October is certainly shaping to be a very interesting month for Gold after bullion posted its first quarterly gain (7.6% in Q3) in a year…important Fib. support is in the $1,270’s, and that has held these past couple of days, with bullion rebounding sharply this morning after yesterday’s nearly $40 an ounce plunge…market participants yesterday viewed the 1st U.S. government partial shutdown in almost 18 years as “deflationary”, but there were also rumors of a forced liquidation by a distressed commodities fund and of selling related to a fund rebalancing on the 1st day of the 3rd quarter…as of 7:50 am Pacific, Gold is up $32 an ounce at $1,320…Silver is 74 cents higher at $21.91…Copper is up 3 pennies at $3.29…Crude Oil has added 94 cents to $102.97 while the U.S. Dollar Index has plunged one-third of a point to 79.84…

A partial U.S. government shutdown is no big deal – that’s merely a firecracker…but tons of dynamite are loading up over the debt ceiling issue, and it almost seems as if certain members of Congress want to see the U.S. default on its debt later this month – if only to bring Washington’s spending and debt problem to the forefront of attention…there’s nothing like sparking a crisis to put the spotlight on an issue, and we all know how Gold will react if a U.S. default were to occur…

Outflows from Gold ETPs totaled $4.2 billion during the 3rd quarter, according to ETF Securities…however, since the price of the precious metal itself rose, total Gold assets under management in Gold ETPs actually increased by $4.3 billion…the 3rd quarter Gold ETP outflows were down sharply from $18.5 billion in the 2nd quarter when there was a massive sell-off in prices…Q2 likely marked the absolute low for Gold ETP’s…since April, Gold ETP outflows declined each month through August, before an uptick again in September…

The 2nd-largest sector inflow into commodity ETP’s during Q3 was into Silver ($707 million)…

As of yesterday, the sales tax levied on purchases of Gold, Silver and platinum bullion and numismatic coins in Texas is now eliminated (Louisiana and Utah have also passed similar legislation recently)…the legislation puts precious metals on a level playing field with other investments…previously, Texans were paying 6.25% on all precious metals purchases under $1,000, a tax was was considered especially burdensome to small investors…the web site www.StateLegalTender.com states that Gold and Silver coins, including those minted by the U.S. government, are currently taxed in more than 2 dozen states…“It makes no legal or economic sense for states to tax Gold and Silver coins,” says the website. “Ending this taxation to enable them to circulate as currency is one of the prime goals of the state legal tender movement.”

Today’s Markets

Japan’s Nikkei average tumbled 314 points overnight to close at a 3-week low of 14170…Chinese markets are closed until Monday…European shares, meanwhile, are off modestly…the European Central Bank (ECB) kept its main interest rate unchanged at record low of 0.5% today…focus remains on whether the ECB will hint at the need for further long-term refinancing operations (LTRO) to help support the economy…

The Dow is under pressure this morning, down 127 points as of 7:50 am Pacific…U.S. private sector job creation came in lighter than expected in September but remained essentially in the same slow-but-steady growth range, according to a report released this morning…ADP and Moody’s Analytics pegged the monthly total at 166,000, lower than estimates of 180,000, with service-sector positions again leading the way…Obamacare is clearly one of the contributing factors in restraining job growth in the U.S. – when government makes it more expensive for businesses to hire people, and creates an uncertain and confusing regulatory environment, don’t expect robust job numbers…

The TSX is off just 32 points as of 7:50 am Pacific while the Venture has gained 4 points to 946 as it continues to show solid support just above its rising 50-day moving average (SMA)…

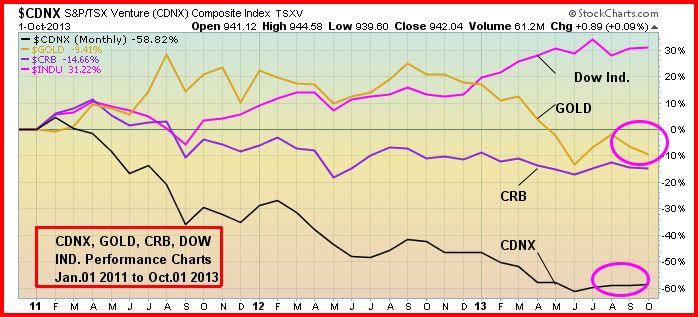

Venture-Gold-CRB 2-Year Comparatve Chart

With a gain of 7.3% during Q3, nearly matching Gold’s performance, the Venture actually outperformed the Dow (up 1%), the TSX (up 5.4%) and the TSX Gold Index (up 3.5%) which is certainly an encouraging sign…

What’s also encouraging is the fact that since August, the Venture has not followed Gold to the downside – the 1st time the Venture has bucked a downward move in Gold since the beginning of the junior sector bear market in early 2011 as you can see on John’s monthly comparative chart below…how significant that is remains to be seen, but this kind of resilience by the CDNX in the face of weakness in Gold (through yesterday at least) is typically a positive sign for the Index…the Venture is down nearly 60% since the beginning of 2011 but may finally have put in a bottom in late June at 859…Gold has declined 9.4% since the beginning of 2011, the CRB Index is off 14.7%, while the Dow has gained 31%…

Global Coal Met Corp. (GMZ, TSX-V) Update

Global Coal Met had a strong day yesterday following interesting news Monday…Global Resources Investment Ltd. (GRIT), a newly-formed United Kingdom based investment trust conditionally approved for listing on the London Stock Exchange, is taking a nearly 19% position in GMZ as part of a share swap…GMZ will have shares in GRIT that it will be able to sell in the market to raise proceeds (expected to be approximately $900,000)…this is not the only Venture company to garner the attention of GRIT (see below)…for the past year, GMZ has been working to obtain a mining permit for its Black Creek Coal Project in Alabama…the company reported Monday that the work required to obtain the permit is substantially complete and GMZ anticipates the permit will be issued in “due course”…

Below is an updated GMZ 20-month weekly chart from John…RSI(14) has broken out above resistance at 50, a positive technical development…current chart resistance at 5 cents…

Portex Minerals Inc. (PAX, TSX-V)

Portex Minerals Inc. (PAX, TSX-V) is another company that has tapped into GRIT as announced in a PAX news release September 24 (Portex has some things on the go, as revealed in that release, which appear interesting, so our readers may wish to engage in some DD on this one)…

“GRIT is a newly formed United Kingdom-based investment trust, conditionally approved for listing on the London Stock Exchange, which will invest in a broad portfolio of resource issuers, in exchange for 40 million newly issued Portex common shares at an issue price of six cents per share. The shares issued will be subject to the private placement’s four-month hold period. GRIT will hold 19.5 per cent of Portex. Upon completion of this transaction and the mineral exploration licence acquisitions referred to above, Portex will have 204,984,300 common shares outstanding. The purchase of the trust units is conditional upon the trust closing its initial financing and becoming listed on the London Stock Exchange. GRIT expects to be listed within the coming weeks.

As part of this transaction, Portex will arrange to sell GRIT units from time to time through the facilities of the London Stock Exchange in order to generate cash proceeds. The proceeds from the sale of the units will be used to advance Portex assets in Spain, Portugal, Northern Ireland and Ireland, as well as for working capital and general corporate purposes. A 6-per-cent advisory fee is payable by Portex in Portex and GRIT shares.”

Magor Corp. (MCC, TSX-V) Updated Chart

A technology play that continues to have tremendous prospects, despite recent share price weakness, is Magor Corp. (MCC, TSX-V) which started trading on the Venture just 6 months ago…check out their latest news release, September 27, and have a look at their web site…the individuals involved in this company have stellar track records, and MCC is making excellent strides with its Aerus cloud-based visual collaboration solutions…the company is completing a $2 million financing at 25 cents which accounts for the recent drop in the share price…below is a chart that shows very oversold technical conditions…we’ll have more on MCC in the coming weeks…

Note: John and Jon both hold share positions in GMZ. Jon also holds a share position in MCC.

27 Comments

The President has called a meeting with the leaders for today at

around 5:30 p.m. Maybe the shutdown will end up being positive,

that is, if they can agree on finalizing a big deal, that is,

including the debt ceiling in any deal. Enough already, our

portfolios are dropping to the point of no return. R !

no point buying shares now,keep your money,notice anon selling off ,good riddens.

BMR TEAM you thought pgx would come bolting out of the gate like the fastest horse on the track.IT seems we are stuck with a old nag ready for the glue factory.AREyou surprised with the performance of the stock so far

As far as I’m concerned, Gil, PGX has come charging out of the gate with their typically aggressive approach to tackling a property, and they’ve delivered very good initial drill results – with probably even better results coming soon. Sheslay is going to become another major Stikine Arch deposit IMHO – all the earmarks are there, as Tempelman-Kluit has explained, and as we can see ourselves. And the Grizzly right beside it will be a key part of the equation. That’s what the geology is telling us. If you’re not bullish on this story simply because the market isn’t reacting so far, then you’re making a serious mistake – as some did during the Blackwater situation. Unfortunately, some investors – who always seem to have a need/desire to follow the crowd – will have to see Prosper Gold at $5 a share (and GGI at $2 a share) before they are able to come to the conclusion that this is indeed a major deposit in the making. That’s perfectly fine. That’s when investors now will have their 10-baggers and will feed those latecomers some of their stock. You can make massive amounts of money in the junior resource market if you have the right vision on how a play is going to unfold. This has the same feel as Blackwater, and other significant discoveries. They do take some time to hit critical mass.

The market can be very irrational at times – it either gets ahead of what’s happening on the ground, or it’s behind what’s happening on the ground. In this case the market is well behind what’s developing at both the Sheslay and the Grizzly. But the market will begin to catch up in due course. That’s how you make money. Geologically, the case for the Sheslay Valley right now is an extremely powerful one. So we’re going on the geology and the high quality leadership teams who are behind all of this. That’s the way to build wealth in these markets. Think big and think long-term with both of these situations. There could be nice bursts to the upside near-term but think about holding for at least a year and see how the Sheslay Valley unfolds – I believe it will be an amazing show. And as this month progresses, that should become more evident.

From a contrarian point of view, things may be getting ready to turn around, everywhere I go on the internet I see nothing but negative remarks about the gold and silver prices, the gold and silver stocks, and I have even been thinking that I cannot win in this game no matter what and I should just throw in the towel. Gold and silver is totally manipulated by the US Federal Gov’t thru their crooked banker JPMorgan, it is not making up any ground as it is up 30 bucks one day and down 40 bucks the next day, and most of the time for no apparent reason at all. Then I keep telling myself, I just need that one play to come in, just be patient.. but until gold and silver really do break out, it will be difficult for most stocks on the venture to really get the attention that they may deserve imo…

Jon

looking at most of the jr stocks that had good initial results, they all seemed to make a run and then settle back down and most never hit the high that they initially ran to. Don’t you think it is a good idea if given the opportunity to take most of the profits in the initial run and see how things follow up. Very few investors if any I would guess ever bought Richfield at pennies and held it to 10 bucks? Just a thought…

Bert – Burt i have a stock tip for you.

Burt – What is the symbol Bert ?

Bert – GGI on the Venture exchange, they are an aggressive group, watch them.

Burt – Why should i listen, you don’t have a good record of being right.

Bert – Why did you have to mention that ?

Burt – The truth has to be told , in fact, you predicted today that the U.S. leaders

would reach an agreement tonight, they didn’t. Need i say more ?

Bert – No ! that will do it, Good night !

Anyone here follow NAN? Interesting, Sentient today exercised all their warrants. Put 3.8 million more in NAN’s coffers. Interesting they chose to do this now. Results pending on Near solid to solid sulfides. If the drill was not going to turn until next summer, why do it now? Also two days ago

September 30, 2013 Dr. Tony Naldrett, Internationally Acclaimed Expert on Magmatic Sulphide Deposits, Joins North American Nickel’s Advisory Board Read More…

– See more at: northamericannickel.com/#sthash.X9cBKIS2.dpuf

Seems something is brewing with NAN and we are about to find out shortly. Thoughts anyone? BMR?

NAN continues to look very good…again, going with the geology, and the group behind this – they’ve done an excellent job so far trying to figure out this system…

Imo,NAN has short intercepts of high sulfides in longer holes,so there is a question whether the stock price will move at all,even with 4% nickel,because the intercepts are so short.The last results they put out caused a selloff.We aren’t talking 185 metre intercepts that Diamond Fields had.The market is a strange animal these days.The CEO isn’t exactly a Murray Pezim clone as far as promoters go.Can he spin the news enough to get a run?They have to go much deeper to give the market a jolt.I really think the management lacks that special pizzazz that can drive a stock.They couldn’t even get VMS above $1.60 with incredible results.It was one run,then downhill all the way.A good promoter would have driven that to $5.00 easy.

Dan

Own some NAN and have been following it, all is looking good, trying not to get too excited though and keep my expectations low so as not to be disappointed, but the exercise of the warrants and the addition of Tony Naldrette is all very positive imo…

Hi Jon,

Can one think that although Prosper Gold (and GGI) has the potential to have great intrinsic value, is it better to wait till the share value drops much lower than it is now before investing? Buying some shares at 25 cents will make it a 20 bagger if it hits $5. PGX is having its promotion stage presently and it will be followed by weaker PPS. I purchased RBW, VGD, and GGB during the promotion frenzy, only to see all three plummet horribly. It is true that we wait for that 10 bagger, but will there be any money left to invest. I was thinking that as much as BMR promotes, can BMR also DEMOTE with the same passion and vigour. This is not a one way street. Thanks.

I don’t agree with your assumption, Alexandre, and I would certainly NOT put PGX in the same category as 90% or more of Venture stocks or the ones you have mentioned…they are in an elite category based on various different measures including quality of management, their geological expertise, the advanced exploration stage of their property, their working capital position and their ability to raise as much capital as they need in the future, not to mention their tight share structure…what if Hole 4 (S027) – coming soon – is their early “glory hole”?…this is an emerging deposit, so if you want to wait until PGX hits 25 cents, go right ahead…that day may never come…after its initial discovery hole, Richfield never looked back though there was volatility along the way…we’ll see the same pattern, I’m sure, with PGX…

Dan

What we have to remember about Nan now is they are finished until next spring.

There is still a good chance for a win though, depending on how the news

lined up plays out. A good stock to watch over the winter. Good luck ! R !

Jon will pgx or ggi be drilling over the winter? Very important to know this. Thank-you. odin

Jim

NAN up as high as 45 cents this morning on pretty decent volume with no news… what happened to buying NAN, then buying PGX and then sitting back and having a beer…???

imo NAN didn’t sell off when that last NR about drilling came out, it was already due for a pullback and a breather, your right about one thing this is a strange market… good luck to us all…hope to have that beer soon too

Can anyone tell me if pgx and ggi will be drilling over winter? Thanks odin

Hi Tom, I would have responded earlier but I was completing a major interview with GGI’s Steve Regoci that lasted longer than expected. Now, to answer your questions in detail based on what both companies (PGX and GGI) have already announced:

Will GGI be drilling over the winter? Absolutely – more drilling is planned this quarter in fact in Mexico, where they have 3 large-scale projects plus the recently acquired La Patilla Property which they are very excited about (Dr. Craig Gibson came up with this one for GGI). The pilot coal program, generating monthly income for GGI, continues, and a potentially important graphite discovery has been made along those coal seams (results from surface graphite samples are due shortly). Drill results also pending from the Locust target at Tonichi. So a lot is happening on the ground at the moment in Mexico. At the Grizzly, GGI’s biggest challenge is figuring out exactly where to drill their first few few holes. And that’s a good problem to have. The scale of this is immense – the company has identified targets over a distance of 15 km from Grizzly West to Grizzly Central. They currently have a crew on the ground in the Grizzly West area, conducting sampling. Results of the recent airborne mag and radiometric survey, combined with results from the current fieldwork, plus a compilation of all previous work conducted at the Grizzly historically and since 2006 by Garibaldi, will be valuable information that GGI will use to prioritize drill targets. It should also be helpful for GGI to see results from all work completed at the Sheslay.

At the Sheslay, PGX has completed its Phase 1 drill program (6 holes) as announced Monday. Results are pending from 3 more holes. The 4th hole (S027) looks the most interesting and has the potential to be a barnburner, or a “glory hole” if you wish. The first 3 holes were very good and fully support the developing model. Besides the drill program, PGX completed an airborne survey over the entire property. They’re also doing regional scale geochemistry, prospecting, trenching, and a detailed IP survey. That’s a tremendous amount of data to come in, and it will give them a much clearer picture of what’s going on geologically. They will analyze this data and use it to plot drill holes (for 2014) over the 5 currently known copper-gold-bearing porphyry targets. Their strategy at the Sheslay is the same as it was at Blackwater. At Blackwater, they made a discovery in late 2009. There was no drilling that first winter. They then went back at it in the spring and gradually ramped up the drilling with several rigs, set up a winter camp and kept drilling right thru the winter of 2010 into 2011, and then the company got bought out in the spring of 2011 by New Gold for a cool half billion. So Bernier and his team work fast. But don’t expect any drilling this winter at the Sheslay or the Grizzly. Plenty of news is still forthcoming, though, given the above. Expect drilling to resume at the Sheslay during Q2. Obviously GGI is taking the Grizzly to the drill stage as well.

There won’t be a lull this winter with GGI because of so much activity in Mexico, including drilling. And one should not assume there will be a lull with PGX. Keep in mind, they’ve looked at around 200 properties. I’m just speculating, but it wouldn’t surprise me at all if they announced the acquisition of a drill-ready Gold property in another jurisdiction (as a strategic second holding in their portfolio) that would give them the opportunity to drill this winter. Sheslay of course is their #1 play and will be their company-builder, but these guys can walk and chew gum at the same time. Their brand says it all – exploration, discovery, wealth. They’re going to keep their feet moving constantly – same of course with GGI.

Results from holes S027 thru S029 (the deeper holes in Phase 1 at Sheslay) could come as early as next week, or perhaps Thanksgiving week, given projected lab turnaround time (that’s our speculation). A discovery at depth (between 300 and 600 metres) could light up PGX like a Christmas tree.

Unbelievable!That’s all I can say.Happy for those who held or just got into NAN.I hope it goes nuts for them!I have no idea where that one’s going.I won’t be surprised if it sells off on the news,but I’d be selling before on a sure profit,because everything else is behaving in a backward manner.

PGX doesn’t even trade!How about that one?Glad I missed it before the halt and bought DBV instead.The rumours are pretty positive that they may be onto something better than anyone knows.

ZEN appears all but dead.Good news today and a major drop occurs.It looks like an INT clone.Done like a dinner,and maybe all the graphite plays are as well.None of them are moving on any news that comes out now.Not a good sign.

I think I’ll hold off on that beer.I need a shot of whiskey instead.

Peter has said that pgx will Not be drilling during the winter. They drilled late in the year and are not set up for a winter camp. That came directly from Peter. As far as DBV goes they are set up for a winter program if needed, there is some speculation going on that DBV may be the feed for pgx, time will tell, but i can tell you that Peter has an interest in DBV, which could be the reason he did part of the airborne survey on DbV’s property.

Jon,imo,nobody cares about GGI’s Mexican properties,their low share price before they started playing around on the Grizzly proves it.The only good thing that the Mexican properties could provide toward the share price,is if they decide to sell one of them for $50 million,and state they will be spending it all on the Grizzly.Otherwise they have no bearing on the stock price.

It will also be very interesting to see if the next three holes,and especially the 590 metre hole gives PGX a jolt or not.Man,if the results are .5-.7%,and little interest is shown by the market,then my theory that it will take an 800-1000 metre hole at high grade to get this area flying comes into play.

DBV supposedly thinks they will be seeing 1% grades,based on their IP results.But,they will need long intercepts to make a dent in the market also,imo.If they get that long intercept,they may be the big mover here.Both GGI and PGX will be idle as far as drilling goes by then,so DBV will have the Sheslay all to themselves,especially if they keep drilling all winter,assuming they get the glory hole they need to interest big money.

I always enjoy reading your reports and comments afterward,and John’s charts.Keep the good work coming.

You should care about Mexico, Jim, because that’s what allowed GGI to cash in on Temoris and not have to do a financing these past 4 years, and that’s why they’ve got $4 million in working capital right now. IMHO, there’s a lot more value to be extracted from down there. So those properties remain very important, and that will become more clear to everyone through our interview with Regoci. It’s quite amazing what’s developing down there. That can only help the company in terms of the Grizzly as well.

The Hat Property is relatively small – one significant disadvantage – and appears to be at the edge of a major system – not in the heart of it. DBV also doesn’t have the management or geological expertise or the working capital that PGX and GGI have. That’s not an opinion – that’s a fact. A lot of cheap private placement stock issued over the last year has also negatively impacted their share structure. Having said that, the Hat still holds some merit and one cannot discount the possibility of a hit there, but this 1% thing at the Hat makes no sense to me.

As far as the next 3 holes from PGX are concerned, what I’m looking for are long intersections (400 m or more) of 0.60% to .80% CuEq to move the market – even better results than the first 3 holes. The market likes to see progression, something CXO has not been able to deliver. A discovery of higher grades at depth will make this very, very interesting. What they’re reported so far is an excellent start and fully supports the model for a major Stikine Arch deposit.

The fieldwork taking place at the Grizzly right now should, IMHO, reveal some very interesting numbers given historical information. “Spectacular” alteration has been described in historical reports referring to western/northwestern parts of the Grizzly. 5 major areas of interest just at the Grizzly West target which represents only a very small portion of the entire property with targets identified over a minimum 15 km distance from Grizzly West to Grizzly Central. This has major scale to it and includes a pluton (Kaketsa) which clearly has impacted mineralization over a wide area throughout the Sheslay Valley.

With all due respect Jon, are you aware that the Ceo of DBV actually researched that entire area and ended up keeping the Hat property. He is well aware of the possible results that pgx may have. Also the next time you speak to Peter would you mind asking him if he’s interested very interested DBV at some point, because those words came out of his mouth to a friend of mine who spoke to him. If you take a look at DBV, it has what appears to be aprox 5 targets and two of the targets could range in the area of 900×500 m each with an Ip of 50 showing. So to suggest they are on the edge is not accurate it could be they have the mother load. The CeO owns 14 million shares, there are presently 28 million trading, also a good portion of the remaining shares are in friendly hands. Their share stucture compared to ggi is outstanding and not far from pgx’s. I own shares in both pgx and dbv. The only thing that DBv doesnt have is a famous name behind it to ensure easy financing which i agree is a big factor. Its apparent a lot of research has not been done on DBV and perhaps one of these days perhaps you will have the opportunity to contact MR. Shirvani at DBv and let us know what he had to say. Appreciate your input.

Paul, the Hat Property has had some interesting historical work done on it and needs to be drill-tested over a wider area. So it definitely has merit. This is likely going to become a major regional play, so we do expect other hits on other properties in time, including possibly the Hat. DBV’s challenge is the working capital issue, and do they have the geological expertise? PGX has Dirk Tempelman-Kluit, GGI has Charlie Grieg and Carl von Einsiedel…who does DBV have? You can have a great-looking property but you need the right geologist(s) to figure it out, and a savvy business/market guy at the top (like Bernier or Regoci) to guide the ship. So there are certain important elements that appear to be missing in DBV. That doesn’t mean the stock isn’t a smart speculative buy at the moment – but PGX and GGI have more solid foundations. If the whole Sheslay area takes off like we expect it to at some point, any company with land in the area is going to see appreciation on their stock price.

I agree witn your comments about the working capital and yes the geologists are important, but having said that he obviously picked out a property that has something Peter is interested in. Perhaps you can contact Mr. shirvani and ask what he’s done and provide a little research on the company. I agree no matter who finds the glory hole everyone will benefit from it. If DBv hits a glory hole financing wont be an issue but I have to say, its nice when a CEO participates in most of the PP. Also not sure if you’re aware but Tech at one point did visit DBV’s property and speak to Mr.Shirvani there was conversation about the property. So it appears there is still a lot for us to really know about him. Time will tell and hopefully PGX and DBv hit big. Sorry I dont own GGI but the best to them as well.

You bring up a good point about Teck. At the end of the day, what I envision happening is Teck taking everybody out here. They’re watching closely. They staked a large land position right up to the southern boundary of the Grizzly. PGX is not interested in being an operator. They just want to prove this thing up as quickly as possible and get taken out. During that process, strategically they have to be looking at the Grizzly and I’m sure the Hat is on their minds as well. It’s going to get very interesting and there could be a lot more chatter around this after the next set of results.

Thanks so much Jon for the detailed answer. odin