Gold is trading lower for the 7th consecutive trading session as the greenback continues to climb…as of 7:15 am Pacific, bullion is down $16 an ounce at $1,370…Silver is 21 cents lower at $22.48…Copper is up 3 pennies at $3.30…Crude Oil has gained 84 cents to $96.00 while the U.S. Dollar Index has surged half a point to 84.22…

An RBC analyst, Geoerge Gero, said it best yesterday with regard to Gold in an interview with CNBC…”Investors around the globe can see a strong dollar, less inflation, weaker commodities … and famous money managers pulling out of the Gold market, so the headwinds are up for Gold,” he stated…

Strong equity markets around the globe are also pulling money away from Gold as investors search for better short-term returns…a successful re-test of the April low of $1,321 would likely bring some confidence back into the Gold market…we’ll see what happens…as John’s charts have shown, there is Fibonacci support for bullion at $1,385 – a close below that level would increase the likelihood of a near-term re-test of $1,321…

Total Silver fabrication demand in 2012 declined 1.8% from 2011’s level, pressured by drops in demand from the photography, jewelry, and photovoltaic sectors, along with lower demand from India, according to the CPM Group in its annual Silver Yearbook Report…India accounts for 10.4% of total Silver fabrication demand and 17.0% of jewelry and silverware demand…the reduction in those sectors and the lower Indian demand more than offset an increase in demand from the electronics, housing, and other sectors…Investment demand for Silver is expected to slip after a strong 2012 as investors are less willing to chase higher prices…the firm said data from the U.S. Commodity Futures Trading Commission suggests that investors are beginning to push away from Silver as the non-commercial trader gross short positions in the first quarter of 2013 are growing rapidly…“Gross shorts increased 95.6 million ounces between Dec. 25, 2012, and March 26, 2013…at 129.9 million ounces on March 26, 2013, the gross short position was larger than it has been, by a wide margin, at any time since 2005…this is indicative of a major shift in investors’ attitude toward Silver, in that fund managers appear to be shifting back toward increased willingness to build and hold large short positions designed to profit from declining silver prices,” they stated…CPM Group also noted at 69.3% reduction in net long positions by the end of the first quarter of 2013…

Today’s Markets

China’s Shanghai Composite out-performed the broader Asian market for a second straight session today as investors cheered moves by the government to ease restrictions on the refinancing process for firms with real estate investments…meanwhile, China’s vice premier said that national demand for commodities had weakened and urged industrial sectors to limit expansion…the Shanghai hit a 7-week high by closing up 31 points at 2283…Japan’s Nikkei average climbed 101 points to 15138…European shares are mildly higher in late trading overseas…as of 7:15 am Paciifc, the the Dow has gained 54 points on very positive consumer sentiment data…the TSX is up 51 points while the Venture, despite lower Gold prices, had added a point to 934…

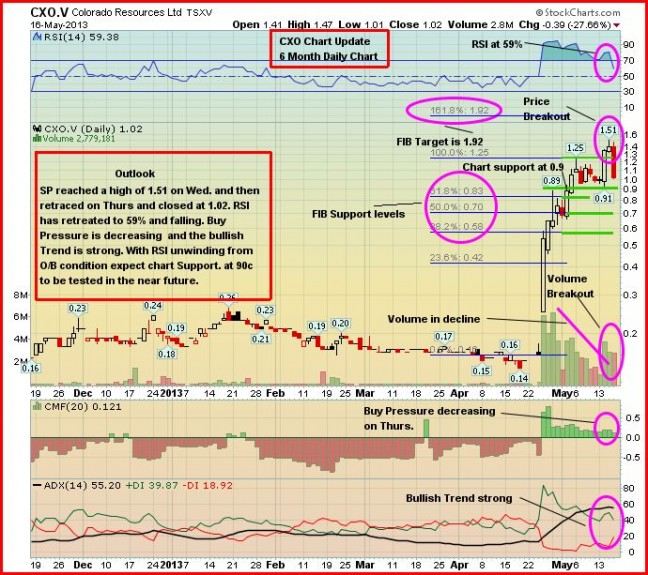

Colorado Resources Ltd. (CXO, TSX-V)

As we stated yesterday, there’s no question there’s going to be continued volatility in Colorado Resources (CXO, TSX-V) as this is typical in the very early stages of a new discovery when the potential size of that discovery is still being evaluated, and investors react to every rumor and every word in a news release…Colorado came out with news late in yesterday’s trading and the stock quickly plummeted from the high $1.20’s to a closing price of $1.02…effective communication is critical in this business, especially when a company is in a “discovery” situation such as Colorado…in our view, management dropped the ball yesterday in how it explained what’s happening on the ground…2 new holes have been completed with assays pending, but here’s the line that spooked some investors that was absolutely unnecessary to include in the release: “The archeologists are on site completing an initial archeological impact assessment survey that is required to allow for the expansion of the drill program”…this sounds like the language a geologist would come up with, not someone who understands the market and what investors expect to hear…there can be several very good (and positive) reasons for a pause in a drill program – this sentence also created fear among investors that the company could be facing native issues or problems in the area, and that’s simply not the case according to our sources…so we hope in the future that Colorado uses a little more wisdom and common sense in communicating progress at North ROK…of course it’s still very early in the game, but this has all the makings so far of a very important new Copper-Gold discovery in northern British Columbia…excellent drill results and other exploration news needs to be supported by proper messaging…

Today’s close will be important…from a technical standpoint, a very strong support band exists between the low 80’s and the low 90’s…below is another chart from John…CXO opened on a positive note this morning and through the first 45 minutes of trading is up 20 cents at $1.22…

The most attractive “area play” at the moment in our view continues to be Victory Ventures (VVN, TSX-V) which has a current market cap of just $1.9 million after yesterday’s close of 9 cents and the completion of a nickel financing…the company is all set and ready to fire up a drill program at its Copau Property (a few kilometres from Colorado’s discovery and 11 km north of Imperial Metals‘ Red Chris Mine) within the next 2 or 3 weeks…IP patterns at Copau resemble those at North ROK…

GoldQuest Mining (GQC, TSX-V)

GoldQuest Mining (GQC, TSX-V) came out the blue with a couple of decent holes yesterday north and south of Romero discovery hole LTP-90 including LTP-132 which returned 17 metres grading 6.21 g/t Au and 0.90% Cu within a broader interval of 130 metres of 1.22 g/t Au and 0.24% Cu…that hole was collared 400 metres south of LTP-90 and tested just a portion of the Romero south anomaly…the majority of that anomaly remains untested…meanwhile, drilling has started at the Guama showing to the west of Romero and this where things could get really interesting in the weeks ahead…GoldQuest Chairman Bill Fisher has agreed to an interview with BMR and the plan is to conduct that interview sometime next week…GoldQuest climbed as high as 43 cents intra-day yesterday before closing at 37.5 cents for a gain of 7.5 cents or 25%…the technical picture has improved after yesterday’s move but there’s still a major band of resistance in the 40’s that the stock will need to overcome in order to clear the path for potentially significantly higher prices…below is a 2.5-year weekly chart from John…GQC is off slightly in early trading this morning…its 10 and 20-day SMA’s are now moving higher together for the first time this year…

Global Met Coal (GMZ, TSX-V)

Global Met Coal (GMZ, TSX-V) continues to show support at its 20-day moving average (SMA) while the 50-day SMA has flattened out after being in decline since late 2011, a very positive sign…the company expects to close its previously announced financing in the very near future while it continues with the final stages of securing a permit for its Black Creek Project in Alabama…putting turnkey projects like Black Creek into production is what this management team, led by George Heard, specializes in…they understand mining technique and how the met coal market operates, so we like this situation a lot given the current market cap of only about $3 million (following the financing)…at a conservative start-up production rate of 10,000 tons, this would produce monthly revenue of approximately $1.5 million…the mining will be contracted out, keeping costs fixed, while the company has suggested publicly that it already has a buyer for its product…while there are always risks in this business, we have every reason to believe that Black Creek will not only be a “cash cow” for GMZ but a profitable company-building project as well…what’s also exciting is that when they’re able to get Black Creek off the ground, they have another very interesting met coal project in Mongolia to sink their teeth into…management is the key, and insiders are strongly invested in this company…

Bellhaven Copper & Gold Inc. (BHV, TSX-V)

Put Bellhaven (BHV, TSX-V) on your radar screen if it’s not already…this stock, like many others in the junior exploration space, has taken a beating over the past year…it was as high as 55 cents in early 2012 and closed yesterday at 6.5 cents…where we see possible opportunity in Bellhaven is that drilling has just started at the company’s La Garrucha Gold-Copper target at its La Mina concession in Colombia which already has an inferred resource of 1.6 million ounces of Gold and 419 million pounds of Copper…La Garrucha is near the eastern edge of the property and is a strong target…in fact, the company right now is drilling right into the heart of a large magnetic anomaly (previous drilling at La Garrucha was restricted to the western fringe of the anomaly because of ownership issues)…4 of the 6 holes that were drilled at La Garrucha in late 2011 encountered significant mineralization including 64 m of 0.8 g/t Au Eq and 24 m of 0.85 g/t Au Eq…grade and thickness of the intercepts increased down hole and to the east, so the system is expected to strengthen in that direction…

Bellhaven has been trading in a downsloping channel since last fall…as we stated yesterday, we’re in the type of market when one can be patient and wait for results because few investors are paying attention to the junior resource market at the moment…in the meantime, a bid around the bottom of the downsloping channel (approximately 6 cents) may make sense for speculative traders…as always, perform your own due diligence…

19 Comments

All these companies with great proven resources in the ground coming out with spectacular assays and doing nothing. Ie. eag. And cxo comes out with mediocre news and goes crazy just like gqc last year. Obvious that both companies have friends in the large funds that are pumping the hell out of sp. and just like gqc cxo will plummet leaving baggies all the way back to pennies. Jon shame on you for pumping this manipulated trash. If you had said to ur readers take a chance and rife the pump then great but call it like it is Jon please.

Open your eyes, Heath. Do your homework and go learn about the area. And take some advice from Rick Rule if you don’t want to take it from me – in this kind of a market, focus on fresh discoveries, and right now northern B.C. is the only game in town.

Jon, Do you like GBB’s discovery?

Sorry, meant “Do you mean like GBB’s discovery?”

Ok Jon. Just like gqc last yeAr and where is its sp now. Ill wager u whatever you like that cxo is back to teens in six months. Classic pump and dump and you know it. Holy shit Jon market cap approaching 100m when companies that have 5m plus 43101 trading at 10m market caps. Jon you are doing nothing to fix your tarnished rep by talking do foolishly

Jon has a good point Heath. In these markets you need to stay with what is hot at the moment, in this case the BC area for sure. Remember QIT and LOT had a good run recently, its all died down now, prices have dropped and volume has moved on to the next big thing. Btw – CXO has climbed 50c today, that’s pretty cazy compared to yesterday…

JON I bought some vvn shares what bothers me most is the size of the property only 448 hectares please comment on this thanx

Doesn’t concern me in the least. You can have a mine on 100 hectares. What’s important is that it’s a strategic piece of land along strike between North ROK and Red Chris, flat, easy to drill, right off a logging road immediately off Highway 37, water access no problem. The IP surveys show similar patterns to North ROK. They have several really promising targets. Also, I haven’t been told this but I think it’s safe to assume that Victory, with its contacts in the area and knowledge of the area, is negotiating for additional ground. So overall I expect them to build substantially on their land package in addition to tackling Copau very aggressively.

Hey Jon, any comments on TAD Mineral Exploration? Don’t know much about this, but I hear some buzz going around with Iskut.

Management issue with that one IMHO, I believe there are better choices.

Jon. Heath mentioned EAG. Is Eagle Hill one of the companys on your radar.If so, any comments. Thanks.

Greg, I have followed EAG fairly closely in recent years, and investors just haven’t gotten too fired up about Windfall Lake even though some of the results from there have been quite good. Some holes have hit some exceptionally high grade Gold, over narrow intercepts, while other holes have seen more consistent mineralization. There has been a lot of drilling at this property. It has potential but there’s a lot of stock out on EAG and it’s also in Quebec, and right now I’m cautious about that province for political reasons given the idiots who are running it and the loud environmental movement there. I think you have to look at what’s working in this current market. Fresh discoveries will garner attention, companies with good share structure and bullish charts, and the ability to raise money. Always follow the money. Special situations that are very close to generating cash flow are also interesting. It’s a very selective market and just because a company has a resource and good assays, doesn’t seem to mean a great deal at the moment in this declining gold/silver price environment. That’s something we may not like but we just have to accept it and go with what’s working.

Really appreciate the response and the DD you guys do.

Thank u, Greg.

Wow cxo that was a real roller coaster in 2 days

lets hope they got the goods as the venture exchange could use a real discovery these days

Heath play the game the how you make money long or short,all speculation stocks get a pump that will never change,some getter hotter than others cause managements can make a difference

no guarranty cxo is a monster discovery but you can trade it and make some coin till proven one way or another

You are arguing my point for me Robert. Thank you. If you had taken time to actually read my post and thought critically about what you were reading instead of scrambling to post some nonsense rebuttal you would see this!!

It is a pump and dump as are 99 % of venture stocks. And yes playing the trade can be a great strategy. Long in a venture stock is like saying your going to a convicted thief, giving him a thousand bucks to park your Mercedes and telling him to be back in 20 mins and then waiting for him to actually show up.

Jon should speak the truth. Call a duck a duck. Just say to readers that its a great pump and dump with absolutely nothing to back it at all. So jump on for the ride but get off quick or be left holding the bag like gqc and hundreds of others. Instead he talks as if its some great play to get involved with with great potential. Only reason some plays take off and some don’t is the connections management have with the funds and banksters. They orchastrate the pump. Simple as that

Peter Bernier sure think it’s a pump. He looks around for 2 years for the best possible project somewhere (after finding probably the biggest gold discovery ever in Canada west of Ontario) and settles on Iskut River. He’s sinking a lot of his own money into it. I wonder why? Heath, no one knows for sure how this is all going to play out. It could fizzle or it could soar like you can’t even begin to imagine. But you insist on insulting the intelligence of a whole bunch of geologists, much smarter than both you and me when it comes to knowing what might be in the ground, who are all over this at the moment. It’s a prolific geological area with North ROK in very close proximity to a mine that’s going into production next year. 242 metres of .63% Cu and 0.85 g/t Au is very valuable rock and comparable to the grades at Red Chris. The infrastructure is there, including the newly built Northwest transmission line. A Ministry of Mines official has already stated that another mine will likely emerge in this area, and that this will probably be the hottest exploration play in Canada over the summer. So to dismiss this as a “pump and dump” is ridiculous. Also, majors – including an Australian company that has just come into the picture up there – are pouring millions into exploration. We’re not dealing here with just a handful of juniors. Look what Freeport-McMoran is going to be spending. Are you trying to tell me these majors are suckers for a pump? In any discovery situation, obviously there is a lot of promotion. That’s a necessary part of the business. Murray Pezim was the best at it. But he also made some huge discoveries which to this day are keeping people employed. This whole Iskut River situation is of significant potential economic importance to British Columbia, so let’s hope Colorado and others succeed in a big way. Right now it’s real and it’s happening. And I’m happy to be in, understanding both the risks and the potential rewards.

I don’t think there is any point at pointing fingers at Jon or anyone else. If your investing in this space….it’s called speculating for a reason and if your investing in one or two ideas..that is plain foolish. You have to find the diamonds in the rough that are fully funded in this market. If you see insiders buying in this market it should be a good indication. We all want the home run but spreading your funds around 5-10 micro resource plays is going to hopefully make you money….anything else is wishful thinking.