Patience prevails and will continue to prevail – happy days are on the way again…Gold exploded to the upside yesterday as the Fed surprised most pundits by deciding NOT to taper…yesterday’s news and market activity was further confirmation to us (we’ve been making this argument for a while now) that the Gold market correction (nearly 40% from the September 2011 high) and the Venture bear market both ended in late June, so prepare for a potential Venture breakout in the very near future…patience is important…again, it’s also critical to be selective as a rising tide will not lift all boats on the Venture…continue to focus on the companies with the working capital, the expertise, the properties and the drive to succeed both on the ground and in the market – companies that can make discoveries that majors will buy…those will be ones who will be doing the “heavy lifting” on the Venture through the balance of the year…

As of 7:30 am Pacific, Gold is flat at $1,365 and catching its breath after shooting up from just below $1,300 yesterday…bullion reversed after correcting about half its gains from the move between late June and the recent high of $1,434…Silver is now safely above important support at $22, up 16 cents at $23.13…Copper has jumped 7 cents to $3.30…Crude Oil is off 34 cents at $107.73 while the U.S. Dollar Index, after getting smashed yesterday, is relatively unchanged at 80.24…

As of 7:30 am Pacific, Gold is flat at $1,365 and catching its breath after shooting up from just below $1,300 yesterday…bullion reversed after correcting about half its gains from the move between late June and the recent high of $1,434…Silver is now safely above important support at $22, up 16 cents at $23.13…Copper has jumped 7 cents to $3.30…Crude Oil is off 34 cents at $107.73 while the U.S. Dollar Index, after getting smashed yesterday, is relatively unchanged at 80.24…

The Fed sent some clear signals yesterday – there is no question they want to see inflation ramp up, and they also want to see a much more robust labor market which means that a string of 200,000+ monthly job growth numbers is likely necessary before they actually begin to taper…this is commodity bullish…they are also concerned about poor fiscal policy in Washington and how it’s preventing the American economy from realizing its full potential…the Fed’s stance is also bringing back talk of a currency war, and there are clearly major technical developments in the U.S. Dollar Index (John has a chart this morning) which are bullish for Gold. the Venture Exchange and commodities in general…

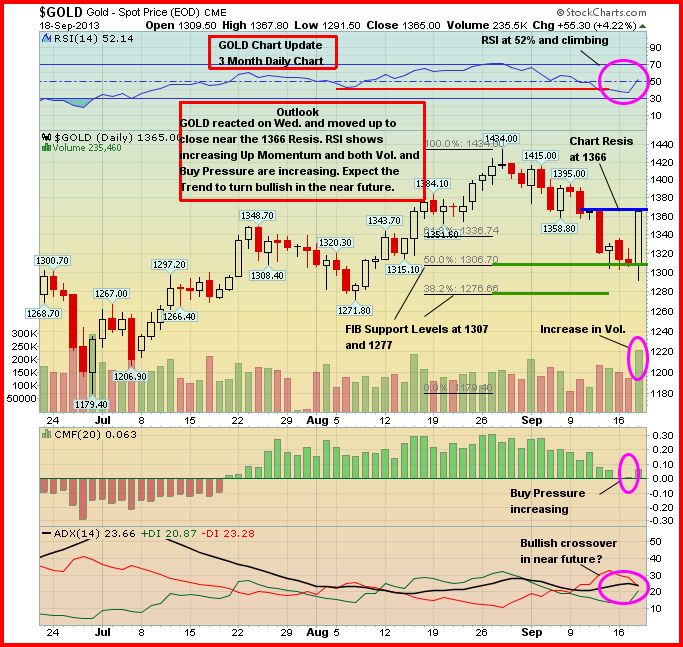

Gold Updated Chart

First, let’s take a look at Gold…the recent pullback was very normal from a technical perspective – a Fibonacci 50% retracement of the gain between the late June low of $1,180 and the late August high of $1,434…there are 2 key levels to watch in the coming days on a closing basis – $1,366 and $1,400…bears will need to run and hide if and when bullion closes above $1,400, and we believe the odds of that happening soon are very good…on John’s 3-month chart, RSI(14) is now showing up momentum at 52%, and it looks like a bullish +Di/-DI crossover is in the works…

U.S. Dollar Index Plunges: 2.5-Year Uptrend Broken

Gold and the Venture perform best when the greenback is in a downtrend…as we pointed out a few days ago, the Dollar Index broke below a 2.5-year uptrend…a test of strong support at 79 is in the cards, but the broken trendline support now becomes very stiff resistance – especially given the fundamentals and the fact it’s likely going to be a while yet before the Fed begins to taper…

Today’s Markets

Asian markets were stronger overnight, thanks to the news from the Fed, as Japan’s Nikkei average climbed 261 points to close at 14766…China’s Shanghai Composite added 6 points to finish at 2192…

European shares are up significantly in late trading overseas…

North America

The Dow is off slightly through the first hour of trading after posting its 5th triple-digit gain yesterday in the past 8 sessions…the TSX is up 2 points at 12933 as of 7:30 am Pacific, while the Venture has added 3 points and is now at 956…North American Nickel Inc. (NAN, TSX-V) continues to look strong, given its discovery in Greenland which looks impressive with assays of course still pending…NAN is up another 3 pennies at 39 cents…

An important breakout is forming (through 12900, requires confirmation) on the TSX as John shows in this 6-month daily chart…

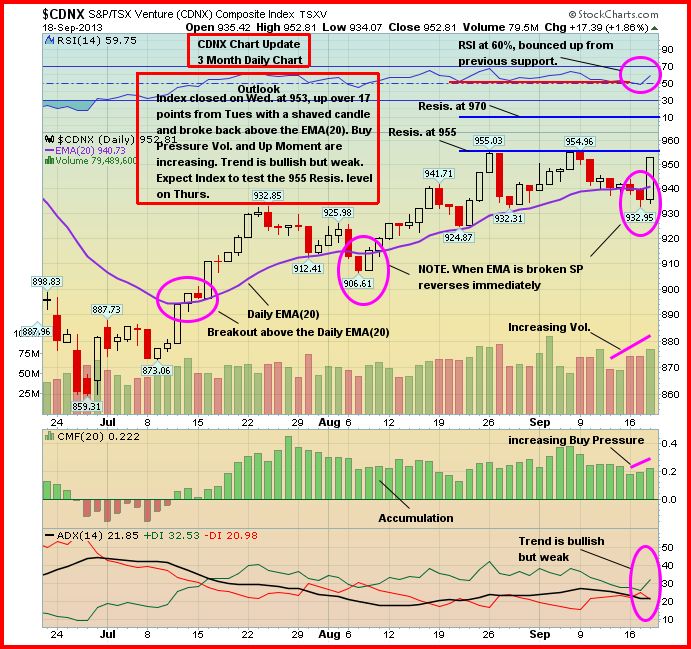

Venture Updated Chart

The impeccable support of the Venture’s EMA(20) has been impressive to say the least…the Venture has also been giving us very bullish clues this month by holding up so well in the face of a 10% drop in the price of Gold – a clear departure from the trading patterns we’ve seen over the last 2+ years…more than ever, we believe that what’s shaping up on the Venture is a major breakout through resistance around the 970 level…such an event could bring in a wave of fresh buying…below is a 3-month daily chart from John…notice how RSI(14) found strong support, and the Index continued its pattern of reversing quickly to the upside after briefly falling below its EMA(20)…

Prosper Gold (PGX, TSX-V) Drilling Intersects Mineralization At Deepest Levels Ever at Sheslay, Nearly 2 Dozen Drill Core Photos Released

Clues That Garibaldi Resources (GGI, TSX-V) Is Next With News

We don’t know the grades or widths yet – those answers are expected during the 1st half of next month – but early indications are that a discovery of importance has indeed been made or is in the process of unfolding at Prosper Gold Corp.’s (PGX, TSX-V) Sheslay Valley Cu-Au Porphyry Project in northwest British Columbia, approximately 60 miles west of Iskut…BMR has an independent geological consultant reviewing these photos and the technical information released yesterday by PGX, and we’ll have much more next week in a comprehensive special report we are preparing on the Sheslay River Valley (Prosper Gold and Garibaldi Resources – GGI, TSX-V)…

Dirk Tempelman-Kluit, who made the multi-million ounce Gold discovery at Blackwater, is one of the top geologists in the country and his expertise was very much on display yesterday in PGX’s news release given its level of detail…be patient if you’re already a PGX shareholder, and expect this important story to start to gain market traction by next week as more investors become aware of it, and speculation begins to ramp up in advance of assay results…

PGX’s goal during this 1st phase of drilling at Sheslay is to test continuity of mineralization at depth…quoting directly from the news release, all holes drilled to date have “intersected Cu-Au mineralization from surface to the bottom of the holes…highly altered, strongly veined and pervasively mineralized medium-grained hornblende monzonite and andesite.”

The emphasis (bold lettering, underlining) is ours – those are key words…no less than 22 drill core photos were released by PGX yesterday, showing impressive alteration and obvious signs of mineralization, and we don’t believe Prosper Gold would be releasing these if they weren’t confident about upcoming results…

PGX is currently drilling the 6th hole…the deepest hole drilled to date is 598 metres…previously, the deepest hole ever drilled at the Sheslay (Star target, formerly Dick Creep) was 335 metres…the average length of Firesteel Resources‘ (FTR, TSX-V) 2 dozen or so holes was only 174 metres…PGX wouldn’t be drilling to 600 metres unless they were “in the right stuff”…keep in mind, the game-changing moment for Red Chris came when drilling started to exceed 400 metres – Imperial Metals (III, TSX) delivered a whopper of a hole that went more than 1,000 metres deep and graded better than 1% Cu with strong Gold values as well…

From surface to depth, Prosper Gold is hitting the same host rocks seen at Red Chris, Galore Creek and Schaft Creek, 3 large Cu-Au porphyry deposits in the Stikine Arch…they stated Red Chris first – whether that was meant to send a message or not, who knows…

Heli-Borne Magnetic & Radiometric Survey Completed

Prosper Gold also announced that a 133 sq. km detailed helicopter-borne magnetic and radiometric survey has been completed at the Sheslay…“Its aims are to expand understanding of the property geology, to refine drill targeting on the 5 known Copper-Gold porphyry targets and to identify possible new targets…the survey covers the entire 6,829-hectare claim area and adjacent ground.”

Does “adjacent ground” mean Garibaldi’s Grizzly Property as well?…Garibaldi posted pictures of the Grizzly on its web site for the 1st time yesterday, another message that things are developing on their front and (we’re speculating) news from them must be imminent…at the moment we’re assuming the beginning of next week…we can’t imagine they would put news out on a Friday, especially if the news is good…

Below is a long-term GGI chart (10-year monthly) that shows a very strong bullish pattern…the recent pullback to 9 cents was a normal Fib. retracement (also tested support at the rising 300-day SMA) that cleansed temporarily overbought conditions as well…this chart tell us GGI has major upside potential in the coming weeks – and its chart pattern is very similar to that observed in Canada Carbon Inc. (CCB, TSX-V) as we mentioned yesterday…GGI’s strong working capital position, along with its promising district-scale projects in Mexico and the emerging excitement at the Grizzly, all combine to give this play strong upside potential in the coming days and weeks…

Note: John and Jon both hold share positions in GGI. Jon also holds a share position in PGX.

13 Comments

Jon – Early indications are that a discovery of importance has indeed been made

or is in the process of unfolding at Prosper Gold Corp.’s

Bert = I don’t quite understand how you have determined that they have nade a

discovery or is in the process of. It’s certainly not because of the market activity,

which is usually a good indication of what is going on.. R !

Bert, if you looked at NAN just a little while ago, trading in the low to mid-20’s, you may have incorrectly come to the same conclusion…you make money in the market by spotting opportunities ahead of others…as we stated, be patient with PGX…there are also some games going on behind the scenes, we suspect, with holders of some cheap seed stock (not much of this is free trading but some) and those who are looking for a possible cross in the market…PGX will wake up and take off in due course…the time to be bullish is NOW, not after the masses are piling in…problem is, most investors would rather follow the crowd, and it’s a lot harder to make money that way…

Hi BMR,

If one could only buy on of PXG and GGI which one should it be? Whom are more developed and best cashed up?

A lot of the market darlings such as ZEN,CCB,CKR,PGX,GGI etc,are beginning to take a backseat to NAN.Everyone seems to be taking a breather and money is starting to pour into NAN in anticipation of their drill results which should begin to flow possibly next week.We are looking at very high sulphides from three different ares on their huge property.NAN has the potential to run extremely hard as a string of PRs comes out.A nickel play the size of Sudbury and volume is just picking up.

John,what are your charts telling you after seeing the speed that NAN is moving up,and at not above average volumes yet?

I agree,Jon.PGX will have its day.But that day will be in October.Tony,the best of the lot right now is NAN.Very,very tight share structure and the lid is about to be blown off the pot.Play NAN,then play PGX.THEN LEAN BACK AND HAVE A BEER!

Hi Jim,

Haven´t the train already left for NAN? up nearly 100 % in last couple of weeks?

Best regards,

Tony

BMR, your overconfidence has burned u big time before. Shall meg mention rbw one more time?

…and climbing.Big boys haven’t even looked at this yet!Next ZEN?….75 KM x 15 KM.And that’s nickel!

NAN.v closing in on over 300% since mid May

.12 to .43 nice return

Jim

The FIB Target stays the same at 51c

Thanks,John!

Trying to portray a positive feeling, is near impossible, when

everything about the market, in which we participate, seems so

negative. Pray tell me how our market could end up 0, with gold

up around $60.00. I have a position in KAM, which in the past has

been following Gold. I bought some shares this morning at 0.91 for

a day trade, shortly after, it settled in at 0.89-0.91 & only traded

a few for the remainder of the day. Near the end, i had to let it go

for 0.90. Very seldom do i get caught, but today i did. I did it, i

started off negative. but ended up positive, in particular, for those,

who will feel good about my losing (joking). R!

GGI news soon I suspect!