Gold has traded between $1.409 and $1,421 so far today after staging an important move yesterday, pushing above the $1,400 level…as of 4:15 am Pacific, bullion is down $3 an ounce at $1,411…Silver is off 33 cents at $22.45…Copper is down a penny at $3.28 but is poised to post its first monthly gain in 4…Crude Oil has slipped another 41 cents a barrel to $93.20 while the U.S. Dollar Index is up nearly one-fifth of a point at 83.25…this is an abbreviated edition of Morning Musings due to travel…

Gold Stocks – Short-Term Trend Is Up

Get ready for a significant rally in Gold stocks, over the short-term at least, a rally that should also extend to the Venture Exchange…

As we’ve noted recently, the Venture has been giving some encouraging signs and we now do expect a breakout through the important 970 resistance in the near future…what has us particularly excited this morning is an obvious change in the dynamics of the TSX Gold Index as bullion starts to flex its muscles again after negative sentiment reached extreme levels…

Below is a 1-year weekly chart for the Gold Index which clearly gives Gold bugs something to cheer about…increasing up momentum, decreasing sell pressure and declining bearishness in the trend are all very evident – plus an RSI(14) that’s climbing from a low “W” in the oversold zone…this bodes extremely well for the month of June…a 20% gain from current levels in the TSX Gold Index is entirely possible which would lift the Index slightly above its 100-day moving average (SMA), currently at 240…the Gold Index gained 10 points yesterday to close at 206 after posting a 7-point gain Wednesday…a minor pullback after a couple of strong days should be expected but any weakness would certainly be a buying opportunity, in our view, based on this bullish chart pattern…the set-up for next month looks very promising…

The inability of the U.S. Dollar Index to push through important resistance at 84.50 has given Gold a much-needed shot in the arm…below is an interesting chart from John that compares the euro with the Dollar Index over the past year, and also shows the performance of Gold which appears to have formed a double bottom (at least for now, a new low in Gold later in the year as part of 1 final plunge can’t be ruled out)…notice the strong support at the neckline for the euro (helpful for Gold)…

Today’s Markets

Asian markets were mixed overnight with Japan’s Nikkei average bouncing back with a gain of 186 points to close at 13775…China’s Shanghai Composite, which far out-performed Asian’s major markets in May with a 6% advance, fell 17 points to finish at 2301…European shares are moderately lower in late trading overseas…retail sales data for Germany disappointed, showing a 0.4% dip when analysts had expected a 0.2% increase for April (month-on-month)…French consumer spending was better-than-expected, posting a 0.3% fall in April compared with estimates of a decline of 0.6%…also in France, producer prices fell 0.9% on a month-on-month basis in April, worse than forecasts…

In North America, stock index futures in New York are pointing toward a lower open…it will be another busy day for U.S. economic data after a slight downward revision in GDP figures and rising numbers for unemployment claims yesterday…investors today will get their first insight into second quarter consumer spending, with the release of personal consumption data for April at 5:30 am Pacific…analysts polled by Reuters forecast personal consumption and income both rose by 0.1% in April, after gains of 0.2% in the previous month…In addition, the Chicago PMI (Purchasing Managers’ Index) for May will be released today and will provide an early indication of how Monday’s ISM manufacturing index might read…

The Venture gained 7 points yesterday to close at 961…a close above 966 today would break a 3-month losing skid…the Venture’s 30-day moving average (SMA) has reversed to the upside – rising for the first time since January – and should now provide support…it’s currently at 954…

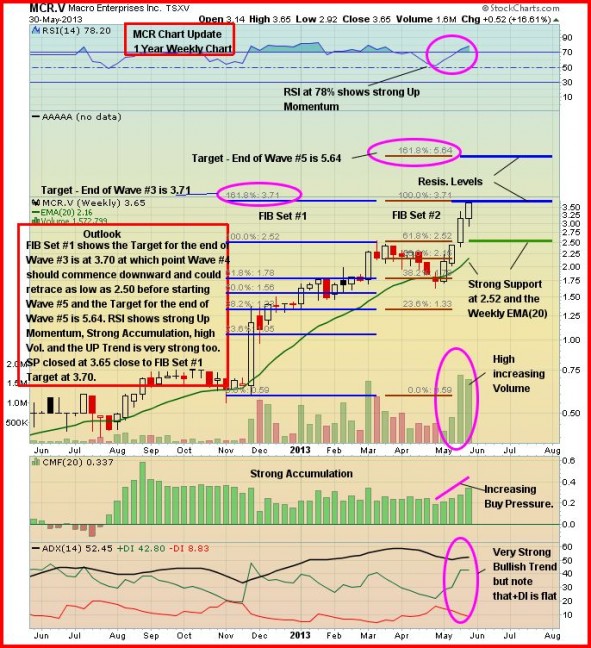

Macro Enterprises Inc. (MCR, TSX-V) Updated Chart

As follow-up to a recent chart and positive comments regarding Macro Enterprises (MCR, TSX-V) – a rare Venture company with earnings momentum – below is an updated chart from John as MCR continues its march higher…it gained 62 cents yesterday to close at $3.65…

Note: John., Jon and Terry do not hold share positions in MCR.

8 Comments

GMZ – New analyze from Juniorgoldreport.

Read more at Junior Gold Report Website…

Spoke with David Johnston from RBW. They are working on the second tranche of the required financing, and it is not easy.

took some vvn for pp close today and drilling starts next week = popper

Pat Sheridan took all PP in VVN

Would readers please complete the following form and send it to Stockcharts. We would like them to add GMZ.V to their database.

Make sure you include YOUR email address.

http://stockcharts.com/help/doku.php?id=support:feedback:symbol_request

Thank you

cxo president interview from vancouver show youtube.com

sounds like news this coming week

president states drill results in a week or 2

were in the second week next week

cxo interview watch at Youtube website

How do you value ZENNYATA VENTURES ZEN?

Well its fairly easy. If we look at Pipe1 we know we have about 45,000,000 tonnes at 5.1% then even assuming a moderate recovery rate we already have 2,000,000 tons of Graphite. But I am working with 1.4million at the moment.

The interesting thing about ZEN’s lump is that it can be refined cheaply and easily to 99.97-99.99% pure.

The purity dictates a price of $30,000 but for safety sake I use $12,000 and then subtract $2000 a ton, for Operating Cash Cost per tonne to get it out of the ground and refined to 99.99%

I am told that this is way too much as far as Cost per ton, but I am being safe for all the measurements.

So 1.4million tons at $10,000 a ton.

That gives an isitu value of 1,400,000 * $10,000=$14,000,000,000

$14billion dollars. Now find a comparable gold project that has an insitu value of $14billion.

At $1300 an ounce that would mean you would need a resource of 10,769,230 ounces of gold.

So find a project that has 10.7million ounces and that is a good “value of ZEN”.

Now start working with some of the actual numbers? $30,000 a ton Triples the insitu value. to $42,000,000,000 or $42billion.

Now forget my 50% reduction of mineralization in Pipe 1 and double that? $84,000,000,000 or $84billion

Now, add in the fact that Pipe 2 is 5 times bigger then Pipe 1 and we know already because we have drilled it, thats its also mineralized to 400meters.

So now lets say we get only another 1.4million in pipe 2? Add another $14billion?

Gee what if we had the same as Pipe 1? Add another $14billion?

Now heaven forbid, what happens if we actually have 3X the size of pipe 1? That would be a total of $42 billion but thats at $10,000? Now start doing the $30,000 with that pipe?

Now….. lol Try to find a project that has an insitu value of much higher then $150 billion whats that worth for share price?

What happens if you just say we should have 2,000,000 tons of Graphite in Pipe 1 total and 5,000,000 in Pipe 2?

7,000,000 tons at $30,000 a ton =$210,000,000,000 or $210 billion insitu value.

Now try to find a project anywhere 161 million ounces of gold and figure out what the shareprice should be with 60,000,000 shares FD?