Gold has traded between $1,278 and $1,289 so far today…as of 7:30 am Pacific, bullion is off $8 an ounce at $1,282…Silver is 18 cents lower at $21.34…Copper is off a penny at $3.24…Crude Oil is up 54 cents at $95.14 while the U.S. Dollar Index is down one-fifth of a point at 81.12…

Rob McEwen, Chairman and CEO of McEwen Mining (MUX, TSX, NYSE) which reported a small Q3 profit last week, voiced optimism regarding Gold in a conference call with investors Friday…“The past 24 months for precious metals investors has been brutal, but I feel like we’re nearing a bottom,” he stated…“We had a brief and explosive rally in August, which I see as a good indication of a potential for large gains going forward. And despite a decidedly ugly mood amongst investors, analysts and market commentators, I believe it is an excellent time to be a contrarian…before the end of 2013, I expect we’re going to see higher Gold, Silver and Copper prices, which will be positive for us, and the industry,” he added…“An important point I’d like to stress is that we have not sold our future earnings to royalty and metals streaming companies, and we have no plans to hedge”…McEwen Mining’s all-in sustaining cost per Gold equivalent ounce in Q3 was $1,081…

Watch for what should be some interesting reports in the near future regarding the Gold market in India from Frank Holmes, Chairman and CEO of U.S. Global Investors (www.usfunds.com)…he’ll be traveling to India later this month to get a feel for what’s happening with Gold in that country…“With the increasing Gold import restrictions in India, the country’s leading position as the world’s biggest buyer of Gold is in jeopardy. I’d like to get a firsthand perspective on what is really taking place with the demand for Gold and get a flavor for what’s going on,” Holmes stated in his weekly Investor Alert over the weekend…

On the subject of India, it was reported this morning that the country’s trade deficit rose to $10.55 billion in October after narrowing to a two-and-a-half-year low of $6.7 billion in the previous month as purchases of Gold and Silver picked up ahead of the festive season, according to government data just released…the value of Gold imports jumped to $1.37 billion in October as compared to $800 million in the previous month…India celebrates a slew of festivals in October and November that traditionally push up the demand for precious metals…

Today’s Markets

Asia-Europe

China’s Shanghai Composite closed slightly higher overnight, erasing earlier losses to finish 3 points higher at 2109…sentiment remained cautious before tomorrow’s conclusion of the 4-day Third Plenum meeting of Communist Party leaders…investors also digested a slew of economic data released over the weekend…annual consumer inflation climbed to an 8-month high of 3.2% in October while industrial output rose at an annual rate of 10.3% in the same period…Japan’s Nikkei average surged 183 points or 1.3% to close at 14270…European shares were modestly higher today…

North America

The Dow, aiming for its 6th straight weekly advance, is up 17 points through the first hour of trading today…the TSX is 3 points higher while the Venture has shed 2 points to 935 as of 7:30 am Pacific…the Venture has been down for two straight weeks after failing to confirm a breakout above resistance at 970…

The Venture Tests Support

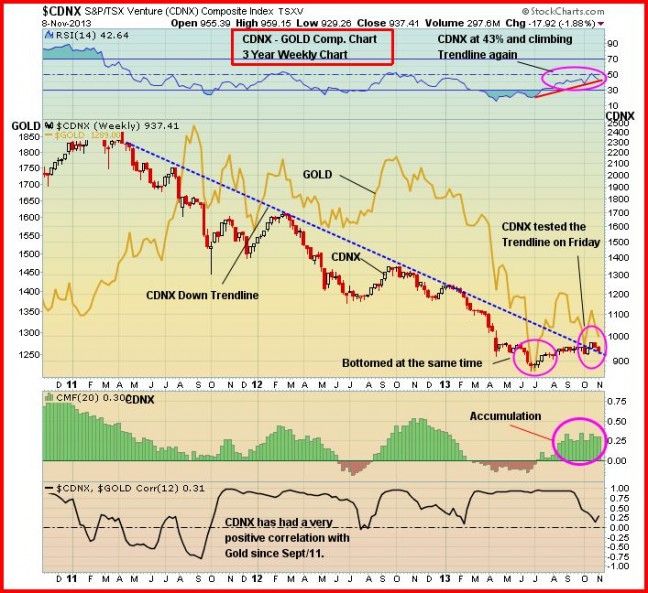

Recently, we made note of the fact that the Venture had finally crawled above a long-term down trendline on its 3-year weekly chart with confirmation of that breakout October 22…this was obviously a bullish development, so what’s an investor to make of the Venture’s performance since then – 10 losing sessions out of 13 including 9 consecutive down days that finally ended Friday?…

The 3-year weekly chart still looks very good, and what we witnessed Thursday-Friday was a successful re-test of that trendline (around 930) which also coincides with the Venture’s 100-day moving average…this SMA is beginning to reverse to the upside…another re-test of the trendline (perhaps a series of tests) is certainly possible…

A couple of other important points – look at how the RSI(14) continues to climb an uptrend – it’s currently at support, and in a pattern very different from the failed rallies of 2011 and 2012…the CMF indicator, meanwhile, shows continued steady accumulation…

Will support hold around 930?…given the time of the year, it would be extremely impressive if it did…this support is solid, but if it doesn’t hold there’s another band of support between 910 and 915…it typically takes investors a period of time (many months) before they realize a bear market or a bull market is over, or (vice-versa) is just beginning…perhaps during the 1st quarter of next year, everyone will be looking back at late June, 2013, as the bear market peak…

Softrock Minerals Ltd. (SFT, TSX-V)

We suggest that speculative investors with a bit of patience perform their due diligence on overlooked Softrock Minerals (SFT, TSX-V) which closed at 2.5 cents Friday for a total market cap of only $500,000…SFT likely has one of the oldest management teams on the entire Venture, but with age comes wisdom as they say…what’s interesting about SFT is that it holds a strategic oil and gas lease covering 640 acres (the lease was just extended to June, 2015, by the Alberta government) in the rapidly developing Charlie Lake producing trend of northwest Alberta…this area is heating up, led by a subsidiary of Tourmaline Oil Corp. (TOU, TSX), and auction prices for oil and gas rights there have skyrocketed…a recent Alberta government sale of a 1-section (640 acre) parcel of P&NG rights directly offsetting SFT’s lease to the north sold for over $900,000…SFT appears to be in a “sweet spot” here…check out Tourmaline’s July 4 news release when the company announced a major expansion to its Charlie Lake play…“Tourmaline Oil Corp.’s Spirit River Charlie Lake oil and gas pool has evolved into a major new hybrid resource play with significant reserve and production upside. This major expansion of the Triassic Charlie Lake play, combined with the successful consolidation of the associated prospective land opportunity, has created a third major core operating area for the company, complementing the NEBC Montney complex and the Alberta Deep basin”…

Softrock has reported that it has received expressions of interest from companies who are interested in drilling a well on its 640 acre lease…this is worth watching closely…

Greencastle Resources Ltd. (VGN, TSX-V)

History shows that whenever Greencastle Resources‘ (VGN, TSX-V) President and CEO Tony Roodenburg starts adding to his share position in the company, investors should pay attention…Roodenburg acquired 700,000 shares October 31 in the open market at 7.5 cents to boost his personal holdings up to nearly 5 million, representing 10.76% of the outstanding stock…a 1 million share bid at 6.5 cents also came into the VGN market last week, and our guess is that Roodenburg is the one behind that bid which still shows this morning…

We don’t think it’s a coincidence that Roodenburg is adding to his Greencastle holdings with VGN as a 50-50 JV partner with Softrock on the Charlie Lake play, a fact that was highlighted by Greencastle in a recent news release…“Activity and land prices have picked up smartly in the area and we are in discussions with several parties regarding development of this section. Our land is now essentially surrounded by new production or recently purchased landholdings. Our discussions are focused on bringing in a partner to drill, allowing Greencastle to hold an overriding royalty similar to the revenue model we have at Primate in Saskatchewan”…

Below is a 1-year weekly VGN chart showing strong new support at 6 cents, after the stock hit an all-time low of 4.5 cents in July, and resistance at 10 cents…

Prosper Gold Corp. (PGX, TSX-V) Update

Award-winning geologist and Prosper Gold (PGX, TSX-V) director Dr. Dirk Tempelman-Kluit delivered a very compelling case regarding the Sheslay Cu-Au Porphyry Project last week, though he was speaking before mostly the converted at the Geological Survey of Canada Discovery Center in Vancouver…Tempelman-Kluit worked for the Geological Survey of Canada for more than two decades and has a strong following in the industry…many of his colleagues were in attendance at last week’s jam-packed discussion – missing were the brokers and high net worth investors that Tempelman-Kluit is eager to reach in the coming weeks and months before the company kicks off its next drill program at the Sheslay in the spring…Prosper needs to tell its story effectively and widely, and we believe it will…Tempelman-Kluit and Pete Bernier can’t simply sit back and expect investors to pile into Prosper simply because their last deal was a huge success…the Sheslay Project has enormous upside but all the strengths of this project need to be communicated as powerfully as possible to a broad audience…

The “takeaways” at last week’s presentation were as follows as emphasized by Tempelman-Kluit:

1. The mineralized system at the Sheslay is powerful, extensive and deep;

2. The Sheslay has “all the earmarks” of other Stikine Arch deposits;

3. The consistency of grades is comparable to other Stikine Arch deposits;

4. Soil geochem, IP and mag data all demonstrate that the Sheslay system has continuity and room to grow.

“The rocks (at Sheslay) look the same as Red Chris,” Tempelman-Kluit stated during his presentation…“People who have been to both say that”…

It’s the opinion of many geologists that Prosper is well on its way to defining a VERY large system at Sheslay with economic grades, and that this area is destined to become one of the most exciting exploration camps in the country over the next 12 months…at BMR, we see a tremendous potential wealth-building opportunity for investors in both Prosper and Garibaldi Resources (GGI, TSX-V) as the leaders in the Sheslay area, so we are obviously going to continue to focus on developments there…this is a fascinating geological story and it’s going to become a major market story in our view as events unfold…

So why, you ask, did Prosper plunge following the release of its last set of assay results from the Sheslay October 29?…

Three factors, we believe, contributed to the sell-off which in our view has created even more of an opportunity for astute investors:

1. Our research has shown that certain individuals (not insiders) holding 6-cent “seed stock” were ready to hit the sell button no matter what the results were from the Sheslay…news came out just minutes before the opening bell that morning, and the selling of this cheap stock is what we believe drove the market down at the open and unfortunately “set the tone”…most of this seed stock had been cleaned up but obviously not all of it…if you’re up 7 or 8 times your money, why not dump your stock on news, force it down and accumulate more below where you sold it?…some investors would certainly think that way…

2. There was no “glory hole” – results from each hole were very good but speculators hoping for a “glory hole” – something in the order of 400 metres grading 0.80% CuEq – were disappointed…the 4th hole in particular had a chance to be a “barnburner” – it was very good but not good enough to excite the market right now…

3. No winter drilling/exploration – the market is a forward-looking machine, and Prosper gave little reason for investors to expect much activity on the ground with the company over the winter…winter drilling is certainly possible in the Sheslay area but Prosper wasn’t set up for it this year and still has a slew of data to review…

A market will take the path of least resistance and the above factors pushed Prosper down…rather than complain about that, or suggest (wrongly) that the Sheslay results weren’t good, investors need to understand the dynamics of what occurred and take advantage of the opportunity if they see one…we certainly see an opportunity with Prosper that’s even better than the one a couple of months ago…this first phase of exploration has been extremely successful in demonstrating that the Sheslay has all the ingredients to become the next major new deposit in the Stikine Arch…by “connecting the Stars”, there’s a path for Prosper to take the Sheslay to a size (and grade) that could easily put multiples on the PGX share price over the next 12 months…more on that later this week…

Technically, Prosper is showing that it has stabilized with strong support at 30 cents…below is a 2.5-year weekly PGX chart from John…

Prosper Gold (PGX, TSX-V) Long-Term Weekly Chart

Eagle Hill Exploration Corp. (EAG, TSX-V)

Eagle Hill Exploration (EAG, TSX-V) continues to aggressively drill its high-grade Windfall Lake deposit in Quebec and should be able to expand significantly on the known resource there given the amount of drilling (more than 50,000 metres once this round is complete) since the NI-43-101 estimate of 1.5 million ounces (indicated and inferred) in July, 2012…the company released initial results last week from the current 25,000-metre program, confirming the potential the expand the resource to the southwest of the Main zone where 11 holes totaling 4,800 metres were recently drilled…3 drill rigs have now been relocated to the Main zone where numerous holes will test lateral extensions of the higher grade and thicker Gold shoots…this should prove interesting and could produce some market-moving numbers early in the New Year…high-grade Gold definitely carries more punch in the current environment…

Over just 3 trading sessions in August, EAG rocketed from a 52-week low of 6.5 cents to 14 cents on total volume of more than 10 million shares…it has a history of sudden moves on impressive volume…the time to be a buyer, of course, is on weakness – and then one needs to have patience…traders can do well on EAG if they get in at the right time…

Below is a 2.5-year EAG chart from John…the stock closed Friday at 8.5 cents…the support band between 7 and 8.5 cents appears to be an ideal “accumulation” zone…sell pressure has weakened considerably since the summer…this is obviously not without risk, but the odds of a run-up early in the New Year on drill results (or speculation) are favorable in our view…as always, perform your own due diligence…

The Windfall Lake estimated resource (2012) comprises 1,665,000 tonnes at 10.05 g/t Au (538,000 ounces) in the indicated category and 2,906,000 tonnes at 8.76 g/t Au (822,000 ounces) in the inferred category…the bulk of the deposit occurs in the Main zone, a SW-NE trending zone of stacked mineralized lenses measuring approximately 600 metres wide and at least 1,400 metres long…

Silver Short-Term Chart

Silver Long-Term Chart

Note: John and Jon both hold share positions in GGI and PGX. Jon holds a share position in VGN.

8 Comments

Gil

My stock pick is DUCK

THE stocks to own seems to be rz and pst in the Colorado area plays

scroll down

$ Purchase Value

120.32

$ Market Value

119.06

$ Profit/Loss

-1.26

% Profit/Loss

-1.05%

Symbol (Name)

Quantity

Cost/Share

Last

Change

% Change

Total Cost

Market Value

$ Gain/Loss

% Gain/Loss

Notes

V.GGI 125.00 0.08 0.090 0.000 0.00% 10.00 11.25 1.25 12.50%

V.HBK 100.00 0.10 0.100 -0.010 -9.09% 10.00 10.00 0.00 0.00%

T.SAM 54.00 0.185 0.190 -0.010 -5.00% 9.99 10.26 0.27 2.70%

V.IO 83.00 0.12 0.100 -0.020 -16.67% 9.96 8.30 -1.66 -16.67%

V.TGK 660.00 0.015 0.015 0.000 0.00% 9.90 9.90 0.00 0.00%

V.GTA 62.00 0.16 0.175 +0.015 +9.38% 9.92 10.85 0.93 9.38%

V.KWG 200.00 0.05 0.050 0.000 0.00% 10.00 10.00 0.00 0.00%

V.RBW 250.00 0.04 0.040 0.000 0.00% 10.00 10.00 0.00 0.00%

V.FMS 30.00 0.34 0.350 -0.010 -2.78% 10.20 10.50 0.30 2.94%

V.PGX 30.00 0.345 0.350 0.000 0.00% 10.35 10.50 0.15 1.45%

V.GBB 250.00 0.04 0.040 0.000 0.00% 10.00 10.00 0.00 0.00%

V.GMZ 250.00 0.04 0.030 -0.010 -25.00% 10.00 7.50 -2.50 -25.00%

120.32 119.06 -1.26 -1.05

lot trade halt,could be interesting.

STOCKS LIKE ‘VQA’ AND ‘RZ’ HAVE BOTH GONE FROM 1.5 CENTS TO 4.5 CENTS IN ONE WEEK OR LESS….’CYP’ WITH LOTS OF CASH (1.5M$+) ALSO SHOWING SIGNS OF LIFE TODAY! SO, SOME STOCKS ARE FINALLY WAKING UP AGAIN! ZEN UP 22 CENTS TODAY TOO!

IAM having problems copy and pasting the portfolio from another site the portfolio does not appear on this site as it does on the other site .the last numbers are the gain or loss. IAM working on the problem .IF anyone has any suggestion please let me know

Hi John,

Could you do a chart of MUX-TO I Think A have Bottomfished good yesterday at 2.02,

Talking about large Porphyry deposit they have a enormous deposit there in Argentina!

Have a nice day 🙂

AIX news release today! Bit coins,etc! sounds exciting!