Gold is closing the week on a strong note…as of 7:45 am Pacific, bullion is up $16 an ounce at $1,340…Silver, which dropped below $21.50 overnight, is now up 15 cents at $21.88…Copper is 3 pennies higher at $3.30…Crude Oil has reversed and is now up 54 cents at $103.57 while the struggling U.S. Dollar Index has lost nearly one-third of a point to 80.21…

Gold was mostly flat early today but suddenly pushed higher following wire reports that Chicago Federal Reserve President Charles Evans suggested, in rather ambiguous Fed-style language, that the U.S. central bank may not begin to scale back its monthly bond-buying program until 2014 because the U.S. economic environment still needs to improve…

In a review of senior Gold company presentations at the Denver Gold forum, which was published Wednesday, Scotia Capital analyst Jakusconek observed that only 3 mining companies – Agnico-Eagle (AEM, TSX), Goldcorp (G, TSX) and Newmont (NMC, TSX), highlighted possible mergers and acquisitions in their presentations…“AEM is looking at opportunities similar to how its Mexican assets have performed,” said Jakusconek. “AEM has the balance sheet flexibility to make any acquisition should an opportunity present itself.”

Today’s Markets

Asian markets were mixed overnight…China’s Shanghai Composite steadied after yesterday’s drop, gaining 4 points to close at 2160…Japan’s Nikkei average slipped 39 points to finish the week at 14760…European shares were off moderately today, thanks to political turmoil in Italy…Silvio Berlusconi’s center-right People of Freedom (PDL) party has threatened to pull out of the country’s fragile coalition government…

The Dow is down 77 points as of 7:45 am Pacific…the TSX, however, is up 3 points while the Venture has added a point to 949…Madalena Energy Inc. (MVN, TSX-V), which John featured yesterday in a chart, is the CDNX volume leader so far this morning and has hit a new 52-week high of 50 cents…

U.S. lawmakers continue to play Russian roulette with the budget and debt ceiling…Congress’s rocky path to avoiding a government shutdown became even rougher yesterday as Speaker John Boehner said the House wouldn’t accept the spending plan likely to emerge from the Senate…Congress must pass a new budget by next Tuesday or trigger a partial government shutdown…more significantly, just a couple of weeks later, the U.S. Treasury says it will be close to running out of money to pay its bills…a brief government shutdown is one thing, and has occurred before; the U.S. defaulting on its debts is quite another…how the circus act in Washington will play out next month will be fascinating to watch…some are certainly taking it in stride and remain very bullish on stocks…Dennis Gartman said, “Even the government can’t ruin this rally.”

A shutdown of the U.S. government for 3 to 4 weeks would reduce Q4 economic growth by as much as 1.4%, economists say, as government workers from park rangers to telephone receptionists are furloughed…has the U.S. become that dependent on government?…perhaps so, given the $16+ trillion in debt that has been racked up…

In a Bloomberg report, Joel Prakken, senior managing director at Macroeconomic Advisers, was quoted as saying, “A shutdown of non-essential services is inconvenient for a while. If we hit the debt ceiling, we’re in unchartered territory. If you miss an interest payment on the national debt, that’s a sovereign default of sorts, and I think it would shake the foundations of the global financial system.”

Corporate America took on a record amount of debt in the month of September as corporate Treasurers rushed to take advantage of a dip in rates and a receptive market…Verizon’s biggest ever $49 billion offer helped drive the month’s investment grade offerings to an all-time high of $147.8 billion so far, besting the $133.9 billion of May, 2008, according to Informa Global Markets. But the offers picked up momentum as the month wore on, and particularly after the Fed surprised markets last week by leaving its $85 billion monthly bond buying program intact for now…

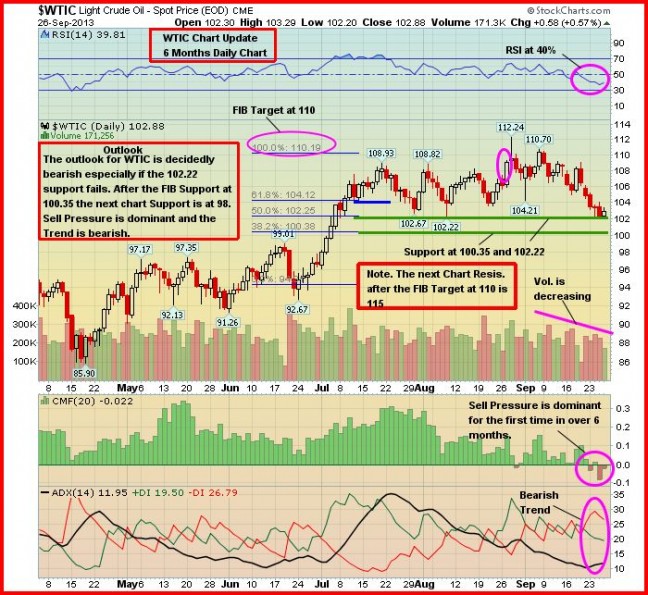

WTIC Chart Update

Important support for WTIC is between $100 and $102 as John points out in this 6-month daily chart…Crude Oil has cooled off considerably after hitting the $110 Fib. target – we’ll now see if the support band holds…

Garibaldi Resources Corp. (GGI, TSX-V) Update

Garibaldi Resources‘ (GGI, TSX-V) President and CEO Steve Regoci promised that GGI would have its feet moving quickly during the last several months of the year, and indeed he is delivering on that promise as outlined in yesterday’s news following the close…October could be a breakthrough month for GGI…exploration is underway at the very prospective Grizzly Property contiguous to Prosper Gold Corp.’s (PGX, TSX-V) Sheslay Cu-Au Porphyry Project…results expected shortly from GGI’s already completed airborne mag and radiometric survey…this survey, flown over parts of the northwestern section of the Grizzly in the area of the Kaketsa Pluton, could provide highly valuable new information…GGI has made the “Grizzly West” target an immediate high priority in the coming weeks, but it’s only 1 of a multiple number of targets that have been identified over a 15 km corridor which underlines the potential scale of this project…rock units and structures are very similar to those immediately to the north on the Sheslay…it’s worth noting that GGI has added C.J. Greig & Associates Ltd. as geological consultants for the Grizzly project…Charlie Grieg is highly respected in the industry, very well known out here in British Columbia…

Meanwhile, there are interesting developments for GGI in Mexico…the company has completed 6 new drill holes at the Locust Gold-Copper target which forms a small portion of the nearly 500 sq. km Tonichi Project…assay results are expected in the near future, and more drilling in Mexico is planned for Q4 (the company has 3 district-scale projects there plus the recently acquired La Patilla Property which has near-term small-scale commercial production potential)…the big surprise in yesterday’s news was the fact that GGI is earning royalty income from coal sales and has also found graphite as part of a pilot program with a private Mexican company…the Mexicans are exploiting near-surface coal seams over parts of Tonichi (GGI owns the asset)…Sonora state has a history of coal and graphite production, and coal seams in this area are very favorable exploration targets for graphite deposits…Garibaldi has submitted graphite surface samples for analysis, and it’ll be interesting to see how the lab results turn out in terms of look, grade, purity, etc…GGI has proven its ability to deliver value out of its projects in Mexico – the sale of Temoris to Paramount Gold & Silver (PZG, NYSE) being an excellent example…not only do they have some outstanding Gold-Copper-Silver prospects in Mexico, but the coal/graphite situation may have some serious legs to it…

As always, perform your own due diligence…GGI has a strong working capital position and in our view clearly falls into the category of that small percentage of Venture companies possessing a healthy balance sheet, clean share structure, the expertise, the properties and the drive to succeed both on the ground and in the market…

Below is an updated long-term GGI chart which has many favorable aspects to it, including a recent reversal to the upside in the 300-day moving average (SMA)…Fib. levels to watch for on the upside are 24 cents, 36 cents and 55 cents (these aren’t price targets, just theoretical levels based on Fib. analysis)…

What To Look For In A Powerful Cu-Au Porphyry System – Dr. Dirk Tempelman-Kluit

Earlier this week, BMR conducted a fascinating interview with Dirk Tempelman-Kluit, recognized as one of Canada’s premier geologists who honed his skills for nearly 3 decades with the Geological Survey of Canada…after leaving the GSC, he met entrepreneur Pete Bernier and the two quickly started what has turned out to be a very successful decade-long friendship and business partnership…together, they are a highly effective and dynamic team, and of course it was Tempelman-Kluit who unlocked the mysteries of the Blackwater system in central B.C. a few years ago which resulted in a multi-million ounce Gold discovery and a $500 million takeover of Richfield Ventures by New Gold Inc. (NGD, TSX)…

Tempelman-Kluit has a deep understanding of B.C. geology, and is currently gunning for his 2nd consecutive major discovery in the province in the emerging Sheslay Valley area south of Dease Lake and west of Iskut…Prosper Gold started drilling the Sheslay Cu-Au Porphyry Project at the end of August, and initial drill results are expected sometime during the 1st half of next month…Sheslay core photos published recently on the PGX web site, combined with the geological summary released by the company September 18, clearly indicate there has been a lot of “fluid movement” in the Sheslay system which is critical for the potential formation of a large porphyry Cu-Au deposit, or series of deposits…below are some interesting comments from Tempelman-Kluit on what he looks for in trying to nail down an economic porphyry system (click on the forward arrow – requires Adobe Flash Player, version 9 or above)…

[audio:https://bullmarketrun.com/wp-content/uploads/2013/09/Dirk-PGX-Clip-2.mp3|titles=Dirk PGX Clip 2]North American Nickel Inc. (NAN, TSX-V) Chart Update

After busting through resistance at 30 cents last week, North American Nickel (NAN, TSX-V) has tested that area for support this week as it hit a low of 31.5 cents yesterday…RSI(14) is unwinding from a temporarily overbought condition…the support at 30 cents is strong as John shows in this 2.5-year weekly chart…

Sunridge Gold Corp. (SGC, TSX-V)

Numerous Venture stocks are showing some interesting technical patterns at the moment…below is a “heads up” on Sunridge Gold Corp. (SGC, TSX-V) from John…as always, perform your own due diligence…

Note: John and Jon both hold share positions in GGI. Jon also holds share positions in PGX and NAN.

8 Comments

Just received an email yesterday about a GGI Webcast/Presentation from MarketSmart Communications, to be held Sept 30, 1:15 Pacific Time

Need to reply to [email protected] to get login instructions ahead of time.

It’ll be interesting to see what they can add, BMR has covered this story pretty well over the past few months. Just nice to see GGI progressing forward with their projects unlike many of the others companies out there today.

GGI Webcast/Presentation Monday Sept 30, 1:30pm Pacific Time

MarketSmart Communications sent out an invite for a GGI Webcast/Presentation need to contact [email protected] to get login instructions ahead of time

found that on stockhouse

TWO watch lists Colorado area play down 25 percent graphite play up 25 percent

A blast from the past,long time bmr readers might remember canada strategic metals! CJC.V , their chart and news are looking good so I took a little bite today,see how it goes!

Hi Everyone….I received an official invitation and it’s actually at 1:15 pm Pacific, 4:15 pm Eastern on Monday…..anyone interested has to confirm their reservation to [email protected]……..great that GGI is communicating with its shareholders and investors like this……

Stay tuned for an interesting week

Jon,

Did you asked Mr. Tempelman-Kluit if we was confident about the grade or do you feel he was confident during the interview. (if he is as good as Gretzky was, I should have a idea of the grade by looking at the core 🙂 lol

Martin

Based on the geological descriptions in their Sept. 18 news release, and the Sheslay core photos, and the historical results of course from the Star, there’s ample evidence I think, Martin, to believe PGX is going to deliver very positive results in terms of both grade and widths. Obviously Dirk would only comment on the general geology and what is in the public domain. But did he seem confident and enthused in the interview? Absolutely. You can tell that he loves this project and is extremely excited about it, and that’s after drilling has already started and he has had a chance to examine the core. I do not know, but I’m assuming they targeted the first several holes around the most interesting holes drilled previously at the Star target (formerly Dick Creek). And they took these holes more to depth.

Given a vastly superior geological team, and most likely a better drill rig, it makes sense to me that they should be able to improve on the historical results which were very good to begin with. And of course the real kicker is, what will they find at depth? Look what happened at Red Chris. That deposit wasn’t drilled below 400 metres until Imperial Metals came along, around 2009. They ended up drilling 1 hole that intersected more than 1% Cu and very good Gold grades over 1,000 metres. It was a spectacular hole. The core photos from Sheslay really tell the tale – no question, this has the classic Cu-Au porphyry earmarks – a robust hydrothermal system has cooked up something quite special there, you can see that in the rocks. Dirk said he “loves” the rocks. Evidence of lots of fluid movement – multi-directional veins, different generations of veins, etc. – all the right ingredients. A significant porphyry deposit, among other things, definitely needs water and a heat engine. Mineralization at the Sheslay is open laterally in all directions and at depth. Will need much more drilling of course to prove it all up, but Bernier has the ability to raise that kind of money (does Colorado?).

The potential scale of this is incredible if you combine the Sheslay and the Grizzly, and the Grizzly is showing similar geological, geochemical, geophysical signatures as the Sheslay. Who knows, maybe the “sweet spot” of this whole system originates on the Grizzly – only time will tell. Potential deposits such as what Prosper is currently drilling know no borders. Goes right across the boundary, IMHO, given the evidence. The airborne survey from GGI should prove interesting – if we’re on the right track with this school of thought, and we strongly believe we are, the data should line right up with that from the Sheslay.

he should