Updated at 8:50 am Pacific

Gold is enjoying another strong day…as of 8:50 am Pacific, bullion is up $25 an ounce to $1,340, thanks to a variety of factors including short covering and fund buying…$1,350 is the key resistance on a closing basis as John’s charts have shown…Gold has been as high as $1,346 today…Silver has shot up 81 cents to $21.39…the next major resistance for Silver is $22 (updated charts below)…Copper, which staged an important technical breakout at the end of last week, is up a penny at $3.28…Crude Oil is flat at $105.90 while the U.S. Dollar Index has added one-fifth of a point to 81.31…

Assets in the SPDR Gold Trust increased 1.8 metric tons to 911.13 tons on Friday, the first increase since June 10, according to data compiled by Bloomberg…holdings in the SPDR Gold Trust have tumbled nearly 450 tons this year, Bloomberg data show…

China’s appetite for Gold continues…the China Gold Association reported today that the country’s actual Gold consumption has risen fully 54% in the 1st half year-on-year and totaled 706.38 tonnes vs. 460 tonnes a year earlier…in 2012, full-year consumption was 832.18 tonnes, so the country is well on target to exceed this figure by a substantial margin having thus already achieved around 85% of last year’s consumption levels in the 1st 6 months of this year alone…China is ready to top India as the world’s largest Gold consumer…

Today’s Markets

The Dow fell modestly in early trading today but has since recovered most of its losses…as of 8:50 am Pacific, it’s down 10 points at 15416…among key U.S. reports this week are retail sales, wholesale and retail inflation figures and manufacturing data…speeches by senior Federal Reserve officials later in the week will also be watched closely amid ongoing speculation over how soon the Fed may start to pull back its asset purchase program…QE “tapering” may not begin as early as next month as many market participants are expecting…the U.S. Treasury will release details of its budget deficit for July at 11:00 am Pacific today…expectations are for a July deficit of $96 billion which would bring the deficit to $606 billion for the first 10 months of the fiscal year, according to analysts from Barclays…

The TSX, thanks in part to strength in the Gold Index, has climbed 30 points to 12572…the Venture is ahead 3 points to 923…more excellent results this morning from the Fission-Alpha Minerals’ Patterson Lake South discovery…FCU is the runaway volume leader so far today on the Venture, hitting a new high of $1.18…as of 8:50 am Pacific, it’s up 6 pennies at $1.16 while AMW has gained 24 cents to $5.89…

Japan’s Nikkei average fell to a 6-week low overnight, closing down 96 points at 13519, as the yen rose on the back of weak 2nd quarter growth data…Japan’s economic performance for the 3-month period through June came in below expectations, suggesting the policies of Prime Minister Shinzo Abe haven’t yet been as effective in spurring growth as hoped, and adding to uncertainty about the government’s willingness to raise the sales tax to firm up its fiscal house…the country’s GDP grew at an annualized rate of 2.6% in the April-June quarter, the government said today…that was much weaker than the 3.6% growth forecast by economists polled by The Wall Street Journal…growth in the first 3 months of the year was also revised down to 3.8% annualized compared with the government’s previous estimate of 4.1%…Japanese officials, however, said the data added to growing optimism over the success of “Abenomics” as it marked a 3rd straight quarter of expansion…

China’s Shanghai Composite hit a 7-week high, gaining 49 points or 2.4% to close at 2101 after more encouraging news over the weekend following following Friday morning’s upbeat industrial production figures…late Friday it was reported that a key measure of China’s money supply, known as the M2, increased 14.5% in July from the year earlier…environmental stocks also got a boost today after Beijing announced unveiled plans to ramp up investment in green industries…

European shares were mixed today…

Canadian Dollar Chart Update

It’s “decision time” for the Canadian dollar which is showing signs of a potential breakout – this would be excellent news for the Venture which tends to perform best when the loonie is in an uptrend…the dollar is very close to climbing out of a downsloping channel in place since late last year as you can see in John’s 3-year weekly chart below…watch closely, this will be important to monitor…

The Sheslay River Valley Copper-Gold Porphyry Play:

B.C.’s Next Exploration Hotspot

How To “Prosper” With Bernier, and Assessing The Potential Power Of Garibaldi’s Grizzly

“It’s critical to always keep your feet moving forward in this business, no matter how challenging the markets might be,” Garibaldi Resources‘ (GGI, TSX-V) President and CEO Steve Regoci told us recently as we were carrying our due diligence on GGI…“You just keep pushing forward”…Garibaldi is now benefiting immensely from the fruits of that gritty approach and leadership, mixed with prudence, as the company is in such an enviable position compared to most of its peers in the junior exploration business…Garibaldi, already anchored by a strong portfolio of Mexican Gold-Silver-Copper properties that it’s actively advancing, is now blessed with an enormous, company-building opportunity in northwest British Columbia where since 2006 it has slowly but systematically explored the very strategic 170-sq. km Grizzly Property adjoining the western and southern borders of the Sheslay Copper-Gold Porphyry Project…

Unlike many Venture Presidents and CEO’s, Regoci is focused exclusively and very intensely on 1 deal – Garibaldi – and quickly created value in Mexico several years ago when he was able to sell the Temoris Property to Paramount Gold & Silver Corp. (PZG, NYSE) for cash and 6 million PZG shares…that deal has allowed GGI to NOT have to carry out a financing for 4 years…as per the most recent financials ending April 30, the company had working capital of $4.7 million…that’s why Sprott Asset Management Ltd. has shown strong confidence in Garibaldi by actually increasing its ownership to approximately 20%, while Regoci and CFO Barrie Di Castri combined hold another 20% or so…there is no warrant “overhang” – no warrants are currently outstanding – and unlike most companies, since it hasn’t done a financing for 4 years, there’s no cheap paper the stock has to fight through…many juniors have destroyed their share structures over the last couple of years, but not Garibaldi…

Recently, 3 game-changing events in the following order occurred that have greatly elevated the importance of the Grizzly, generating fresh investor interest in Garibaldi: 1) Colorado Resources‘ (CXO, TSX-V) North ROK Copper-Gold discovery 60 miles to the east that has created a frenzy of exploration activity in the general area; 2) Pete Bernier’s decision, after nearly 2 years of searching the globe for the best project for his new venture (Prosper Gold, PGX.H, TSX-V), to acquire an option to earn up to an 80% interest in the Copper Creek Property (renamed the Sheslay Copper-Gold Porphyry Project) contiguous to the western and southern boundaries of the Grizzly; and 3) the surprise May 15 re-election of the mining-friendly free enterprise coalition (Liberal Party) in British Columbia that’s encouraging the development of resources throughout the province…

Regoci has agreed to an interview with BMR shortly after Bernier’s Prosper Gold begins trading, expected imminently, following approval of PGX’s qualifying transaction by the Exchange…while he has been tight-lipped regarding the Grizzly, our hunch is that Garibaldi – while still pushing hard with its quality assets in Mexico that give the company its rock-solid foundation for the future – could soon come out with guns blazing in northwest B.C. given its financial, management and geological strengths, plus 3 special dynamics regarding the Sheslay River Valley:

1. The Credibility And Expertise Of Bernier’s Prosper Gold Group

What they did at Blackwater over a very short period was incredible – they executed with amazing precision – and in 2011 Bernier’s Richfield Ventures was bought out by New Gold Inc. (NGD, TSX) for half a billion dollars as Blackwater became one of the largest Gold discoveries in Canadian history;

2. The World-Class Deposit Potential Of The Sheslay Project

What many investors don’t realize is that Bernier and renowned geologist Dirk Tempelman-Kluit are taking over a property at a considerably more advanced stage of exploration than what Colorado started with at North ROK in the spring of this year…that fact, combined with how aggressively they will approach this project, is why we believe the Sheslay could rapidly emerge as the most exciting Copper-Gold play in all of British Columbia…Tempelman-Kluit is a master at data compilation and interpretation, which is why he was able to figure out Blackwater when others before him couldn’t…Prosper Gold will start with no less than 5 mineralized zones and drill-ready targets (Star, North Star, East Star, Copper Creek and Pyrrhotite Creek)…4 of the 5 porphyry-style targets are permitted for drilling and clustered within a 12 sq. km area with mineralization open in all directions…

Drilling will start at the Star (formerly Dick Creek) where Firesteel drilled a total 23 holes beginning in 2004…results included 242.3 metres grading 0.44% Cu and 0.32 g/t Au and 142.1 metres grading 0.44% Cu and 0.25 g/t Au…each and every hole intersected significant mineralization and no less than 85% of the holes bottomed in strong mineralization… stunningly, the average length of the holes was only 174 metres…Firesteel never went deep enough, and quite frankly the company lacked the geological expertise and the financial resources to take this project to the next level…

Meanwhile, there are multiple distinct porphyry-style targets in the Pyrrhotite Creek area located in the southwest portion of the Sheslay Property with mineralization again open in all directions…

Properties that ultimately become major deposits and operating mines have often gone through multiple owners and exploration stages over many years, just like the Red Chris to the east…finally, one could say, the Sheslay is now in the right hands…below is an interesting early conclusion from geologist William Thompson when he filed a Copper Creek assessment report for Erin Ventures Inc. in 1997…

“Geochemical survey anomalies with coincident old and new geophysical anomalies indicate the presence of widespread mineralization with some very significant anomalies…it is difficult to imagine there is not an ore body somewhere on a property with results such as these…the area as a whole where significant mineralization exists extends southwest to Mount Kaketsa (5 km) and southeast to Hatchau Lake (about 10 km) or roughly 50 square kilometres”…

3. The Grizzly-Sheslay Geological Connection

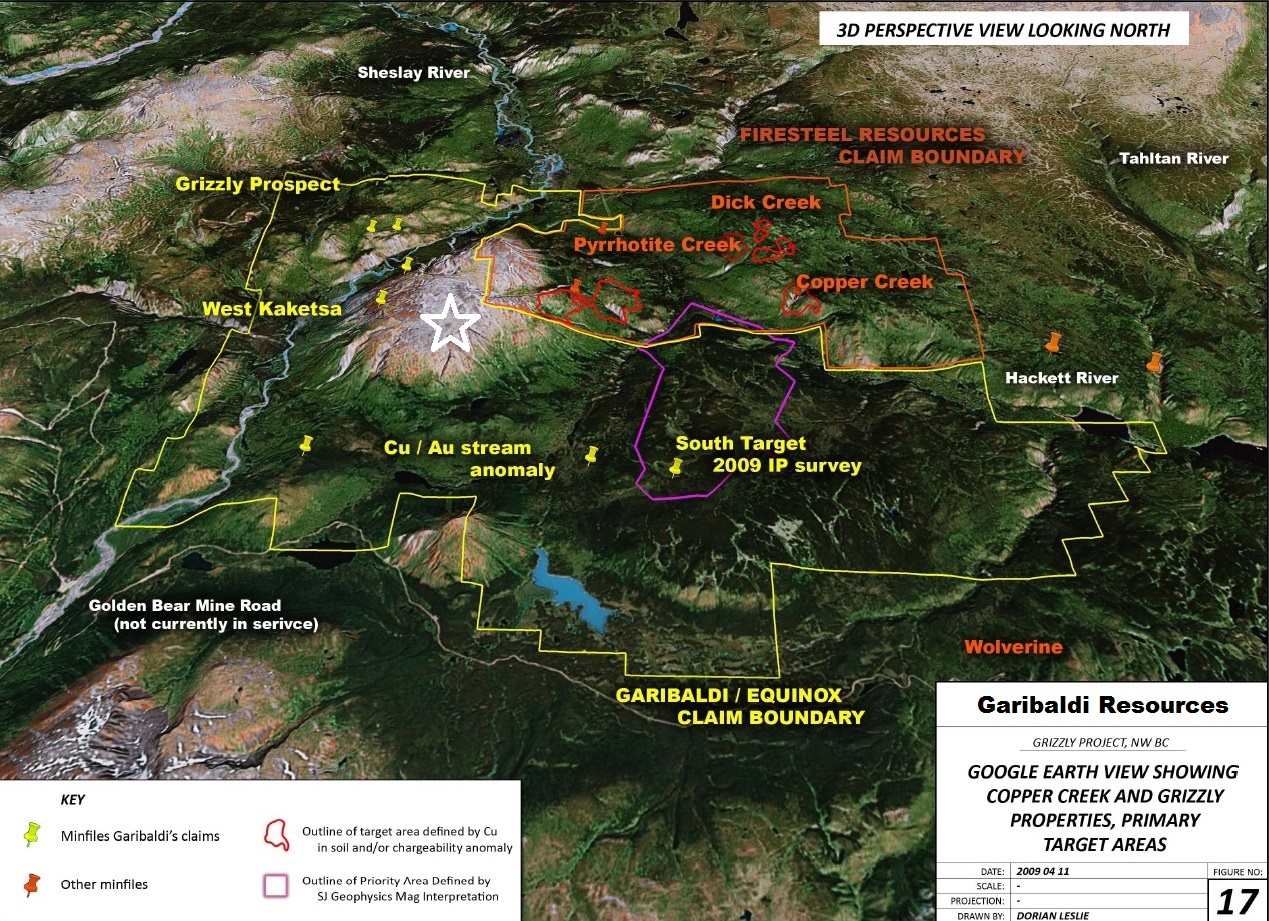

Largely due to its easier access, Sheslay is much more advanced from an exploration standpoint than the Grizzly…but there’s an intimate connection between the 2 properties and the “blue sky” potential of the latter is very evident based on airborne magnetic surveys, other data, and common sense…particularly intriguing is the northwest corner of the Grizzly which features the Kaketsa Pluton, an elliptical, north-trending intrusion approximately 4 x 5.6 km in size and interpreted by geologists as an important “heat engine” driving mineralizing fluids – at both the Grizzly and the Sheslay…it extends from the Grizzly onto the southwest portion of the Sheslay as you can see in this 3D perspective looking north…”spectacular alteration” has been noted on parts of Mount Kaketsa…

As above map shows, there are (so far at least) 2 main and large areas of interest at the Grizzly – the “Southern Block” and the “Western Block“…4 known alkalic porphyry Cu-Au showings (Grizzly, Kid, Ho and West Kaketsa) were discovered historically through intermittent exploration within the NW corner of the Garibaldi claims…keep in mind, this entire area of the Grizzly is still very under-explored…what we do know from historical reports is that the mineralization observed, for example, at West Kaketsa (highly altered and sheared volcanic and intrusive rocks containing disseminated and fracture controlled chalcopyrite over exposed widths of at least 24 metres – that’s just the surface expression, what’s the length of this structure?) resembles that at Pyrrhotite Creek…only 3 shallow holes have ever been drilled at the Grizzly – more than 3 decades ago, and in the NW corner of the property…each hole reportedly intersected potassic alteration and Copper mineralization, though no values are available and apparently none of the holes was assayed for Gold…airborne magnetic surveys and soil geochemical work on the southern block, carried out by Garibaldi, have outlined significant areas of interest with similar geological and geophysical signatures to the Sheslay…

Below is a regional map that shows how the Sheslay and the Grizzly are at the top of B.C.’s infamous “Golden Triangle”, right on trend with other major discoveries to the south…the past producing, high-grade Golden Bear Mine (Au) is about 30 km to the west of the Grizzly…

The Sheslay River Valley is a fascinating geological area and an ideal setting for a new mine in northwest British Columbia…more on this story as the week progresses…

B2Gold Corp. (BTO, TSX)

No writedowns…lower operating costs…upgraded production guidance…improved earnings picture…increased reserve estimates…it’s rare to read or hear those words from any producer these days, but that’s what’s happening with B2Gold Corp. (BTO, TSX)…“With the company’s proven technical team, strong operational performance, financial strength, and high-quality development and exploration projects, B2Gold is well positioned to continue its rapid growth as an intermediate Gold producer,” stated company President and CEO Clive Johnson in a news release last Tuesday…

BTO closed Friday up 9 cents at $3.10…significant additional appreciation appears likely based on the stock’s current technical posture as shown in John’s 3-year weekly chart…as always, perform your own due diligence…as of 8:50 am Pacific, BTO is trading at $3.17 for a gain of 7 cents after climbing as high as $3.21…important resistance levels are $3.20 and $4.00…

Updated Silver Charts

Silver has been out-performing Gold just recently, and that’s an encouraging sign…when the Gold-Silver ratio is declining, typically this is a clear indication that money flow is positive for precious metals…

Silver’s strong support band between $17.50 and $19.50 has held, at least for now, with the near-term outlook positive as a rally gains traction…sell pressure has declined significantly, and RSI(2) has climbed to its highest level since early January on this 3-year weekly chart…as it works its way higher, the next major resistance level Silver will need to overcome is $22…

Silver Long-Term Chart

What’s interesting about the long-term chart is that RSI(2) has finally battled its way out of extreme oversold conditions not seen since the 2008 Crash…Silver has gone about a year without RSI(2) entering the overbought area…based on historical patterns, we should expect RSI(2) on this long-term chart to return to the overbought zone during the 2nd half of this year – perhaps within the next couple of months…keep in mind there is major resistance around $26…

Short-Term Silver Chart

8 Comments

Even with Gold at $28.00, we are just not there yet & it still could be awhile.

BMR put forward two very positive articles today & so far, we are only able to

manage 23K shares of GGI. No one seems to care, BMR who they say…. Back in

the good days, this stock would be trading up to 0.50, so we continue to wait

& continue to show our dismay along the way. R !

The Venture is a slow-moving train at the moment, Bert, but at least it’s going in the right direction; a spark here, a spark there, will start to light things up over the next couple of weeks…just a matter of being patient at this point…

Jon,did Mr. Regoci indicate whether they are planning an all out assault on the Grizzly once Bernier begins on his property,or will GGI be playing the wait and see game.The potential combination of both companies going all out and coming up with spectacular grades could drive the stock prices of both companies through the roof if the promotion is done right.Promotion and results,that’s what so many companies forget about.

Hi Jim, my take on Regoci is that he’s a very smart and capable CEO who understands also how to be opportunistic and when to pull the trigger, so to speak. What’s unfolding in the Sheslay area is a major geological and market story, so I would be shocked if GGI doesn’t aggressively tackle the Grizzly almost immediately as Bernier starts drilling. That’s my opinion, for what it’s worth. Bernier has all his ducks in a row. Both groups (Prosper and Garibaldi) have outstanding geological teams on the ground and will execute, I’m sure, in every way both on the ground and in the market.

Prosper Gold adds flow-through shares to financing

2013-08-06 15:24 ET – News Release

Shares issued 14,881,683

PGX.H Close 2013-05-03 C$ 0.42

Mr. Peter Bernier reports

PROSPER GOLD PROVIDES FINANCING UPDATE

Further to its news releases dated May 7 and July 18, 2013, Prosper Gold Corp. will be adding a flow-through common share component to its previously announced non-brokered private placement. The private placement now provides for the issuance of up to $2-million of units of the company at a price of 35 cents per unit and up to $500,000 of flow-through shares of the company at a price of 40 cents per flow-through share for gross proceeds of up to $2.5-million.

Each unit will consist of one common share and one-half of one common share purchase warrant. Each warrant shall be exercisable to acquire one common share for a period of 24 months at an exercise price equal to 60 cents. In the event that Prosper Gold’s common shares trade at a closing price on the TSX Venture Exchange of greater than 80 cents per share for a period of 20 consecutive trading days at any time after the closing date of the private placement, Prosper may accelerate the expiry date of the warrants by giving notice to the holders thereof, and, in such case, the warrants will expire on the 30th day after the date on which such notice is given by Prosper Gold. The financing will be non-brokered; however, the company may pay finders’ fees in accordance in the rules and policies of the TSX-V. The financing is subject to the approval of the TSX-V.

The company may, at any time prior to the closing of the private placement, increase the size of the private placement by up to an additional $2.5-million (in total) by issuing up to an additional $1-million of units and up to an additional $1.5-million of flow-through shares on the same terms and at the same price as the units and flow-through shares sold under the private placement.

The private placement is being conducted concurrently with the company’s proposed qualifying transaction under TSX-V Policy 2.4. For avoidance of any doubt, the flow-through portion of the private placement does not include the issuance of any warrants of the company.

who is buying some cheap pp paper from pgx at 35 cents

VANCOUVER, BRITISH COLUMBIA–(Marketwired – Aug. 13, 2013) – CAVAN VENTURES INC. (TSX VENTURE:CVN) (“Cavan” or “the Company”) is pleased to announce completion of airborne geophysics over its located 36 kilometers west of Hearst, Ontario. Both high-resolution magnetic and time-domain electromagnetic (‘TDEM’) data were collected, for a total of 190 line-kilometers. Prospectair (Gatineau, QC) carried out the survey, with Magnor Exploration Inc. (La Baie, QC) engaged by the Company to manage the project. The magnetic and TDEM data are under review, with results expected in the coming weeks.

.

Beside zen.v property. A potenetial bargain at .06!!!

Cavan completes geophysics over Cage claims (Adjacant to Zenyatta

Perhaps a far less volatile trade than gold!! with equal upside.