical bullion…Singapore last year excluded Gold traded for investment from sales tax, prompting interest in buying and storing bullion in the city-state…”The time is ripe for a facility in the region (Asia-Pacific) to pick up steam.,” stated Mark Smallwood, head of wealth planning at Deutsche Asset & Wealth Management for the Asia-Pacific region…”We believe that Singapore is well positioned to develop as a complementary custody and trading platform to the traditional hubs,” he added (source: Reuters)…

China’s Producer Price Deflation A Concern

The downturn in the Chinese economy could be the most drawn-out since the 1997-1998 Asian Financial Crisis, according to research firm IHS, following a slew of weaker-than-expected economic data for May released over the weekend…”The macro data for May have confirmed that the economy is stuck in stagnant growth again after a brief rebound…the risk for growth is now predominantly on the down side,” Xianfang Ren, senior economist at IHS, wrote, highlighting that persistent deflation in producer prices and the pullback in fixed asset investment growth are two grave concerns…”Deflation (producer prices) has lasted for 15 straight months, compared with 12 months during the Global Financial Crisis (in 2008-2009)…that offers a signal that this round of downturn might turn out to be the most drawn-out one since the Asian Financial Crisis which had thrown China into 31 straight months of deflation,” she said…China’s producer price index fell 2.9% in May from a year earlier, steeper than a 2.6% decline in April…industrial deflation is ‘poisonous’, Ren added, as it impacts business profitability and thus deters investment in inventory or equipment…the cornerstone of China’s economic recovery, fixed asset investment, also saw growth weakening to 20.4% year-on-year in the January-May period from 20.6% in the January to April period – driven by a slowdown in the manufacturing sector…

Today’s Markets

China’s Shanghai Composite is closed until Thursday as the country celebrates the “Dragon Boat” holiday…Japan’s Nikkei average soared 5% overnight to close at 13514 after a revised reading of Japan’s first-quarter GDP surpassed market forecasts and fueled hope that Prime Minister Shinzo Abe’s stimulus policies – dubbed “Abenomics” – are strengthening the economy…government data showed that the economy expanded at an annualized rate of 4.1% between January and March, lifted by strong household spending and a pick-up in private residential investment…that was much higher than the preliminary estimate of 3.5%, which was already the fastest rate recorded by any Group of Seven economy…European shares are up slightly in late trading overseas…the Dow is down 32 points to 15216 through the first hour of trading…credit rating agency Standard & Poor’s this morning upgraded its credit outlook for the U.S. government to “stable” from “negative”, saying the chances of a downgrade of the country’s rating is “less than one in three”…in August 2011, S&P became the first credit rating agency to downgrade the sovereign U.S. credit rating from top-rated “AAA” to “AA”, the second highest rating, and had left the U.S. credit outlook at “negative” at that time…the TSX is off 12 points as of 7:15 am Pacific while the Venture has slipped 4 points to 947…

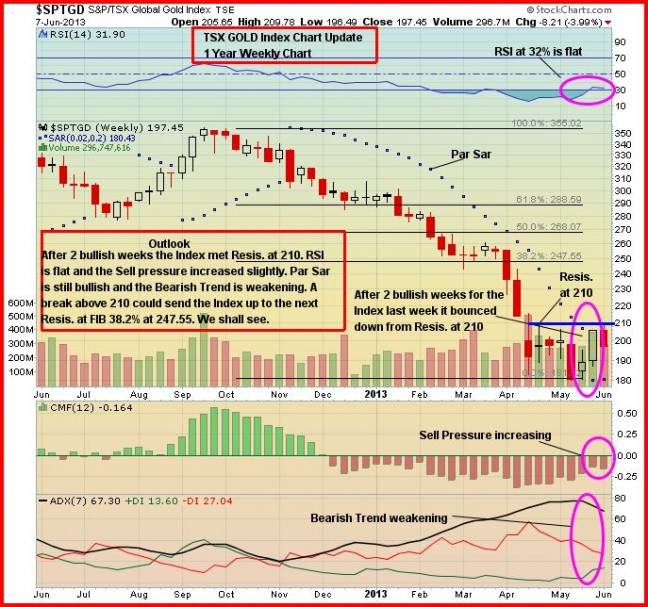

TSX Gold Index Chart Update

The TSX Gold Index met resistance at 210 last week and got hit hard Friday as Gold dropped about $30 an ounce…the 210 area for the Gold Index is like the 970 area for the Venture – both are critical resistance levels that need to be overcome in order for bullish momentum to really kick in…the Gold Index closed Friday at 198, 3 points above its rising 20-day moving average (SMA) which has provided support this morning…below is an updated 1-year weekly chart from John…the bearish trend is clearly weakening which of course is a positive sign, but investors must be patient…the Gold Index touched 195 in early trading today but is now up a point as of 7:15 am Pacific at 199…

GoldQuest Mining (GQC, TSX-V)

The GoldQuest train can pick up speed in a hurry once it gets moving, and it finally started moving last week and cleared a very important resistance band between 40 and 48 cents which now becomes support…GQC closed Friday at 54 cents which confirmed the breakout…the market is expressing confidence that the newly-identified Guama trend immediately west of last year’s Romero discovery could bear fruit as drilling continues (see our report and interview with GoldQuest Executive Chairman Bill Fisher May 30)…below is an updated technical look at GQC in a 2.5-year weekly chart from John…GQC is unchanged through the first 45 minutes of trading at 54 cents after climbing as high as 58 cents…

Everton Resources (EVR, TSX-V)

History shows that when GoldQuest starts flying, Everton Resources (EVR, TSX-V) is usually not far behind…EVR of course has a large land package in the DR, most notably the APV Property right next to the massive Pueblo Viejo Mine operated by Barrick (ABX, TSX) and Goldcorp (G, TSX)…EVR appears to have bottomed out at 2.5 cents (May) and closed Friday at 4.5 cents…EVR must overcome technical resistance at a nickel and then resistance at the down trendline as shown in this 3-year weekly chart…

Updated Silver Charts

Geoff Candy at Mineweb reports that Silver prices may see weakness coming from reduced industrial demand…according to the note, Silver demand from solar panels accounts for 10% of physical demand but despite growing sales of solar panels around the world, the product’s main market is Europe which will likely see significantly lower sales in 2013…as a result, Silver may take longer than Gold to see a price reversal…indeed, Silver has been under-performing Gold for a while now…the short-term chart for Silver shows continued strong sell pressure as the metal struggles to form a base around $22 an ounce…it closed slightly below that level at the end of last week…

Short-Term Silver Chart

Long-Term Silver Chart

Note the very extreme RSI(2) oversold condition at an incredible 1.88%, an all-time low for this indicator since the bull market in Silver began over a decade ago…this kind of situation tells us that a turnaround in Silver can’t be far off, though even slightly lower prices are possible first…

8 Comments

Read Clive Maund

Any updates on RBW?

CXO even Coffin questioned the timely News release CXO released

There should be an investigation by the exchange of dissimating news of cxo

Jon..heard from a buddy today, that GMZ has a rollback resolution on their upcoming AGM.Any. Comments. Thanks

Looking into it – never even heard a whisper of something like this.

Greg, I’ve checked this out and from what I’m being told, from reliable sources, the rollback option would only come into play in the event they are asked to do so by a potential purchaser of the company, which makes sense. So if it does occur, it would be under those circumstances which of course would have to be considered positive. As it says, “The Board wishes to be in a position during the ensuing year, if it considers it to be in the best interests of the Company, to effect a consolidation of the company’s issued share capital.” There is some thinking that GMZ could be a potential takeover candidate if the planned production scenario unfolds in Alabama as expected. Keep in mind that a lot of rollbacks occur simply because a company can’t raise capital due to a bloated share structure and low share price. GMZ certainly doesn’t have a bloated share structure and is able to raise the money it needs in the current environment – word has it, their PP will be oversubscribed. In other words, this is not an issue worth losing any sleep over.

Jon…really appreciate the quick response, and will pass on the info.

Remember Visible Gold(VGD). Zara Resources is offering to purchase 19.9% of VGD, to take control of the board and dismiss the management.

zararesourcesinc.com/news-releases/zara-announces-offer-to-purchase-shares-of-visible-gold-mines-inc/

VGD was a really bad call, really.