After powering through important resistance at $1,350 yesterday, to a fresh 7-week high, Gold is up $1 an ounce at $1,367 as of 7:30 am Pacific…Silver is 7 cents higher at $23.08…it has climbed for 7 straight sessions entering today, gaining 17% during that time amid a more positive outlook for global industrial production…Copper is up 2 pennies to $3.34…Crude Oil remains firm, underpinned by the chaos in Egypt…WTIC is up 48 cents to $107.81…the U.S. Dollar Index, meanwhile, has added more than one-tenth of a point to 81.28…a quick note to our readers…we’d appreciate your help in getting Pete Bernier’s Prosper Gold (PGX.H, TSX-V) added to the Stockcharts.com data base in anticipation of imminent trading so we’re able to include charts at the appropriate time…the request on Stockcharts.com is easy to carry out – John will provide simple instructions in the comments section…

Total holdings in Gold exchange-traded funds appear to have stabilized lately, according to HSBC…the bank cites Bloomberg data showing that the top 14 Gold ETFs collectively held 62.7 million ounces as of August 14, virtually unchanged from a week earlier…“By our calculations, Gold ETF liquidations have occurred in 30 out of the 32 weeks so far this year with an average weekly liquidation of 736,000 oz,” HSBC said. “Stabilization in Gold ETF holdings may be a sign that investors are turning less pessimistic on the yellow metal. Furthermore, another indicator of investor’s waning pessimism on Gold is the short positions on the Comex, which have declined for 4 straight weeks. Short positions stood at 13.6 million oz at the end of 6 August, down from the all-time high of 17.9 million oz on 9 July. With that said, declining investor pessimism for Gold may open up the possibility for short positions to continue to be covered, which in turn is positive for prices, in our view.”

A filing with the Securities and Exchange Commission (SEC) this week revealed that Goldman Sachs increased its holdings in SPDR Gold Trust during the 2nd quarter to 4.4 million shares – 6 times its holdings at the end of March…the Goldman Sachs “Gold Smash” created a panic in March, then they turned around and became buyers…there were large sellers during Q2, of course, including billionaire John Paulson who cut his holdings in the ETF by more than half…other sellers included Northern Trust, which sold 5 million shares, and Bank of America and UBS which sold over 2 million shares each…

Commerical traders (smart money) cleared out virtually all of their short positions in July – an obvious clue that Gold has put in an important bottom, at least for now…while the commercials were reducing their short positions to historic lows, other traders (large and small specs often wrong on their positioning) were trimming their long positions to very low levels, another sign Gold was ready to reverse…public opinion surveys in North America show that the average “Joe” is still very negative about Gold – great sign – after being incredibly bullish just a couple of years ago…meanwhile, the Chinese keep buying like crazy…

Updated Gold Charts

Immediately below we begin with fresh 2-year weekly Gold chart from John…yesterday’s move requires confirmation today, which appears likely, with the next major resistance at $1,400…RSI(14) has broken out of a downtrend and is showing strong up momentum…sell pressure has declined significantly and it’s reasonable to expect it will turn into buy pressure in the very near future…the overall bearish trend is clearly weakening, so this move in Gold does appear to have legs – shorts are about to get clobbered like the longs were a few months ago…

Gold Chart – 50, 200, 500-day Moving Averages

Below is a 2-year daily chart showing Gold’s 50, 200 and 500-day SMA’s…note the large gap that has opened up between the 50-day ($1,309 and likely to reverse to the upside soon after being in decline since late 2012) and the 200-day ($1,523)…it’s this gap that we can see closing during the current rally…the 500-day is declining at $1,616…plenty of resistance between $1,500 and $1,600, where Gold broke down in the spring, but there’s certainly a good opportunity to test that resistance later this quarter or in Q4…

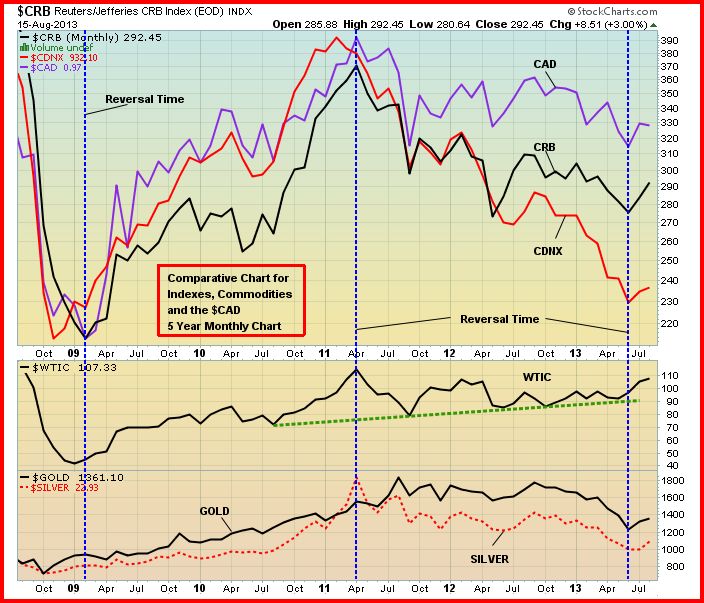

CRB Index Chart Update

Below is a 5-year monthly CRB chart…note how reversals have occurred every 2 years…also note how strong WTIC has been – a steady upsloping channel…

Today’s Markets

China’s Shanghai Composite was volatile overnight, surging 5.6% at one point before going into reverse and finishing in negative territory – down 13 points at 2068…traders attributed the wild swings to a variety of factors, including a possible erroneous trading order from brokerage Everbright Securities, whose shares have since been suspended…other rumors included a possible cash reserve ratio cut for banks and futures-related trades ahead of the settlement of August contracts…Japan’s Nikkei average finished down 103 points at 13650…

European shares were mixed today…euro-area exports increased for the 1st time in 3 months, led by a rebound in Germany, while inflation held steady at 1.6% as the economy gathers strength after the longest recession since the debut of the single currency…exports from the 17-nation bloc rose a seasonally adjusted 3% in June from May, when they dropped 2.6%, the European Union’s statistics office in Luxembourg said today…shipments from Germany, Europe’s biggest economy, gained 6.4% after a 9% decline the prior month…the euro-area inflation rate remained at 1.6% in July, a separate report showed…

North America

After losing over 300 points the last 2 trading sessions, while bonds yields jumped to their highest level in 2 years, the Dow is essentially unchanged through the first hour of trading today…U.S. consumers, bracing for higher interest rates and slightly slower economic growth, were a bit less optimistic in August as sentiment retreated from last month’s 6-year high, a survey released this morning showed…the Thomson Reuters/University of Michigan’s preliminary reading on the overall index on consumer sentiment slipped to 80.0 from 85.1 in July, well below the 85.5 reading expected by economists…

Retail giant Walmart reported yesterday a surprise drop in sales for the latest 3 months and offered a very cautious outlook for the rest of the year…in addition, data released yesterday by the Bureau of Labor Statistics showed that Americans’ real weekly earnings tumbled 0.5% from June to July…the figure is derived from a 0.2% drop in real average hourly earnings, plus a 0.3% decrease in the average work week…these are all factors the Fed will be taking into account next month when it decides whether or not to begin scaling back QE…given the expected volatile political climate in Washington, we believe the Fed will be patient and will wait to see other data during Q4 before any tapering process begins…

The TSX is up 18 points as of 7:30 am Pacific while the Venture has added 3 points to 935…the TSX Gold Index backed off from 210 resistance in early trading and is currently down 2 points at 205…

Fission Uranium Inc. (FCU, TSX-V) Updated Chart

The Patterson Lake South Uranium discovery in Saskatchewan heated up again yesterday with Fission Uranium Inc. (FCU, TSX-V) and Alpha Minerals (AMW, TSX-V) reported a 4th mineralized zone, and the stocks responded by hitting new all-time highs…we’re still very bullish on this play, but it’s never foolish to take some profits off the table – especially when you see a chart in a temporarily overbought condition and likely in need of a minor correction for “cleansing” purposes…FCU closed yesterday at $1.34 and is up another 11 cents to $1.45 as of 7:30 am Pacific, 7 pennies above John’s latest Fib. level…keep in mind that FCU corrected nearly 20% when it hit the previous Fib. level of $1.10…so guide yourself accordingly…we’re not here to tell you when to buy, sell or hold, just to provide you with additional insight and information that can form part of your own due diligence…

Great Panther Silver (GPR, TSX)

Great Panther Silver (GPR, TSX) has had quite a run, posting gains in 7 consecutive sessions (same as Silver) and jumping 48% during that period…it closed yesterday at $1.24, its 200-day SMA (in decline since late 2011) where resistance for now can be expected…it’s reasonable to assume that there will be a pullback before there’s a a possible assault on the Fib. resistance levels John has outlined (RSI-2 on the daily chart is in extreme overbought territory)…a few positive factors with regard to this 2.5-year weekly chart…RSI(14) at 57% is showing strong up momentum…weak buy pressure has replaced sell pressure which has been dominant all year…and there has also been a bullish ADX crossover, the first time we’ve seen that in GPR since the summer of last year…there’s strong support at $1…a minor correction to unwind temporarily overbought conditions could see GPR test that $1 area before resuming an upward trend…the company reported a net loss of $5.1 million loss for the 3 months ended June 30, compared with net income of $400,000 for the same period in 2012…as always, perform your own due diligence…as of 7:30 am Pacific, GPR is down 6 pennies to $1.17…

Note: John, Terry and Jon do not hold positions in GPR or FCU.

21 Comments

What no talk about huldra silver ? I think you shouldn’t be giving any stock advice after yapping about Huldra silver

Regarding the comment from “Clueless”, Huldra did a magnificent job of bringing Treasure Mountain into production as quickly as they did, and they got burned with the drop in the Silver price and institutional redemptions. That’s the risk in this business – a lot of bright investors were involved in HDA. It’s beginning to bounce back now, we’ll see what happens. Fantastic property. You will never, ever bat 100% in the junior resource market. That’s why we’ve always stated it’s critical to hold a basket of these juniors. You cut your losses to a minimum, and all you need is 1 or 2 big winners out of 10 to make good money in this business. You win some, you lose some. That’s the way this speculative market has always been and always will be. It’s volatile and not for the faint of heart. But you cannot beat the potential leverage this industry offers. Understand the risks and always do your own DD. Don’t blame others for your losses. Cut them short and move on to the next one.

Hi Folks

BMR needs your help again….we need Stockcharts to add PGX/H.V to their database.

On their website they have a special form for requesting a symbol. Here is how to get it.

1. Go to stockcharts.com and you get the “Home” page.

2. Enter PGX/H.V in the Symbol box in the top right hand corner.

3. On the next page find “Request a Symbol” and click on it.

4. You should get a form to request the new symbol.

5. Make sure the Symbol you enter is …PGX/H.V and don’t forget to add in your email address in the required box.

6. Click on submit.

Many thanks

John BMR

ACN getting ready to drill there nevada (king mine property)never drilled before so one to watch 15 mil shares os

some nice looking targets on presentation

asher-resources.com/i/pdf/maps/KingMiningIPChargeabilityAu.pdf

also chairman from queenston mining is now chairman of Acn

ggi should get interesting once pgx resumes trading

Wouldn’t surprise me if the drills are already turning at Sheslay. PGX will come out of the gate flying, especially in the current Gold/Copper environment, with such a low float, and drilling in progress. I fully expect GGI to execute quickly on its end with the Grizzly once the PGX dynamic is in play, which some say could be early as next week.

PGX/H.V gives an error msg

There was an error with your request, please try again.

I copied and pasted

It worked for me, ChartTrader…make sure your other entries were correct….

The stock request worked for me. In the meantime, I e-mailed both v.VVN and v.GMZ to see if I get a response regarding some sort of update for us shareholders…

Hi Steven, I stopped by GMZ’s office yesterday but George wasn’t available – in meetings. Spoke with the secretary and asked her to get George to give me a call as soon as possible. I will drop by the office again Monday if I haven’t heard from him. As far as VVN goes, I got an update yesterday. They’re making final arrangements for drilling and expect to get that underway by month-end it appears. As an aside, keep an eye on Castle Resources (CRI) – interesting trading today and yesterday. Picked up a bit this morning. In fact, over 40 million shares have traded the last month or so. Accumulation happening here. They have a nice resource with their Granduc Project near Stewart, which they’ve put on the block for possible JV/development opportunities. With Cu and Au looking good, CRI has a chance to recover nicely.

PGX.H.v says Your symbol request has been submitted. If you’d like to submit another symbol, please fill out the form again.

seems they like the period not a slash at this end

cheers

OK, thanks ChartTrader. And anyone else who can submit the same request.

Spot gold above res. of 1370 🙂

Jon, Thanks for the update(s). It is greatly appreciated. I look forward to hearing what v.GMZ has to say when you catch up with them.

Big North Graphite V.NRT

Best Graphite play out there 🙂

au-wire.com/big-north-graphite-beats-peers-to-market-huge-growth-ahead/

I checked with stockcharts as to the correct symbol to use to request the addition of PGX to their database. Here is their reply.

“Waverly Crowe, Aug 16 14:51 (PDT):

Dear John,

Thank you for your feedback. Please use the Symbol Request form for requesting symbols. The form is available at the following web address:

http://stockcharts.com/support/symbolrequest.html

The symbol would be PGX/H.V

We use a scoring system to determine which stocks to add to our database. As soon as a stock receives enough interest, it is added. Please understand that it might take unpopular stocks longer to get added.

Best Graphite play out there

There is only 1 and that is Zenyatta Ventures 1 of a kind in the world deposit

Sooner or later the Market will wake up and price Zenyatta into the big leagues were it belongs

coming sooner than most think

NRT

Zenyatta has’nt produced anything yet, NRT has 🙂

nrt Amorphous graphite is the cheapest stuff in the world

you guys need to study what zenyatta has found

NRT reported 200 ton sale but no dollar amount received that i could find.Whats up with that????